Centrally cleared cryptocurrency derivatives could be a real-world test of clearinghouses’ margining and default procedures, particularly if derivative notional volumes increase and cryptocurrencies exhibit heightened price volatility, says Fitch Ratings.

Although they have largely avoided direct exposure to cryptocurrencies, banks’ role as clearing members creates a secondary channel for cryptocurrency risk. This could indirectly affect banks under more extreme stress scenarios, such as if margining and clearinghouse capital contributions prove insufficient to absorb counterparty defaults.

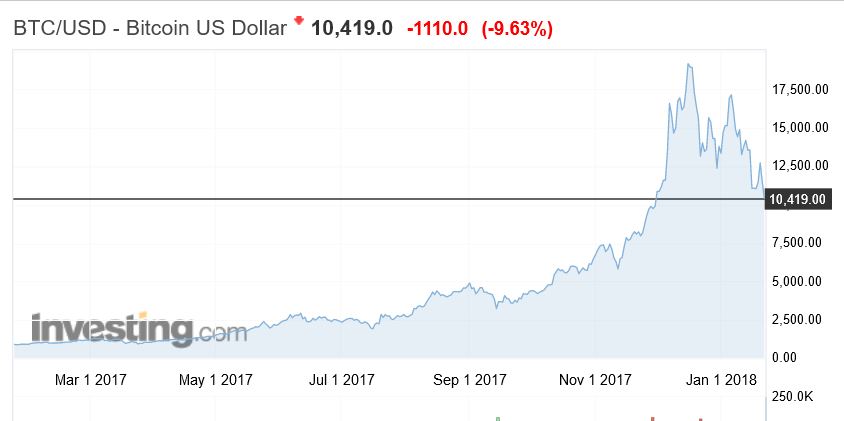

A dramatic increase in financial institutions’ exposure to cryptocurrency derivatives could challenge clearinghouses and large financial institution clearing members in ways beyond those typically associated with the introduction of new market products. Cryptocurrencies are prone to extreme price volatility, which has been exacerbated by a nascent, unregulated underlying market with a limited price history and without generally accepted fundamental valuation principles. These factors complicate margin calculations, particularly related to short positions, for which losses cannot be capped. Inadequate margins may lead to use of clearinghouses’ collective funds to mitigate losses, thus calling upon the resources of non-defaulting clearing members, including many of the world’s largest banks and other financial institutions.

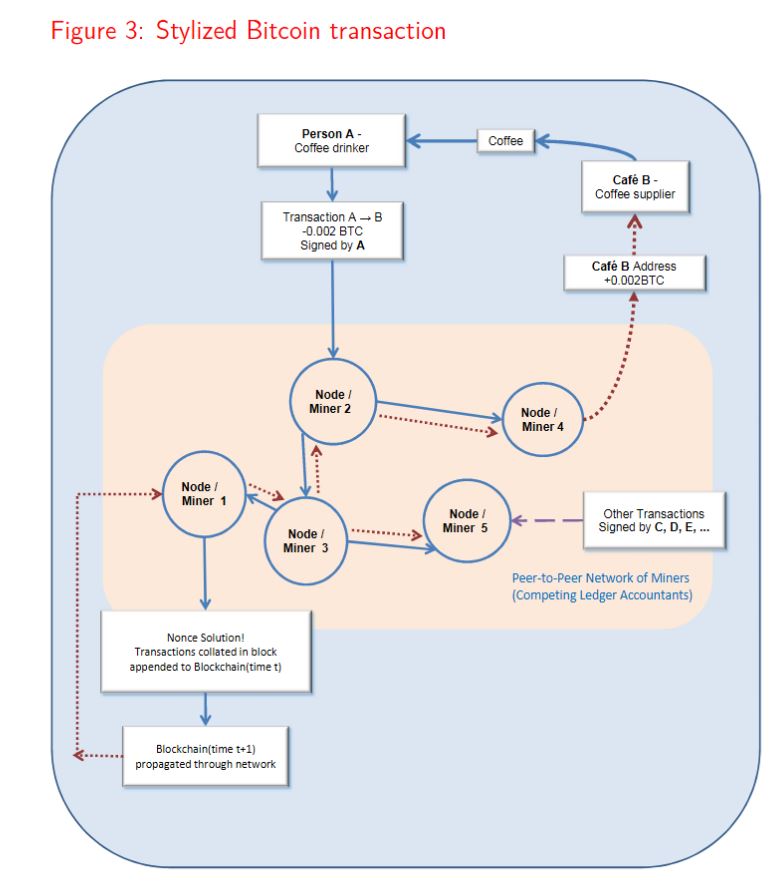

Bitcoin futures are cash-settled derivatives (i.e. without delivery of the base asset) that allow investors to assume long and short exposures to bitcoin prices without directly facing the cryptocurrency itself. In December 2017, CME Group and CBOE introduced the trading of bitcoin futures under the tickers BTC and XBT, respectively. BTC contracts are cleared through CME Clearing, while XBT contracts are cleared through Options Clearing Corporation (OCC).

As of May 9, 2018, open interests in XBT and BTC were modest at 6,287 and 2,479 contracts, respectively, worth approximately $59 million and $116 million, respectively. However, if challenges associated with trading the cryptocurrency are addressed, including uncertainty over regulatory, tax and legal frameworks, cryptocurrency derivative volumes could grow.

Clearinghouses have imposed high initial margin requirements, as well as price and position size limitations, suggesting a cautious approach thus far to trading cryptocurrency derivatives. As of May 9, 2018, initial (maintenance) margin requirements at CME were 43% of the associated notional amount, while at OCC the percentage was 44%, up from around 30% at the derivatives’ introduction in December 2017. Position limits at both exchanges are limited to 5,000 contracts in total or 1,000 in spot/expiring contracts. Consistent with price limitations for equity indexes, the maximum price limits at CME and CBOE are set at 20% above or below the previous day’s closing price, and trading is not permitted outside this band. There are also special price fluctuation limits set at 7% and 13%, which lead to temporary trading suspension.

The CME and OCC have not yet established separate legal entities or default funds for cryptocurrency derivatives, instead allocating exposure to the same default funds as equity indexes. This is understandable given the cost inefficiencies of establishing entities and default funds for what is currently a relatively low volume business. Nevertheless, a member default from losses on cryptocurrency derivatives may cause disruptions in other cleared products. Should centrally-cleared cryptocurrency derivatives materially grow, Fitch would expect clearinghouses at a minimum to establish separate default funds in an effort to isolate and mitigate associated risks.