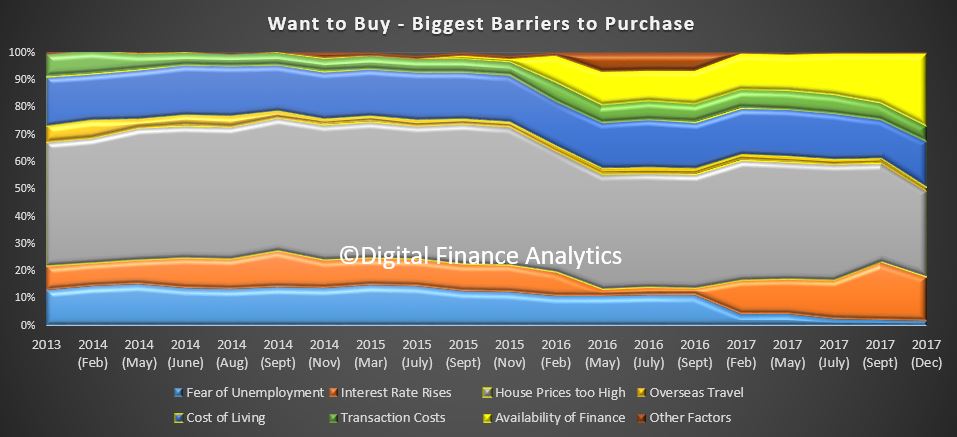

Now, in our review of the results from our household surveys, we look at owner occupied purchasers. We start with “want to buys” – households who would like to purchase but cannot. High home prices are the strongest barrier (31%), followed by availability of finance (27%), rising costs of living (17%) and concerns about interest rate rises (16%). Unemployment is not currently a major concern.

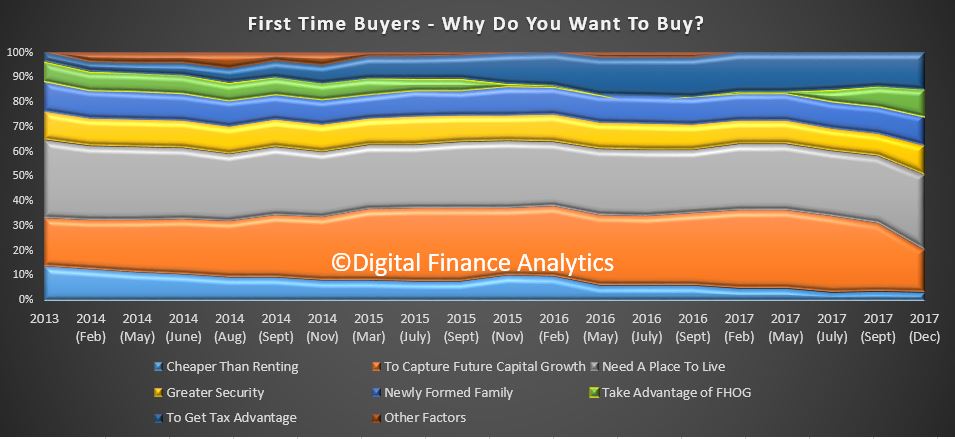

Turning to first time buyers, around 30% are buying for a place to live, while 17% are eying the potential capital gains (down from 31% a year ago). 15% are motivated by tax breaks, and 11% by the availability of first home owner grants (FHOG), up from 1% a year ago. Greater security is also another factor (12%).

Turning to first time buyers, around 30% are buying for a place to live, while 17% are eying the potential capital gains (down from 31% a year ago). 15% are motivated by tax breaks, and 11% by the availability of first home owner grants (FHOG), up from 1% a year ago. Greater security is also another factor (12%).

