Dr Andreas Dombret Member of the Executive Board of the Deutsche Bundesbank spoke on the finalisation of Basel III – “One size fits all? Applying Basel III to small banks and savings banks in Germany“.

A demanding 2017 lies ahead of banks and savings banks: While the sector is witnessing a structural scale-back of sorts, low interest rates and competition from digital service providers are weighing on profit opportunities. At the same time, the risks that need to be managed have not got any smaller – no, the challenges posed by the low-interest-rate environment are, together with mounting interest rate risks, making them even more demanding.

Many institutions are therefore seeking new strategies and rethinking their business models. To make matters more difficult, a raft of further regulatory reforms is just around the corner.

2 Basel III and the completion of regulatory reform

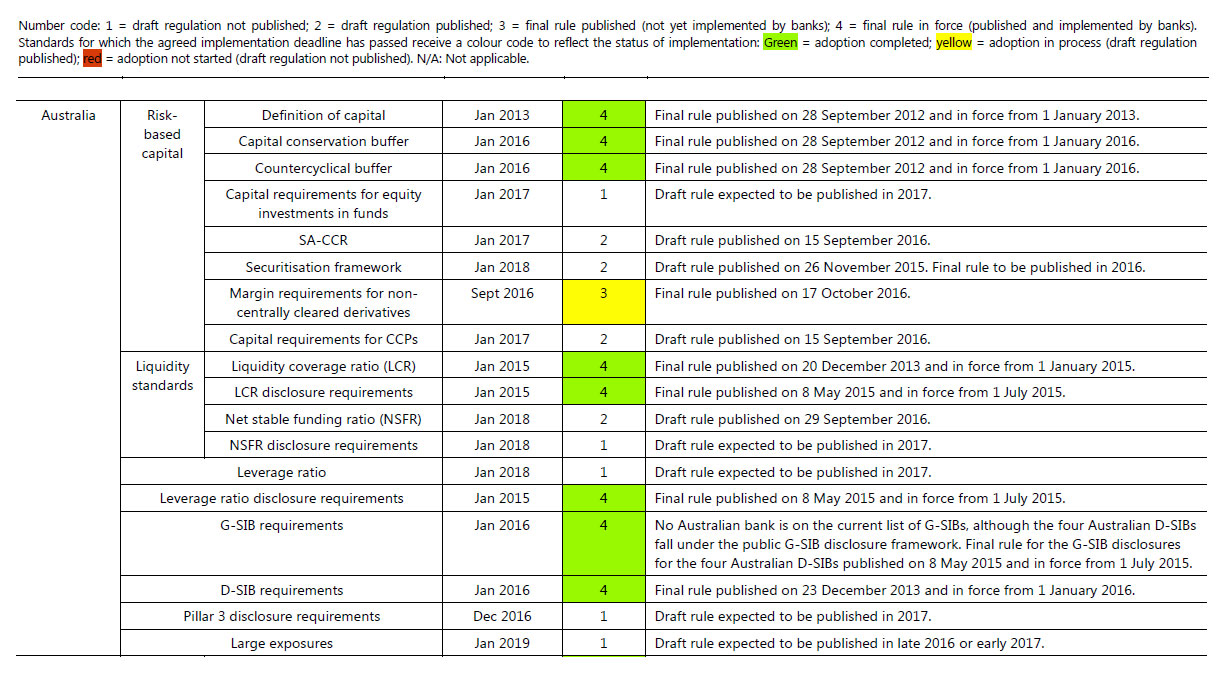

I’m talking, first and foremost, about the finalisation of Basel III in the Basel Committee on Banking Supervision and its transposition into EU law by way of CRR II and CRD V.

The finalisation of Basel III is the topic of much discussion at the moment, which centres specifically around approaches for calculating risk-weighted assets (RWA). Although many parts of this last package of reforms are already done and dusted – primarily the fundamental revamping of trading-book approaches – some final parts are still being debated in the Basel Committee. This is the case with respect to reforms concerning the treatment of credit risk and operational risk, for instance.

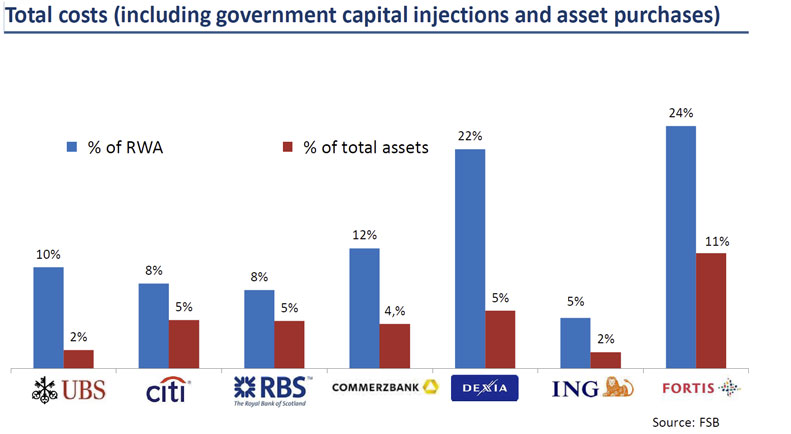

Many banking industry representatives are afraid that this last package of reforms will create a new set of burdens. I see it the other way around: these reforms are necessary, as they complement and round out the Basel reform process. What we saw during the financial crisis was that the approaches to calculating RWA produced capital requirements that were too low in some cases, and a response is urgently needed.

