The ATO published the latest data on Self-managed superannuation funds to 2016. The number and balance of funds continues to grow and contributions are growing faster than to retail or industry funds. More property is held and under limited recourse borrowing arrangement.

In 2015–16, estimated average return on assets for SMSFs was positive (2.9%), a decrease from the estimated returns in 2014–15 (6.0%). This was the same as the investment performance for APRA funds of more than four members (2.9%) and remains consistent with the trend for APRA funds over the five years to 2016.

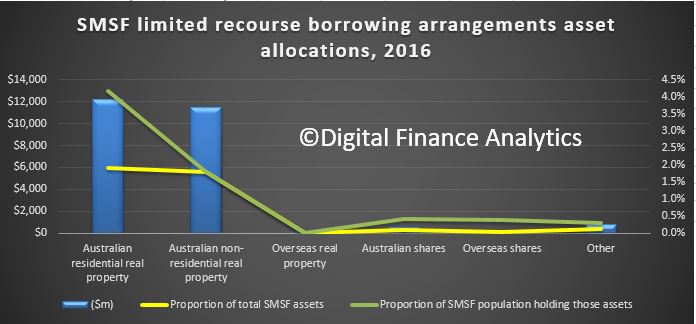

We also see a rise in property investment within SMSFs, with 7% of SMSFs reported $25.4 billion assets held under limited recourse borrowing arrangement (LRBAs), which is slightly higher than in 2015 (6%). The majority of these funds held LRBA investments in residential real property and non-residential real property.

The estimated average total expense ratio of SMSFs in 2016 was 1.21% and the average total expenses value was $13,700. This would be lower than the typical costs in a retail fund.

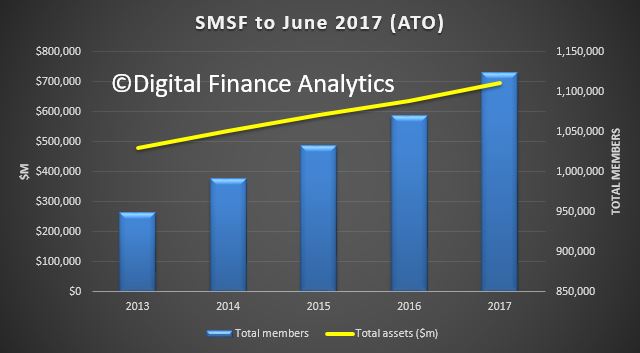

SMSF’s make up 30% of all superannuation assets which in total are worth $2.3 billion. There were 597,000 SMSFs holding $697 billion in assets, with more than 1.1 million SMSF members as at 30 June 2017. Over the five years to 30 June 2017, growth in the number of SMSFs averaged almost 5% annually.

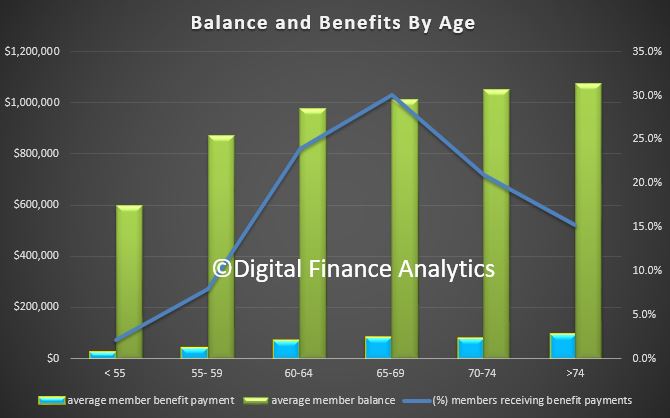

At 30 June 2016 the average SMSF member balance was $599,000 and the median balance was $362,000, an increase of 26% and 32% respectively over the five years to 2016.

At 30 June 2016 the average SMSF member balance was $599,000 and the median balance was $362,000, an increase of 26% and 32% respectively over the five years to 2016.

The average member balances for female and male members were $511,000 and $641,000 respectively. The female average member balance increased by 30% over the five-year period, while the male average member balance increased by 22% over the same period.

Over the five years to 2016, the proportion of members with balances of $200,000 or less decreased from 42% to 32% of all members.

In 2016, the majority of members had balances of between $200,001 and $1 million.

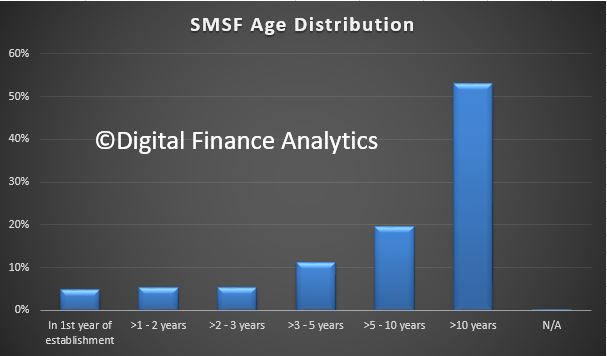

53% of SMSFs have been established for more than 10 years, and 16% have been established for three years or less.

