Today’s video post discusses the implications of the latest official lending data and announced rate rises.

Tag: Adelaide Bank

Adelaide Bank to monitor struggling property borrowers

Adelaide Bank is introducing an alert system that will monitor property borrowers that are struggling with their repayments.

The bank and its subsidiaries and affiliates will compare monthly mortgage repayments with borrowers’ income ratios.

“As part of our ongoing commitment to responsible lending, we are introducing the visibility of metrics relating to loan to income and monthly mortgage repayment to income ratios into our serviceability calculator for new loan applications – at the application stage only,” said Darren Kasehagen, Adelaide Bank’s head of business development and strategy.

Kasehagen told Australian Broker that additional commentary from the broker will be required when these internal guides are exceeded.

He stressed that this only applies to new loans.

“There is currently no change to our monitoring of existing loans,” he said.

The Australian Financial Review reported yesterday (8 February) that loans that exceed the bank’s guidelines will prompt a “diary note commentary” to alert the bank of possible mortgage stress.

The report said that this will automatically happen where the loan-to-income ratio exceeds five times or monthly mortgage repayments exceed 35% of a borrower’s income.

“The bank is telling third parties the data ‘is only required for internal purposes’,” said the AFR.

It attributed the bank’s move to an effort by lenders to prevent problem loans amid concern over rising household debt.

Fintech Spotlight – Tic:Toc:The 22 Minute Home Loan

This time, in our occasional series where we feature Australian Fintechs, we caught up with Anthony Baum, Founder & CEO of Tic:Toc.

Whilst there are any number of players in the market who may claim they have an online application process for home loans, the truth is, under the hood, there are still many manual processes, workflow delays and rework, which means the average time to get an approved loan is often 22 days, or more.

But Tic:Toc has cracked the problem, and can genuinely say they can approve a loan in 22 minutes. This represents a significant improvement from a customer experience perspective, but also a radical shift in the idea of home lending, moving it from a “specialised” service which requires broker or lender help, to something which can be automated and commoditised, thanks to the right smart systems and processes. Think of the cost savings which could be passed back to consumers!

But, what is it that Tic:Toc have done? Well, they have built an intelligent platform from the ground up, and have turned the loan appraisal on its head, through a five-step process.

The first step, when a potential customer is seeking a home loan, is to start with the prospective property. The applicant completes some relatively simple details about the home they want to purchase or refinance, and the system then applies, in real time, some business rules, including access to multiple automatic valuation models (AVMs) to a set confidence level, to determine whether a desktop valuation, or full valuation is required to progress, or whether the prospective deal is within parameters. If it is, the application proceeds immediately to stage 2. In the case of a refinanced loan, this is certainly more often the case.

