The Financial Services Royal Commission just published an information paper, the third in their series, on car loans ahead of their hearings next week.

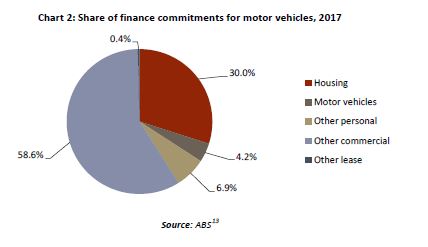

They say car loans make up a very small proportion of new finance commitments, making up 4.2% of total new finance commitments in calendar year 2017, an increase from 2.7% in calendar year 2007. But delinquency rates are rising. The value of loans is north of $35 billion.

They say car loans make up a very small proportion of new finance commitments, making up 4.2% of total new finance commitments in calendar year 2017, an increase from 2.7% in calendar year 2007. But delinquency rates are rising. The value of loans is north of $35 billion.

For calendar year 2017, new finance commitments for motor vehicles totalled around $35.7 billion, but this excludes commitments of revolving credit. An aggregate revolving credit figure is published by the ABS but not attributed to a purpose (such as the purchase of motor vehicles). In particular, revolving credit may include dealer ‘floor plan’ financing arrangements, which allows a car dealer to settle a liability with a financier simultaneously with, or soon after, the sale of the vehicle to a customer.

Indicatively, 90% of all car sales are arranged through finance, of which around 39% are financed through a dealership and around 61% are financed from other sources.

In the December quarter 2017, car loan payments were the largest vehicle-related expense for the ‘hypothetical household’ in both capital cities and regional areas, with repayments larger than weekly fuel costs.

Over the past 10 years there has been an increase in financing for new motor vehicles and a decrease in financing for used motor vehicles.

Profit margins for car dealers rely not only on car sales, but on ancillary services, including the sale of finance and insurance.

While there is no comprehensive list of the number of car loan providers and brokers owned by or who are authorised representatives of AFSLs that are ADIs, some finance brokers owned by ADIs are providers of car loans and leases. Some illustrative examples are provided below.

Esanda, a provider of motor vehicle financing, is a division of ANZ Banking Corporation. In October 2015, ANZ agreed to the sale of the Esanda Dealer Finance portfolio to Macquarie Group Limited. The sale affected finance arranged through a car dealership, rather than financing arranged with Esanda directly or through a finance broker.

As at the announcement date (8 October 2015), the sale of the retail Dealer Finance portfolio was expected to be complete by 31 October 2015 and the wholesale Dealer Finance portfolio by 31 March 2016.

Macquarie notes on its website that it is ‘one of Australia’s largest motor financiers’, with car finance, sourcing and other services provided by Macquarie Leasing Pty Ltd.

MyFord Finance is a registered business name of Macquarie Leasing Pty Ltd.54 ACA Research, which publishes an annual Automotive Finance Insight Report based on a survey of nearly 800 automotive finance customers throughout Australia, notes in an article from December 2016 that ‘ANZ and Macquarie Bank (including Esanda) are currently the greatest beneficiaries of the broker channel’.

Holden Financial Services is a registered trademark of General Motors LLC and is used under sub-licence by St George Bank, a division of Westpac Banking Corporation Limited.

According to ASIC, car dealers have two main sources of finance-related income from a sale. Either they receive ‘a range of financial benefits from lenders, including upfront commissions for individual loans, volume bonuses according to the level of business arranged with a lender, and soft dollar benefits’.

‘Soft-dollar’ benefits are benefits received other than a basic cash commission or direct client fee.

Alternatively, dealers ‘can charge the consumer a dealer origination fee for assisting in the provision of finance’.

The ACCC notes that after-market services can often ‘contribute significantly to manufacturers’ and dealers’ overall profitability’, noting that ‘dealers will be willing to sell some goods and services with a lower mark-up (including new cars) if this means they can sell more high mark-up services (such as parts, insurance and finance)’.

On 7 September 2017, ASIC banned ‘flex commissions’ in the car finance market. Flex commissions are paid by lenders to car finance brokers (typically car dealers), allowing the dealers to set the interest rate on the car loan. The legislative instrument set by ASIC operates so that the lender not the car dealer has responsibility for determining the interest rate that applies to a particular loan. Lenders and dealerships have until November 2018 to implement new commission arrangements that comply with the new law.

ACA Research has noted that, based on its survey data released in 2016, around 33% of buyers browsed a finance broker website and 16% of buyers used a broker to secure financing. ACA Research results also showed that consumers who obtain car loans spend time considering their options before visiting a dealership. 81% of consumers researched finance options online, 76% of consumers considered their finance options prior to test driving a vehicle and 51% of consumers chose a lender prior to visiting a dealership.

Stratton Finance, a finance broker specialising in car financing, notes from its research that in 2017, the average car loan size was $39,445, the median loan size was $31,003 and the most popular loan size was $20,000. Stratton Finance also noted that men on average borrow around $5,000 more to finance a vehicle purchase than women. According to Stratton Finance, this was a result of women choosing to purchase smaller, more economical cars.

The delinquency indices for motor vehicle loans have increased since 2012, but remain at low levels in absolute terms. The 30+ days past due arrears rate has increased to 1.6% of loans by end June 2017 and the 60+ days past due arrears rate has increased to 0.8% of loans by end June 2017. Both indices, according to Fitch Ratings, have reached ‘record quarter-end levels’. Fitch expects increased losses in the September quarter 2017, reflecting rising arrears over the past nine months.