The Bank for International Settlements, the “Central Bankers Banker” has just released an interesting, and concerning report with the catchy title of “Financial spillovers, spillbacks, and the scope for international macroprudential policy coordination“.

But in its 53 pages of “dry banker speak” there are some important facts which shows just how much of the global financial system is now interconnected.

They start by making the point that over the past three decades, and despite a slowdown coinciding with the global financial crisis (GFC) of 2007–09, the degree of international financial integration has increased relentlessly.

In fact the rapid pace of financial globalisation over the past decades has also been reflected in an over sixfold increase in the external assets and liabilities of nations as a share of GDP – despite a marked slowdown in the growth of cross-border positions in the immediate aftermath of the GFC.

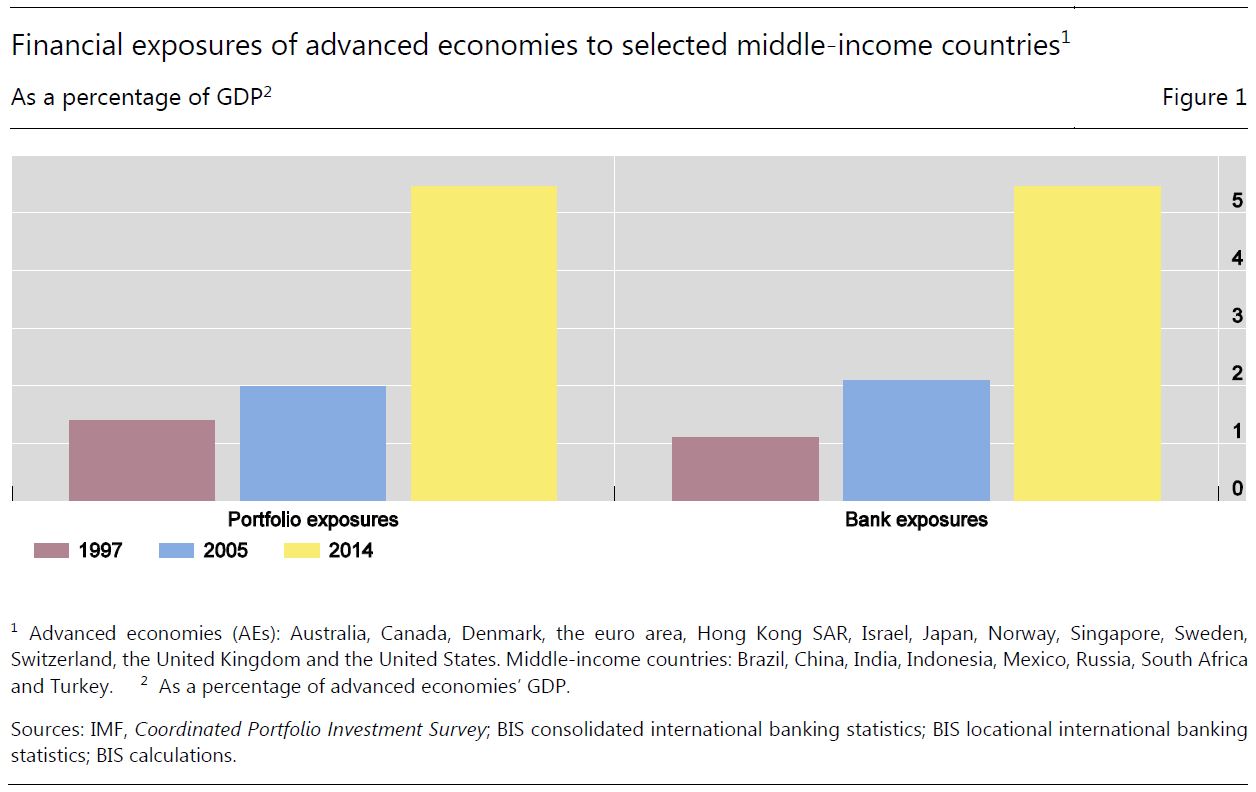

This chart shows the evolution of advanced economies’ financial exposures to a group of large middle-income countries, split into portfolio exposures and bank exposures. It shows that both types of exposures have increased substantially since the late 1990s.

