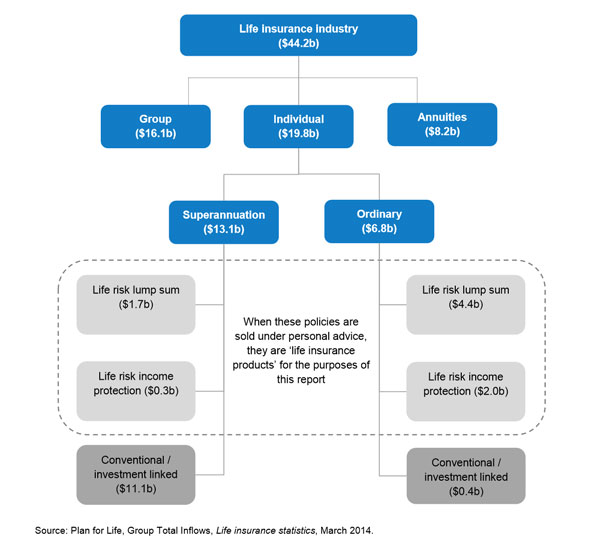

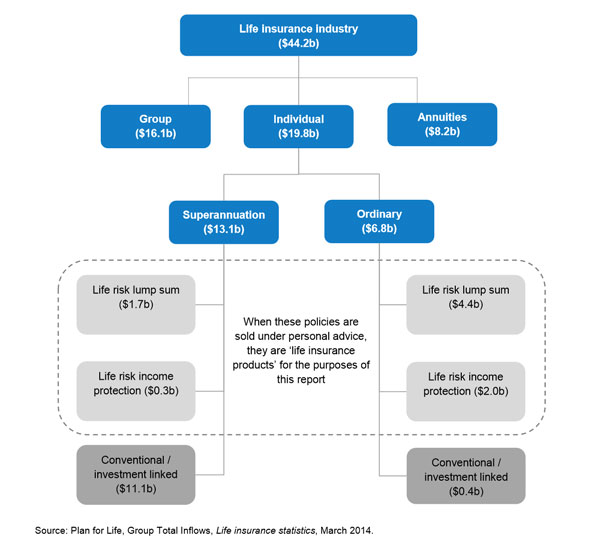

ASIC today released their review of activity in the Life Insurance Industry, and finds that consumers interests are not always given priority. The $44bn industry touches superannuation, annuities, and other elements, as shown in a diagram reproduced from the report. We have previously highlighted the issues around annuities. They found that high upfront commissions are more strongly correlated with non-compliant advice, and we think that it is another case, like FOFA of product sales being dressed up as advice.

An ASIC review of life insurance advice has found that the industry needs to improve the quality of advice and ensure that the interests of consumers are given priority. ASIC’s review of more than 200 advice files from large, medium and small Australian financial services (AFS) licensees found that 63% were compliant. However, more than one third (37%) of the advice consumers received failed to comply with the laws relating to appropriate advice and prioritising the needs of the client. ‘This is an unacceptable level of failure, and the life insurance industry is now on notice to lift standards and professionalism. Both insurers and advice firms need to work on delivering a consistently better service for consumers’, ASIC Deputy Chairman Peter Kell said.

‘Life insurance is a key product through which consumers manage risk for themselves and their families. It is therefore important that both the products and the advice meet the consumer’s requirements. ‘There is both a need and a demand for quality life insurance advice, and our report provides examples of advisers delivering a service that meets the needs of their clients. However, this result must be achieved on a more consistent basis’, Mr Kell said. ASIC’s report sets out the various commission models that are used to remunerate advisers in the life insurance sector. The report found that high upfront commissions are more strongly correlated with non-compliant advice, including in situations where the recommendation is to switch products.

‘The industry as a whole needs to consider how remuneration and compliance practices can better support good quality outcomes for consumers’, Mr Kell said. Affordability of insurance is an important issue for consumers, and ASIC’s report includes cases where clients were recommended insurance cover that was likely to be very difficult to afford given their financial circumstances. ASIC’s report confirmed that the high rate at which life insurance policies are lapsing warrants consideration by the life insurance industry to ensure that industry practices are sustainable.

