Today we discuss how banks lend, and why the idea that bank deposits limit bank lending is plain wrong and helps to explain why home prices have exploded in recent years.

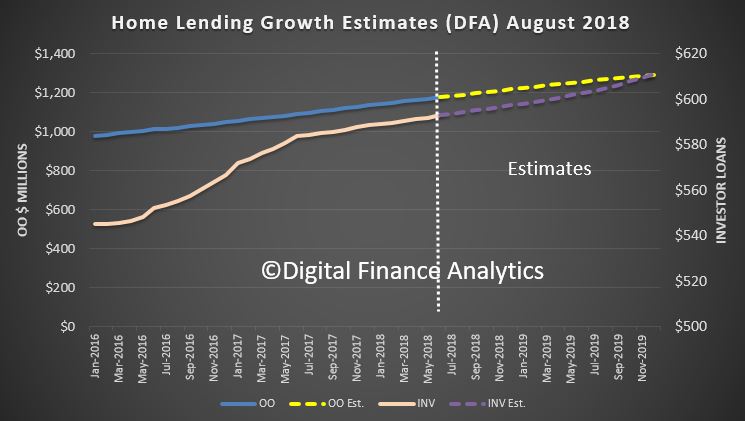

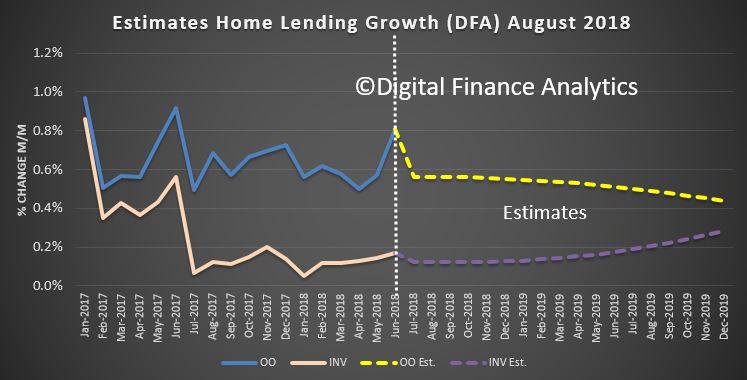

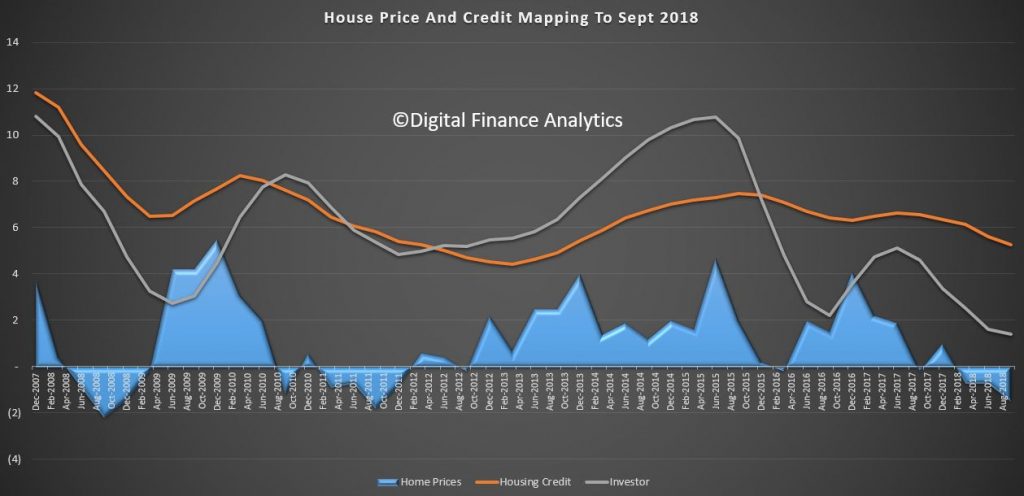

The correlation between home prices and credit availability are clear to see. We have updated this chart to take account of 2018 data. As credit rose from 2012 onward, home prices did too. It also suggests that if credit availability is tightened, we should expect prices to fall – take note, given the current tighter underwriting standards now in force. This is why I predict ongoing falls in property prices.

And more specifically, credit for property investment is even more strongly correlated. As we know investors are attracted by the capital growth, and also the capital gains and negative gearing tax breaks available.