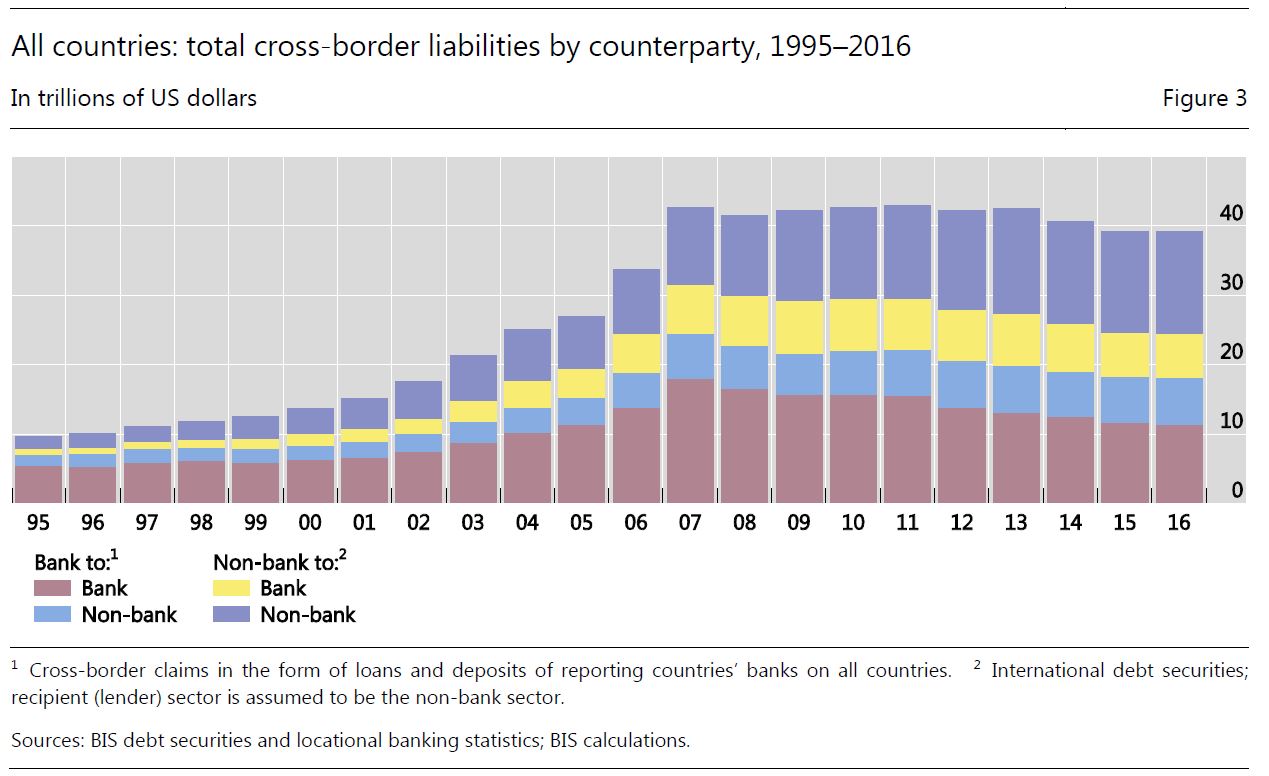

Here is another chart which again the linkages, looking at cross-border liabilities by counterparty. The chart shows the classification of cross-border debt liabilities by type of counterparty. It shows that cross-border liabilities where both creditor and debtor are banks are the largest of the four possible categories, and increased rapidly in the run-up to the GFC. It also shows a rapid increase in credit flows relative to foreign direct investments (FDI) and portfolio equity flows.

They explain that cross-border bank-to-bank funding (liabilities) can be decomposed into two distinctive forms: (a) arm’s length (interbank) funding that takes place between unrelated banks; and (b) related (intragroup) funding that takes place in an internal capital market between global parent banks and their foreign affiliates. They note that cross-border bank-to-bank liabilities have also played a major role in the expansion of domestic lending, at their peak in 2007 these flows accounted for more than 25% of total private credit of the recipient economy.

This also opens the door to potential arbitrage, for example “rebooking” of loans, whereby loans are originated by subsidiaries but then booked on the balance sheet of the parent institution. Indeed, the presence of foreign branches of financial institutions that are not subject to host country regulation may undermine domestic macroprudential policies.

This degree of global linkage raises significant issues, despite the argument trotted about by economists that there are benefits from the improved efficiency of resource allocation.

First, the increased global interconnectedness has led to new risks, associated with the amplification of shocks during turbulent times and the transmission of excess financial volatility through international capital flows. They suggest there is robust evidence that private capital flows have been a major conduit of global financial shocks across countries and have helped fuel domestic credit booms that have often ended in financial crises, especially in developing economies.