That is why the Basel III package will not be complete until these further reforms have been implemented, and that is why we are referring to the process as the finalisation of Basel III. What I want, here and now, is to clearly disabuse people of the notion that a completely new standard is being introduced.

Of course, what is being asked of institutions is significant and by no means negligible. However, all outstanding reforms are based on the existing regulatory framework and take it a step further. I therefore believe that they should be easier to implement than many fear.

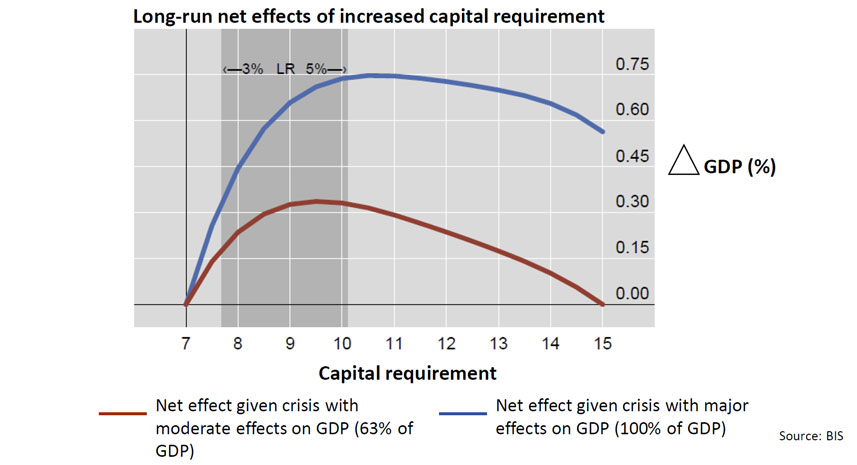

That said, I do understand why banks and savings banks would be jittery at the prospect of a further increase in capital requirements. That is why, in the Basel III finalisation process, the Bundesbank has come out strongly against a further increase in capital requirements. Our motto must therefore be that no agreement in Basel is better than a bad agreement. At the same time, though, an international standard has a very high value that must not be underestimated. This is all the more true in a time in which more and more countries are turning inwards. The Bundesbank will also continue to work towards a compromise on Basel III – one that benefits Germany.

3 Reforms and smaller institutions: a one-size-fits-all solution or graduated rules?

Let me turn now to a second, different topic. In talks with smaller banks and savings banks about the post-crisis reforms, I hear one concern being echoed time and again: that smaller institutions perceive the operational burdens of regulation as being particularly overwhelming. As they put it, a burden that is much more onerous on small banks and savings banks than on their much larger competitors. This is an issue I take very seriously, for the banks and savings banks are right.

Therefore, for the next few minutes I will discuss the question as to whether banking regulation should be offered only as a one-size-fits-all solution for all banks and savings banks – or whether multiple different regulatory regimes should be created to fit different sizes of institutions.

Ladies and gentlemen, it is my firm view that there is absolutely no way a one-size-fits-all approach can do justice to today’s banking landscape – with its very large and complex institutions, its numerous smaller and regional institutions, and the wide expanse of medium-sized institutions! It will positively damage the structure of our banking system – a structure that gave us stability during the financial crisis.

You may well all be familiar with the allegation that the purpose of the new regulatory regime is to encourage more and more consolidation in the industry – including Germany’s banking industry. Of course, mergers among banks and savings banks must not be a taboo topic – but, by the same token, they must not be a regulatory objective, either. I admit to being a fan and proponent of diversity in terms of bank size and business model, as this makes our banking system more stable. Supervisors are not supposed to be making structural policy; rather, they ought to be actively working towards proportionality in regulation.

This is precisely why banking regulation and banking supervision are already designed with a large degree of proportionality. However, the ambitious reforms following the financial crisis have made the rulebook more complex, particularly because the rules were oriented to the epicentre of the financial crisis: large and medium-sized institutions with risky business models.

This new regime has made compliance a much more difficult and time-consuming affair. This overhead is high for each and every institution – regardless of its size. However, small banks and savings banks, owing to their smaller staff sizes, are far less able to spread the costs of compliance across their employees and have to either hire additional staff or enlist external aid. This leads to comparatively higher burdens.

