Robbie Barwick from the Citizens Party and I discuss the need to create a National Bank to support the economic reconstruction which with country needs.

Tag: Coronavirus

Deeper In The Mire – DFA Daily 31 March 2020

The latest finance update with a distinctively Australian flavour.

The Heart Of The Matter – With Tony Locantro

Investment Manager Tony Locantro from Alto Capital and I discuss the leading indicators of the economy and property in the light of recent events. The months ahead will be troublesome, to say the least!

Senate Unanimously Passes $2T Stimulus Package

The Senate unanimously passed a massive stimulus package late Wednesday night in an effort to jumpstart the US an economy. As reported in The Hill

The bill provides more than $2 trillion for workers, small business and industries impacted in recent weeks by the virus.

The bill marks an unprecedented attempt by the federal government to revive the economy and prevent a deep recession. The 2008 Troubled Asset Relief Program (TARP), by comparison, was $700 billion.

The Senate’s vote comes one week after they passed a $104 billion “phase two” coronavirus package.

The wide-reaching bill includes a $1,200 one-time check for individuals who make up to $75,000. That amount would scale down until it reached an annual income threshold of $99,000, where it would phase out altogether.

It also provides $377 billion in small business aid, would defer federal student loan payments through Sept. 30, 2020, and would prevent money given under the bill to the Pentagon to be transferred to the border wall.

The bill also provides $100 billion for hospitals and $200 billion for other “domestic priorities,” including child care and assistance for seniors.

The unemployment provision includes four months of boosted unemployment benefits, including increasing the maximum unemployment benefit by $600.

The 700-plus page bill includes a $500 corporate liquidity fund to corporations; $25 billion would be set aside for U.S. airlines, $4 billion for air cargo carriers and $17 billion for other distressed companies related to critical national security.

CBA Provides Advice To Customers

A large scale communication campaign has been launched by CBA to clearly address customers’ most common questions and concerns. It is one of the clearest I have seen yet, and provides some really helpful advice. Kudos to them on their Financial Guide for Customers.

In what is a concerning and confusing time for many Australians, Commonwealth Bank is launching a mass coronavirus communication campaign from today, across all mainstream and social media channels, to help customers access the support and information they need.

CBA’s financial assistance contact centres are currently receiving up to eight times the usual call volumes with a significant number of customers wanting information on how to access support from CBA as well as the recently announced Government assistance measures as they face job loss and business closures.

This new campaign, centred on a detailed Financial Guide for Customers, aims to provide clear, concise, consistent and reliable information to help customers navigate the large volume of recent announcements, as they try to comprehend what support they are eligible for and how to access it quickly.

Customers are also looking for reassurance as well as the tools that will help them regain control of their financial wellbeing.

With the Federal Government designating banking as an essential service, Commonwealth Bank intends to keep as many of its branches open as possible while also encouraging customers to use digital banking for all banking needs other than those for which a visit to a branch is unavoidable. Branches have a range of safe distancing, health and hygiene measures in place.

At such an important time for customers in need, CBA will do whatever it can to help keep as many businesses afloat, as many people in jobs, and as many people in their homes, as possible.

The new Financial Guide will be regularly updated in its easy-to-read format and is available at www.commbank.com.au/coronavirus.

A Speedy Journey Downward

This trifecta of risks – uncontaminated medical emergencies, insufficient economic-policy arsenals, and geopolitical white swans – will be enough to tip the global economy into persistent depression and a runaway financial-market meltdown. After the 2008 crash, a forceful (though delayed) response pulled the global economy back from the abyss. We may not be so lucky this time.

From Project Syndicate. The shock to the global economy has been both faster and more severe than the 2008 global financial crisis (GFC) and even the Great Depression. In those two previous episodes, stock markets collapsed by 50% or more, credit markets froze up, massive bankruptcies followed, unemployment rates soared above 10%, and GDP contracted at an annualized rate of 10% or more. But all of this took around three years to play out. In the current crisis, similarly dire macroeconomic and financial outcomes have materialized in three weeks.

