DFA research was featured in a recent The Advisor article.

Brokers have the mortgage market in the palms of their hands – for now – but will the tech-savvy borrowers of the future always need their help? The Adviser reports.

Ask any broker if they can ever see a future in which borrowers go online for their home loan – a complete, end-to-end solution – and the response is always the same: “A mortgage is the biggest financial decision you will ever make, and people want a professional to guide them through that.”

Certainly, this seems to be the case now: broker market share is at an all-time high. What brokers don’t write is written by the banks’ direct channels, with few home loans written online.

As Loans.com.au founder Kim Cannon says, “Many people still get confused with online lending. It is really a lead generation business.”The online offering in Australia remains underdeveloped, and this is good news for brokers and branch managers.

But what do their customers really want? Are they rushing out to see a broker because they want to, or because it is really only one of two options?

This is an interesting, albeit controversial question. But it’s critical to ask it if we are to have an open-minded, mature discussion about the future of mortgage distribution.

Nobody really knows the answer; that will become clearer in time.

What is perfectly clear right now, however, is that a growing number of Australians are using digital devices to source their information.

According to US-based market research firm eMarketer, Australia boasts the highest tablet penetration in the Asia-Pacific region.

The firm found that nearly 60 per cent of Australian internet users will use a tablet this year.In 2014, a Deloitte media survey found smartphone ownership has increased significantly among Australians over the past three years, with 89 per cent now owning a smartphone.

Meanwhile, the same survey found 53 per cent of respondents owned a smartphone, personal computer and tablet.

Of those that did not own a smartphone, 32 per cent plan to purchase one in the next 12 months.

Of those that did not own a tablet, 33 per cent plan to purchase one in the next 12 months and 11 per cent in the next 6 months.

With no end in sight to the digital migration, brokers need to ask themselves where they fit in. What part do you play in all this?

There is a fresh generation of borrowers on the horizon, tablet in one hand, smartphone in the other.

They will soon be demanding a home loan – ASAP. Everything else happens at the click of a button or swipe of the finger, so why not this?

These borrowers have no memory of life before the internet and have been raised on a steady diet of instant access and reward. They have little patience for slow connections. But they need a home loan – now.

Will they visit a broker? Will they go to the bank? Or will some enterprising tech giant meet their demands with a quick and easy, online solution?

Natives, migrants and Luddites

There are three key themes or strands to the issue of online lending.

The first is search, which essentially involves people going online to do comparative searches between different products and then applying direct through one of the lenders.

Then there is the next stage, which is trying to do the whole thing online, applying online and transacting all the way through.

And third, there is peer-to-peer lending: a whole new and quite different kind of animal – and probably the most disruptive one.

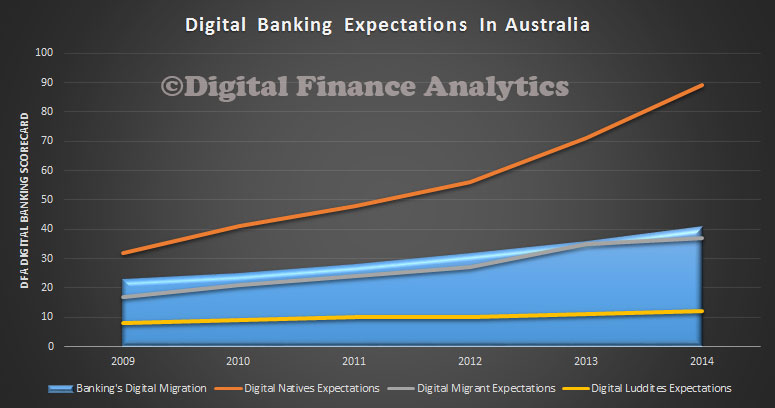

Martin North, principal of Digital Finance Analytics (DFA), surveys 26,000 consumers each year and specifically looks at their channel preferences and how they go about buying products.

“The big thing I am noticing is there is a significant rise in those who, as a first point of interaction online, want to go and find things out for themselves,” Mr North tells The Adviser.

“I split the population between digital natives, digital migrants and digital Luddites,” he explains.

Digital natives tend to be a bit younger. They are naturally online and use social networks. These people are very in tune with going online to search the different options and maybe even checking social media and arriving at a conclusion of what they want to do.

From the population base, they make up around 35 per cent of households in the market for financial services.

Then you’ve got the Luddites, who really don’t do much online and aren’t really interested. They never go near the online environment at all. They are going to the branches and the brokers. They are about 30 per cent of the population.

Those in the middle are the digital migrants – they are migrating towards the online environment but are still relatively cautious about online channels.

