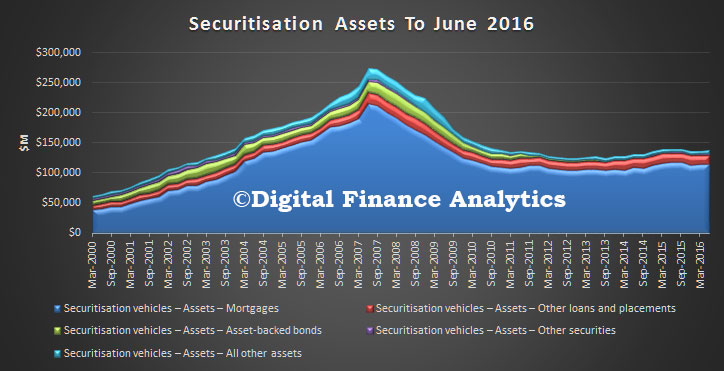

The RBA statistics gives a view of the state of play of in particular mortgage backed securitisation. Prior to the GFC this form of financing was accelerating, but since then has been less popular – due to higher regulatory requirements, lower overseas demand, and the emergence of other funding structures. The costs of issuance, which before the GFC were significantly lower than more traditional funding alternatives, has largely been negated.

As a result, total mortgage backed assets fell 0.37% month on month to $114 billion. Compare this with a peak of $215 billion in June 2007.

As a result, total mortgage backed assets fell 0.37% month on month to $114 billion. Compare this with a peak of $215 billion in June 2007.

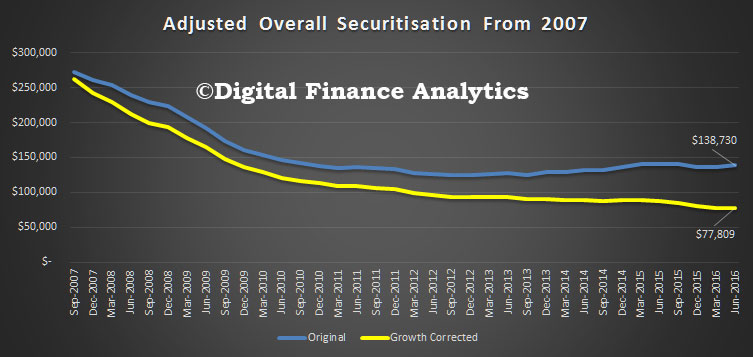

Remembering that bank credit has been growing significantly, the fall is, in real terms, even more stark. The chart above depreciates the total securitisation pool of ~$138 billion by credit growth, from its peak in 2007. It shows that in 2007 terms, the fall is even greater, to ~$78 billion, a significant drop from its peak of $274 billion.

Remembering that bank credit has been growing significantly, the fall is, in real terms, even more stark. The chart above depreciates the total securitisation pool of ~$138 billion by credit growth, from its peak in 2007. It shows that in 2007 terms, the fall is even greater, to ~$78 billion, a significant drop from its peak of $274 billion.

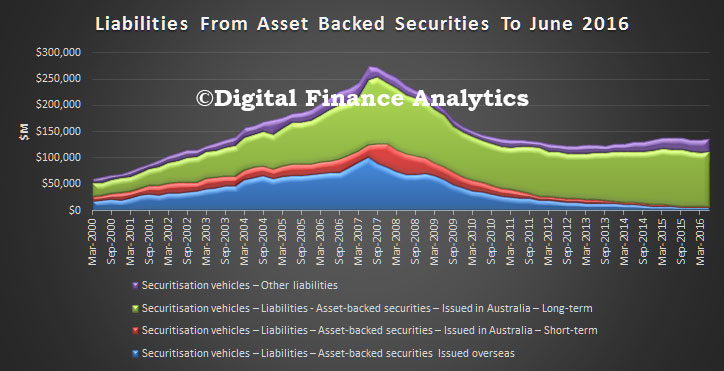

The other significant fact is that now 94% of securitisation deals are being sold in Australia, of which 75% are short term, and 19% long term. Overseas issuance, which peaked in 2007, remains close to their lows, at around 1.6%.

The other significant fact is that now 94% of securitisation deals are being sold in Australia, of which 75% are short term, and 19% long term. Overseas issuance, which peaked in 2007, remains close to their lows, at around 1.6%.