Suncorp released their Hy18 results today. Reported net profit before tax was $452 million, down 15.8% on pcp. They explain this fall in terms of the impact of the damaging Victorian hailstorm that occurred just prior to the balance date, as well as the significant investment in their two major programs.

The management are doing the right things to get the business onto a stronger revenue and profit generating position, but still have risks relating to the future share of home lending, and ongoing natural hazards. Their digital strategy is beginning to pay dividends, but there is more to do. APRA’s recent announcements on capital ratios means the advanced capital approach will likely be less beneficial.

The result included the Business Improvement Program investment of $50 million, Marketplace spend of $36 million, with Natural Hazards $65 million unfavourable to allowance, driven primarily by the Victorian hail storm. Natural hazards were $395 million overall.

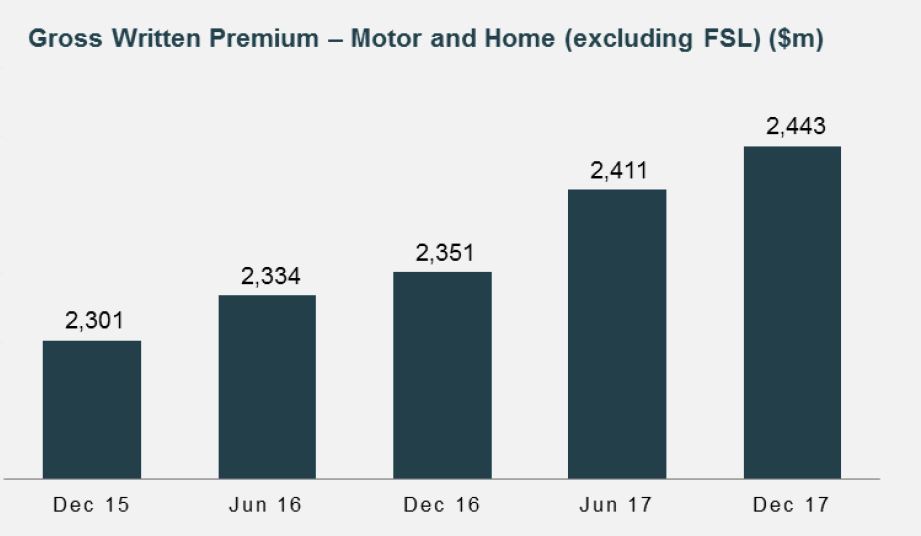

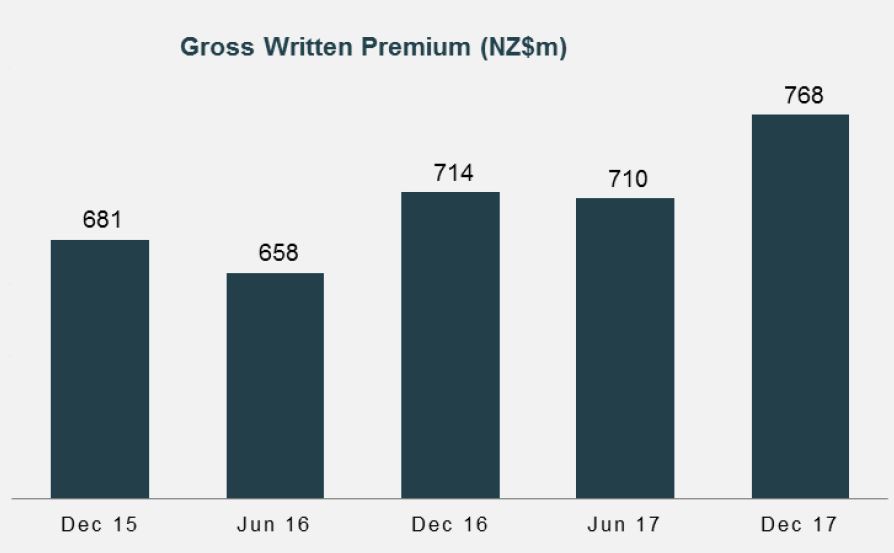

The Group’s top line growth was 2.5% driven by strong momentum in both Consumer General Insurance and Banking: Australian Home and Motor Insurance Gross Written Premium (GWP) up 3.9%; Bank lending growth 8.7%, well above system; Australian Life Insurance underlying profit after tax increased to $39 million, up 56% and New Zealand General Insurance achieved GWP growth of 7.6%

