The latest edition of our finance and property news digest with a distinctively Australian flavour.

Tag: Coronavirus

More From The Investment Manager’s Front Line – With Tony Locantro

Tony Locantro from Alto Capital, in Perth and I discuss the latest in the markets, and where we go from here.

The Bank That Could Save Australia

Robbie Barwick from the Citizens Party and I discuss the legislation to move to a National Bank, with a focus on infrastructure investment. Actually an entity already exists, it just needs a wider mandate.

Household Finances In A Time Of COIVD

We started to run some additional questions in our household surveys from January, and have been tracking the spreading impact of the economic shutdown as it spread in response to the virus. Last night we ran a live event where we discussed the main findings and answered questions, but we are also posting some of the analysis today. First here is the show:

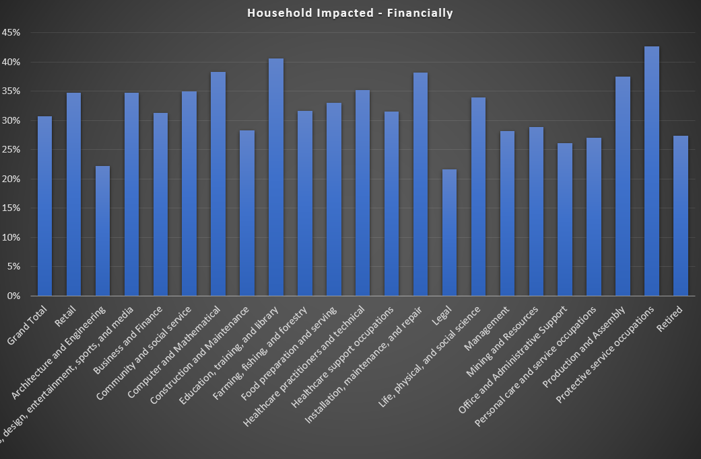

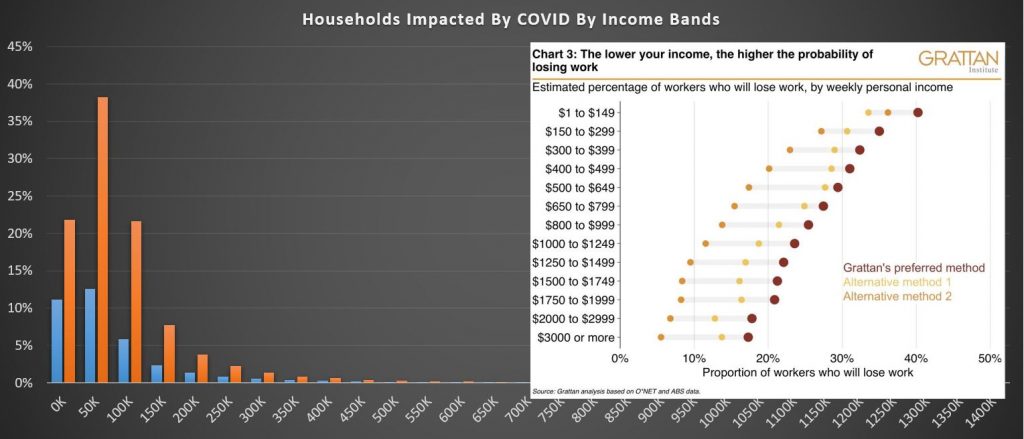

In our surveys we asked two questions. First, have household finances been impacted by the virus/economic slow down, and second, how. Overall 36% of households have been adversely impacted by COVID from a finance perspective. However this does vary by industry, for example, more than 40% of those in education have taken a hit, whereas those in the legal profession are at 20%. Protective services was high, thanks to the closure of transport hubs and other public spaces.

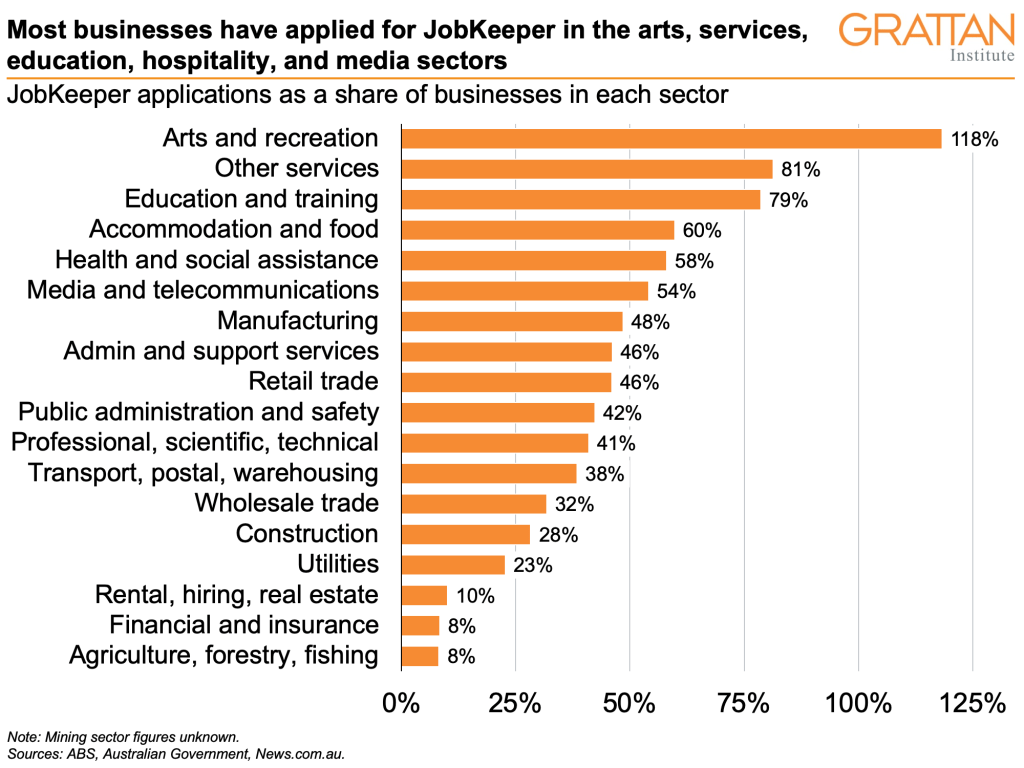

The Grattan Institute yesterday blogged that those in Arts, Services and Education were most likely to be applying for JobKeeper.

