On Friday morning, commissioner Kenneth Hayne QC published a background paper titled Some Features of the Australian Banking Industry.

The paper points to the role of authorised-deposit taking (ADI) institutions, which hold 55 per cent of the total assets of Australian financial institutions.

It also points to declining competition in the the banking sector, with the number of credit unions falling due to consolidation and the major banks holding 75 per cent of total assets held by ADIs in Australia.

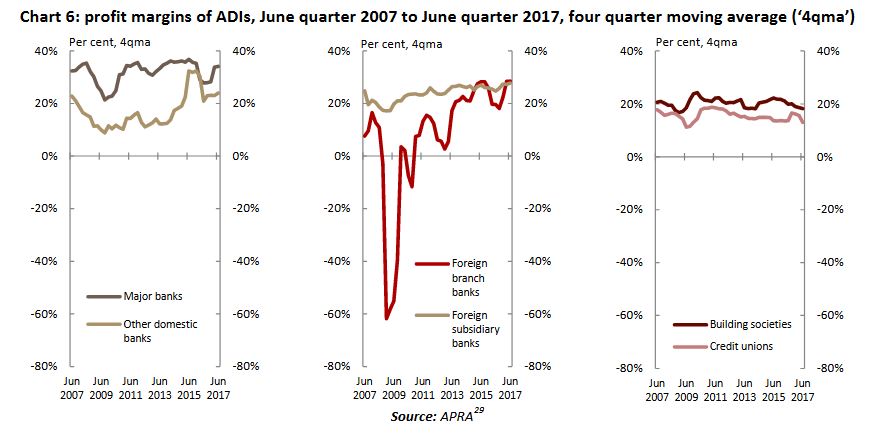

The paper notes that five of the 20 listed companies that make up the ASX20 are banks, noting that the major banks have “generally achieved higher profit margins than other types of ADIs”.

“The major banks earned a profit margin of 36.4 per cent in the June quarter 2017. Major banks’ net profit after tax in the June quarter 2017 was $7.8 billion,” noted the paper.

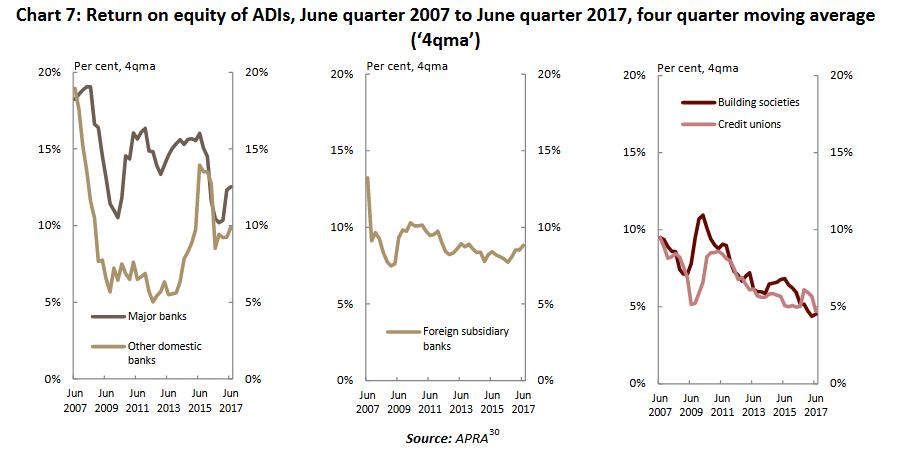

While the commission noted that precise international comparisons are difficult, it found that Australia’s major banks are “comparatively more profitable (as assessed by net income as a percentage of total assets) than some of their international peers in Canada, Sweden, Switzerland and the UK”.

“Similar conclusions can be reached for international comparisons for Australian major banks’ return on equity,” said the paper.

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, will hold its initial public hearing at 10am this morning in Melbourne. The hearing will be streamed lived through the Royal Commission’s website.