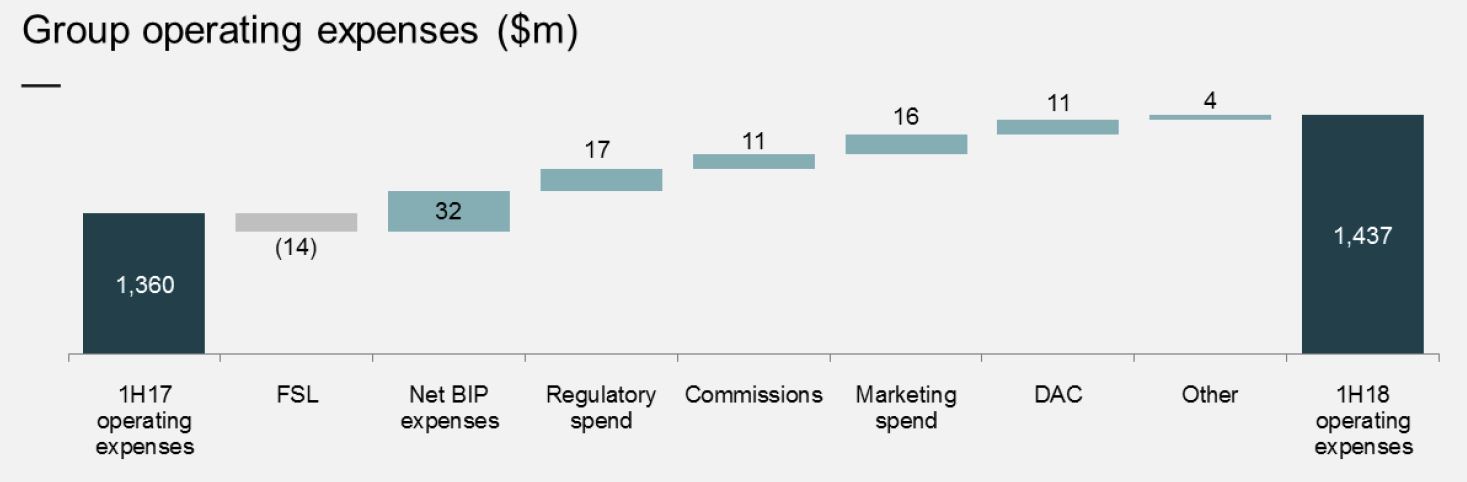

Total operating expenses increased 3.3 per cent, excluding the Business Improvement Program, and 5.7 per cent when including the net investment in the program.

Their $2.7 billion Business Improvement Program will reset the cost base and they foresee stronger growth ahead (presumably large insurance claims permitting!). The net benefits this year will be $10 million but that grows quickly to an expected $195 million next year, and $329 million in FY20.

Their $2.7 billion Business Improvement Program will reset the cost base and they foresee stronger growth ahead (presumably large insurance claims permitting!). The net benefits this year will be $10 million but that grows quickly to an expected $195 million next year, and $329 million in FY20.

Digital interactions are up 19% since this time last year. This has contributed to a 10% reduction in complaints.

In FY19, they are committing to a $2.7 billion cost base despite expected volume growth, and inflation.

The interim dividend was 33 cents, reflecting a payout ratio of 90%.

Looking across the divisions:

Insurance (Australia) – NPAT of $264 million was down 28.5 per cent as solid growth in net earned premiums was offset by higher natural hazard costs and the impact of investment in the Business Improvement Program.

GWP growth for Home and Motor Insurance was 3.9 per cent, driven by unit growth and price increases, while GWP growth in Commercial lines was 1.5 per cent for HY18. CTP premium growth was impacted by scheme reform in NSW and Queensland.

