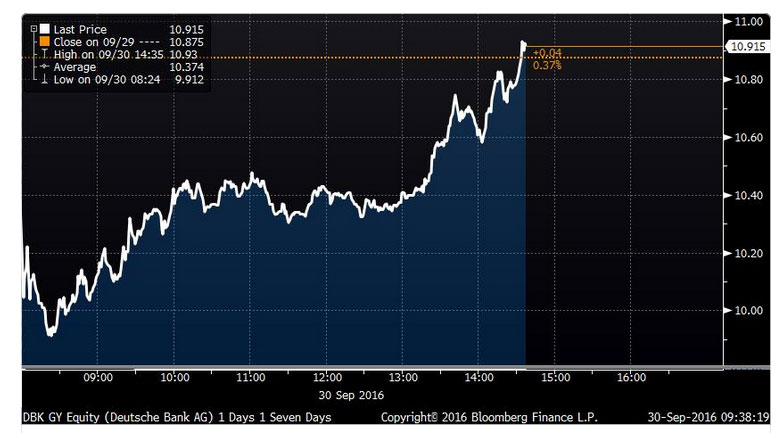

Deutsche Bank is in the news for all the wrong reasons. Some speculators believe that it will be the 2008 Lehman Brothers collapse all over again. Shares in the bank were briefly driven down to single digits. They seem to have stabilised around €10 but this remains well below the €30 just over a year ago and €100 a share in 2007. And the bank’s future is uncertain.

Clearly investors are worried and there is an absence of people who believe even €10 would be a sensible investment. At €10 per share, an investor has a right to €48 of equity. But the problem is whether that €10 will ever be returned to you – let alone with gains. Like many other banks though, Deutsche Bank faces a number of headwinds, which have knocked its profits in recent years.

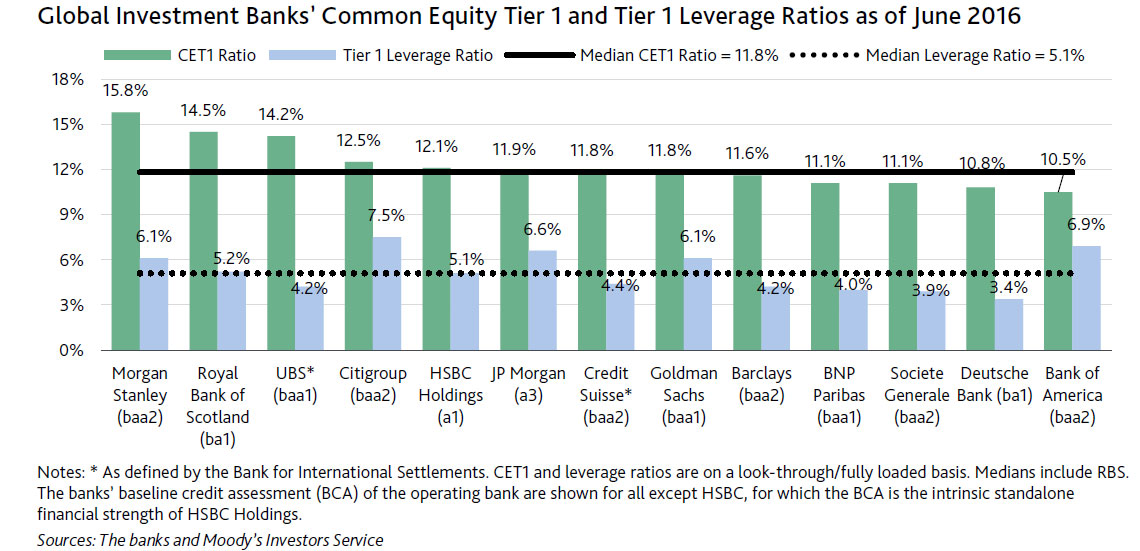

New regulation since the financial crisis requires that banks must accumulate their profits to create a greater cushion against the risks that became apparent in 2008. This means that the profits that Deutsche will earn over the next few years will be used to increase the size of that cushion rather than being returned to shareholders. Relief is unlikely, as the IMF has identified Deutsche as “the most important net contributor to systemic risks in the global financial system”.

Large well-established banks have a second problem. They have become fat with too many employees juggling outdated, disparate and often dysfunctional IT systems. Deutsche has more than 100,000 employees. Its retail branches – a number of which have been cut this year – are labour intensive and add to these problems.

Dealing with this problem requires reinvesting some of its profits in restructuring its activities – which again means less money for shareholders in the short-run. Failure to do so, however, will create opportunities for new entrants to the banking market such as alternative finance and new fintech operations.

The European Central Bank’s negative interest rate policy is compounding problems. Historically, banks benefited from retail depositor inertia – depositors that park their money in accounts and don’t act upon earning little or no interest. A healthy deposit base ensured a source of zero or low-cost funds that could be lent elsewhere. But the benefit of depositor inertia disappears when interest rates go negative as it costs money to service these customers with extensive retail networks. Imposing user fees is unpopular with customers.

Crisis catalyst and management

These structural issues are well known. The catalyst for the recent action is a US$14 billion fine from the US Department of Justice for mis-selling mortgage bonds a decade ago. Deutsche is looking to negotiate a smaller figure, but if the $14 billion fine sticks the bank could need to raise another €9 billion of equity. At current prices, hapless investors would need to subscribe an additional 60% of their investment to simply hang on to the share of future profits that they expected to receive prior to the fine.

While Deutsche talks confidently of lowering its fine, it is unlikely to attract buyers for its stock. Meanwhile, speculators betting on a decrease in the share price are pushing an open door. Plus, given the dysfunctional nature of eurozone financial regulation, the high political costs of German government intervention and risk of signalling that larger eurozone members play by a different set of rules – the German government will be slow to intervene.

Adding to this complexity, the fine from the US government comes just days after the US$13 billion fine the EU hit Apple with, making some suspicious that there is an element of revenge at play. True or not, the uncertain outcome during the lengthy appeals process will only increase the perceived risks of an investment in Deutsche Bank.

From the sidelines, one would be sympathetic to the CEO’s statement that Deutsche is a strong bank that is being targeted by “forces that want to weaken us”. The bank has assets of more than €1.8 trillion and equity of €67 billion.

As a large, complex entity, it is easy for outsiders to speculate that the bank may be weak, further eroding investor and customer confidence in both the bank and European bank regulation. The coming days will largely determine whether the negative feedback loop between confidence and the stock price can be broken. At worst, the outcome will be significant economic and political difficulties in the coming weeks. At best, it may create a sense of urgency within the eurozone to comprehensively address the banking sector issues that have festered for the past eight years.

Author: Eamonn Walsh, Professor of Accounting, University College Dublin