For that reason – and because smaller institutions pose less of a threat to financial stability than medium-sized to large institutions – I think that offering relief to small banks and savings banks is the right thing to do.

One thing that is of paramount importance to me, however, is this: any relief measures being discussed here have to solve the actual problem – which is not, first and foremost, the minimum capital requirements, but primarily the operational burdens imposed by the need to comply with complex rules.

What this means specifically is that any relief for smaller banks and savings banks must be about removing operational burdens – and of this I am firmly convinced. On the other hand, there cannot and must not be any easing of capital and liquidity requirements.

Moreover, no relief should be permitted to jeopardise financial stability. Medium-sized, highly systemically interconnected institutions – those referred to as “too interconnected to fail” – and those institutions with risky business models should not be provided any relief. The recent financial crisis, during which many insolvent institutions had to be bailed out, is still fresh in all of our minds. We also need to be careful not to create any loopholes that end up being used by so many small institutions that a situation of general distress results.

I am therefore firmly convinced that institutions need to be regulated with a sense of proportionality without diluting the new regulatory regime. I am committed to ensuring that the debate on greater proportionality is not used as a pretext for reducing capital and liquidity requirements but that it instead results in an actual reduction in operational burdens on smaller banks and savings banks.

4 Greater proportionality – but how?

How can the goal of regulatory proportionality be achieved in a reasonable manner without any side effects?

There are two conceivable approaches. The first is a details-driven approach that involves introducing special exceptions or adjustments to individual rules.

The second is the creation of separate regulatory frameworks for smaller institutions, on the one hand, and large multinational institutions, on the other.

The details-driven approach has already been pursued as part of the EU reforms I explained earlier, with the Commission emphasising a reduction in the burden on smaller institutions in all reform areas. In its draft consultative document, it has proposed a variety of relief measures and de minimis thresholds, such as in disclosure and reporting requirements. Institutions below these thresholds will be subject to considerably simplified rules, with some requirements even being abolished altogether, which is something I can only welcome.

We just need to be careful not to set the de minimis thresholds too high, as otherwise there would be considerable risks that were inadequately regulated.

With that in mind, I would like to return to the conviction I expressed earlier on: relief measures that reduce capital and liquidity requirements need extremely careful consideration. Examples include some of the exemptions to the leverage ratio (LR) and the net stable funding ratio (NSFR). Another is the considerable enlargement of the SME factor. Whereas real economic growth is unlikely to receive any boost, the minimum requirements for institutions’ risk provisioning could be weakened.

Let me come to the second approach: the two-tiered system. The fact that work is being done on a details-driven approach doesn’t mean at all that this fundamental approach cannot be pursued as well.

Specifically, we are talking about a fundamental approach that envisages a dedicated rulebook for smaller institutions – an approach that would systematically address the excess burden placed on smaller institutions’ operational capacities.

In this scenario, only banking multinationals would be subject to the fully loaded Basel III requirements in the EU. This would be appropriate from a risk perspective: we would be regulating global banking institutions under a harmonised set of global rules, while smaller institutions and those operating within a certain region would be governed by graduated rules that do justice to their different business models and risk profiles by setting less complex requirements.

The Basel Committee would also benefit from such a dedicated rulebook for banks operating internationally. If the 28 member states knew that the fully loaded Basel standards were only applicable to large, internationally active banks, we wouldn’t have to worry any more about detailed national exemptions, but could instead devote our entire energy to the key task: standards for large, internationally active banks.

I feel very much that Brussels and Basel should examine this approach with an open mind. Such a systematic approach to relieving the burden on smaller institutions, to the extent that it is deliverable, is generally superior to a patchwork of exemptions. In this connection, I am very eager to open up a dialogue with the banking community. To this end, a joint working group was recently established, comprising delegates from the Federal Ministry of Finance, the Bundesbank, BaFin and the central associations of the German banking industry, in order to develop proposals along these lines.

5 Conclusion

Ladies and gentlemen, the implementation of Basel III will impose further demands on banks and savings banks – but I think that less time and effort will be required than many currently fear.

With regard to the implementation of reforms, two things are of paramount importance to me. Under no circumstances must we water down what has been achieved since the financial crisis; rather, we must maintain a robust regime of rules.

That said, a one-size-fits-all approach will not do justice to the banking landscape. One of the objectives guiding the actions taken to finalise the agenda of reforms in Europe should therefore be to lessen the operational burdens on small, low-risk institutions – ie to make the final regulatory regime more granular.

The objective must not be to erode minimum capital requirements and thereby open a new gateway for stability problems. Instead, it is about reducing operational burdens on small institutions without hollowing out capital and liquidity requirements.

This, ladies and gentlemen, is how we can secure a diverse, successful and, above all, stable financial sector – to serve the German economy.