An article by Cameron Kusher, CoreLogic RP Data senior research analyst highlights that according to data from the Reserve Bank the ratio of household debt to disposable income is 153.8% and the ratio of housing deb to disposable income is 140.3% both of which are record highs.

Each quarter the Reserve Bank (RBA) publishes selected household finance ratios which show some key statistics about the level of debt held by Australian households. Although Australia has relatively low levels of public debt, private debt is extremely high and unlike many other countries there hasn’t been a decline in that debt in the aftermath of the financial crisis.

The latest household finances data from the RBA shows that in December 2014, the ratio of household debt to disposable income was 153.8%, its highest level on record. Housing debt accounts for 91% of total household debt and is recorded at a record high ratio of 140.3%. The chart shows that the level of debt has been relatively unchanged since 2005 but is now heading higher.

Focussing on the housing component of this debt, of the 140.3% ratio, 92.2% of that figure was owner occupier housing and 48.0% was investor housing. Once again, both are currently at record high levels. As with total housing debt, both had been relatively unchanged over recent years but have lifted over the past couple of years. It is important to note that the gap between owner occupier debt and investor debt is at near record high levels too.

Although household debt is high, the value of household assets is much higher than the debt. According to the data from the RBA the ratio of household assets to disposable income is 813.8%, much higher than the ratio of household debt at 153.8%. From the housing perspective, the ratio of housing assets to disposable income is recorded at 444.0% compared to a ratio of 140.3% for housing debt to household income. The chart shows that the ratio for both household and housing assets had been higher before the financial crisis however, both are now clearly trending higher again.

The data also shows that the ratio of household debt to household assets is 16.7% while the ratio of housing debt to housing assets is 28%. This highlights that although household and housing debts are high, the value of those assets is substantially higher than the level of debt. While this may be true at a national level it doesn’t mean that everyone is immune from the effects of an economic and/or housing market downturn.

Although these figures would provide some comfort that most households have the ability to sell assets to repay debt if they hit trouble, it is important to remember that it is a national view. There are areas of the country where households are much more susceptible to housing and economic downturns. Some specific areas and household types are recent first home purchasers, areas where there has been very little home value growth in recent years, single industry townships and areas where households have re-drawn a large proportion of their home’s equity.

With regards to the recent increases in household and housing debt, obviously very low interest rates (which have just got lower) are encouraging increased borrowing, particularly for housing. On the other hand, saving is not attractive because there is virtually no returns available. While most households can comfortably meet their mortgage requirements with mortgage rates at these levels, it is important to remember that a mortgage is usually a 25 to 30 year commitment and mortgage rates can fluctuate significantly over that time. The fact that household debt levels merely flat-lined rather than reduced following the financial crisis creates some concerns about what will happen once mortgage rates start to normalise (whenever that may be). Furthermore, the rate cut delivered this week may encourage even further leveraging into the housing market.

These are of course average figures across all household. However, as we have shown already, if you segment the household base, you discover that household debt is concentrated in different segments. Some are well able to cover the debts they owe, even if rates were to rise, but others are, even in the current low rate environment close to the edge, and with incomes static, vulnerable even to small rises in interest rate.

