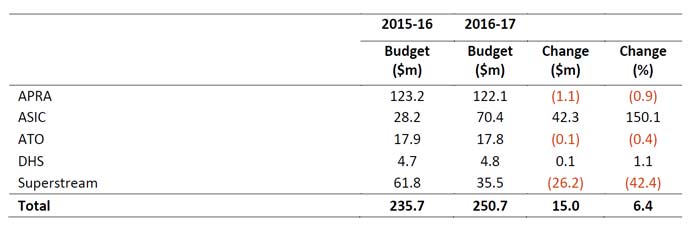

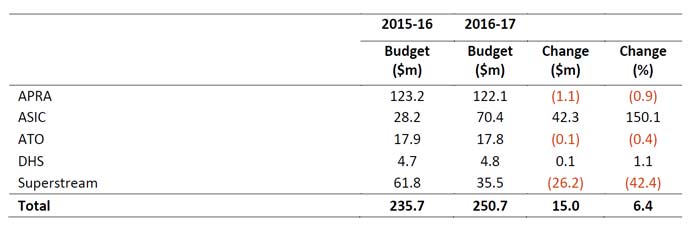

The financial industry levies are set to recover the operational costs of APRA and other specific costs incurred by certain Commonwealth agencies and departments, including the Australian Securities and Investments Commission, the Australian Taxation Office, and the Department of Human Services. ASIC gets a 150% uplift, reflecting the requirement for greater supervision of across financial services.

The Treasury has released a paper, prepared in conjunction with the Australian Prudential Regulation Authority (APRA), seeking submissions on the proposed financial institutions supervisory levies that will apply for the 2016-17 financial year by Friday, 3 June 2016.

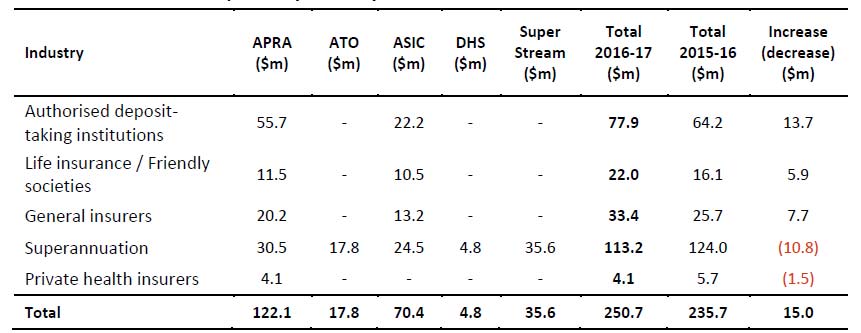

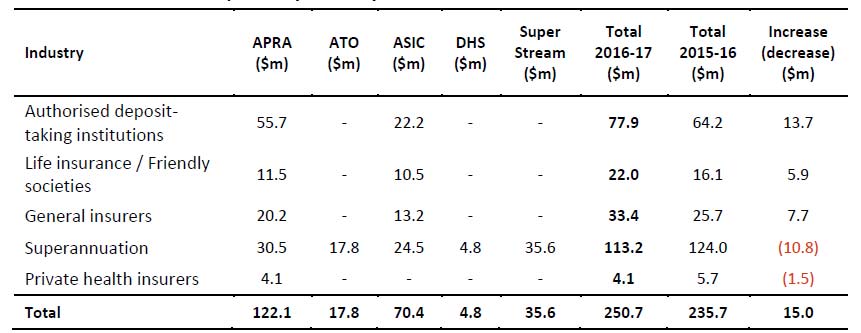

Here they are itemised by industry segment.

Here they are itemised by industry segment.

Australian Securities and Investments Commission component

Australian Securities and Investments Commission component

A component of the levies is collected to partially offset ASIC’s regulatory costs in relation to consumer protection, financial literacy, regulatory and enforcement activities relating to the products and services of APRA regulated institutions as well as the operation of the Superannuation Complaints Tribunal (SCT). In addition, the levies are used to offset the cost of a number of Government initiatives including the over the counter (OTC) derivatives market supervision reforms and ASIC’s MoneySmart programmes.

$70.4 million will be recovered to offset ASIC regulatory costs through the levies in 2016-17. This amount is 150.1 per cent more than in 2015-16 as a consequence of the Government’s decisions to provide funding to the SCT to deal with legacy complaints and improve processes and infrastructure ($5.2 million) and to bolster ASIC to protect Australian consumers ($37.0 million).

As part of the improving outcomes in financial services package, the Government will:

- invest $61.1 million over four years to enhance ASIC’s data analytics and surveillance capabilities as well as modernise ASIC’s data management systems;

- provide ASIC with $57.0 million over four years to enable increased surveillance and enforcement in the areas of financial advice, responsible lending, life insurance and breach reporting; and

- accelerate the implementation of a number of key measures recommended by the Financial System Inquiry.

From 2017-18 onwards, ASIC’s regulatory costs will be recovered from all industry sectors regulated by ASIC. The Government will consult extensively with industry to refine and settle an industry funding model for ASIC.

Australian Taxation Office component

Funding from the levies collected from the superannuation industry includes a component to cover the ATO’s regulatory costs in administering the Superannuation Lost Member Register (LMR) and Unclaimed Superannuation Money (USM) frameworks. In 2016-17, it is estimated that the total cost to the ATO in undertaking these functions will be $17.8 million, with the full amount to be recovered through the levies in line with the requirements of the Government’s Charging Framework.