The average mortgage broker, aged in their early 50s, sits somewhere between the Luddite and the digital migrant, says Mr North.

“So which segments of the population are more inclined to go online? The natives. Therefore, anyone thinking about online has to be thinking about what they are doing because they are the future,” he says.

The online lending space

There are very few end-to-end propositions within which borrowers can go online and apply for a mortgage all the way through. In terms of transacting, it’s clunky.

NAB has been the most successful so far – with UBank, its answer to no-frills online banking.

Last year, UBank mortgages grew from $2.2 billion to $2.7 billion in the six months to March 31, an increase of 22.8 per cent.

That was 12 months ago.

Then-chief executive Alex Twigg said the growth is evidence of a global shift towards online mortgage distribution.

“We have had a significant uptake in our mortgage volumes direct through UBank and you will see that across the globe,” Mr Twigg says.

“Fifteen years ago, across the UK, there was a significant move towards online mortgages; you’ve seen it happen in the US; and you are now seeing it happening in Australia.”

While yet to launch a complete online mortgage solution, CBA is widely considered to be the leader of the major banks in terms of digital.

The lender spent a billion dollars upgrading its systems, giving customers some smart new apps and online banking capabilities in the process.

“If I have a look at how our customers interact with us, you go back five years and a lot more transactions occurred in a branch or maybe online,” says CBA’s group executive of institutional banking and markets, Kelly Bayer Rosmarin. “Now, upwards of 65 per cent of our transactions occur on a mobile phone or iPad in a mobile way.”

However, CBA’s head of mortgages, Clive Van Horen, says digital disruptors represent a real threat, particularly overseas where they have made significant progress in the home loan space.

“In the US you have Quicken Loans,” Mr Van Horen says.

“Fifteen years ago they were an accounting software company and today they are the second biggest writer of mortgages in the United States, behind Wells Fargo.

“They have a digital contact centre – they don’t have branches. I’m not saying they are going to be in Australia in the next few months, but digital disruptors can very quickly enter the market.

“I think the challenge they would have is overcoming the multiple touch-points of the banks,” Mr Van Horen says.

Multiple touch-points marry the digital experience with the face-to-face experience, Mr Van Horen adds, as CBA looks to adapt its offering for customer convenience.

“A customer might want to talk to somebody in person, or pick up the phone, or go online and they don’t want to have to re-enter information and go through everything from scratch, so that is something we have been integrating across all channels,” he says.

“A customer can start a mortgage application online and finish in a branch or a mobile lender can visit them. It is much more integrated.”

This omni-channel experience is one that the big banks have touted for a while, says DFA’s Martin North.

However, most of the majors are completely conflicted because they have the branch and the third-party channel competing with each other and Mr North feels that, as a result, the online element is not getting a fair look-in.

“Most of the people I talk to in the large institutions are talking about an omni-channel experience,” he says. “I think that’s crap. From the research I have done and looking at a forward perspective, we are past omni-channel.

“It is now time to think really hard about the strategic relevance of digital and online and build your strategy around that and move away from branch and broker channels.”

What borrowers want

The majors are still struggling with the digital element, regardless of how much they are investing in new technology.

“The banks will tell you that they believe most customers want to have a face-to-face conversation. Well I’m not sure that’s true anymore,” says Mr North.

He points to the use of digital devices in Australia and argues that the conundrum is that most of the incumbents are still denying a digital revolution is taking place.

When Mr North surveys consumers about their channel preferences, he asks them two questions: what do they currently do, and what would they like to do.

People are frustrated and constrained about what they can do, he says.

“The digital natives tell me they don’t need face-to-face. They say, ‘If I can interact in some other way, that’s fine by me, but in Australia I can’t do that because nobody allows me to’.

“So there is an expectation gap between what most players are offering and what those digital natives particularly want,” he says.

The economic argument, however, is even stronger, Mr North continues.“Profitability is higher among digital natives and digital migrants than digital Luddites,” he says. “So if they are not careful, the major banks are going to effectively continue to try and service customers who become less and less profitable over time.

“It doesn’t make any economic sense to me.”

Another worrying issue for brokers and banks is that new entrants could beat them to the punch.

The Deloitte Australian Mortgage Report 2014 surveyed a panel of major lenders, non-banks and large broker groups and found that new online channels will be the greatest non-major mortgage competitors of the future.

Mortgage Choice’s outgoing chief executive Michael Russell said the strong digital brands are a concern.

“Google, Yahoo, Coles, Woolworths and Apple are the ones that alarm me in terms of their capability to quickly morph into a financial services business,” he says.

ING Direct’s executive director of distribution, Lisa Claes, says the digital giants such as Apple, Google and PayPal could be successful in the mortgage space.