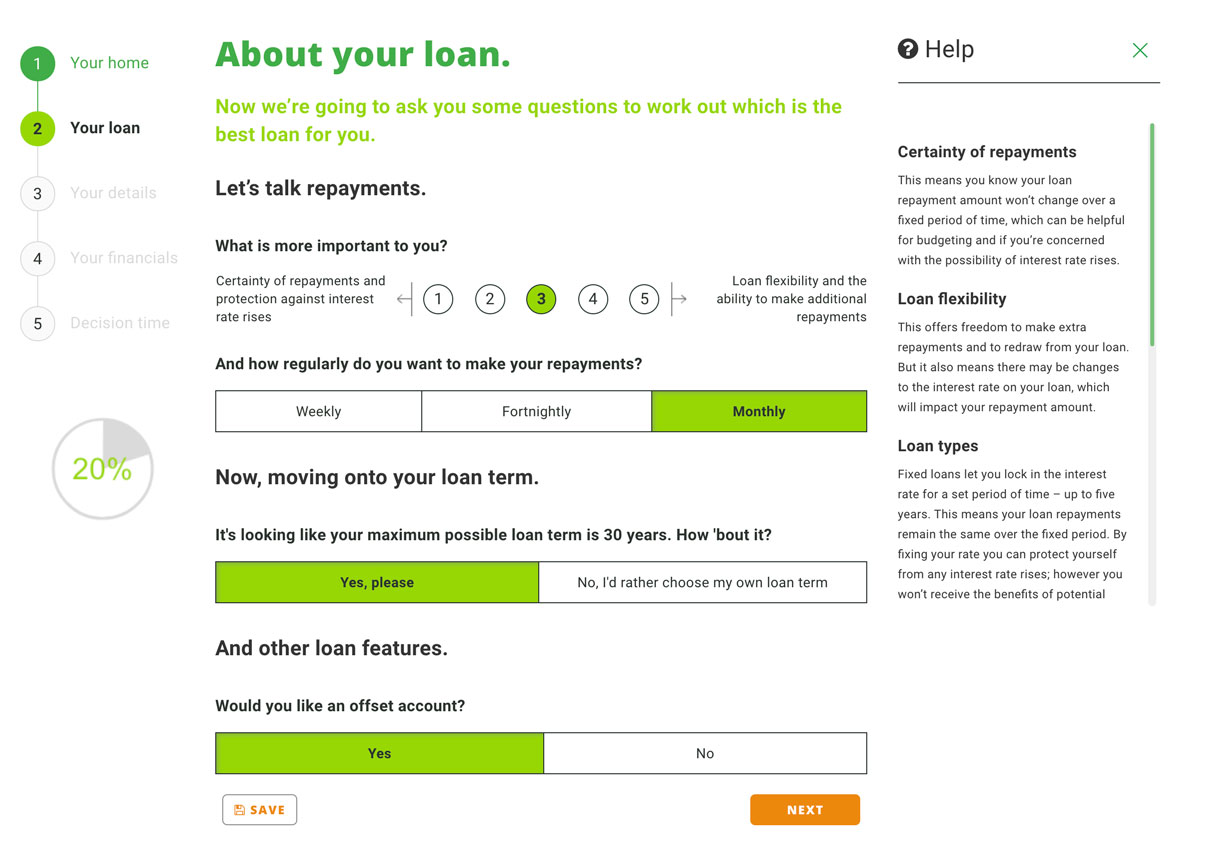

In the second step, the business rules at Tic:Toc focus on the product. They have built in the responsible lending requirements under the credit code. This means they can apply a consistent set of parameters. This approach has been approved by ASIC, and also been subject to independent audit. Compared with the vagaries we see in some other lender and broker processes, the Tic:Toc approach is just tighter and more controlled.

In the second step, the business rules at Tic:Toc focus on the product. They have built in the responsible lending requirements under the credit code. This means they can apply a consistent set of parameters. This approach has been approved by ASIC, and also been subject to independent audit. Compared with the vagaries we see in some other lender and broker processes, the Tic:Toc approach is just tighter and more controlled.

Up to this point, there is no personal information captured, which makes the first two steps both quick, and smart.