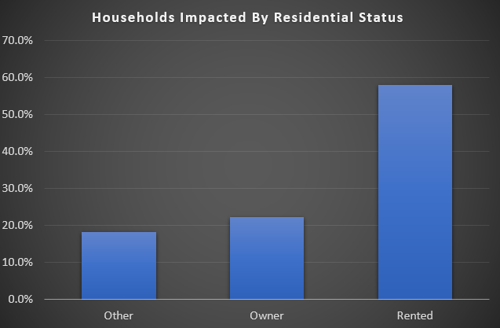

60% of households in rental accommodation have been adversely impacted, compared with 22% of property owners.

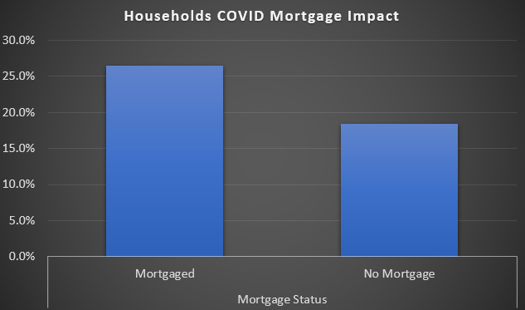

27% of those with a mortgage are impacted compared with 18% of those who are property owners without a mortgage.

Lower income households are more adversely impacted. Half of those earning less than $50k a year and one third earning between $50-100k are impacted. This is also consistent with Grattan research. This is because many of these jobs are part-time, gig, or zero hours, and lower paid.

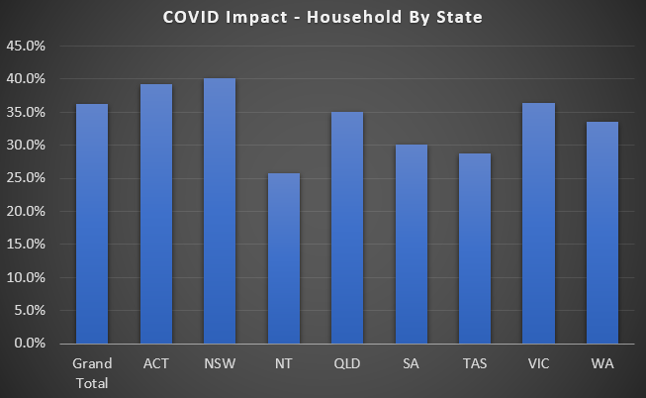

There are some state variations, with 40% of households in NSW adversely impacted, compared with 26% in NT. 35% of households in QLD and 37% in VIC are hit, and ACT was above WA, just.

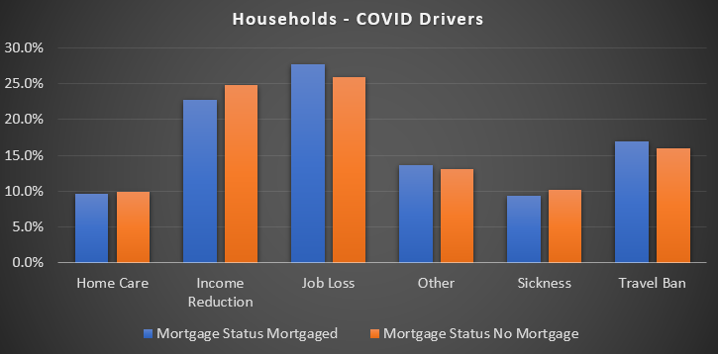

When we examine the nature of the impact, we found that job losses were driving more than 25% of those with a mortgage, followed by income reduction due to less hours, or less pay. There were some differences between those holding a mortgage and those not (though at the margin).

