High-frequency trading and dark liquidity have been two of the most topical market structure issues globally over recent years. During 2015, ASIC have undertaken two new reviews of high-frequency trading and dark liquidity. The aim of these reviews has been to update and build on their earlier analysis of equity markets and to assess the effect of high-frequency trading on the futures market.

No further regulation specifically addressing high-frequency trading or dark liquidity is proposed at this stage but ASIC says they will continue to monitor developments involving these and other markets issues.

The 2015 reviews involved:

(a) stakeholder engagement, including over 40 meetings with fund managers, market participants, high-frequency traders and market operators. Over 20 separate meetings on principal trading and facilitation with market participants, fund managers and overseas regulators;

(b) in-depth analysis of equity and futures order and trade data; and

(c) literature review, including research by academics and other regulators

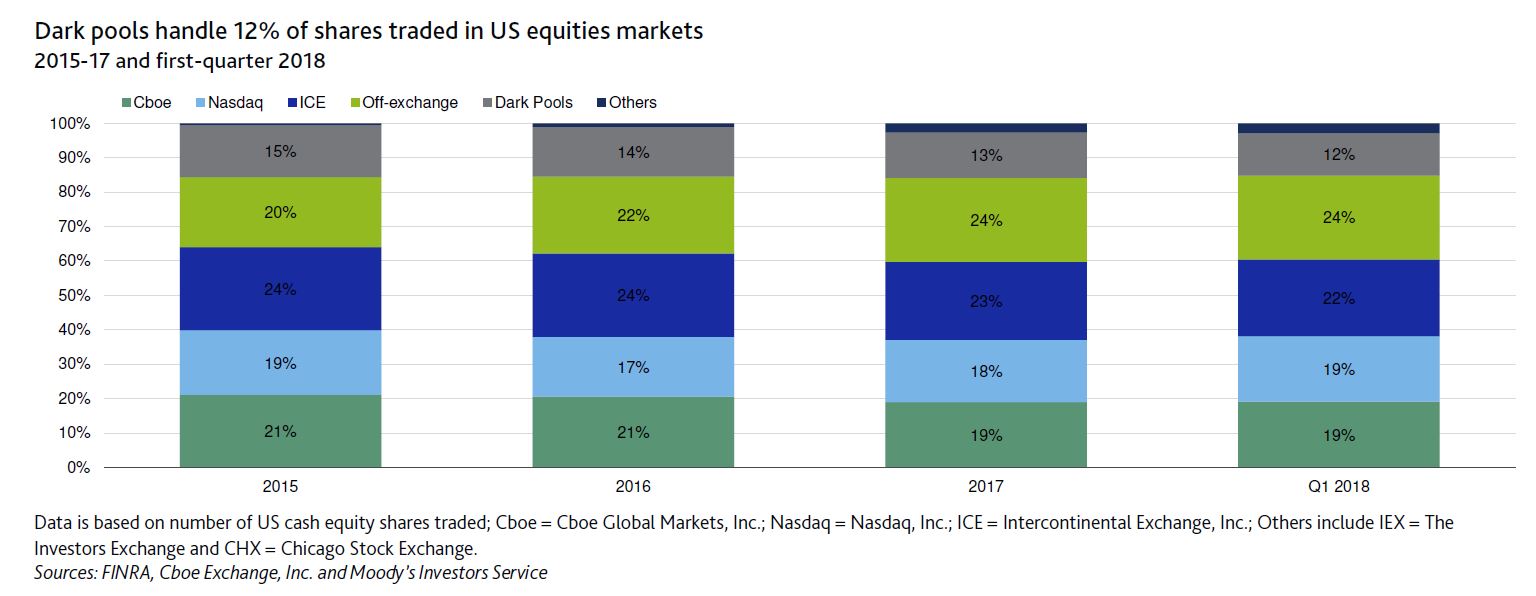

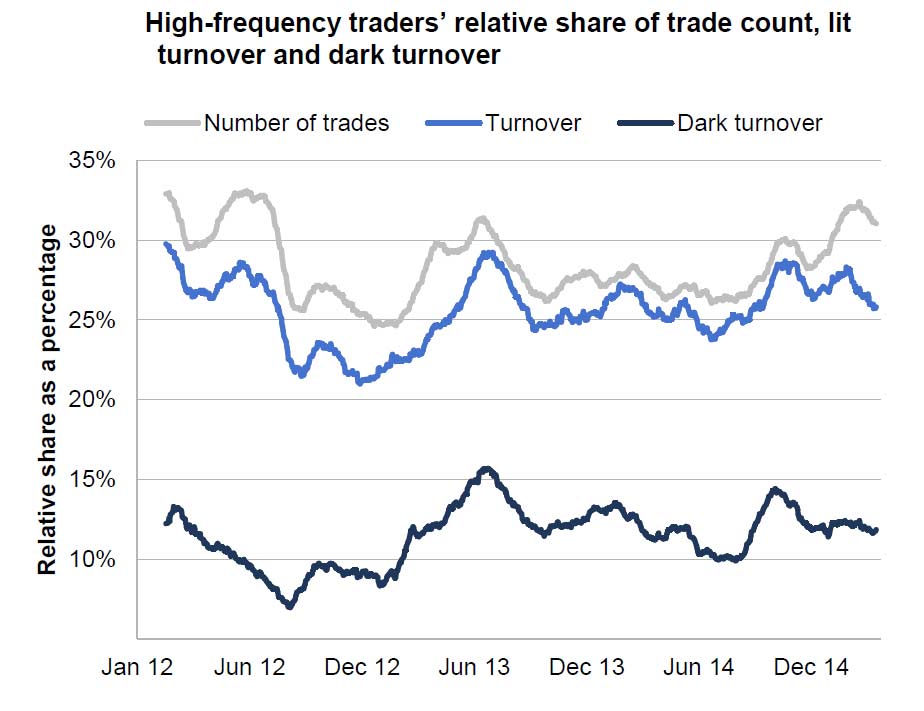

High frequency trades make up more than 30% of all trades, and dark turnover is sitting at about 12%.

ASIC’s Key Findings

ASIC’s Key Findings

High Frequency Trading – Equity Markets

- The level of high-frequency trading in our equity markets is reasonably steady at 27% of total turnover (this is comparable to Canada, the European Union and Japan).

- However, the concentration of high-frequency trading in our markets is higher, with 30% fewer high-frequency trading accounts. Trading is also more active in mid-tier securities than in 2012.

- High-frequency traders are trading somewhat more aggressively than in 2012, while still contributing significantly to the orders at the best displayed prices. Average holding time is between 50 and 60 minutes.

- High-frequency traders appear to have become more sophisticated. Compared to 2012, they are better at avoiding interacting with one another and they are extracting larger gross trading revenues. ASIC estimate that they earned $110–180 million in aggregate over the 12 months to 31 March 2015. This translates to a cost of 0.7 to 1.1 basis points to other market users. This is material, but substantially less than other figures suggested by some, and less than some other trading costs (e.g. average bid–offer spreads are 13 basis points).

- High-frequency trading does not appear to be a key driver of transaction costs. It appears that higher levels of high-frequency trading assist in lowering transaction costs for low turnover securities.

- Some concerns about predatory trading remain (i.e. where trading is undertaken to exploit others or unfairly induce them to trade). While not excessive in our markets, predatory trading can adversely affect the trading outcomes for fundamental investors (those who buy or sell on an assessment of intrinsic value). Fundamental investors remain ASIC’s regulatory priority and unchecked predatory trading can undermine our objectives for those investors to have confidence and trust in our markets and for our markets to be fair, orderly, transparent and efficient.

High Frequency Trading – Futures market