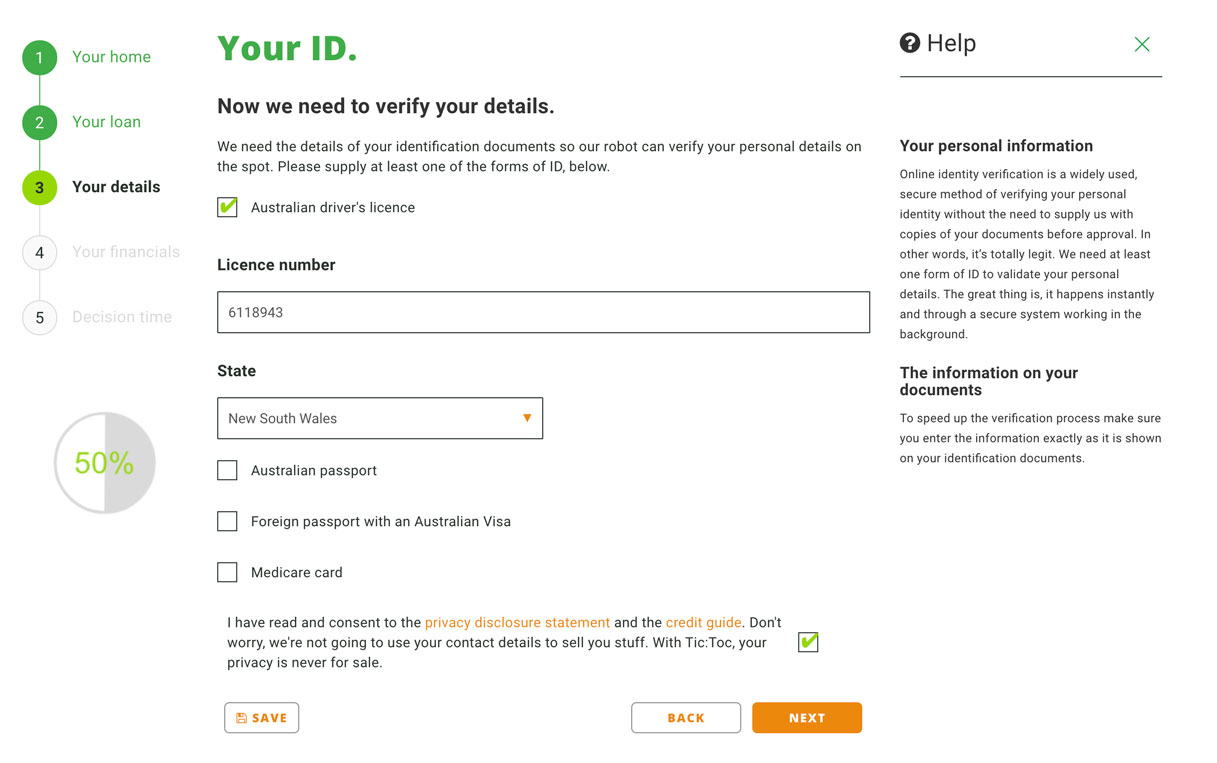

In step three, the Tic:Toc platform takes the application through the eligibility assessment by capturing personal information and verifying it through an online ID check, and then makes an initial assessment, before completing a financial assessment.

In step three, the Tic:Toc platform takes the application through the eligibility assessment by capturing personal information and verifying it through an online ID check, and then makes an initial assessment, before completing a financial assessment.