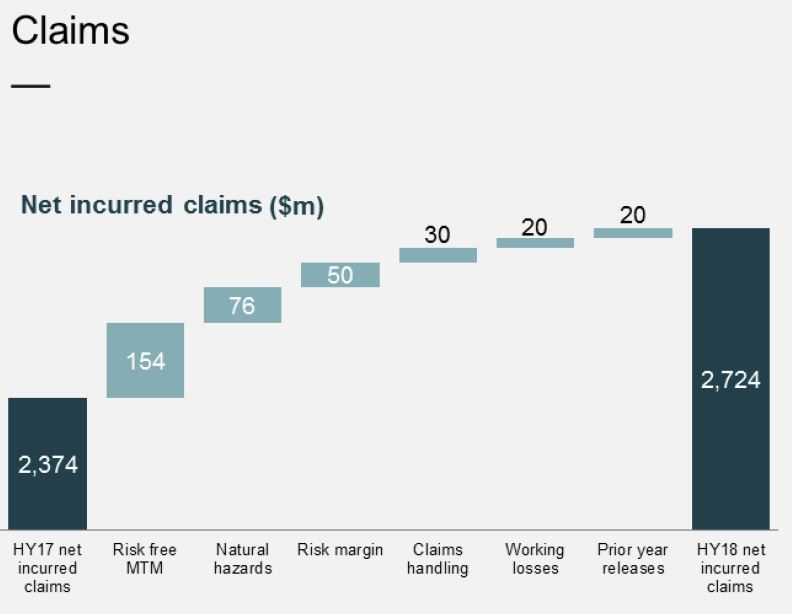

Net incurred claims costs were up 14.7 per cent, reflecting higher natural hazard costs.

Net incurred claims costs were up 14.7 per cent, reflecting higher natural hazard costs.

Investment income on the insurance funds was $120 million. The headline result was supported by mark-to-market gains from narrowing credit spreads and the outperformance of inflation-linked bonds. This was offset by mark-to-market losses from an increase in risk-free rates. The underlying portfolio yield was $106 million, or 2.3% annualised, which is slightly below our expectation of around 80 basis points above the risk-free rate.

Investment income on the insurance funds was $120 million. The headline result was supported by mark-to-market gains from narrowing credit spreads and the outperformance of inflation-linked bonds. This was offset by mark-to-market losses from an increase in risk-free rates. The underlying portfolio yield was $106 million, or 2.3% annualised, which is slightly below our expectation of around 80 basis points above the risk-free rate.

Australian Life Insurance underlying profit after tax was $39 million, up 56 per cent for the half, reflecting benefits of repricing and the ongoing focus of the optimisation program.