Second, international capital flows have created macroeconomic policy challenges for advanced economies as well. For example, the rest of the world’s appetite for US safe assets was an important factor behind the credit and asset price booms in the United States that fuelled the subsequent financial crisis and created turmoil around the world. It is also well documented that since the GFC, the various forms of accommodative monetary policy pursued in the United States and the euro area have exerted significant spillover effects on other countries by influencing interest rates and credit conditions around the world – irrespective, at first sight, of the nature of the exchange rate regime.

Finally, there is evidence to suggest that in recent years financial market volatility in some large middle-income countries has been transmitted back, and to a greater extent, to asset prices in advanced economies and other countries. For instance, the suspension of trading after the Chinese stock market drop on 6 January 2016 affected major asset markets all over the world. Thus, international spillovers have become a two-way street – with the potential to create financial instability in both directions.

This means that macroeconomic settings in the USA – and especially the progressive rise in their benchmark rate, and reversal of QE, will have flow-on effects which will resonate around the global financial system. In a way, no country is an island.

The paper does also make the point that there may be some benefits – for example, if the global economy is experiencing a recession for instance, the coordinated adoption of an expansionary fiscal policy stance by a group of large countries may, through trade and financial spillovers, benefit all countries. The magnitude of this gain may actually increase with the degree to which countries are interconnected, the degree of business cycle synchronisation, and the very magnitude of spillovers.

But, if maintaining financial stability is a key policy objective, the propagation of financial risks through volatile short-term capital flows also becomes a source of concern.

After detailed analysis the paper reaches the following conclusions.

First, with the advance in global financial integration over the last three decades, the transmission of shocks has become a two-way street – from advanced economies to the rest of the world, but also and increasingly from a group of large middle-income countries, which we refer to as SMICs, to the rest of the world, including major advanced economies. These increased spillbacks have strengthened incentives for advanced economies to internalise the impact of their policies on these countries, and the rest of the world in general. Although stronger spillovers and spillbacks are not in and of themselves an argument for greater policy coordination between these economies, the fact that they may exacerbate financial risks – especially when countries are in different phases of their economic and financial cycles – and threaten global financial stability is.

Second, the disconnect between the global scope of financial markets and the national scope of financial regulation has become increasingly apparent, through leakages and cross-border arbitrage – especially through global banks. In fact, what we have learned from the financial trilemma is that it has become increasingly difficult to maintain domestic financial stability without enhancing cross-border macroprudential policy coordination, at least in its structural dimension. Avoiding the leakages stemming from international regulatory arbitrage and open capital markets requires cooperation, but addressing cyclical risks requires coordination.

Third, divergent policies and policy preferences contribute additional dimensions to global financial risks. In the absence of a centralised macroprudential authority, coordination needs to rely on an international macroprudential regime that promotes global welfare. Yet, divergence in national interests can make coordination unfeasible. Fourth, significant gaps remain in the evidence on regulatory spillovers and arbitrage, and the role of the macroprudential regime in the cross-border transmission of shocks. In addition, research on the potential gains associated with multilateral coordination of macroprudential policies remains limited. This may be due in part to the natural or instinctive focus of national authorities on their own country’s objectives, or to greater priority on policy coordination within countries – an important ongoing debate in the context of monetary and macroprudential policies. This “inward” focus may itself be due to the lack of perception of the benefits of multilateralism with respect to achieving national objectives – which therefore makes further research on these benefits all the more important.

This assessment suggests that, in a financially integrated world, international coordination of macroprudential policies may not only be valuable, but also essential, for macroprudential instruments to be effective at the national level. A first step towards coordination has been taken with Basel III’s principle of jurisdictional reciprocity for countercyclical capital buffers, but this principle needs to be extended to a larger array of macroprudential instruments. Further empirical and analytical work (including by the BIS, FSB and IMF) on the benefits of international

macroprudential policy coordination could play a significant role in promoting more awareness of the potential gains associated with global financial stability. This work agenda should involve a research component focused on measuring the gains from coordination and improving data on cross-border financial flows intermediated by various entities (banks, investment funds and large institutional investors), as well as improving capacity for systemic risk monitoring.

My own take is that we have been sleepwalking into a scenario where large capital flows and international financial players operating cross borders, negating the effectiveness of local macroeconomic measures, to their own ends. This new world is one where large global players end up with more power to influence outcomes than governments. No wonder that they often march in step, in terms of seeking outcomes which benefit the financial system machine.

Somewhere along the road, we have lost the plot, but unless radical changes are made, the Genie cannot be put back into the bottle. This should concern us all.