- High-frequency trading has grown rapidly in the futures market (130% since December 2013), although from previously low levels. High-frequency trading in the S&P/ASX 200 Index Futures Contract (SPI) accounts for 21% of traded volume and in the Three Year and Ten Year Commonwealth Treasury Bond Futures Contracts (bond futures) it accounts for 14% of traded volume. While these levels do not currently concern ASIC, they are closely monitoring growth

- ASIC are conducting inquiries into a number of traders for excessive order entry and cancellation in the ASX 24 market during the quarterly expiries (i.e. the ‘roll’). This practice affects other market users because it prevents the prioritisation of their orders and forces them to cross the spread (i.e. pay more). ASIC has asked ASX to consider what steps may be taken to discourage this practice.

Dark liquidity

- There has been a partial shift back to using dark liquidity for its original purpose, namely large block trades to reduce market impact. This is a positive development and, in part, a response to the lowering of block trade thresholds in May 2013

- Many of the concerning trends with crossings systems that ASIC identified in 2012 have abated. The reasons for this are likely due to buy-side clients demanding improved standards and ASIC market integrity rules introduced to enhance fairness and improve transparency around the operation of crossing systems

- There has been a decline in the use of crossing systems and growth in the use of the exchange dark venues (i.e. ASX Centre Point and Chi-X hidden orders). This is likely a response to the trade with price improvement rule introduced in May 2013, and a lack of price improvement opportunities in crossing systems

- There is a trend here and overseas toward exchange and crossing system operators seeking to preference some market users over others (e.g. better or worse order execution priority) for dark trading. These developments have the potential to undermine fair and non-discriminatory trading and may be inconsistent with operators’ obligations. ASIC is unlikely to support any form of preferencing where it unduly favours some market users over others, unfairly limits access to market facilities, or otherwise results in the unfair treatment of orders or market users

- ASIC has concerns about how some market participants are managing their conflicts of interest for principal trading and client facilitation. Market participants should review their arrangements to protect clients’ trading intentions, manage conflicts of interest, avoid the risks of insider trading, conduct compliance and supervision and have appropriate incentive structures. They should avoid situations where staff are responsible for the participant’s own trading while having access to unexecuted client orders. Additional controls, including physical separation, should be put in place to manage the conflicts and conduct risk arising from active facilitation

We think high frequency trading is of concern, because it is clear, those who invest in major IT systems to reduce transaction times have significant market advantage – it has become an arms race, where smaller players cannot win. The system is essentially gamed.