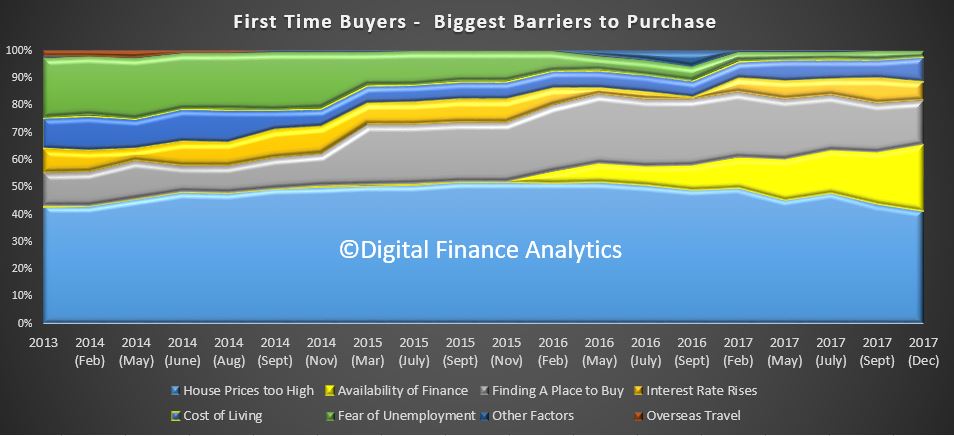

Turning to first time buyer barriers, the most significant challenge is problems with finance availability at 24.5% (compared with 11% a year ago), and house prices 41.1% (compared with 45.5% a year ago). Finding a place to buy is a little easier, down from 24% a year ago to 16% now.

Turning to first time buyer barriers, the most significant challenge is problems with finance availability at 24.5% (compared with 11% a year ago), and house prices 41.1% (compared with 45.5% a year ago). Finding a place to buy is a little easier, down from 24% a year ago to 16% now.

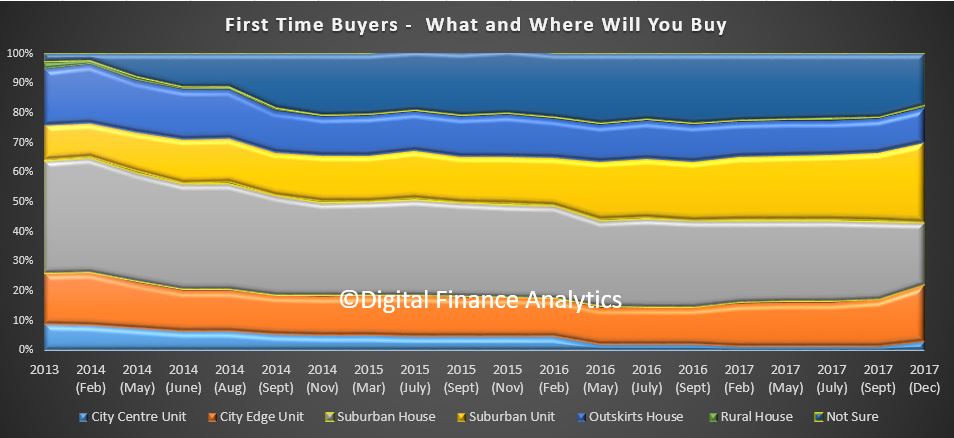

Looking at the type of property they expect to purchase, we see a rise in city edge units, and suburban units, as more purchase an apartment not a house. 17% are not sure what to buy, compared with 22% a year ago.

Looking at the type of property they expect to purchase, we see a rise in city edge units, and suburban units, as more purchase an apartment not a house. 17% are not sure what to buy, compared with 22% a year ago.

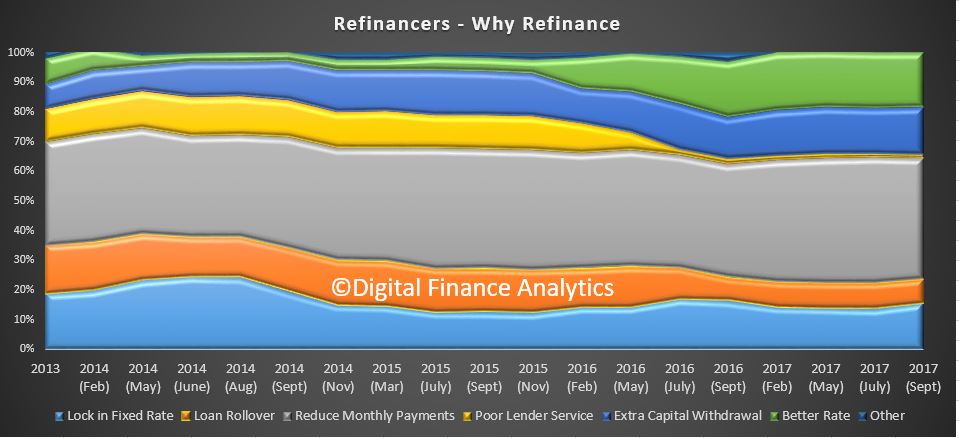

Those seeking to refinance are driven a desire to reduce monthly payments (42%), 17% to withdraw capital, 18% for a better interest rate and 14% to lock in a fixed rate. Poor lender service is not a significant driver of refinancing.