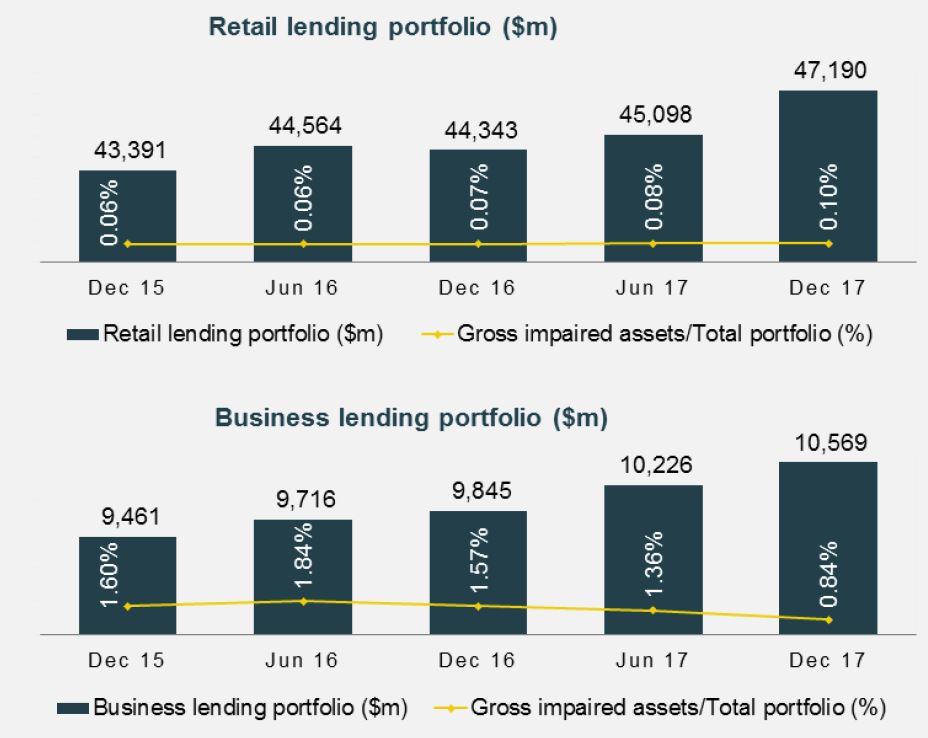

Banking & Wealth– delivered an NPAT of $197 million for the half, down 5.3 per cent on HY17, with good top line growth, offset by investment in the Business Improvement Program. Lending growth of 8.7 per cent reflected strong consumer and commercial lending momentum within Suncorp’s risk appetite.

Net interest margin (NIM) of 1.86 per cent remained strong supported by asset repricing and efficient funding.

Net interest margin (NIM) of 1.86 per cent remained strong supported by asset repricing and efficient funding.

Business credit quality was strong over the period. Impairment losses of $13 million, representing 4 basis points, remain well below the long‐run range

New Zealand – achieved a profit after tax of NZ$67 million (A$61 million) for the half year, an improvement of 81 per cent over the prior corresponding period. GWP growth was 7.6 per cent (in NZ dollar terms), with good performance across all channels (on a like for like basis, excluding the impact of the sale of Autosure in FY17, GWP increased 10.4%). Strong new business and retention rates delivered in‐force premium growth of 5 per cent (in NZ dollar terms).

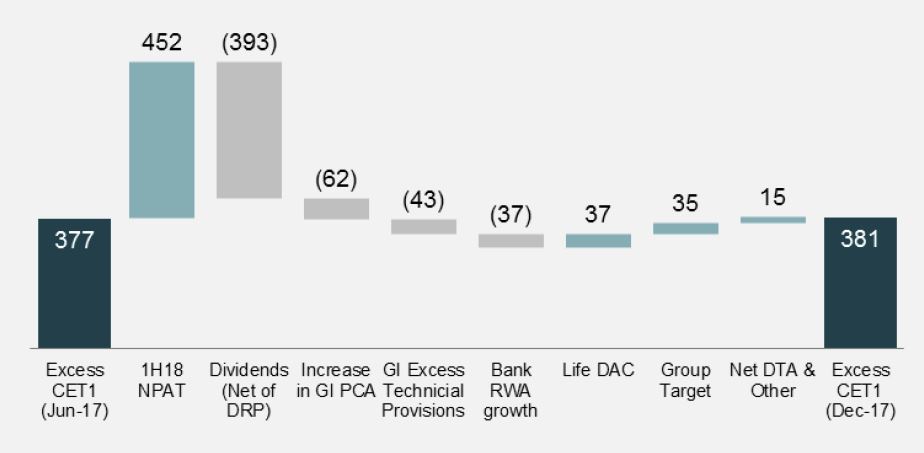

After payment of the dividend, the franking account balance will be $158 million. The Group is well capitalised with $381 million in CET1 capital held above its operating targets.

After payment of the dividend, the franking account balance will be $158 million. The Group is well capitalised with $381 million in CET1 capital held above its operating targets.

Suncorp remains committed to returning excess capital to shareholders.

Suncorp remains committed to returning excess capital to shareholders.

With regards to advanced capital management (IRB) they said:

While the pathway to advanced status has been more protracted than we had originally anticipated, we continue to work constructively with the Regulator to clarify the next steps in this process and the associated Basel 3 and ‘unquestionably strong’ capital requirements.