Earlier this month, it took just 15 days for the US stock market to plummet into bear territory (a 20% decline from its peak) – the fastest such decline ever. Now, markets are down 35%, credit markets have seized up, and credit spreads (like those for junk bonds) have spiked to 2008 levels. Even mainstream financial firms such as Goldman Sachs, JP Morgan and Morgan Stanley expect US GDP to fall by an annualized rate of 6% in the first quarter, and by 24% to 30% in the second. US Treasury Secretary Steve Mnuchin has warned that the unemployment rate could skyrocket to above 20% (twice the peak level during the GFC).

In other words, every component of aggregate demand – consumption, capital spending, exports – is in unprecedented free fall. While most self-serving commentators have been anticipating a V-shaped downturn – with output falling sharply for one quarter and then rapidly recovering the next – it should now be clear that the crisis is something else entirely. The contraction that is now underway looks to be neither V- nor U- nor L-shaped (a sharp downturn followed by stagnation). Rather, it looks like an I: a vertical line representing financial markets and the real economy plummeting.

Not even during the Great Depression and World War II did the bulk of economic activity literally shut down, as it has in China, the United States, and Europe today. The best-case scenario would be a downturn that is more severe than the GFC (in terms of reduced cumulative global output) but shorter-lived, allowing for a return to positive growth by the fourth quarter of this year. In that case, markets would start to recover when the light at the end of the tunnel appears.

But the best-case scenario assumes several conditions. First, the US, Europe, and other heavily affected economies would need to roll out widespread testing, tracing, and treatment measures, enforced quarantines, and a full-scale lockdown of the type that China has implemented. And, because it could take 18 months for a vaccine to be developed and produced at scale, antivirals and other therapeutics will need to be deployed on a massive scale.

Second, monetary policymakers – who have already done in less than a month what took them three years to do after the GFC – must continue to throw the kitchen sink of unconventional measures at the crisis. That means zero or negative interest rates; enhanced forward guidance; quantitative easing; and credit easing (the purchase of private assets) to backstop banks, non-banks, money market funds, and even large corporations (commercial paper and corporate bond facilities). The US Federal Reserve has expanded its cross-border swap lines to address the massive dollar liquidity shortage in global markets, but we now need more facilities to encourage banks to lend to illiquid but still-solvent small and medium-size enterprises.Subscribe now

Third, governments need to deploy massive fiscal stimulus, including through “helicopter drops” of direct cash disbursements to households. Given the size of the economic shock, fiscal deficits in advanced economies will need to increase from 2-3% of GDP to around 10% or more. Only central governments have balance sheets large and strong enough to prevent the private sector’s collapse.

But these deficit-financed interventions must be fully monetized. If they are financed through standard government debt, interest rates would rise sharply, and the recovery would be smothered in its cradle. Given the circumstances, interventions long proposed by leftists of the Modern Monetary Theory school, including helicopter drops, have become mainstream.1

Unfortunately for the best-case scenario, the public-health response in advanced economies has fallen far short of what is needed to contain the pandemic, and the fiscal-policy package currently being debated is neither large nor rapid enough to create the conditions for a timely recovery. As such, the risk of a new Great Depression, worse than the original – a Greater Depression – is rising by the day.

Unless the pandemic is stopped, economies and markets around the world will continue their free fall. But even if the pandemic is more or less contained, overall growth still might not return by the end of 2020. After all, by then, another virus season is very likely to start with new mutations; therapeutic interventions that many are counting on may turn out to be less effective than hoped. So, economies will contract again and markets will crash again.

Moreover, the fiscal response could hit a wall if the monetization of massive deficits starts to produce high inflation, especially if a series of virus-related negative supply shocks reduces potential growth. And many countries simply cannot undertake such borrowing in their own currency. Who will bail out governments, corporations, banks, and households in emerging markets?

In any case, even if the pandemic and the economic fallout were brought under control, the global economy could still be subject to a number of “white swan” tail risks. With the US presidential election approaching, the crisis will give way to renewed conflicts between the West and at least four revisionist powers: China, Russia, Iran, and North Korea, all of which are already using asymmetric cyberwarfare to undermine the US from within. The inevitable cyber attacks on the US election process may lead to a contested final result, with charges of “rigging” and the possibility of outright violence and civil disorder

Similarly, as I have argued previously, markets are vastly underestimating the risk of a war between the US and Iran this year; the deterioration of Sino-American relations is accelerating as each side blames the other for the scale of the health emergency. The current crisis is likely to accelerate the ongoing balkanization and unraveling of the global economy in the months and years ahead.

