UBS continues their forensic dissection of the mortgage industry with the release of their analysis of data from Westpac, which the lender provided to the Royal Commission. This was representative data from the bank of 420 WBC mortgages analysed by PwC as part of APRA’s recent review. APRA Chairman Wayne Byres found WBC to be a “significant outlier”, with

PwC finding 8 of the 10 mortgage ‘control objectives’ were “ineffective”.

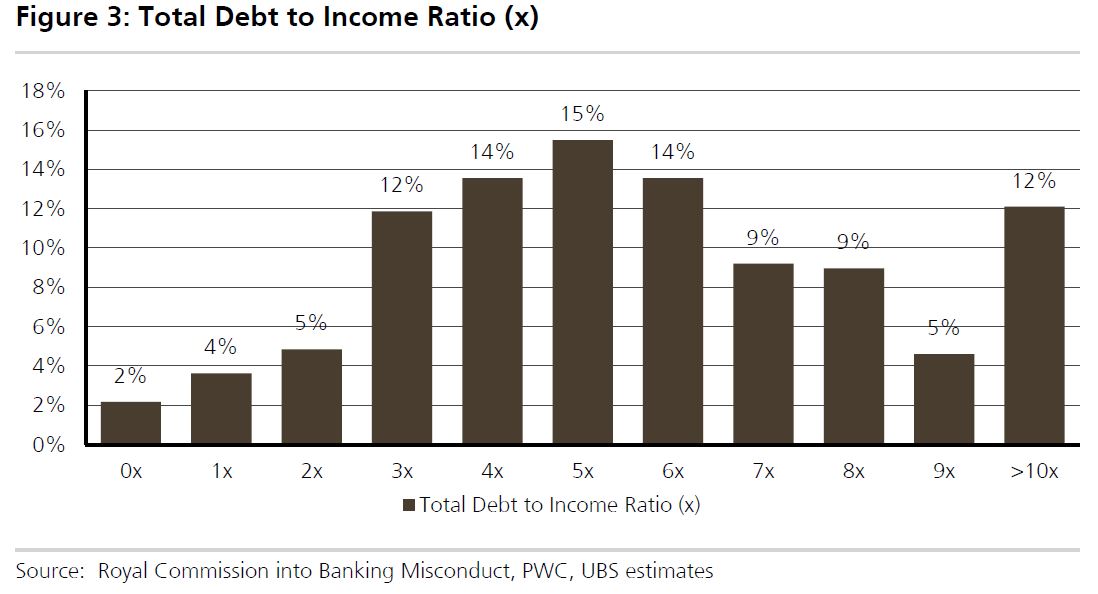

UBS says for the first time information on borrower’s Total Debt-to-Income ratios (not Loan-to-Income) has been made available. They found WBC’s median Debt-to-Income at 5.4x, with 35% of the sample having Debt-to-Income ratios of >7x. Further 46% of the mortgage applications had an assessed Net Income Surplus of <$250 per week.

This data raises questions regarding the quality of WBC’s $400bn mortgage book (70% of its loans). While WBC has undertaken significant work to improve its mortgage underwriting standards over the last 12 months, we expect it and the other majors to further sharpen underwriting standards given the Royal Commission’s concerns with Responsible Lending. This could potentially lead to a sharp reduction in credit availability.

This raises two questions. First how much tighter will credit availability now be. We continue to expect an absolute fall in loan volumes, and this will translate to lower home prices.

Second, is this endemic to the industry, or is Westpac really an outlier? From our data we see similar patterns elsewhere, so that is why we continue to believe we have systemic issues.

- Income is being overstated and expenses understated.

- Customers have multiple loans across institutions and these are not always being detected, so their total debt burden is higher than the bank sees.

Combined these are significant and enduring risks. Chickens will come home to roost! Especially if rates rise.

So does this mean UBS will stop selling securitised loan products and refund the ones already sold by them? Or is the usual “we sold you a diamond” by one part of UBS thats selling CDO’s or whatever its name is today and “what a horrible loan portfolio” by another?

I think UBS should be included in the RC particularly based on their overseas operations routinely getting fined for all sorts of things, it would be unreasonable to “assume” UBS Australia is clean.