The Basel Committee released their status update of progress in implementation the requirements under Basel III. While some progress is being made, there are still gaps. The Australian implementation still has gaps, especially around aspects of disclosure.

In 2012, the Committee started the Regulatory Consistency Assessment Programme (RCAP) to monitor progress in introducing domestic regulations, assessing their consistency and analysing regulatory outcomes.

As part of this programme, the Committee periodically monitors the adoption of Basel standards. The monitoring initially focused on the Basel risk-based capital requirements, and has since expanded to cover all Basel standards. These include the finalised Basel III post-crisis reforms published by the Committee in December 2017, which will take effect from 1 January 2022 and will be phased in over five years. When those reforms were published, the Group of Central Bank Governors and Heads of Supervision, the oversight body of the BCBS, reaffirmed its expectation of full, timely and consistent implementation of all elements of the package.

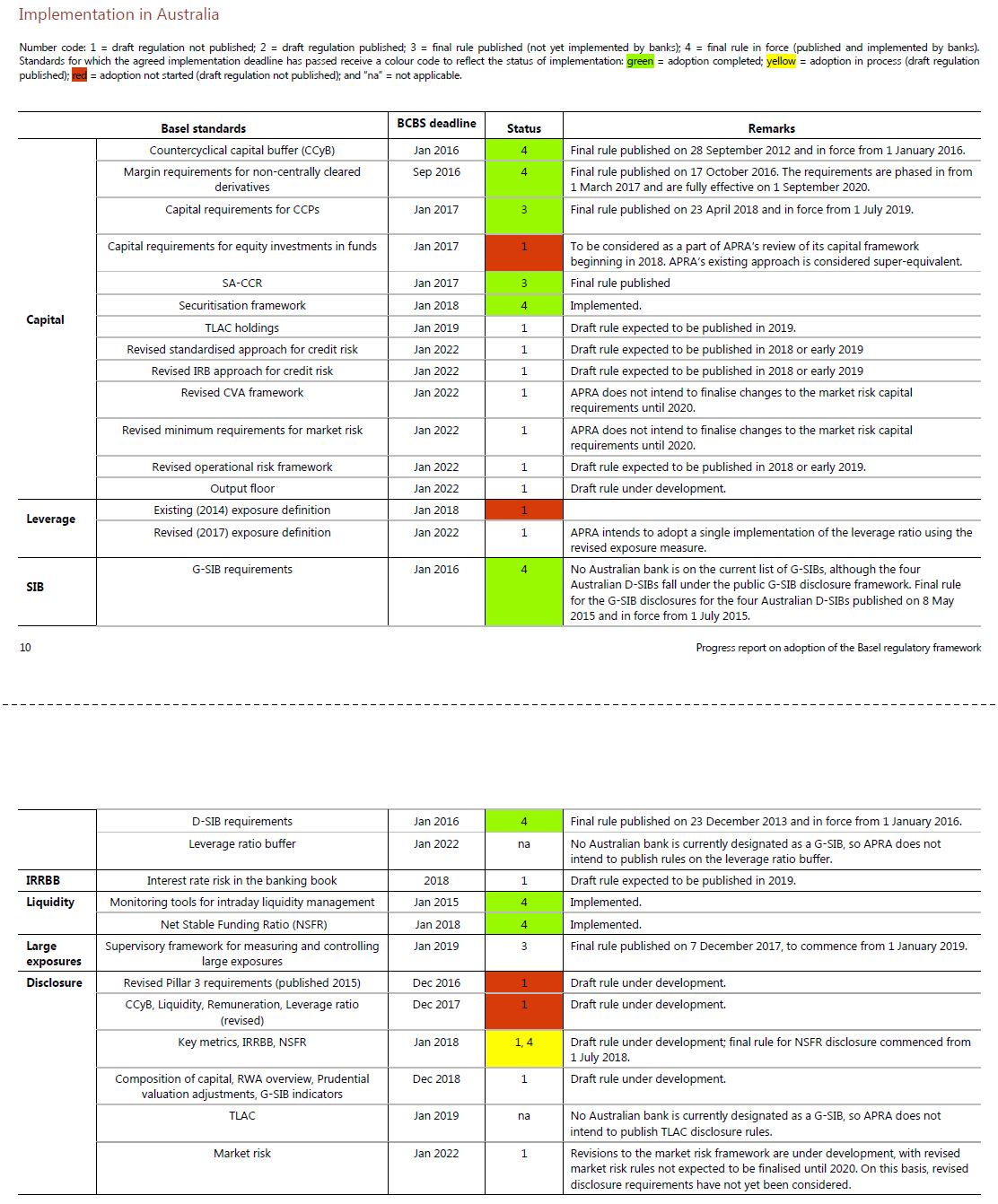

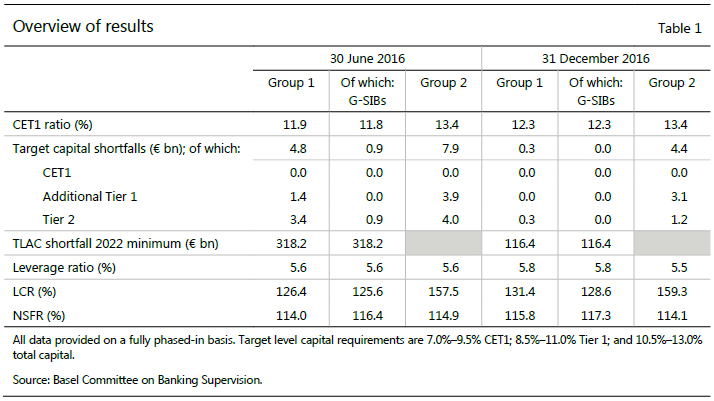

As of end-September 2018, all 27 member jurisdictions have risk-based capital rules, Liquidity Coverage Ratio (LCR) regulations and capital conservation buffers in force. Twenty-six member jurisdictions also have final rules in force for the countercyclical capital buffer and the domestic systemically important bank (D-SIB) requirement. With regard to the global systemically important bank (G-SIB) requirements published in 2013, all members that are home jurisdictions to G-SIBs have final rules in force.

Since the last report published in April 2018, member jurisdictions have made further progress in implementing standards whose deadline has already passed. These include the leverage ratio based on the existing (2014) exposure definition, which is now partly or fully implemented in 26 member jurisdictions. Moreover, 25 member jurisdictions have issued draft or final rules for the Net Stable Funding Ratio (NSFR), and 20 member jurisdictions have issued draft or final rules for the revised securitisation framework. In case of implementation of the standardised approach for measuring counterparty credit risk exposures (SA-CCR), 24 member jurisdictions have issued draft or final rules. Also, draft or final rules for the capital requirements for bank exposures to central counterparties (CCPs) have been issued by 23 member jurisdictions.

However, in many jurisdictions, rules for these standards are yet to be finalised and come into force. This is notably the case for the NSFR, with only 10 member jurisdictions having final rules in force as of end-September 2018.

There has been also progress in implementation of standards whose deadline is within the next six months. On requirements for total loss-absorbing capacity (TLAC), 15 member jurisdictions have issued draft or final rules. Similarly, 21 member jurisdictions have issued draft or final rules for the large exposure (LEX) framework and for interest rate risk in the banking book (IRRBB).

They publish a country by country assessment, here is the one of Australia. Still more to do clearly, especially in terms of disclosure.