Author: Nouriel Roubini, Professor of Economics at New York University’s Stern School of Business and Chairman of Roubini Macro Associates

Bank of England launches Contingent Term Repo Facility

This step is designed to help alleviate frictions observed in money markets in recent weeks, both globally and domestically, as a result of the economic shock caused by the outbreak says the Bank of England.

The CTRF is a flexible liquidity insurance tool that allows participants to borrow central bank reserves (cash) in exchange for other, less liquid assets (collateral).

The Bank’s liquidity insurance facilities support financial market functioning by providing market participants with predictable and reliable sources of liquidity. The Bank’s liquidity insurance facilities support financial stability by reducing the cost of disruption to critical financial services.

Holding additional CTRF operations over the next two weeks complements the Bank’s existing liquidity facilities. The CTRF will run alongside the Bank’s regular sterling market operations – the Indexed Long-Term Repo (CTRF) and Discount Window Facility (DWF). The Bank is also able to lend in all major currencies through its participation in the central bank swapline network.

The CTRF will lend reserves for a period of three months. This will also allow participants to use the CTRF as a way to bridge beyond the point at which drawings can be made from the Term Funding Scheme with additional incentives for SMEs (TFSME) – helping to support lending to the real economy as quickly as possible.

An accompanying Market Notice provides additional detail and the terms of this operation

RBNZ: Mortgage Holiday and Business Finance Support To Cushion COVID Impacts

The New Zealand Government, retail banks and the Reserve Bank are today announcing a major financial support package for home owners and businesses affected by the economic impacts of COVID-19.

The package will include a six month principal and interest payment holiday for mortgage holders and SME customers whose incomes have been affected by the economic disruption from COVID-19.

The Government and the banks will implement a $6.25 billion Business Finance Guarantee Scheme for small and medium-sized businesses, to protect jobs and support the economy through this unprecedented time.

“We are acting quickly to get these schemes in place to cushion the impact on New Zealanders and businesses from this global pandemic,” Finance Minister Grant Robertson said.

“These actions between the Government, banks and the Reserve Bank show how we are all uniting against COVID-19. We will get through this if we all continue to work together.

“A six-month mortgage holiday for people whose incomes have been affected by COVID-19 will mean people won’t lose their homes as a result of the economic disruption caused by this virus,” Grant Robertson said.

The specific details of this initiative are being finalised and agreed urgently and banks will make these public in the coming days.

The Reserve Bank has agreed to help banks put this in place with appropriate capital rules. In addition, it has decided to reduce banks ‘core funding ratios’ from 75 percent to 50 percent, further helping banks to make credit available.

We are announcing this now to give people and businesses the certainty that we are doing what we can to cushion the blow of COVID-19.

The Business Finance Guarantee Scheme will provide short-term credit to cushion the financial distress on solvent small and medium-sized firms affected by the COVID-19 crisis.

This scheme leverages the Crown’s financial strength, allowing banks to lend to ease the financial stress on solvent firms affected by the COVID-19 pandemic.

The scheme will include a limit of $500,000 per loan and will apply to firms with a turnover of between $250,000 and $80 million per annum. The loans will be for a maximum of three years and expected to be provided by the banks at competitive, transparent rates.

The Government will carry 80% of the credit risk, with the other 20% to be carried by the banks.

Reserve Bank Governor Adrian Orr, said: “Banks remain well capitalised and liquid. They also remain highly connected to New Zealand’s business sector and almost every household in New Zealand. Their ability to extend credit to firms to bridge the difficult times created by COVID-19 is critical and made more possible with today’s announcements. We will monitor banks’ behaviour over coming months to assess the effectiveness of the risk-sharing scheme.”

The Government, Reserve Bank and the Treasury continue to work on further tailor-made support for larger, more complex businesses, Grant Robertson said.

Economists: Reality; Reality: Economists

And so it starts. The latest musings from Australian’s army of economists are beginning to wake up to the grim reality. Reality is not friendly. And the news will likely get worse ahead.

First, Westpac says that the unemployment rate is set to reach 11% by June. The economy is now expected to contract by 3.5% in the June quarter. And a sustained recovery is not expected until Q4.

Just last week they forecast a peak in the unemployment rate of 7%. Since then we got more extensive shutdowns than originally envisaged. Economic disruptions are set to be larger as the government moves to address the enormous health challenge which the nation now faces.

