The Council just updated their charter, and published their latest minutes. At least there is some minimal disclosure now, though high-level. Note the fact that Treasury is one of the members, alongside the RBA, ASIC and APRA.

The Council of Financial Regulators (the Council) is the coordinating body for Australia’s main financial regulatory agencies. There are four members: the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), the Australian Treasury and the Reserve Bank of Australia (RBA). The Reserve Bank Governor chairs the Council and the RBA provides secretariat support. It is a non-statutory body, without regulatory or policy decision-making powers. Those powers reside with its members. The Council’s objectives are to promote stability of the Australian financial system and support effective and efficient regulation by Australia’s financial regulatory agencies. In doing so, the Council recognises the benefits of a competitive, efficient and fair financial system. The Council operates as a forum for cooperation and coordination among member agencies. It meets each quarter, or more often if required.

The updates charter says:

The Council of Financial Regulators (CFR) comprises APRA, ASIC, the RBA and Treasury. It aims to facilitate cooperation and collaboration between member agencies, with the ultimate objectives of promoting stability of the Australian financial system and supporting effective and efficient regulation by Australia’s financial regulatory agencies. In doing so, the CFR recognises the benefits of a competitive, efficient and fair financial system.

The CFR provides a forum for:

- identifying important issues and trends in the financial system, with a focus on those that may impinge upon overall financial stability;

- exchanging information and views on financial regulation and assisting with coordination where members’ responsibilities overlap;

- harmonising regulatory and reporting requirements, paying close attention to regulatory costs;

- ensuring appropriate coordination among the agencies in planning for and responding to instances of financial instability; and

- coordinating engagement with the work of international institutions, forums and regulators as it relates to financial system stability.

The CFR will draw on the expertise of other non-member government agencies where appropriate for its agenda, and will meet jointly with the ACCC, AUSTRAC and the ATO at least annually to discuss broader financial sector policy.

Their latest minutes:

At its meeting on 5 July 2019, the Council of Financial Regulators (the Council) discussed systemic risks facing the Australian financial system, regulatory issues and developments relevant to its members. The main topics discussed included the following:

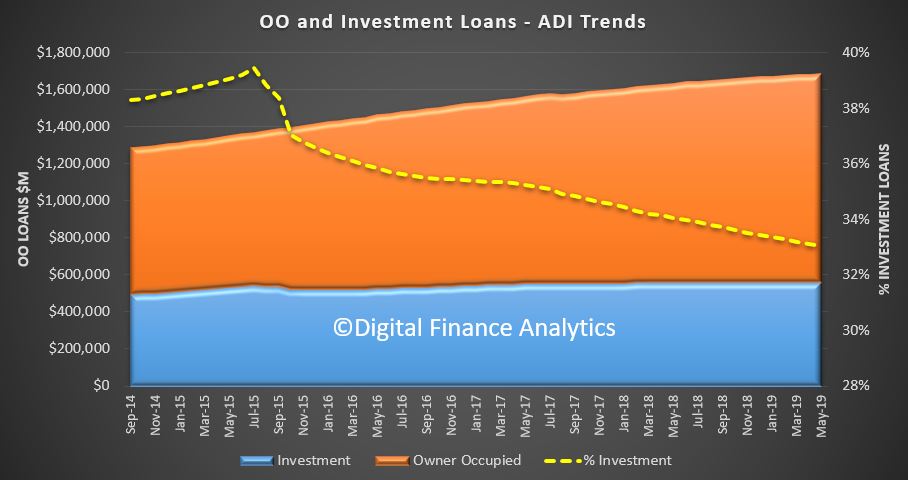

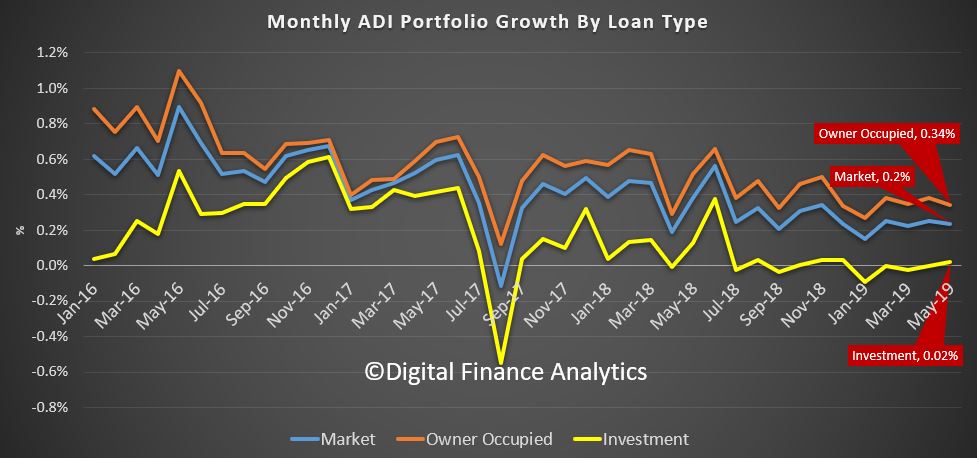

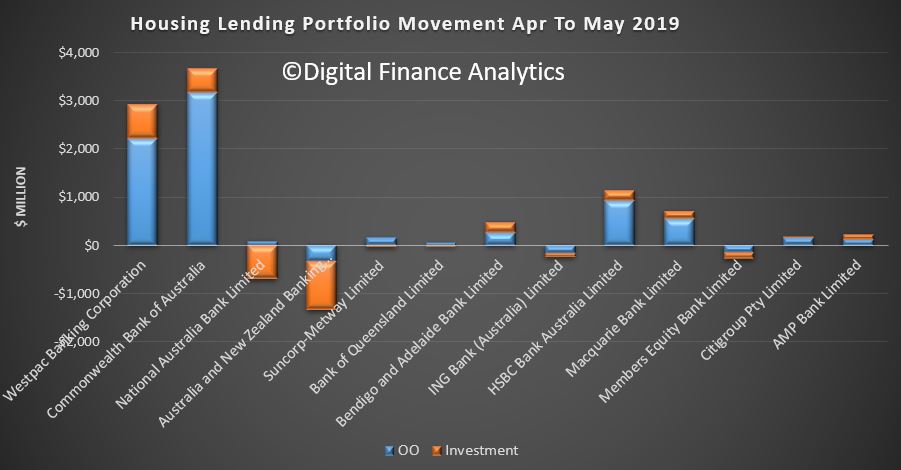

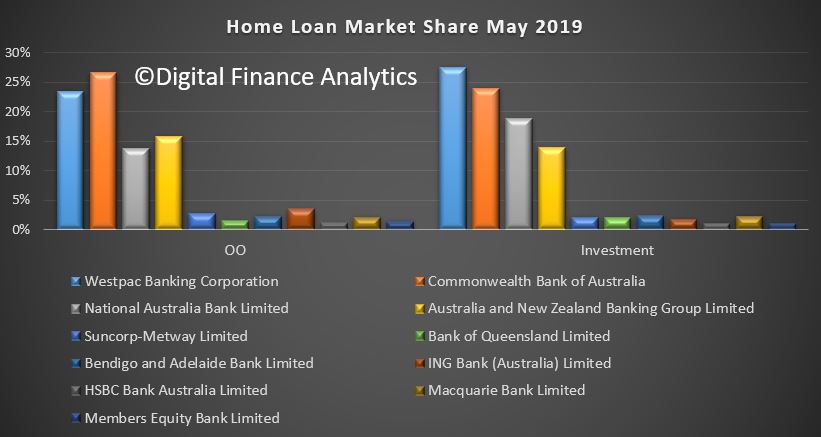

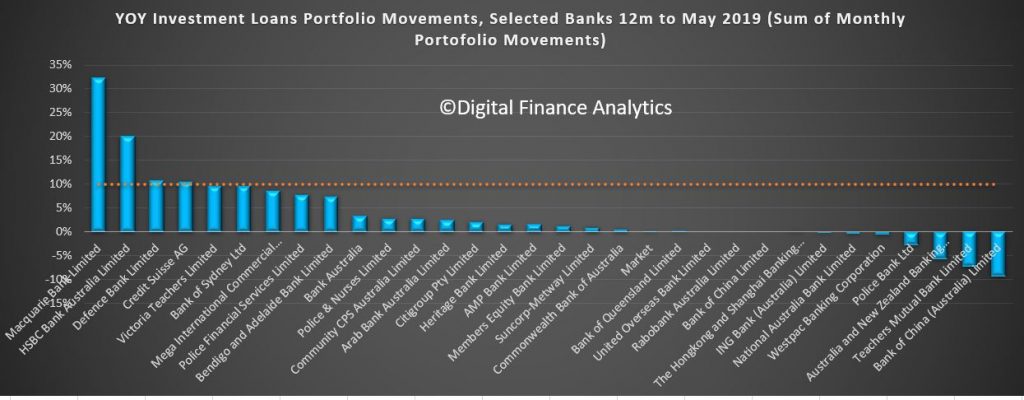

- Financing conditions and the housing market. The Council discussed credit conditions and ongoing adjustment in the housing market. Housing credit growth has stabilised at a relatively low level, with lending to investors remaining weak, particularly from the major banks. Demand for housing credit has been subdued, though there has also been some tightening in credit supply. Business credit growth has weakened recently, with lending to small businesses declining over the past year. Lenders are themselves applying stricter verification of expenses and income to small businesses, and lending may be affected by declining collateral values as housing prices decline.

