S&P Global Ratings has maintained its low risk insurance industry and country risk assessment (IICRA) for Australia’s mortgage insurance sector, awarding the second strongest rating on a six point scale.

According to a release from the ratings agency, “In our opinion, product risks for mortgage insurers remain elevated, reflecting the recent history of sustained house price appreciation across the Australian housing market.

“House prices in Australia’s major cities of Melbourne and Sydney have declined in the past 12 months, easing some risk attributes. We expect the house price declines in Australia’s largest cities to be orderly, while risks associated with slow wage growth and relatively high debt to income levels remain,” the statement continued.

Responding to the results, QBE chief executive officer Phil White says the low risk is due to the Australian market’s high diversification.

Speaking to Australian Broker, he said the diversification in borrower profiles, geographic distribution of mortgages, and the range of banks with LMI in the marketplace enhances strength.

“Diversification is one of the fundamental things that underpins Australia. The second part is how LMI was designed to meet the needs of our market. The regulatory regime here is extremely good and that is underpinned also by a very disciplined underwriting environment.

“I’m not too worried about some of the scare mongering there might be around the forecast for house prices or the economy more broadly. LMI has been designed to suit the Australian market and the future for it right now is quite positive,” he continued.

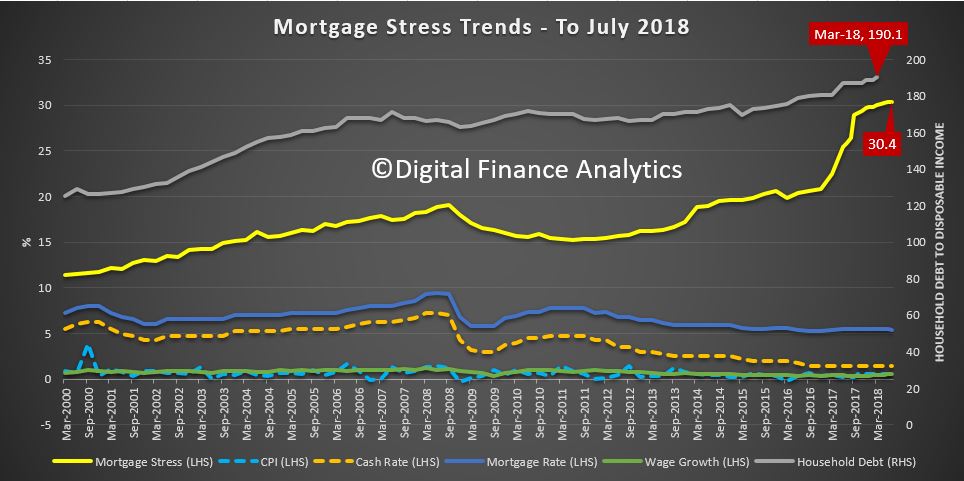

However, Martin North, principal of Digital Finance Analytics, says the current environment is “risk on” and, noting rising delinquencies in WA and other areas, those risks are set to rise.

“Generally it is risk on for the insurers and the majors. The banks that have released their financial results this reporting season are showing slightly higher 90 day plus delinquency rates and that was also true in the most recent Moody’s report. It’s not a huge increase but the trend is definitely up.”

Drawing on independently collated data, North says 30.4% of owner occupied borrowing households are finding it difficult to manage repayments currently. This equates to 970,000 households, of which more than 23,000 are in severe stress.

“They’re making the payments but it’s difficult and this is the highest that number has ever been,” he commented.

In contrast to S&P’s outlook, North concluded, “Mortgage rates will rise slightly because of international funding pressures. Of course the US will put its rate up once or twice more this year and that will flow through. It’s risk on rather than risk off and I think we need to watch this very closely.”