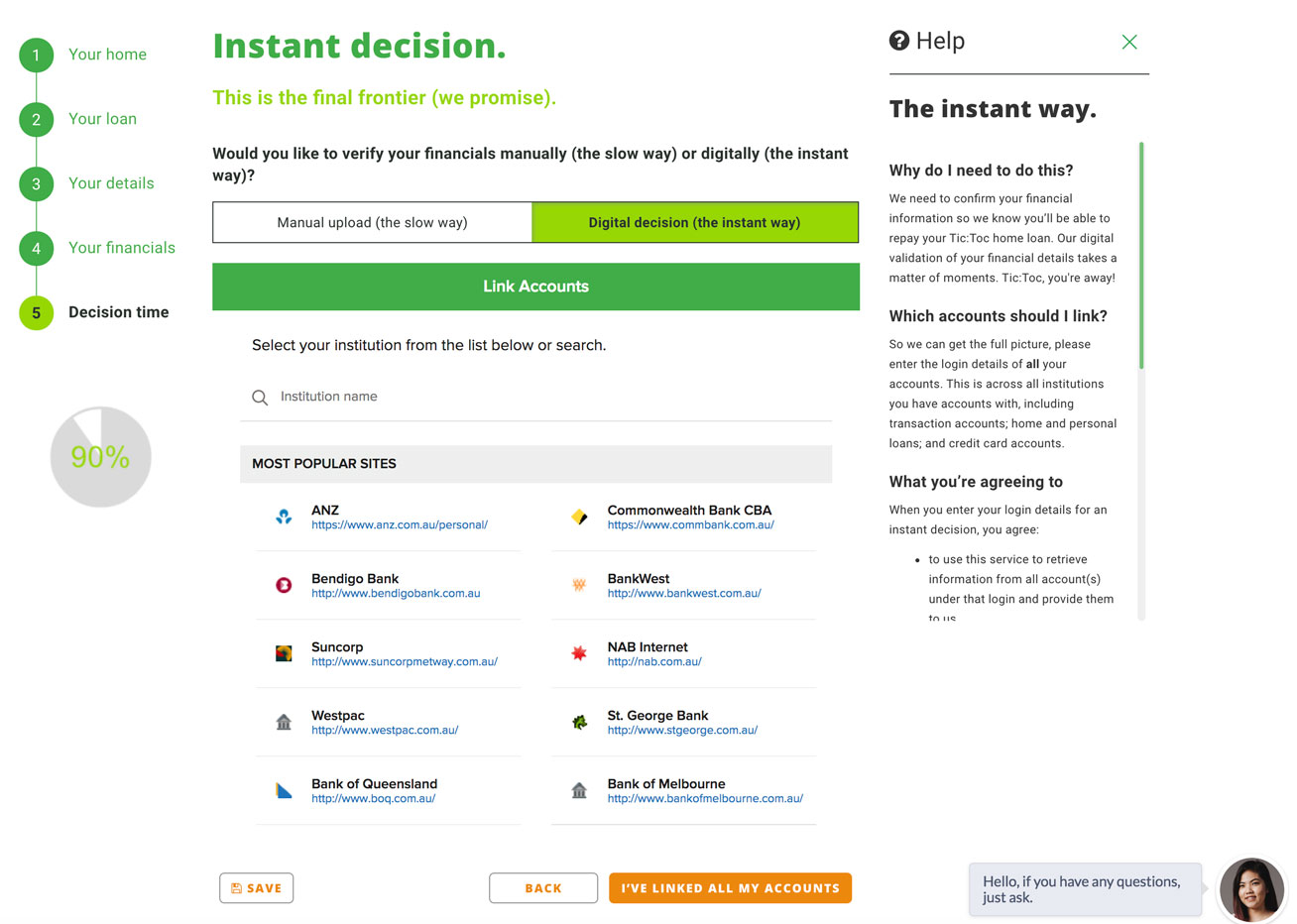

In step four, for the application to progress, the information is validated. This may include uploading documents, or accessing bank transaction information using Yodlee to validate their stated financial position. Tic:Toc says their method applies a more thorough and consistent approach to the financial assessment, important given the current APRA focus on household financial assessment and spending patterns.

After this, the decisioning technology kicks in, with underwriting based on their business rules. There is also a credit underwriter available 7 days a week to deal with any exceptions, such as use of retirement savings.

After this, the decisioning technology kicks in, with underwriting based on their business rules. There is also a credit underwriter available 7 days a week to deal with any exceptions, such as use of retirement savings.

The customer, in a straightforward case if approved, will receive confirmation of the mortgage offer, and an email, with the documentation attached, which they can sign, and send the documents back in the post. So, application to confirmed offer in 22 minutes is achievable.

The lender of record is Bendigo and Adelaide Bank, who will provide the loan, and Tic:Toc has a margin sharing arrangement with them, rather than receiving a commission or referral fee. Of course the subsequent settlement and funding will follow the more normal bank processes.

Since starting a few months ago, they have had around 89,000 visits from some 66,000 unique visitors and in 4 months have received around $330m of applications, with a conversion of around 17% in November. Anthony says that initially there had been quite a high rate of people applying who were declined elsewhere in the first few weeks, but this has now eased down, and the settlement rate is improving. They also had a few technical hiccups initially which are now ironed out.

In terms of the loan types, they only offer principal and interest loans (though an interest-only product is on the way), and around 50% of applications are for refinance from an existing loan. Around 75% of applications are for owner occupied loans, and 25% from investors.

