The Bank for International Settlements Committee on Payments and Market Infrastructures has released a report “Central bank

digital currencies“. It looks at both wholesale and more generally available models. The former, they say might be useful for payments but more work is needed to assess the full potential. Although a CBDC would not alter the basic mechanics of monetary policy implementation, its transmission could be affected. A general purpose CBDC could have wide-ranging implications for banks and the financial system. Customer deposits may become less stable, as deposits could more easily take flight to the central bank in times of stress.

Interest in central bank digital currencies (CBDCs) has risen in recent years. The Committee on Payments and Market Infrastructures and the Markets Committee recently completed work on CBDCs, analysing their potential implications for payment systems, monetary policy implementation and transmission as well as for the structure and stability of the financial system.

CBDC is potentially a new form of digital central bank money that can be distinguished from reserves or settlement balances held by commercial banks at central banks. There are various design choices for a CBDC, including: access (widely vs restricted); degree of anonymity (ranging from complete to none); operational availability (ranging from current opening hours to 24 hours a day and seven days a week); and interest bearing characteristics (yes or no).

Many forms of CBDC are possible, with different implications for payment systems, monetary policy transmission as well as the structure and stability of the financial system. Two main CBDC variants are analysed in this report: a wholesale and a general purpose one. The wholesale variant would limit access to a predefined group of users, while the general purpose one would be widely accessible.

Wholesale CBDCs, combined with the use of distributed ledger technology, may enhance settlement efficiency for transactions involving securities and derivatives. Currently proposed implementations for wholesale payments – designed to comply with existing central bank system requirements relating to capacity, efficiency and robustness – look broadly similar to, and not clearly superior to, existing infrastructures. While future proofs of concept may rely on different system designs, more experimentation and experience would be required before central banks can usefully and safely implement new technologies supporting a wholesale CBDC variant.

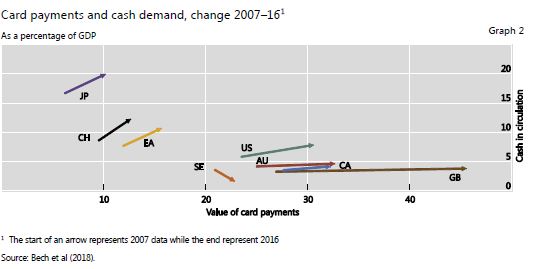

In part because cash is rapidly disappearing in their jurisdiction, some central banks are analysing a CBDC that could be made widely available to the general public and serve as an alternative safe, robust and convenient payment instrument.

In circumstances where the traditional approach to the provision of central bank money – in physical form to the general public and in digital form to banks – was altered by the disappearance of cash, the provision of CBDC could bring substantial benefits.

However, analysing whether these goals could also be achieved by other means is advisable, as CBDCs raise important questions and challenges that would need to be addressed. Most importantly, while situations differ, the benefits of a widely accessible CBDC may be limited if fast (even instant) and efficient private retail payment products are already in place or in development.

Although a general purpose CBDC might be an alternative to cash in some situations, a central bank introducing such a CBDC would have to ensure the fulfilment of anti-money laundering and counter terrorism financing (AML/CFT) requirements, as well as satisfy the public policy requirements of other supervisory and tax regimes. Furthermore, in some jurisdictions central banks may lack the legal authority to issue a CBDC, and ensuring the robust design and operation of such a system could prove to be challenging. An anonymous general purpose CBDC would raise further concerns and challenges. Although it is unlikely that such a CBDC would be considered, it would not necessarily be limited to retail payments and it could become widely used globally, including for illegal transactions. That said, compared with the current situation, a non-anonymous CBDC could allow for digital records and traces, which could improve the application of rules aimed at AML/CFT.

The introduction of a CBDC would raise fundamental issues that go far beyond payment systems and monetary policy transmission and implementation. A general purpose CBDC could give rise to higher instability of commercial bank deposit funding. Even if designed primarily with payment purposes in mind, in periods of stress a flight towards the central bank may occur on a fast and large scale, challenging commercial banks and the central bank to manage such situations. Introducing a CBDC could result in a wider presence of central banks in financial systems. This, in turn, could mean a greater role for central banks in allocating economic resources, which could entail overall economic losses should such entities be less efficient than the private sector in allocating resources. It could move central banks into uncharted territory and could also lead to greater political interference.