They says that historically, recessions have tended to emanate from investment cycles, particularly those centred on property and building with the initial shock centred on construction. As this recession will hit services much harder, the loss in jobs will be much quicker, but so too can the rebound be much faster, all dependent on how many firms remain solvent.

In usual recessions it is often uncertain whether the economy is in recovery phase whereas the signals around government policy (particularly shutdowns) will be much clearer and households and business will respond.

Their latest forecasts are based on an assessment of the expected impact of the Package on jobs and growth.The two stimulus packages cost a total of $25.8bn in 2019/20 and $36.3bn in 2020/2021.Of that total of $62bn, $22.85bn is allocated to direct payments to the unemployed and social security beneficiaries while $31.9bn is set aside for small business to retain workers.

However small business only receive cash if they retain workers. The subsidy (keeping cash which is withheld from workers for PAYE tax) is only, say, 20–30% of the direct cost of the worker. Given the current hugely challenging outlook for business, the Package will be measured in terms of its success in keeping people in work.

And AMP’s Shane Oliver says:

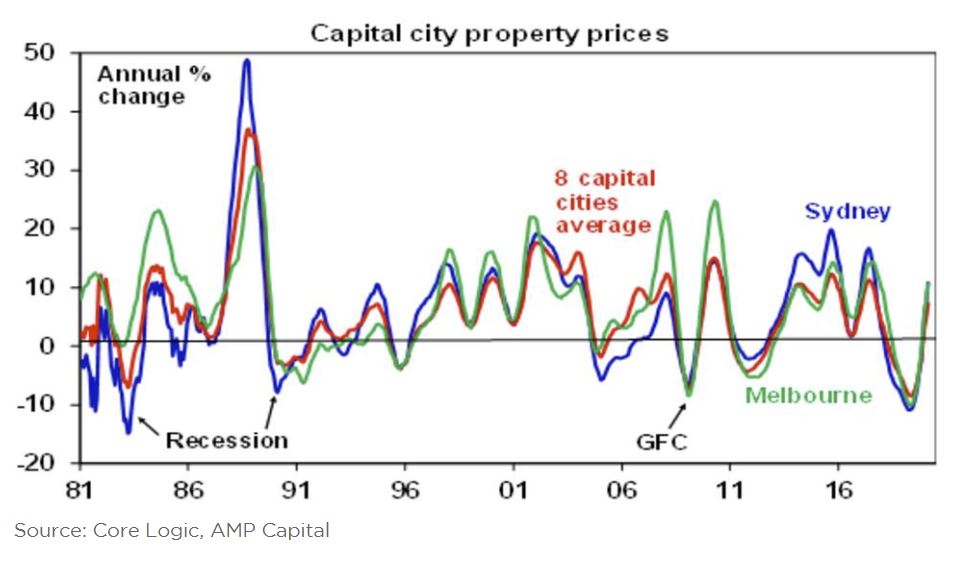

Auction clearance rates and sales momentum are showing some signs of slowing this month. This may reflect an increasing desire on the part of buyers and sellers to put property transactions on hold to avoid being exposed to the virus unnecessarily. Social distancing policies will only intensify this. On its own this may crash transactions but may just flatten price gains.

However, it’s the likely recession that we have now entered due to coronavirus related shutdowns that imposes the big risk. We expect at least two negative quarters of GDP growth in the March and June quarters with the risk that the September quarter is also negative. And the contraction could be deep because big chunks of the economy will be largely shut – tourism, travel, and entertainment with a severe flow on to parts of retailing. The toilet paper, sanitiser and canned/frozen food boom may help supermarkets for a while – but as Deutsche Bank recently calculated for every $1 spent on such items there is $15 spent on things that are vulnerable to social distancing.

Past large share market falls have seen a mixed impact on property prices. The 1987 50% share market crash actually boosted home prices as investors switched from shares to property. But the key is what happens to unemployment as this often forces sales and crimps demand. Back in 1987 the economy remained strong and unemployment fell but the recessions of the early 1980s and early 1990s saw falls in average national capital city home prices of 8.7% and 6.2% respectively as unemployment rose. The GFC share market fall of 55% also saw a 7.6% home price fall, even though it wasn’t a recession, because unemployment rose from 4% to nearly 6%.