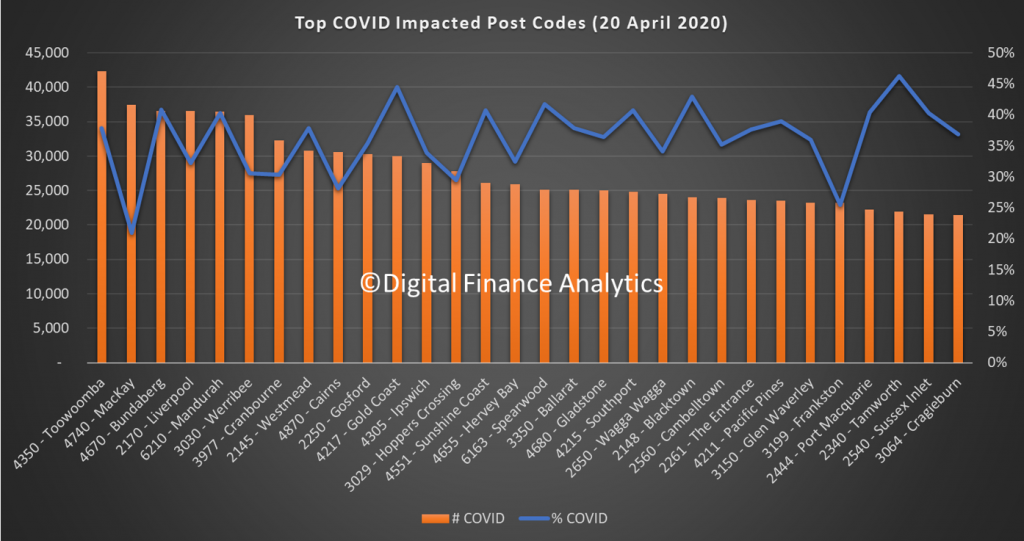

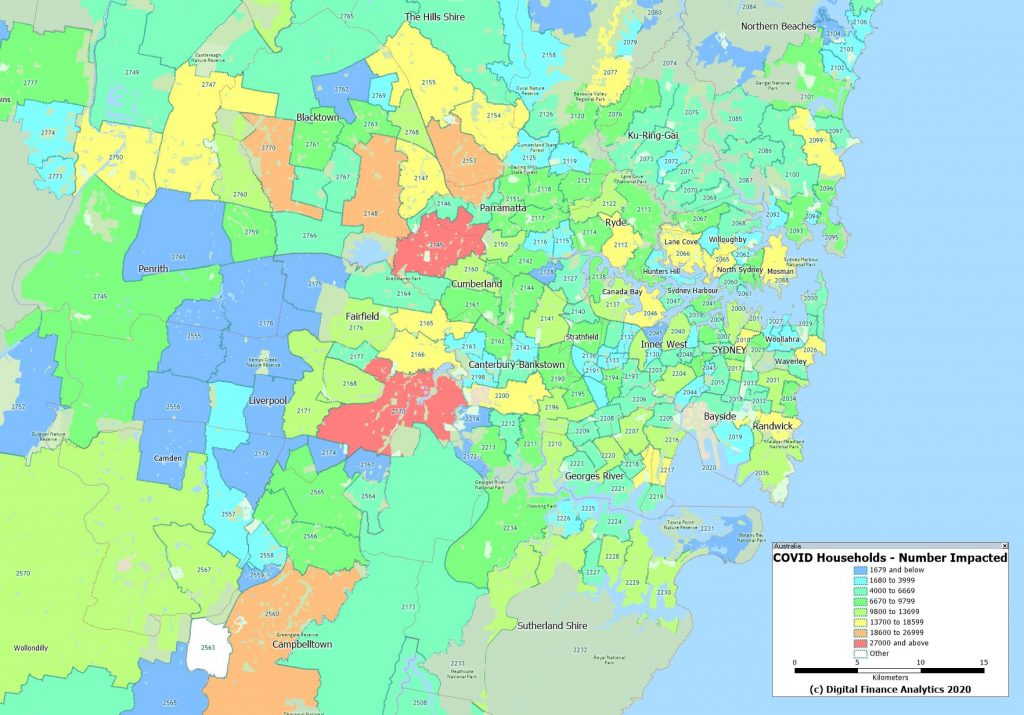

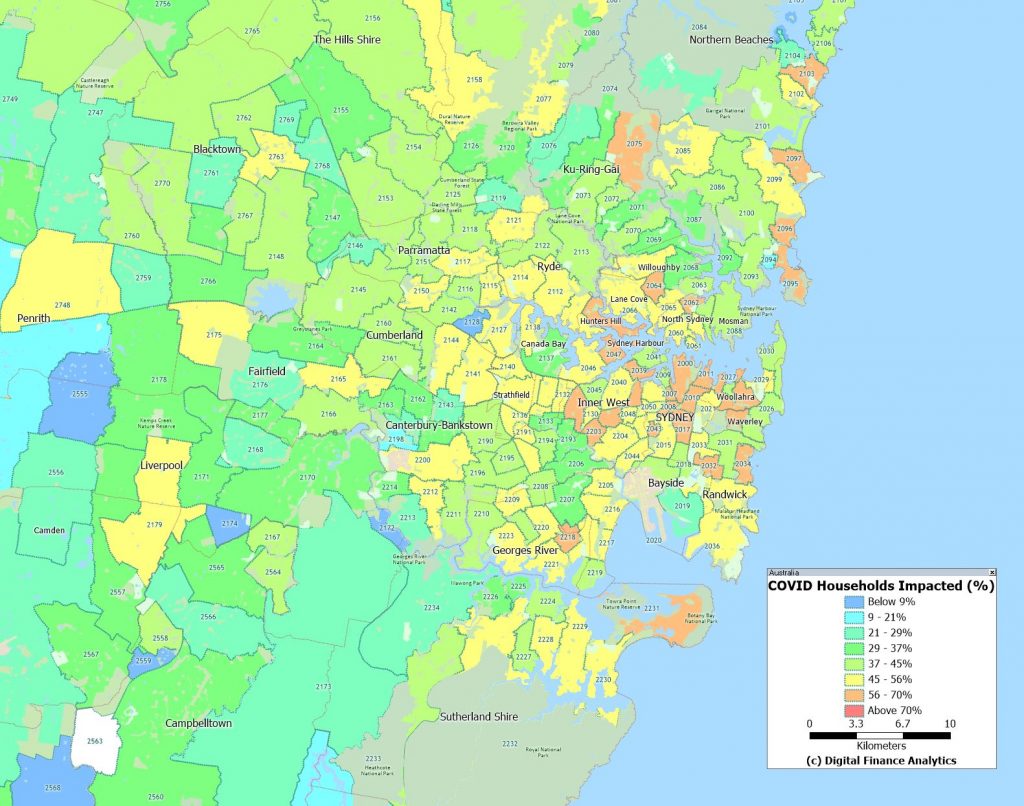

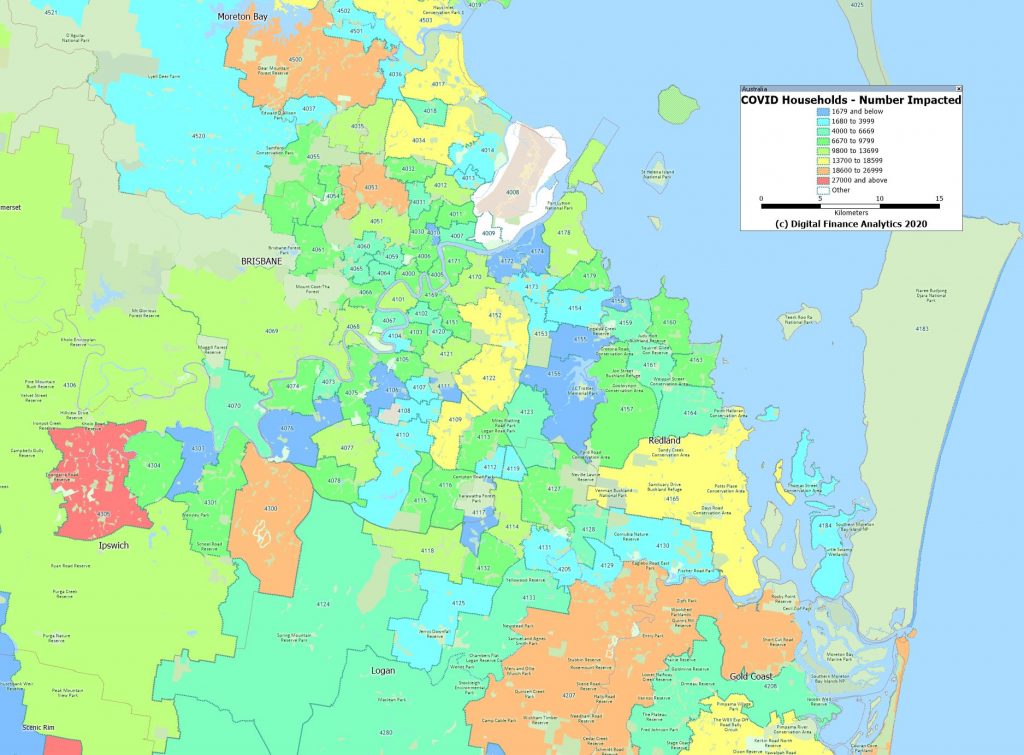

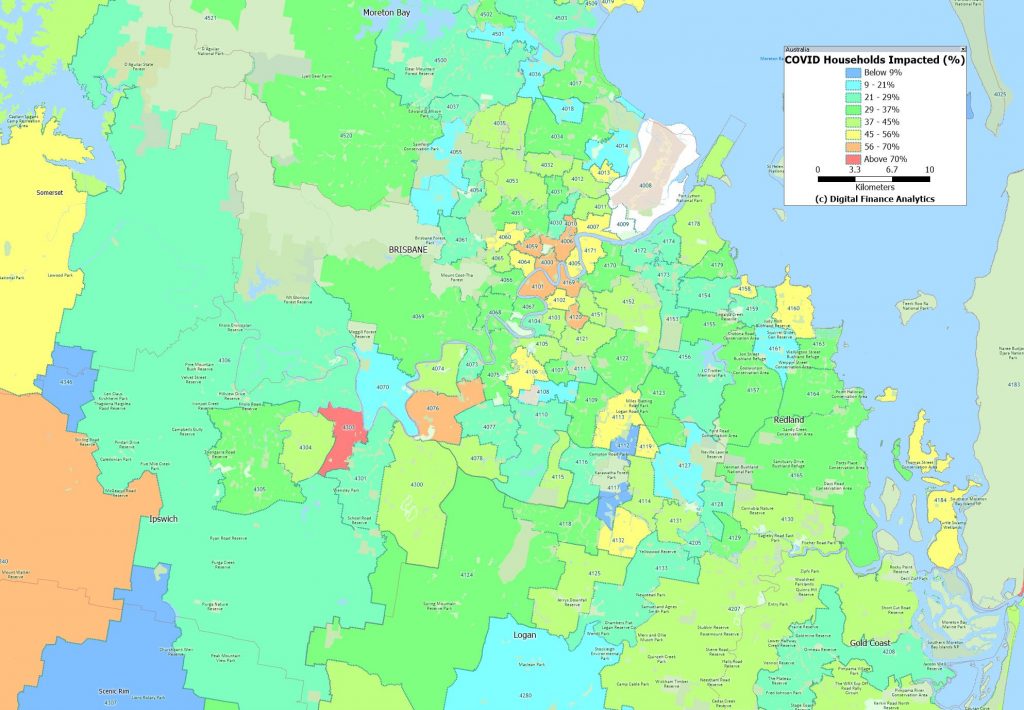

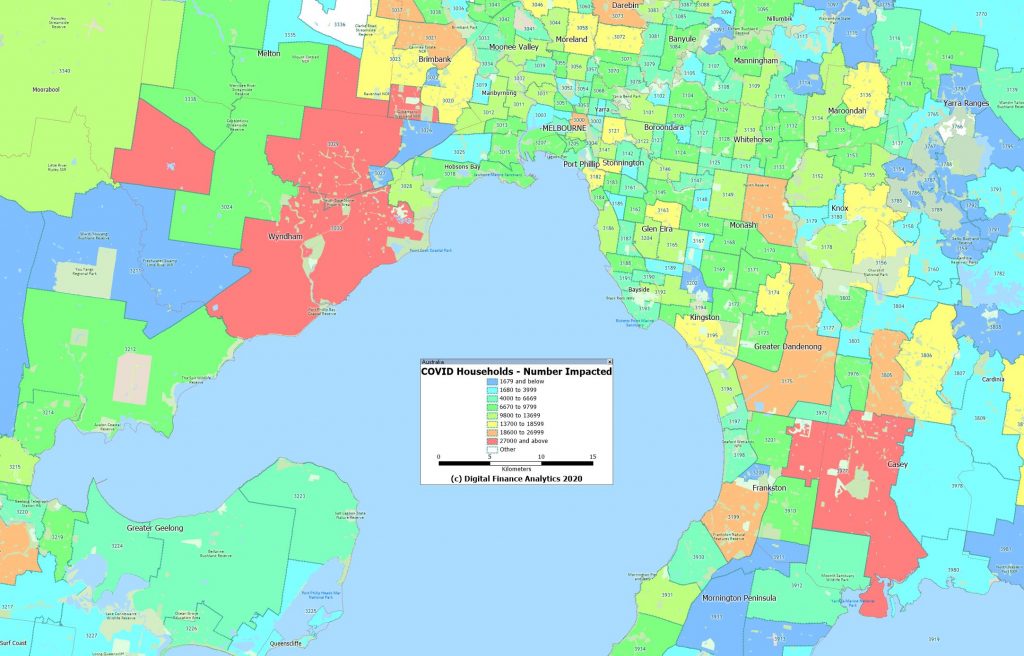

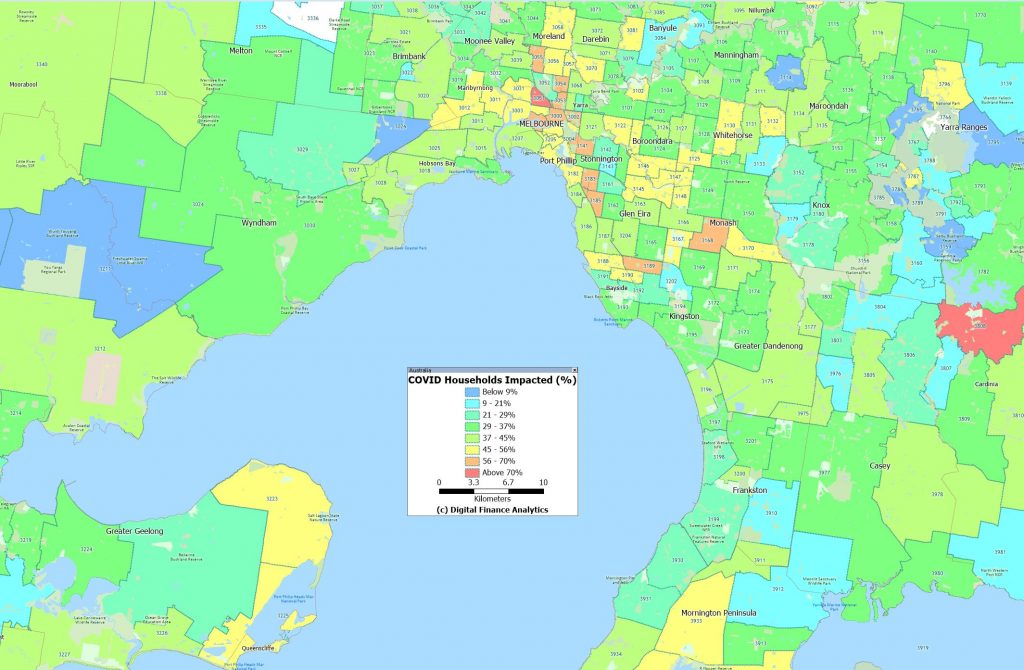

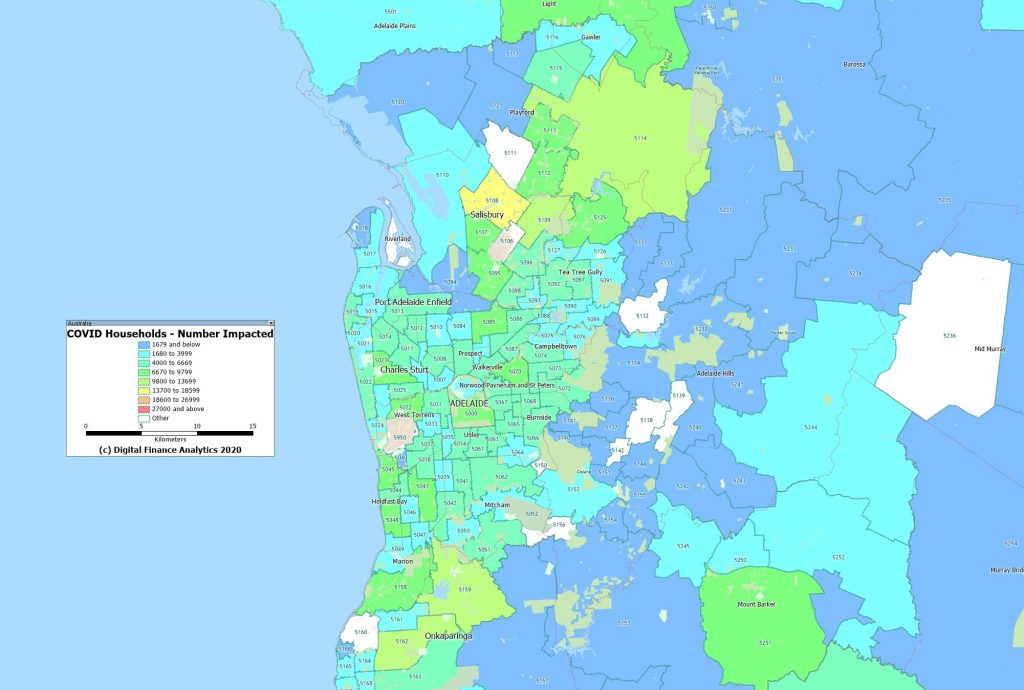

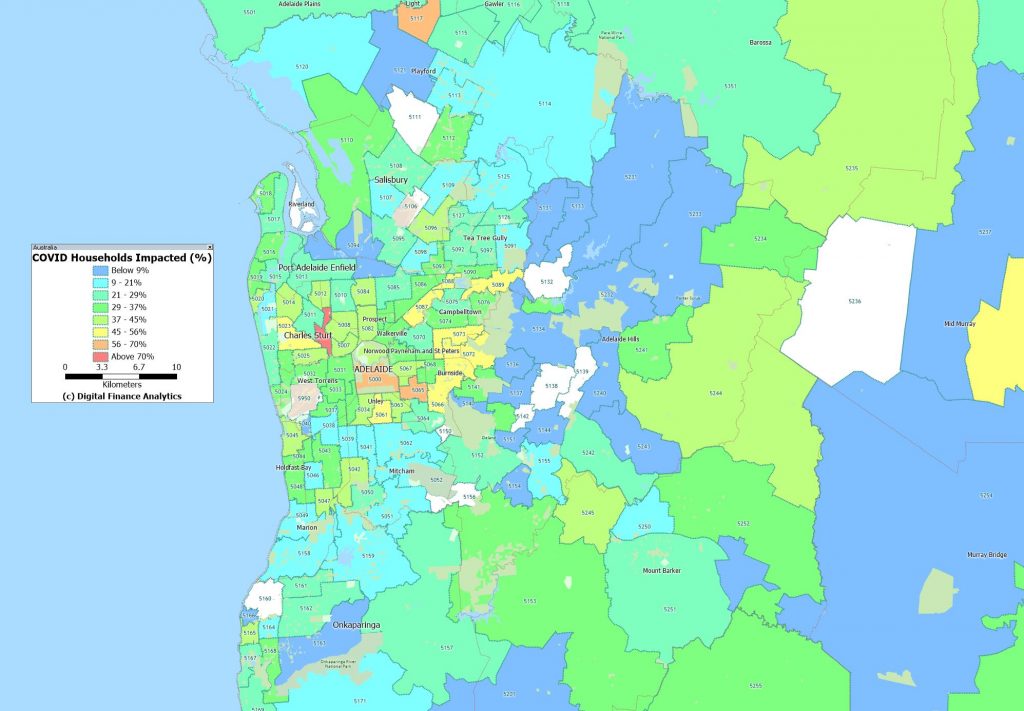

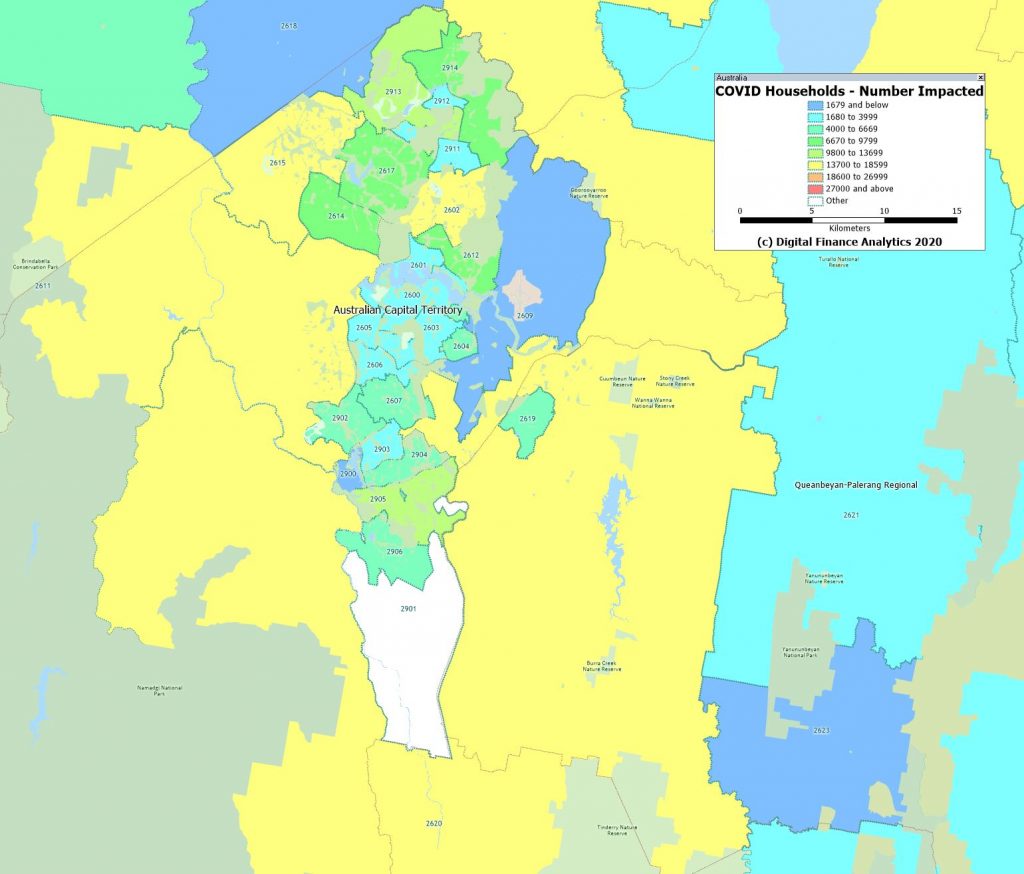

