The Australian Financial Security Authority (AFSA) released regional personal insolvency statistics for the June quarter 2017.

There were 7,729 debtors who entered a new personal insolvency in the June quarter 2017 in Australia. This is a fall of 311 debtors (3.9%) compared to the March quarter 2017. Victoria and Queensland had the strongest falls, falling by 131 and 111 debtors respectively. Both of these states had falls in the number of debtors in both the capital city and the rest of the state.

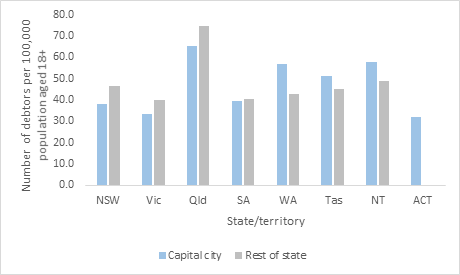

Regional Queensland has the highest relative proportion of debtors, and the were also more in regional NSW compared with those in the City.

Personal insolvency in Australia: capital cities compared to rest of state

New South Wales

There were 1,297 debtors who entered a new personal insolvency in Greater Sydney in the June quarter 2017. The regions with the highest number of debtors were Campbelltown (83), Wyong (74) and Penrith (71).

There were 892 debtors who entered a new personal insolvency in rest of New South Wales in the June quarter 2017. The regions with the highest number of debtors were Newcastle (43), Tamworth – Gunnedah (42) and Shoalhaven (42).

Victoria

There were 1,045 debtors who entered new personal insolvencies in Greater Melbourne in the June quarter 2017. The regions with the highest number of debtors were Casey – South (76), Wyndham (71) and Whittlesea – Wallan (70).

There were 410 debtors who entered a new personal insolvency in rest of Victoria in the June quarter 2017. The regions with the highest number of debtors were Geelong (59), Ballarat (45) and Bendigo (29).

Queensland

There were 1,023 debtors who entered a new personal insolvency in Greater Brisbane in the June quarter 2017. The regions with the highest number of debtors were Springfield – Redbank (71), Browns Plains (70) and Ipswich Inner (55).

There were 1,272 debtors who entered a new personal insolvency in rest of Queensland in the June quarter 2017. The regions with the highest number of debtors were Townsville (116), Ormeau – Oxenford (95) and Mackay (91).

South Australia

There were 378 debtors who entered a new personal insolvency in Greater Adelaide in the June quarter 2017. The regions with the highest number of debtors were Onkaparinga (67), Playford (53) and Salisbury (41).

There were 115 debtors who entered a new personal insolvency in rest of South Australia in the June quarter 2017. The regions with the highest number of debtors were Eyre Peninsula and South West (29), Limestone Coast (20) and Murray and Mallee (12).

Western Australia

There were 755 debtors who entered a new personal insolvency in Greater Perth in the June quarter 2017. The regions with the highest number of debtors were Wanneroo (86), Rockingham (77) and Swan (74).

There were 161 debtors who entered a new personal insolvency in rest of Western Australia in the June quarter 2017. The regions with the highest number of debtors were Bunbury (43), Wheat Belt – North (21), Augusta – Margaret River – Busselton (18), Mid West (18) and Pilbara (18).

Tasmania

There were 84 debtors who entered a new personal insolvency in Greater Hobart in the June quarter 2017. The regions with the highest number of debtors were Hobart – North West (38), Hobart – North East (16) and Hobart – South and West (12).

There were 98 debtors who entered a new personal insolvency in rest of Tasmania in the June quarter 2017. The regions with the highest number of debtors were Launceston (33), Devonport (16) and Burnie – Ulverstone (14).

Northern Territory

There were 52 debtors who entered a new personal insolvency in Greater Darwin in the June quarter 2017. The regions with the highest number of debtors were Palmerston (19), Darwin Suburbs (16) and Darwin City (9).

There were 30 debtors who entered a new personal insolvency in rest of Northern Territory in the June quarter 2017. The regions with the highest number of debtors were Alice Springs (14) and Katherine (11).

Australian Capital Territory

In the June quarter 2017, 89 debtors entered new personal insolvencies in the Australian Capital Territory. The regions with the highest number of debtors were Tuggeranong (31), Gungahlin (22) and Belconnen (20).