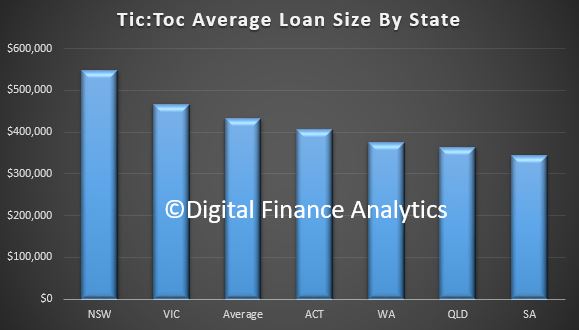

The average loan size is about $433,000. However, there are significant state variations:

In the short time the business has been up and running, they have managed to build brand awareness, receive a significant pipeline of applications, and lay the foundation for future growth. The team stands at 40, and continues to grow.

In the short time the business has been up and running, they have managed to build brand awareness, receive a significant pipeline of applications, and lay the foundation for future growth. The team stands at 40, and continues to grow.

The firm also has won a number of innovation awards. They have been listed in the KPMG and H2 Venture’s Fintech 100 (as one of the emerging stars); was a finalist, Best Banking Innovation in the Finder 2017 Innovation Awards; and a standout (and case study), in the Efma Accenture Distribution & Marketing Innovation Awards.

The firm also has won a number of innovation awards. They have been listed in the KPMG and H2 Venture’s Fintech 100 (as one of the emerging stars); was a finalist, Best Banking Innovation in the Finder 2017 Innovation Awards; and a standout (and case study), in the Efma Accenture Distribution & Marketing Innovation Awards.

Looking ahead, Tic:Toc is looking to power up its B2B dimension, so offering access to its platform to broker groups and other lenders. Whilst the relationship with Bendigo and Adelaide Bank has been important and mutually beneficial, they are still free to explore other options.

In our view, the Tic:Toc platform and the intellectual property residing on it, have the potential to change the home lending landscape. Not only does it improve the risk management and credit assessment processes by applying consistent business rules, it improves the customer experience and coverts the mysterious and resource heavy home loan process into something more elegant, if commoditised.

Strangely, within the industry there has been significant misinformation circulating about Tic:Toc, which may be a reaction to the radical proposition it represents.

Reflecting on the conversation, I was left with some interesting thoughts.

First, in this new digital world, where as our recent Quiet Revolution Report showed, more households are wanting a better digital experience, it seems to me there will be significant demand for this type of proposition.

But it does potentially redefine the role of mortgage brokers, and it will be a disruptive force in the mortgage industry. I would not be surprised to hear of other lenders joining the platform as the momentum for quicker yet more accurate home loan underwriting grows.

As a result, some of the excessive costs in the system could be removed, making loans cheaper as well as offering a quantum improvement in customer experience.

Time is running out for the current mortgage industry!

Adelaide Bank Ditches Commercial Lo Doc Loans

Adelaide Bank has announced it will be getting rid of lo doc commercial loans after a full review of its Smartsuite Commercial product offering.

This “will begin the exciting task of rebuilding our value proposition” and will eventually provide “broker partners with more options and product enhancements,” the bank said in a statement.

Effective from 1 July, the bank will delete its lo doc loans from its product offerings. No further lo doc applications will be accepted after close of business on 30 June.

Adelaide Bank has also restricted the release of equity for unverified business or investment purposes to $200,000 or 10% of the security value (whichever is lower). Working capital is not acceptable under these changed conditions.

The lender has also altered its Simple Doc declaration to ensure that clients declare that any income generated from property is sufficient to meet loan commitments while acknowledging that they can comfortably afford repayments without financial hardship.

Finally, the client will also be required to declare that they have other income sources available to service this loan if the need arises.

Lo doc commercial loans already in the systems, either awaiting settlement or formal approval, will be honoured as will loans submitted following the current lending policy.

“As previously announced, we are re-constructing our commercial offering to incorporate on our off balance sheet programs and are simplifying the product suite pending the review,” Damian Percy, general manager of Adelaide Bank told Australian Broker.

Additionally on 1 July, Adelaide Bank will also rollout an updated Smartsuite Commercial Application form to brokers through the website.