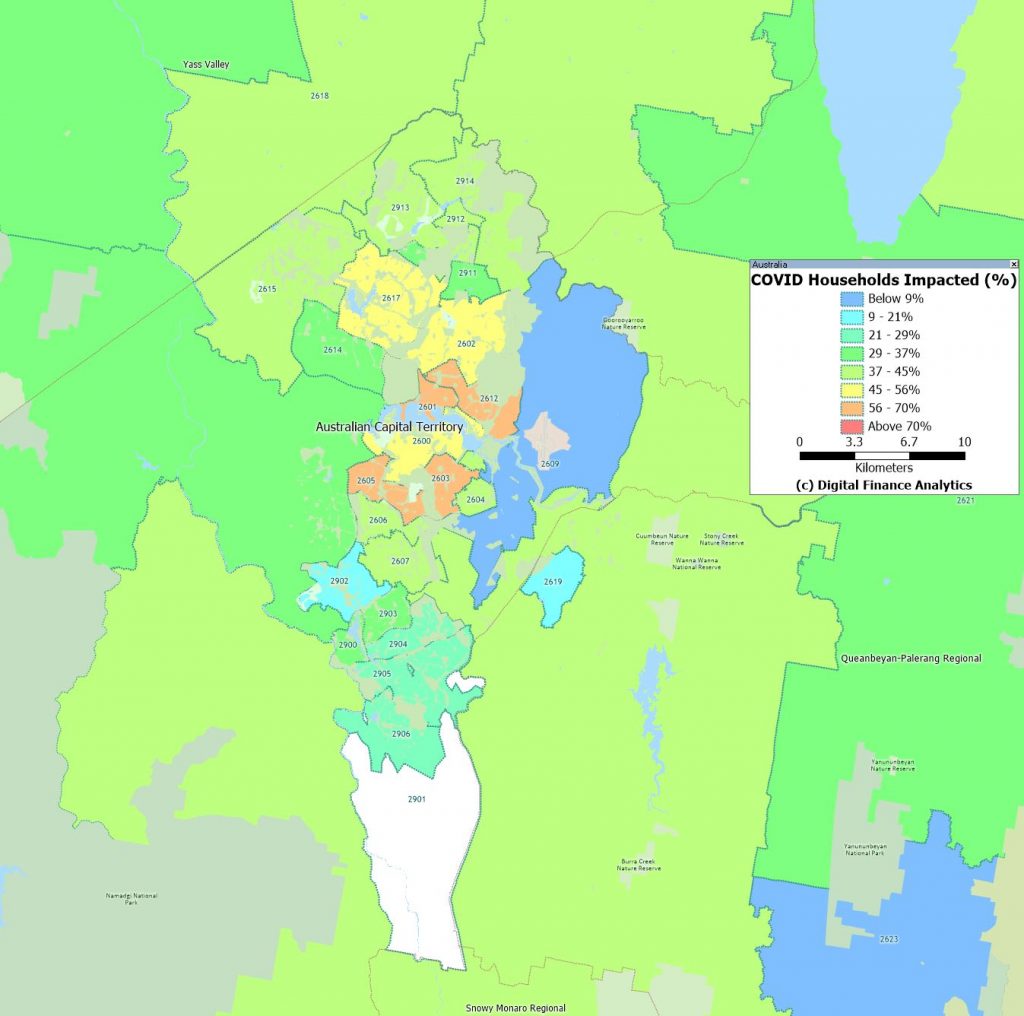

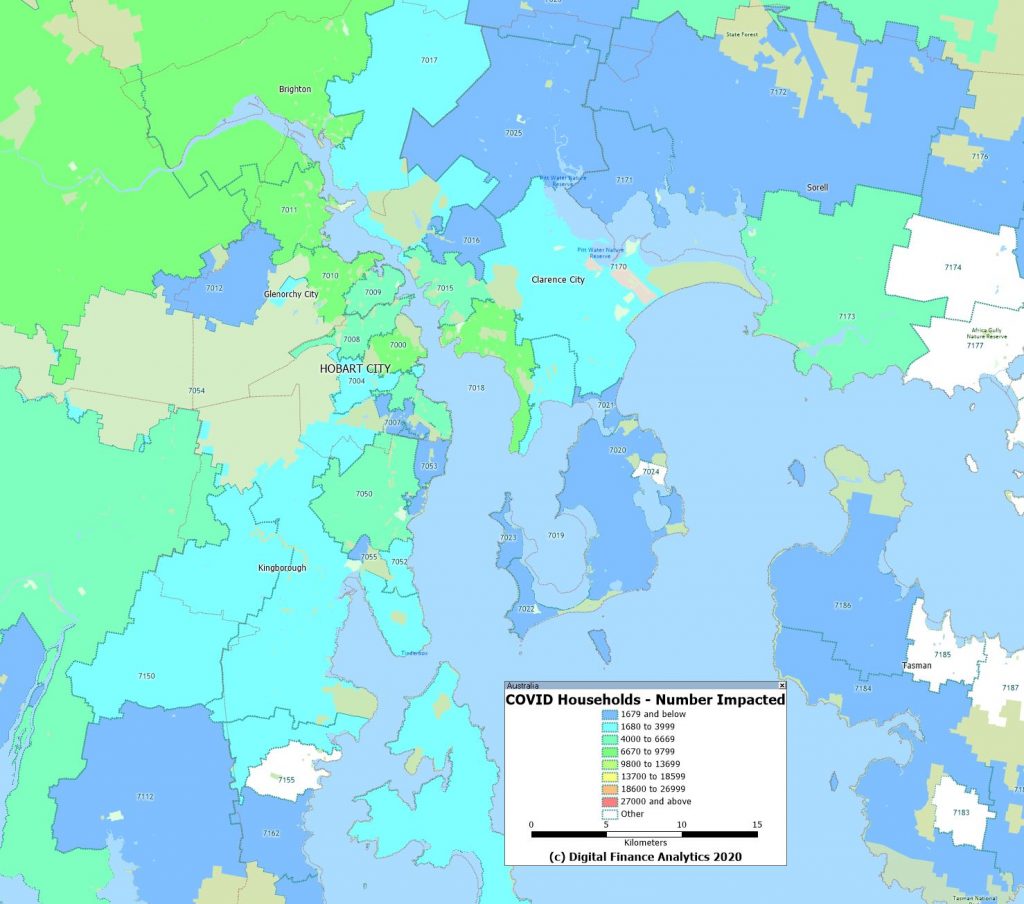

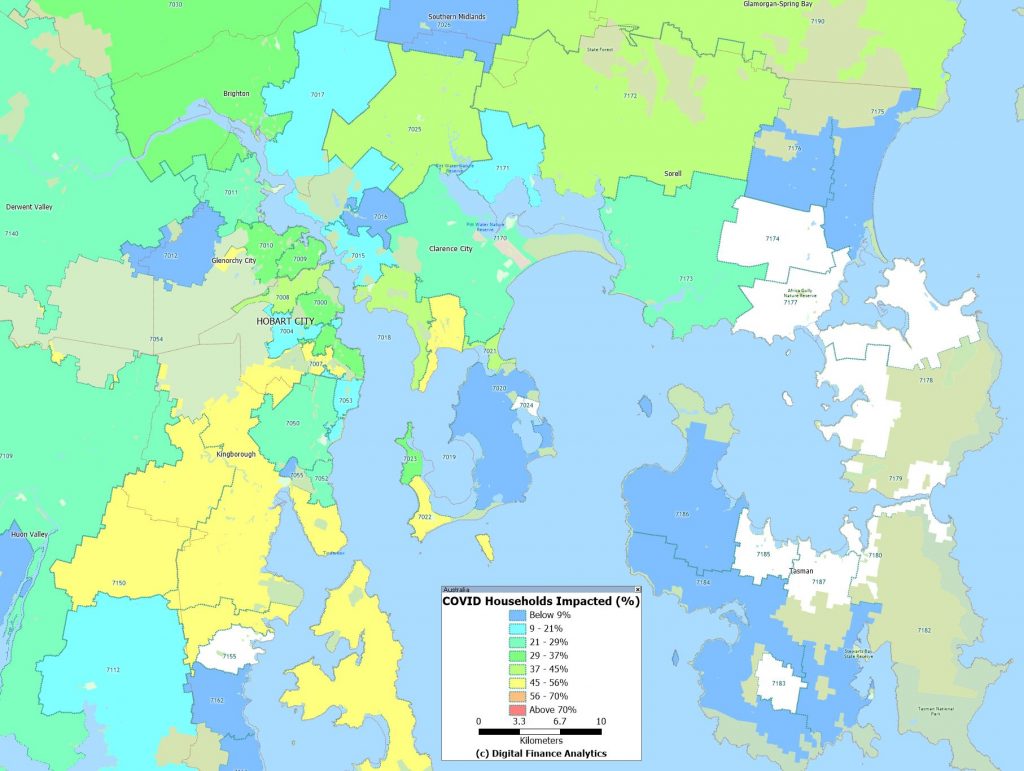

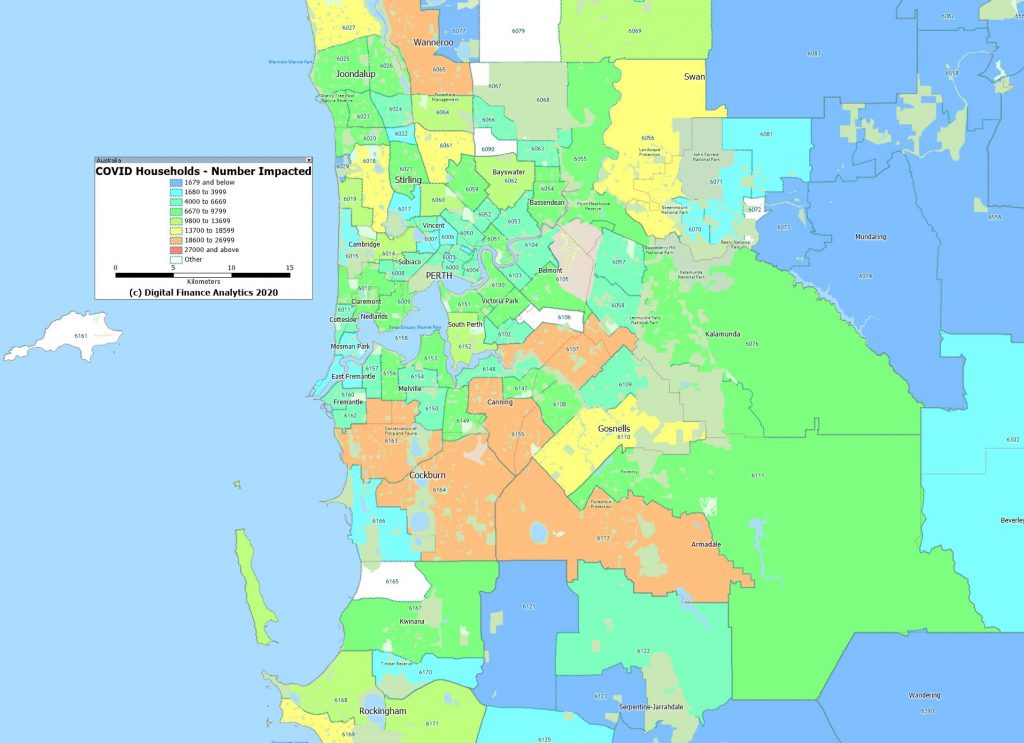

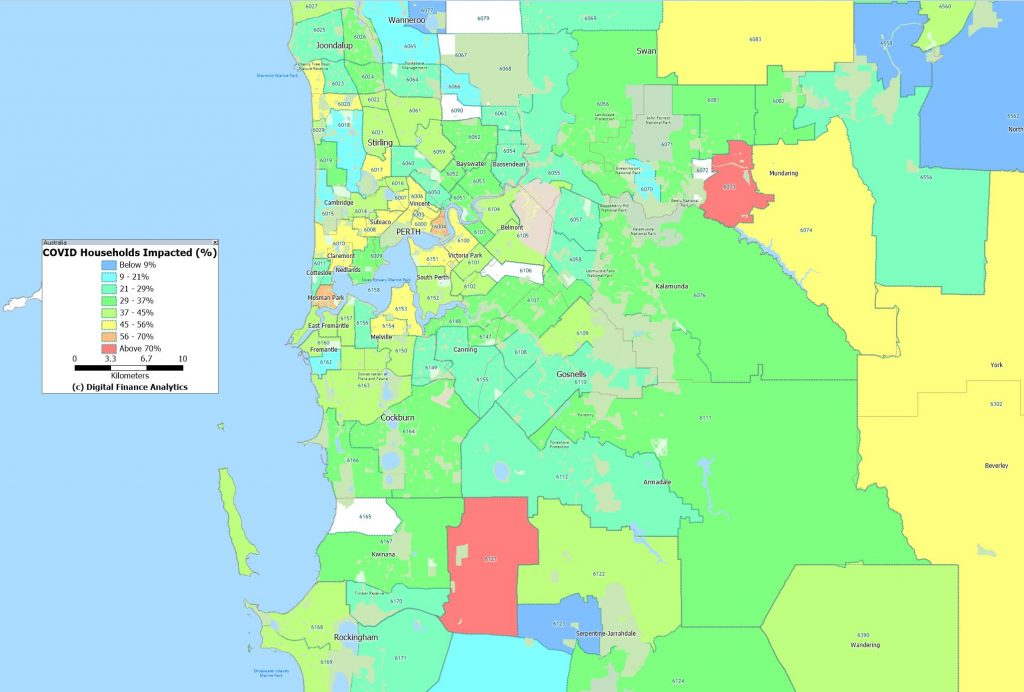

Because of the nature of the DFA survey, which is run to a post code level, we were able to identify those post codes with the largest counts of households impacted by COVID, financially speaking. We found that Toowoomba 4350 has the largest