Following an article in The Adviser highlighting a ‘major flaw’ in the online form for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, the commission has now updated the form to better reflect channel choice.

On Wednesday, The Adviser ran a story in which Queensland-based broker Nicki McDavitt warned that the figures cited by the initial hearing of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry could be wrong, after she identified what she called a “major flaw” in the commission’s online form.

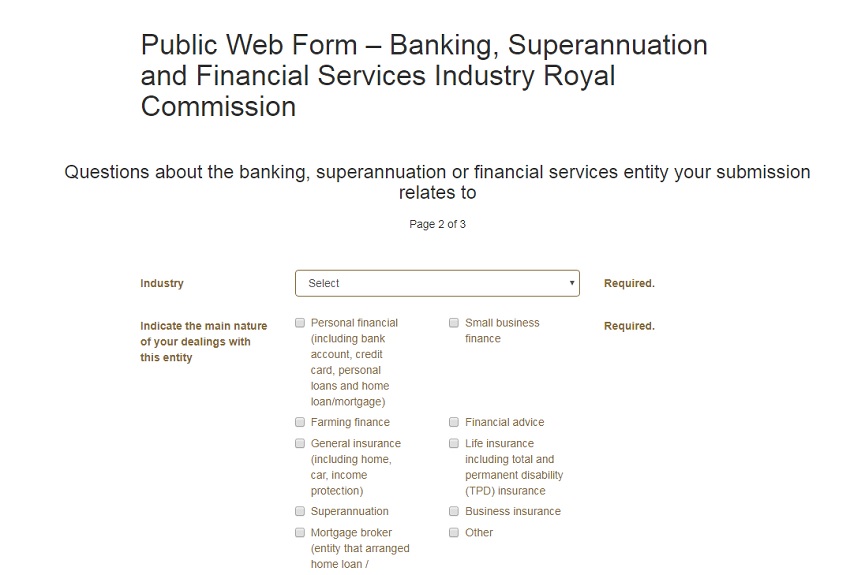

The form asks users to identify the “nature of the dealings” in which misconduct took place.

However, the only option specifically relating to home loans fell under the category ‘mortgage broker’. Ms McDavitt therefore said that the commission’s figures on mortgage broker-related misconduct could be “false” as they may include information relating to bank branch home loans (and therefore be miscategorised).

However, the royal commission has today (14 February) updated the form to allow users to select ‘home loan/mortgage’ under the ‘personal finance’ option (see below). The mortgage broker option has also been updated to read ‘entity that arrange homed loan/mortgage’

Speaking to The Adviser following the change, Ms McDavitt said: “I’m absolutely thrilled. I’m thrilled that I was listened to and I’m thrilled that it has been changed.”

Ms McDavitt said the Royal Commission thanked her for bringing it to their attention as they had “not even realised that it was not even there” and brought it up with the web designers who changed it today (14 February).

“I said to [the contact]: ‘It does mean that those statistics that you have been flouting will be wrong’ and she acknowledged that it could be a risk, but said: ‘Thankfully we’ve caught it early’. And I said ‘yes’.”

The Adviser had asked the commission yesterday (13 February) for a comment on the issue and whether it would be changing the form, and received the following response: “The online submission process is working well and based on the number of submissions received to date, we are confident that those using the form have been able to identify correctly the nature of their dealings, including to identify home loans taken out with banks.

“We are also reviewing submissions as they come in to ensure that they are appropriately categorised.

“We are committed to ensuring that the information on our website is clear and easy to understand, so we will continue to review and improve the website going forward.”

The heads of both the mortgage broker associations had spoken to The Adviser this morning, both highlighting that they would be raising this issue of the online form error with the royal commission.

Speaking to The Adviser after the change, the executive director of the FBAA, Peter White, welcomed the change, but added that he believed the bank branches “still get off lightly, as the grouping/sections for arranging loans is highlighted separately for brokers, whereas the bank branches are not identified separately but rather in the cluster titled ‘Personal Financial’”.

He added: “This should read as ‘Personal Banking’ or the like, and then have the itemisation in brackets following it.”