- Council members discussed the signs of stabilisation in the Sydney and Melbourne housing markets, evident in both housing prices and auction clearance rates. They observed that the adjustment over the past two years has been sizeable and conditions in most other capital cities continue to be soft. Risks to lenders from housing price falls have to date been limited by the strength of the labour market, low interest rates and the improvement in lending standards in recent years. Housing loan arrears have continued to edge higher, but with significant variation between regions.

- Members were updated on ASIC’s public consultation on its responsible lending guidance. The responsible provision of credit is a cornerstone of consumer protection and is important to the Australian economy. It was noted that the consultation is not about increasing requirements; but rather, clarifying and updating guidance on existing requirements. For example, ASIC may further clarify areas where the law does not require responsible lending requirements to be applied (e.g. in small business lending). The Council agencies will continue to closely monitor developments in financing and the housing market.

- ASIC’s product intervention powers. ASIC updated the Council on its proposed approach to the new product intervention power, legislation for which passed in April 2019. This gives ASIC the power to proactively intervene where a financial product has resulted or is likely to result in significant detriment to consumers. ASIC has launched a public consultation on its approach. Council members discussed possible applications of the new power given it is now available for use.

- Product design and distribution obligations. The Council also discussed the implications of new product design and distribution obligations for retail holdings of bank-issued Additional Tier 1 (AT1) instruments. Members encouraged issuers to review their practices for issuing AT1 instruments ahead of the commencement of the new obligations in April 2021. They noted that APRA would continue to treat all AT1 instruments as regulatory capital, capable of absorbing losses in the unlikely event of a bank failure. Members discussed the importance that all holders of AT1 instruments, particularly retail investors, recognise that AT1 instruments could be written down or converted to equity.

- Policy developments. Members discussed a number of policy developments, including the implementation of the recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. APRA provided an update on its policy work, including changes to its guidance on the minimum interest rate used in serviceability assessments for residential mortgage lending (announced on the morning of the meeting). APRA also updated the Council on its planned increases in the loss-absorbing capacity of ADIs to support orderly resolution. Members discussed proposals by New Zealand authorities to significantly increase Tier 1 capital ratios for banks in New Zealand.

- Financial market infrastructure (FMI). The Council’s FMI Steering Committee provided an update on the design of a crisis management legislative framework for clearing and settlement facilities. This will ensure the necessary powers to resolve a distressed domestic clearing and settlement facility. A second consultation is now planned for late 2019. The Committee has also considered proposals for enhancements to the agencies’ supervisory powers and other changes to improve the regulatory framework in relation to market infrastructures. The results of the Council’s consultation findings will be provided to Government, to assist with policy design and the drafting of associated legislation (the draft of which would also be consulted on before being introduced to Parliament).

- Stored-value payment facilities. The Council discussed elements of a potential regulatory framework for payment providers that hold stored value, following a public consultation in 2018. Discussion focused on suitable criteria to determine the regulatory regime that should apply to providers of stored-value facilities, along with the adequacy of consumer protection arrangements. Once completed, the conclusions of this work will be provided to the Government for consideration.

- Competition in the financial system. Council agencies and the Australian Competition and Consumer Commission (ACCC) are developing an online tool to improve the transparency of the mortgage interest rates paid on new loans. This follows a recommendation of the Productivity Commission’s inquiry into Competition in the Australian Financial System. The tool relies on a new data collection and is expected to be available in 2020.

- Climate change. Council members noted the work undertaken by regulators to address the implications of the changing climate, and society’s response to those changes, for the Australian financial system.

- Updated Charter. The Council agreed to adopt an updated Charter, which is being published today. The Charter emphasises the Council’s financial stability objective, while also recognising the benefits of a competitive, efficient and fair financial system. It also highlights the Council’s focus on cooperation and collaboration to support the activities of its member agencies.

In conjunction with the Council meeting, the Council agencies held their annual meeting with other Commonwealth regulators of the financial sector. This included representatives from the ACCC, the Australian Taxation Office and the Australian Transaction Reports and Analysis Centre (AUSTRAC). Topics discussed included enforcement and data initiatives affecting the financial sector.