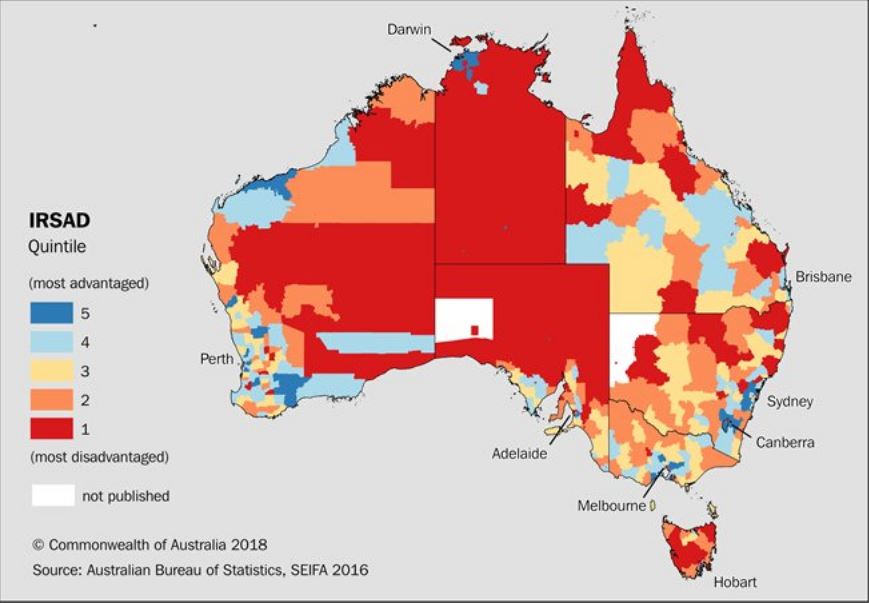

Ku-ring-gai on Sydney’s upper north shore is Australia’s most advantaged Local Government Area (LGA) according to new data released today from the ABS 2016 Census of Population and Housing.

Home to just over 118,000 residents on Census night, the leafy area is officially the most advantaged LGA in the country based on the ABS’ Socio-Economic Indexes for Areas (SEIFA), which ranks areas in Australia according to relative socio-economic advantage and disadvantage.

Another Sydney LGA, Mosman, which includes the affluent suburbs of Balmoral, Beauty Point and Clifton Gardens, has also been ranked amongst the most advantaged. In fact, SEIFA data shows the 10 most advantaged LGAs in Australia are all located around the Northern and Eastern areas of Sydney Harbour and in coastal Perth.

The most disadvantaged LGA is Cherbourg, approximately 250 kilometres north-west of Brisbane (QLD), followed by West Daly (NT). The 10 most disadvantaged LGAs in Australia can be found in Queensland and the Northern Territory.

SEIFA can help governments, communities and businesses determine areas needing additional funding and improved services, identify potential business opportunities, and research the relationship between health and education outcomes and the socio-economic conditions of an area.

The latest data has found that more than 30 per cent of people born in China, South Africa and Malaysia live in advantaged areas and less than 10 per cent reside in disadvantaged areas. Meanwhile, 40 per cent of Vietnamese-born live in disadvantaged areas and only a small proportion (11 per cent) live in advantaged areas.

People of Aboriginal and/or Torres Strait Islander origin are more likely to live in the most disadvantaged areas with 48 per cent living in the bottom fifth most disadvantaged LGAs, compared to 18 per cent of non-Indigenous people. Overall, only 5.4 per cent of Aboriginal and/or Torres Strait Islander people live in areas of high relative advantage compared with 22 per cent of non-Indigenous people.

New for 2016 SEIFA are easy-to-use features and data visualisation tools, including interactive maps on the ABS website, making interpreting Census data even easier.

For local rankings, go to the 2016 SEIFA publication. The full suite of online Census data products is available on the ABS website.

| 10 MOST ADVANTAGED AREAS

|

||

|

Rank

|

Local Government Area

|

Usual Resident Population

|

|

|

||

|

1

|

Ku-ring-gai (NSW)

|

118,053

|

|

2

|

Mosman (NSW)

|

28,475

|

|

3

|

Woollahra (NSW)

|

54,240

|

|

4

|

Cottesloe (WA)

|

7,597

|

|

5

|

Peppermint Grove (WA)

|

1,636

|

|

6

|

Nedlands (WA)

|

21,121

|

|

7

|

North Sydney (NSW)

|

67,658

|

|

8

|

Lane Cove (NSW)

|

36,051

|

|

9

|

Cambridge (WA)

|

26,783

|

|

10

|

Hunters Hill (NSW)

|

13,999

|

|

|

||

| 10 MOST DISADVANTAGED AREAS

|

||

|

Rank

|

Local Government Area

|

Usual Resident Population

|

|

|

||

|

1

|

Cherbourg (Qld)

|

1,269

|

|

2

|

West Daly (NT)

|

3,166

|

|

3

|

Belyuen (NT)

|

164

|

|

4

|

Woorabinda (Qld)

|

962

|

|

5

|

Central Desert (NT)

|

3,677

|

|

6

|

Aurukun (Qld)

|

1,269

|

|

7

|

Yarrabah (Qld)

|

2,559

|

|

8

|

Doomadgee (Qld)

|

1,405

|

|

9

|

Napranum (Qld)

|

957

|

|

10

|

Palm Island (Qld)

|

2,446

|

|

|

||