number of households impacted in the country, followed by Mackay 4740, Bundaberg 4670, Liverpool 2170, Mandurah 6210, Werribee 3030 and Cranbourne 3977. This underscores that COVID is hitting household finances areas across the country, not just in the main urban centres. Or to put it another way, even areas with low infection rates are being severely financially impacted.

We have mapped both the number of households in each post code, and the percentage of households in each post code adversely impacted financially. There are some important differences. For example, in Sydney, post codes in western Sydney have higher absolute counts, but the relative proportion of households hit is higher in the more affluent eastern suburbs, despite having lower densities.

We completed similar mapping for the other major centres. Brisbane

Melbourne

Adelaide

ACT

Hobart

Perth

The Australian Economy Has Been Completely Destroyed Within 4 Weeks – Part 1

Economist John Adams and Analyst Martin North are back! Today we get behind the economic data and discuss whether the Australian response to COVID is correctly calibrated.

The World Just Changed – The DFA Daily 15th April 2020 [Podcast]

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Now Its Getting Very Real – The DFA Daily 14 April 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

The Existential Crises – The DFA Daily 13 April 2020 [Podcast]

The latest edition of our finance and property news digest with a distinctively Australian flavour.

The Existential Crises – The DFA Daily 13 April 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

The Tenants And Landlords Wicked Problem – The DFA Daily 12 April 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.