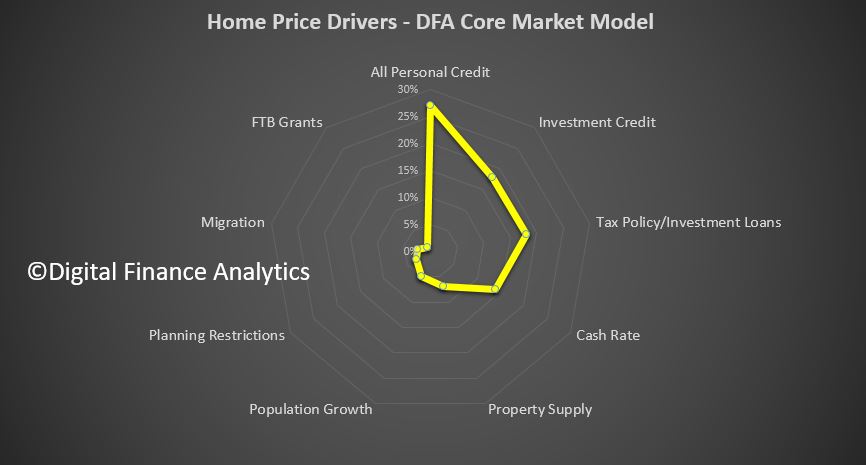

What’s most interesting is the relative weight of these different factors in driving home prices. The four most powerful levers in terms of home prices is first overall growth in personal credit, including mortgages and other loans at 27% of total impact. Investment lending contributed a further 18%, followed by tax policy for investment property at 17% and the cash rate at 14%. The other factors, the ones which are spoken about the most, property supply, population growth, planning restrictions and migration, together make up just 22% of total impact. Or in other words, without addressing the credit elephant in the room, tax policy and interest rates, the chances of taming prices is low. First time buyer incentives were less than 1%!

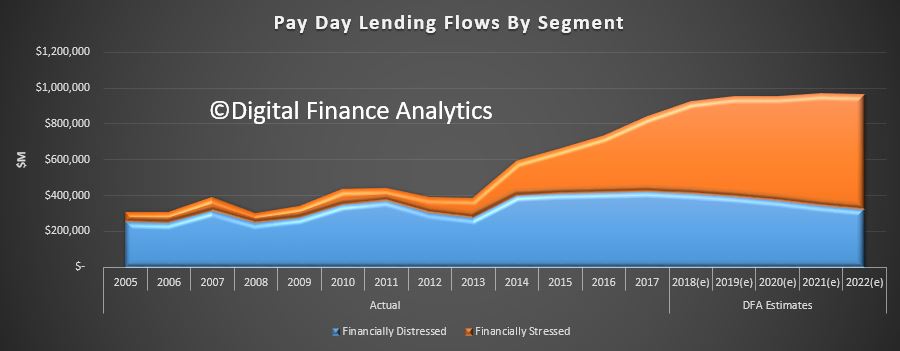

So the greatest of these is credit policy, which has for years allowed banks to magic money from thin air, to lend to borrowers, to drive up home prices, to inflate the banks balance sheet, to lend more to drive prices higher – repeat ad nauseam! Totally unproductive, and in fact it sucks the air out of the real economy and money directly out of punters wages, but make bankers and their shareholders richer. Plus, the second order impacts to the construction sector.

Two final observations. First the GDP calculation we use in Australia is flattered by housing growth (triggered by credit growth) and construction activity. The second driver of GDP growth is population growth. But in real terms neither of these are really creating true economic growth, as seen in the per capita data.

Second, the capital regulatory framework from the Bank For International Settlements is still a hangover from the days when deposits were thought to drive loans – so holding a ratio of assets to protect deposits made sense. But given the multiplier effect available to banks via their ability to issue bonds and the like increase their loan books, the BIS rules as currently formulated are ineffective. In fact by applying low risk weights to mortgage loans, they encourage to banks to leverage up more – in Australia our major banks have only about 5%of shareholder capital at risk. This is way too low.

To, conclude, to solve the property equation, and the economic future of the country, we have to address credit. But then again, I refer to the fact that most economists still think credit is unimportant in macroeconomic terms!

The alternative is to continue to let credit grow well above wages, and lift the already heavy debt burden even higher. In fact, some are calling for a reversal of recent credit tightening to resurrect home price growth. But, that is, ultimately unsustainable, and why there will be an economic correction in Australia, and quite soon.