ASIC has made a number of recommendations for insurers, AFS licensees, advisers and their professional associations, including a focus on how to ensure client interests are met and balancing the issue of affordability versus cover. Mr Kell said, ‘ASIC is committed to working with the industry to address the problems we’ve identified and to improve outcomes for consumers.’ Following the surveillance work and the conduct that has been uncovered ASIC has commenced follow-up investigations in certain cases which are ongoing. ‘Where inappropriate advice was provided we are considering enforcement action or other regulatory action’, Mr Kell said.

However, DFA believes that this is part of a wider issue with consumer advice in Financial Services. The problem is the various elements within a consumer’s financial portfolio will fall under different regulatory environments, which are just not consistent. If its mortgage related, then the advice is centred on whether the loan is suitable or not (no best client interest here) and commissions are rife ; if its financial planning related, the FOFA, offers some safeguards, and also significant gaps around general advice, as we discussed recently. Now life insurance is another problematic area. It is time for some joined up thinking. A consumer will require financial service advice across multiple products including loans and investments, but all part of a single financial portfolio. There should be consist consumer-centric processes, irrespective of the products being touted. We applaud ASIC for again championing the interests of the consumer, but there is so much more to be done.

The solution is simple. Separate advice from product sales (a.k.a general advice). Exclude any incentive payments for those providing advice. Clearly disclose any product fees (including trading and transaction fees). Job done.

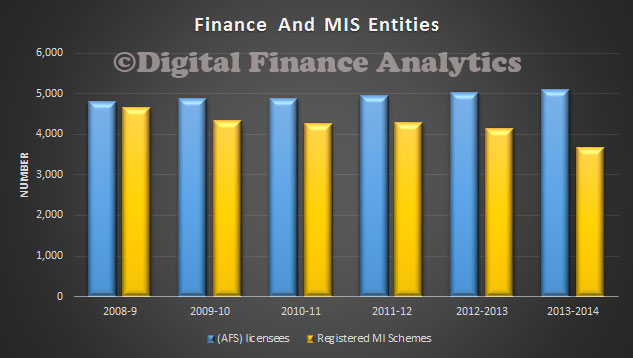

There was a steady rise in the number of Australian Financial Services Licenses issued, including a number of limited licenses to Accountants enabling them to offer financial advice. On the other hand, the number of registered Managed Investment Schemes (MIS) fell, explained partly by the collapse of agribusiness schemes such as Timbercorp and Great Southern.

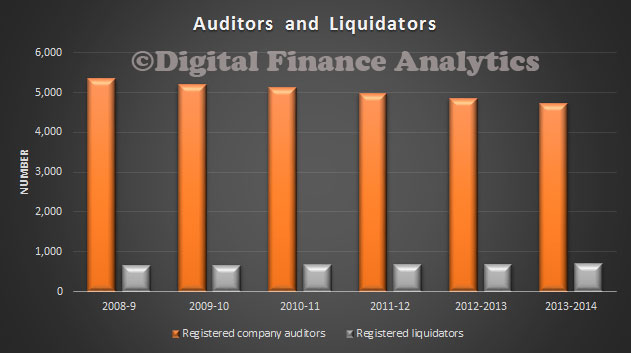

There was a steady rise in the number of Australian Financial Services Licenses issued, including a number of limited licenses to Accountants enabling them to offer financial advice. On the other hand, the number of registered Managed Investment Schemes (MIS) fell, explained partly by the collapse of agribusiness schemes such as Timbercorp and Great Southern. Finally, we note that the number of registered Auditors fell a little, now below 5,000 (despite the rise in companies), as there has been considerable consolidation in the audit sector; whilst the number of entities registered as Liquidators rose slightly.

Finally, we note that the number of registered Auditors fell a little, now below 5,000 (despite the rise in companies), as there has been considerable consolidation in the audit sector; whilst the number of entities registered as Liquidators rose slightly.