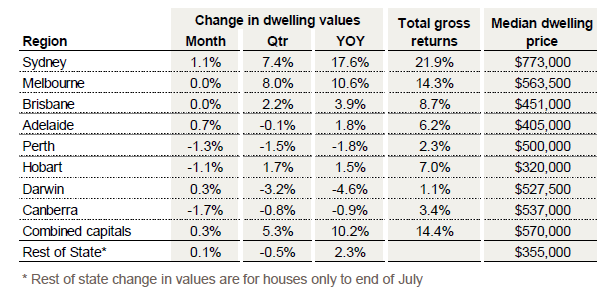

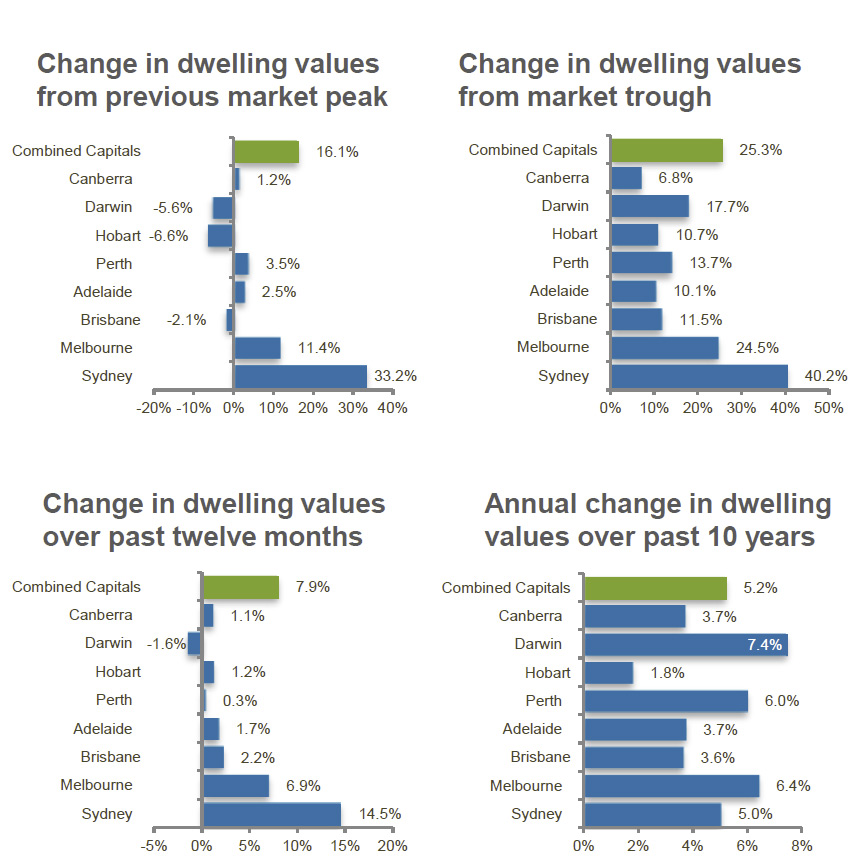

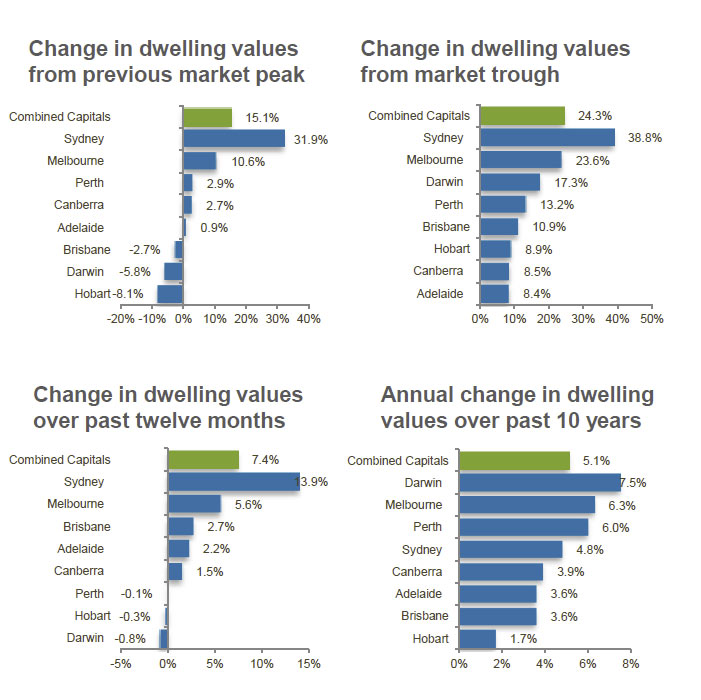

Whilst the combined average house price was up 10.9% in the past 12 months, mortgage application activity appears to be a little lower now.

Whilst the combined average house price was up 10.9% in the past 12 months, mortgage application activity appears to be a little lower now.