“There is a credible school of thought that they will continue to penetrate financial services,” Ms Claes says. “The digital giants could be successful.”

The threat of new entrants is also on the regulator’s radar and has been a significant theme of the Financial System Inquiry.

Speaking at the ASIC Annual Forum in Sydney last year, ASIC deputy chair Peter Kell said digital players and consumer brands are in the regulator’s sights.

“Do we anticipate that there will be a potential range of new players that we will have to deal with within a fairly short space of time?” Mr Kell said.

“I would say definitely yes, and some of them are already there.

“You can see some of those big supermarkets, for example, wanting to sell insurance and potentially moving into other financial products, and we will be ensuring we have a level playing field and making sure they treat customers fairly.”

Where brokers fit in

There are really only two online lenders that compete with the third-party and direct channels: NAB’s UBank and Firstmac’s Loans.com.au.

According to Sydney-based broker Alex Lambros, the UBank product is not as competitive as the Loans.com.au offering, which is a threat to his business.

“It is a basic type of offering and fits some borrowers,” Mr Lambros says.

“We come up against that every now and again.”

But while the UBank offering does not concern him, the fact that NAB has an online offering is interesting, he says.

“They are in the broker market, they support it – or they say they support it – yet they still provide a cheaper alternative, even though it is a pretty black and white product,” Mr Lambros says.

In fact, the basic, no-frills nature of the current online product range works in a broker’s favour – the rigidity of an online vanilla home loan will essentially limit to whom it appeals.

Kim Cannon, who launched Loans.com.au three years ago, says borrowers drawn to the online lender are not the young, digitally-native first home buyers you might expect.

“There are certain people who need their hand held through the loan process and people who don’t,” Mr Cannon says. “We rarely see a first home buyer or young person come through Loans.com.au.

“They either go to a branch or a broker because they need that advice.”

More than anything, the online customer is rate-focused and demands a quick and easy process, according to Mr Cannon.

Loans.com.au is undergoing constant improvements to enhance the experience and make it simpler for borrowers to obtain a loan as quickly as possible.

“Every week we are working through a new process, a better way of doing things. You are always looking at gaining that edge – how do we make it faster without denying quality?” Mr Cannon says.

“We are looking at the [valuation firm] ValEx process at the moment and how we can improve that. A valuation may only take a day and a half to go through ValEx, but there are still delays.”

With all these improvements going on, is it not reasonable to expect the online space to develop into a legitimate channel in the not too distant future?

Nevertheless, Mr Cannon believes brokers will always have the upper hand in the mortgage market. Besides, he says, the digital enhancements to his online option flow through to the rest of his third-party business.

“The brokers get the benefit of all of that,” he says. “We have been looking at our credit process and what we were doing and overdoing. Just doing a review like that meant we were able to speed up our decision-making processes and cut a lot of the unnecessary stuff out. Now that has been passed on to the broker channel and brokers are seeing the benefit.

“People may see Firstmac and Loans.com.au as channel conflict but I see it as channel improvement to some degree.”

The opportunity for brokers

So, while online lending may well represent a threat to brokers, it can also be an opportunity.

Borrowers who need mortgage advice, first home buyers and those with more complex borrowing needs will become the target market for the broker of the future.

It is here that diversification comes into play, as brokers with multiple offerings and a diverse skillset develop unique service propositions that compare favourably with online alternatives.

Tailored solutions will always require a specialist.

Online lenders will be looking to ramp up their offerings, enhancing their capabilities and gaining market share as a result.

To combat this, brokers must use diversified offerings as a first line of defence, says Moshe Moses, director of Astute Financial Sydney City Central.

“The home loan broker has to be aware that there are two facets to their business. It is not just about writing a loan – a computer can do that for you now – it is about providing the service and being able to offer more than a mortgage,” Mr Moses says.

“A lot of our customers have come and discussed UBank. But we say to them that they don’t have a face behind it, they don’t have a touch-point.

“CBA came out with HomePath, which fell flat on its face when it was introduced,” he says.

The Commonwealth Bank closed its low-cost online mortgage business in 2008. All HomePath customers were subsequently transferred over to CBA branded loans.

HomePath represented just 0.5 per cent of all CBA loans and posted a $7.8 million profit for the year ended 30 June 2008.

The issue with these online providers is that there is no human interaction, Mr Moses says, and that is why brokers need to have a diversified offering.

“That then provides the interaction that UBank or any of these other lenders cannot provide,” he says.

There is much more that brokers can do to combat the online threat – as long as they are willing to ensure they have a good platform that provides the service and structure for what a client needs, not just the simple transaction they ask for.