The majority of this funding supports the ATO’s activities, which include:

- the implementation of strategies to reunite individuals with lost and unclaimed superannuation money including promotion of the ATO On Line Individuals Portal and targeted SMS/e mail campaigns;

- working collaboratively with funds to engage members being reunited with their super, including Super Match and providing funds with updated contact information about their lost members;

- processing of lodgements, statements and other associated account activities;

- processing of claims and payments, including the recovery of overpayments;reviewing and improving the integrity of data on the LMR and in the USM system; and

- reviewing and improving data matching techniques, which facilitates the display of lost and unclaimed accounts on the ATO On Line Individuals Portal.

The funding also supports the ongoing upkeep and enhancement of the ATO’s administrative system for USM frameworks and the LMR, and for continued work to improve efficiency and automate processing where applicable.

Department of Human Services component

The Department of Human Services administers the Early Release of Superannuation Benefits on Compassionate Grounds programme (ERSB). The compassionate grounds enable the Regulator (the Chief Executive of Medicare) to consider the early release of a person’s preserved superannuation in specified circumstances.

The volume of ERSB applications has significantly increased since it was made possible to apply online. In 2015-16, the ERSB received 27,688 applications. This was a 44 per cent increase compared with the previous year. In 2016-17, the ERSB is forecast to receive approximately 38,763 applications. This will represent an approximate increase in volume of 40 per cent compared with the previous year.

The programme is expected to cost the Government $4.8 million in 2016-17. In line with the Government’s Charging Framework, this amount will be recovered in full through the levies.

SuperStream component

Announced as part of the former Government’s Stronger Super reforms, SuperStream is a collection of measures that are designed to deliver greater efficiency in back-office processing across the superannuation industry. Superannuation funds will benefit from standardised and simplified data and payment administration processes when dealing with employers and other funds and from easier matching and consolidation of superannuation accounts. The costs associated with the implementation of the SuperStream measures are to be collected as part of the levies on superannuation funds. The levies will recover the full cost of the implementation of the SuperStream reforms and are to be imposed as a temporary levy on APRA-regulated superannuation entities from 2012-13 to 2017-18 inclusive.

The costs associated with the implementation of the SuperStream reforms are estimated to be $35.5 million in 2016-17 and $32.0 million in 2017-18.

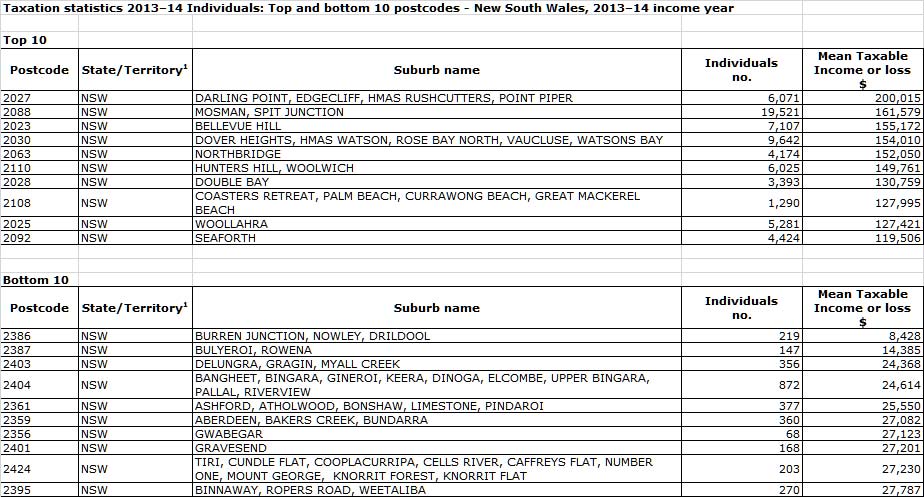

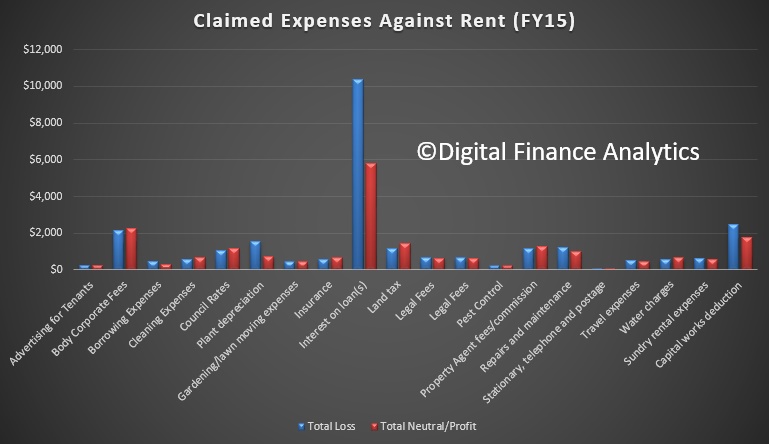

Significantly, the major factor between loss and profit is the interest amount. Those reporting a loss had bigger interest payments (presumably larger loans?). But it is also worth looking at the 20 categories (yes 20!!) which can be claimed. Behold the wonders of our generous tax system, and the reason why so many do not want it to stop.

Significantly, the major factor between loss and profit is the interest amount. Those reporting a loss had bigger interest payments (presumably larger loans?). But it is also worth looking at the 20 categories (yes 20!!) which can be claimed. Behold the wonders of our generous tax system, and the reason why so many do not want it to stop.