The ABS released their taxation revenue statistics to 2017-2018 today. The series contains many interesting nuggets of insight, but there were two which stood out for me.

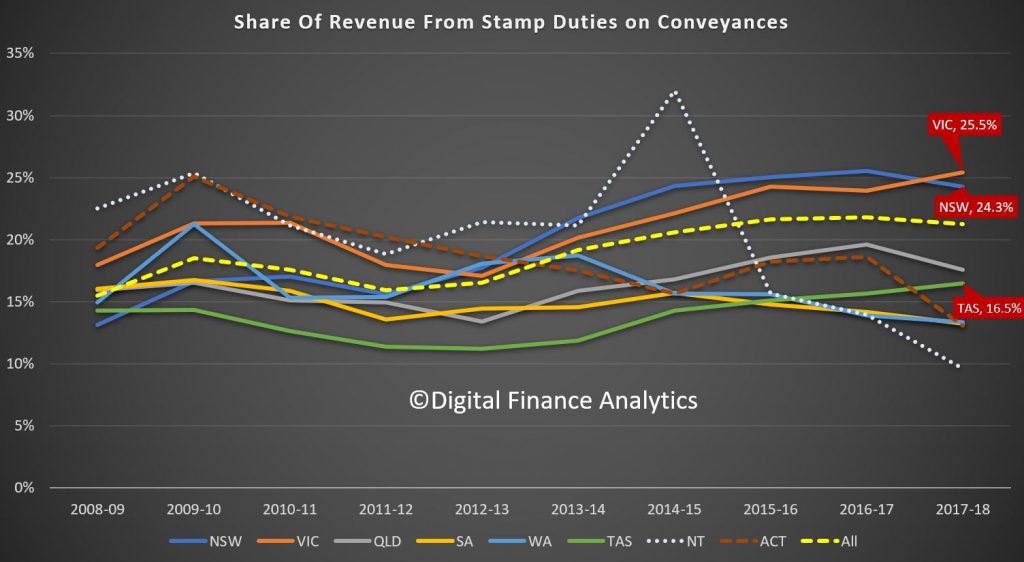

First, the share of revenue for the states, drawn from stamp duty is falling, but still makes up 25.5% of Victoria’s take and 24.3% of New South Wales. Guess what will happen in the housing sales momentum continues to ease.

State coffers will be under pressure (so expect to see ways to entice people to transact ahead).

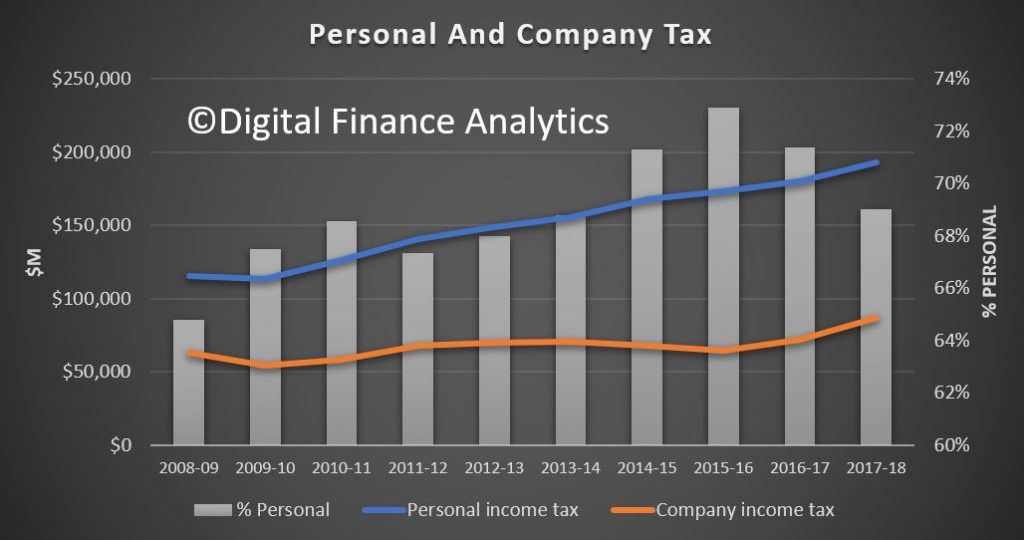

The other relates to the mix of personal income tax and corporate tax, bearing in mind that in real terms, personal income is flat, while company profits are pretty healthy (for now).

We see that back in 2008-9 the proportion of personal tax sat at 64.8%, rose to a peak of 72.9% in 2015-16, and sat at 69% in 2017-18. Bracket creep will explain much of the rise of course.

Puts the drive to reduce company tax further into a different context, given the current financial pressures on households.