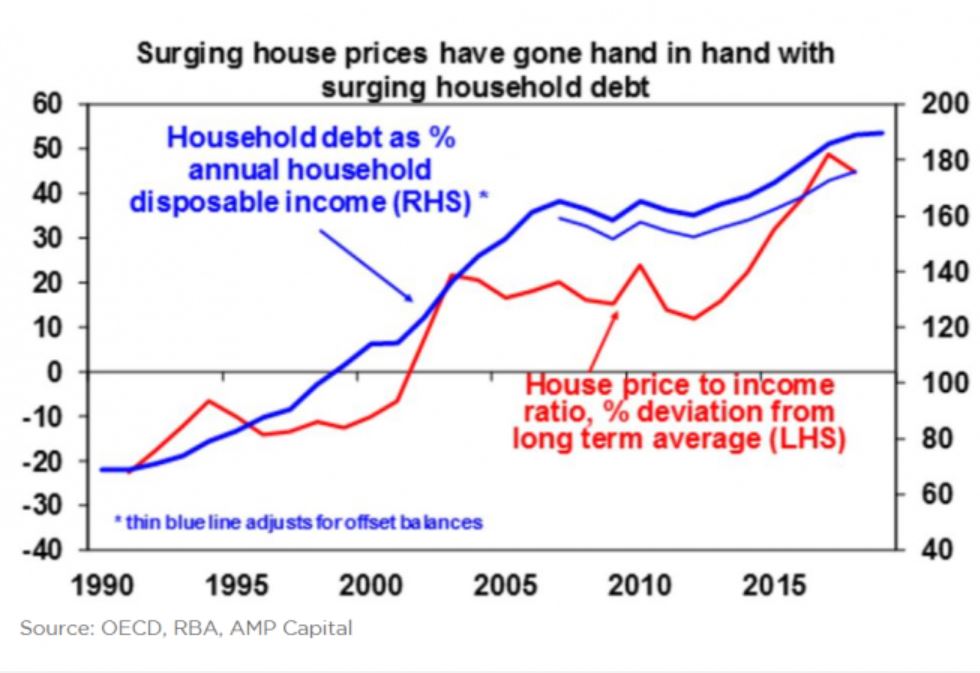

If the recession turns out to be long – pushing unemployment to say 10% or more – then this risks tripping up the underlying vulnerability of the Australian housing market flowing from high household debt levels and high house prices. The surge in prices relative to incomes (and rents) over the last two decades has gone hand in hand with a surge in household debt relative to income that has taken Australia from the low end of OECD countries to the high end.

So he says “we have always concluded that the combination of high prices and debt on their own won’t trigger a major crash in prices unless there are much higher interest rates or a recession. Unfortunately, we are now facing down the barrel of the latter. A sharp rise in unemployment to say 10% or beyond risks resulting in a spike in debt servicing problems, forced sales and sharply falling prices. This could then feedback to weaken the broader economy as falling home prices lead to less spending and a further rise in unemployment and more defaults and so on. This scenario could see prices fall 20% or so”.

Bear in mind though that part of this would just be a reversal of the 9% bounce in average capital city prices seen since mid-last year.

It’s also not our base case but it highlights why governments and the RBA really have to work hard to avoid letting the virus cause a lot of company failures, surging unemployment and household defaults.

And Goldman Sachs is still relatively sanguine.

Goldman Sachs said it was now forecasting a 6 per cent contraction in the domestic economy in 2020 — the biggest since the 1920s Great Depression — with unemployment peaking at 8.5 per cent.

On the upside, the strength of Australian bank balance sheets in terms of funding, liquidity and capital left them “significantly less vulnerable than compared to any point in the recent past”.

“Similarly, the source of historic loan losses for banks — corporate balance sheets — enter this downturn in a better condition than at any point in the last 40 years, with close to all-time-low levels of gearing and all-time low debt-servicing ratios,” Goldman said.

But given the scale of the forecast contraction, bad debts were now expected to rise significantly to 50bps of loans and slash bank earnings by 20 per cent.

A hard-landing scenario would wipe out between 50-70 per cent of the sector’s earnings.

The Slow Grind South – DFA Daily 23 March 2020

The latest edition of our daily digest of the latest finance news with a distinctively Australian flavour.

Harry Dents Webinar: https://nz561.isrefer.com/go/hdcb/ormn/