Though Australia’s economic growth is currently being buttressed by a number of global and domestic factors, a number of weaknesses will see GDP growth drop back below trend by the end of next year, says Westpac via InvestorDaily.

According to Westpac’s June market outlook report, the 1 per cent GDP growth recorded in the first quarter of 2018 was an “above trend outcome” and “further confirmation that the Australian economy performed solidly over the past year”.

But report co-author and senior economist Andrew Hanlan indicated that this growth would not be sustained in the years ahead.

“Areas of weakness persist and are likely to weigh on the outlook,” Mr Hanlan wrote.

The current growth was being sustained by a cluster of both global and domestic forces, such as global growth which grew 0.6 per cent to 3.8 per cent in 2017, “the strongest pace since 2011”.

“We expect world growth to hold around this 3.8 per cent pace in 2018, supported by the US. However, conditions in China are likely to moderate,” the senior economist noted.

Furthermore, drags on commodity prices and mining investment had minimised, though “not quite complete”.

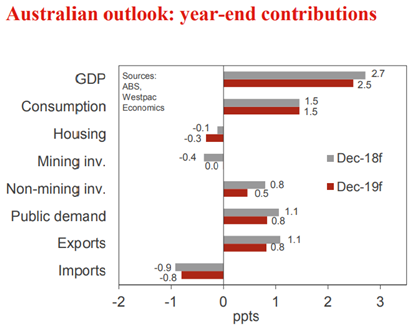

Other growth drivers such as public demand (that is, activity or investment undertaken by the public sector or government), business construction and exports had also pushed up growth, according to Mr Hanlan.

However, a number of weaknesses persist, particularly regarding consumer spending – which was “choppy”, “slightly below trend” and unsustainable – and housing.

“The consumer is vulnerable at a time of weak wages growth, high debt levels and slipping house prices,” with falling house prices potentially resulting in “negative spill-overs for consumer demand”.

“The housing sector is cooling as lending conditions tighten, with prices easing back from recent highs,” Mr Hanlan added.

Furthermore, jobs growth has slowed and home building activity shrank by 5 per cent in 2017.

“We expect GDP growth to moderate to 2.7 per cent in the year to December 2018 and then slip to a below trend 2.5 per cent for December 2019.”