Those seeking to refinance are driven a desire to reduce monthly payments (42%), 17% to withdraw capital, 18% for a better interest rate and 14% to lock in a fixed rate. Poor lender service is not a significant driver of refinancing.

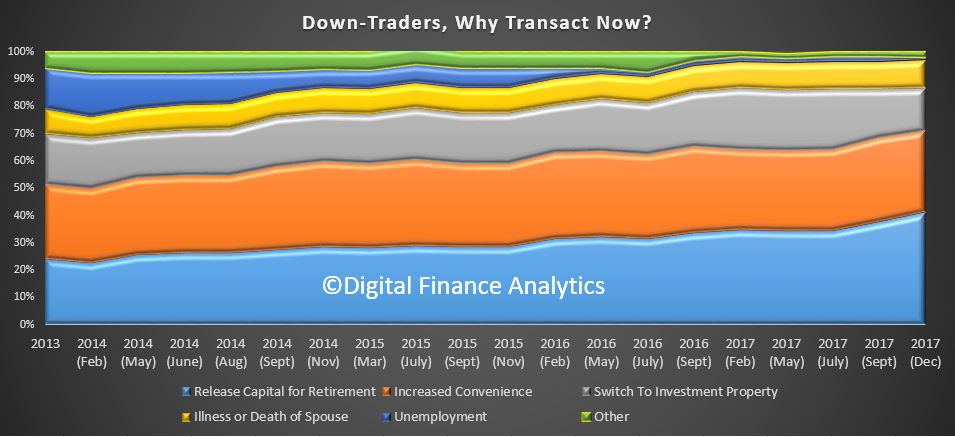

Those seeking to sell and move down the market are seeking to release capital for retirement (41%), up from a year ago, 30% moving for great living convenience, and 10% because of illness or death of a spouse. Interestingly, the attraction of putting funds into an investment property has reduced from 23% a year ago to 16% now.

Those seeking to sell and move down the market are seeking to release capital for retirement (41%), up from a year ago, 30% moving for great living convenience, and 10% because of illness or death of a spouse. Interestingly, the attraction of putting funds into an investment property has reduced from 23% a year ago to 16% now.

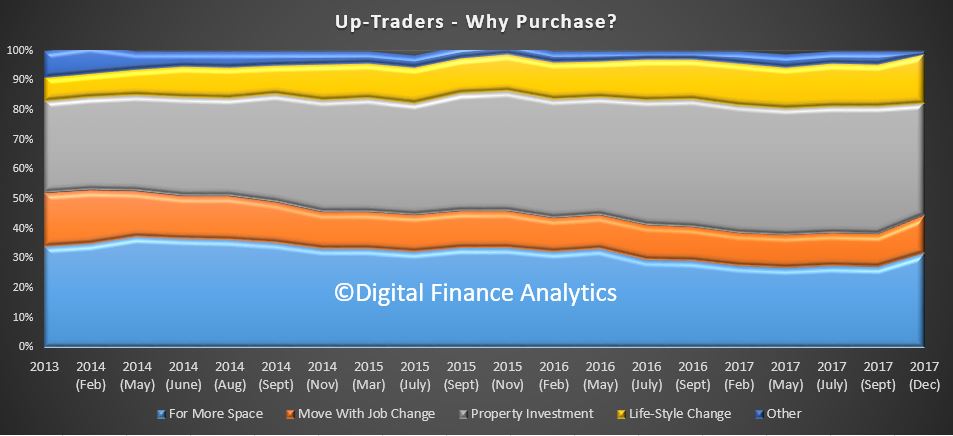

Finally, those seeking to trade up, 32% are doing so to get more space, 38% for investment purposes down from 43% a year ago, 17% for life style change and 13% for job change.

Finally, those seeking to trade up, 32% are doing so to get more space, 38% for investment purposes down from 43% a year ago, 17% for life style change and 13% for job change.

So the surveys highlight the lower appetite for investment property, the barriers limiting access to funds, and the desire to extract capital before prices fall much further.

So the surveys highlight the lower appetite for investment property, the barriers limiting access to funds, and the desire to extract capital before prices fall much further.

Putting all this together, we think home prices are likely to fall further, as investor appetite continue to dissipate, and whilst there will be some first time buyer substitution, it will not be sufficient to keep prices high. Sydney, Brisbane and Melbourne markets are most likely to see a fall though 2018. There is a risk of a more sustained fall if more property investors decide to cut their losses and try to lock in paper profits.