53% of SMSFs have been established for more than 10 years, and 16% have been established for three years or less.

For the 2015–16 income year, the average assets of SMSFs were just over $1.1 million, a growth of 25% over five years and 3% from 2015. Total contributions to SMSFs increased by 21% over the five years to 2016. This is significantly higher than the growth of total contributions to all superannuation funds (16%) over the same period. The majority of SMSFs continued to be solely in the accumulation phase (53%) with the remaining 47% making pension payments to some of or all members.

For the 2015–16 income year, the average assets of SMSFs were just over $1.1 million, a growth of 25% over five years and 3% from 2015. Total contributions to SMSFs increased by 21% over the five years to 2016. This is significantly higher than the growth of total contributions to all superannuation funds (16%) over the same period. The majority of SMSFs continued to be solely in the accumulation phase (53%) with the remaining 47% making pension payments to some of or all members.

At 30 June 2017, 57% of all SMSFs had a corporate trustee rather than individual trustees.

Of newly registered SMSFs in 2015 to 2017, on average 81% were established with a corporate trustee.

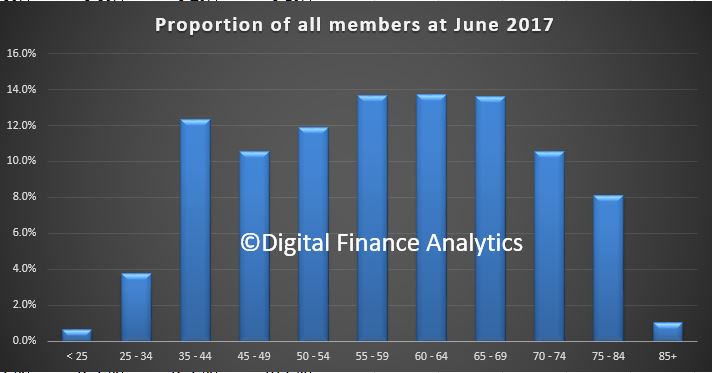

At 30 June 2017 there were 1.1 million SMSF members, of whom 53% were male and 47% female.

The trend continued for members of new SMSFs to be from younger age groups. The median age of SMSF members of newly established funds in 2016 was 47 years, compared to 59 years for all SMSF members as at 30 June 2017.

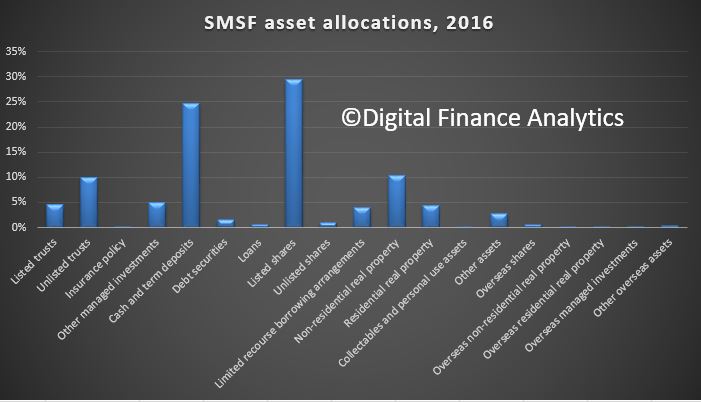

SMSFs directly invested 80% of their assets, mainly in cash and term deposits and Australian-listed shares (a total of 54%).

SMSFs directly invested 80% of their assets, mainly in cash and term deposits and Australian-listed shares (a total of 54%).

In the five years to 2016, cash and term deposits decreased (by 7%) to 25% of total SMSF assets.

In 2016, 7% of SMSFs reported $25.4 billion assets held under Limited recourse borrowing arrangement (LRBAs), which is slightly higher than in 2015 (6%). The majority of these funds held LRBA investments in residential real property and non-residential real property. In terms of value, real property assets held under LRBAs collectively made up 93% or $23.7 billion of all SMSF LRBA asset holdings in 2016.

In 2016, 7% of SMSFs reported $25.4 billion assets held under Limited recourse borrowing arrangement (LRBAs), which is slightly higher than in 2015 (6%). The majority of these funds held LRBA investments in residential real property and non-residential real property. In terms of value, real property assets held under LRBAs collectively made up 93% or $23.7 billion of all SMSF LRBA asset holdings in 2016.

The estimated average total expense ratio of SMSFs in 2016 was 1.21% and the average total expenses value was $13,700.

The estimated average total expense ratio of SMSFs in 2016 was 1.21% and the average total expenses value was $13,700.

The average ‘investment expense’ and ‘administration and operating expense’ ratios were consistent at 0.65% and 0.56% respectively.