The latest edition of our finance and property news digest with a distinctively Australian flavour.

Tag: Dodd-Frank

The Feds’s 2019 Stress Test Parameters

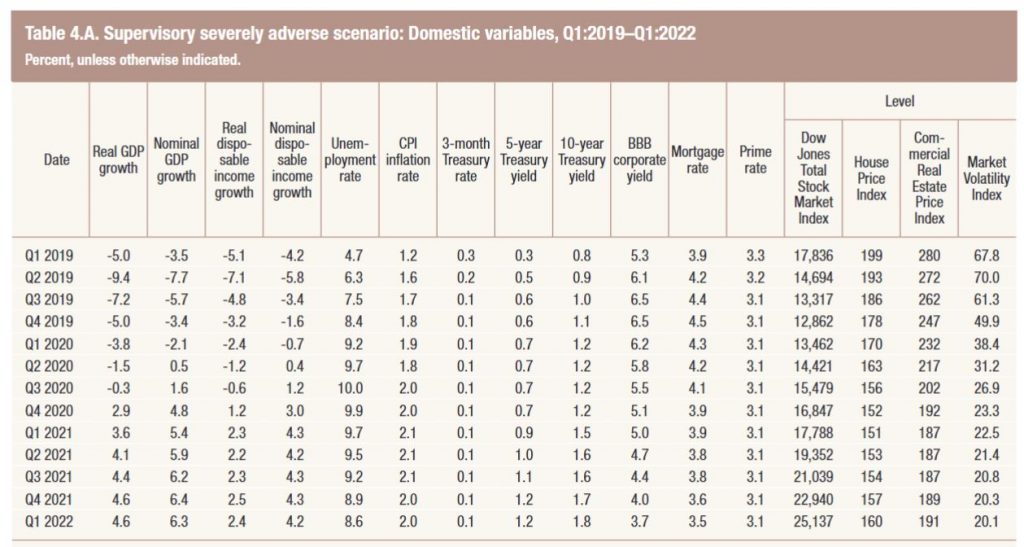

The Federal Reserve Board has released the scenarios banks and supervisors will use for the 2019 Comprehensive Capital Analysis and Review (CCAR) and Dodd-Frank Act stress test exercises. The extreme scenario assumes a short sharp fall, in 2020.

Whilst its a theoretical exercise, kudos to the FED for making public the inputs, and of course they will publish results, to an individual firm level later (unlike or opaque APRA tests, where disclosure remains appalling).

Stress tests, by ensuring that banks have adequate capital to absorb losses, help make sure that they will be able to lend to households and businesses even in a severe recession. CCAR evaluates the capital planning processes and capital adequacy of the largest U.S. bank holding companies, and large U.S. operations of foreign firms, using their planned capital distributions, such as dividend payments and share buybacks and issuances. The Dodd-Frank Act stress tests also help ensure that banks can continue to lend during times of stress, but use standard capital distribution assumptions for all firms. Both assessments only apply to domestic bank holding companies and foreign bank intermediate holding companies with more than $100 billion in total consolidated assets.

The stress tests run by the firms and the Board apply three hypothetical scenarios: baseline, adverse, and severely adverse. For the 2019 cycle, the severely adverse scenario features a severe global recession in which the U.S. unemployment rate rises by more than 6 percentage points to 10 percent. In keeping with the Board’s public framework for scenario design, a stronger economy with a lower starting point for the unemployment rate results in a tougher scenario. The severely adverse scenario also includes elevated stress in corporate loan and commercial real estate markets.

“The hypothetical scenario features the largest unemployment rate change to date,” Vice Chairman for Supervision Randal K. Quarles said. “We are confident this scenario will effectively test the resiliency of the nation’s largest banks.”

The adverse scenario features a moderate recession in the United States, as well as weakening economic activity across all countries included in the scenario.

The adverse and severely adverse scenarios describe hypothetical sets of events designed to assess the strength of banking organizations and their resilience. They are not forecasts. The baseline scenario is in line with average projections from surveys of economic forecasters. It does not represent the forecast of the Federal Reserve.

Each scenario includes 28 variables–such as gross domestic product, the unemployment rate, stock market prices, and interest rates–covering domestic and international economic activity. Along with the variables, the Board is publishing a narrative description of the scenarios that also highlights changes from last year.

Firms with large trading operations will be required to factor in a global market shock component as part of their scenarios. Additionally, firms with substantial trading or processing operations will be required to incorporate a counterparty default scenario component.

Banks are required to submit their capital plans and the results of their own stress tests to the Federal Reserve by April 5, 2019. The Federal Reserve will announce the results of its supervisory stress tests by June 30, 2019. The instructions for this year’s CCAR will be released at a later date.

Also on Tuesday, the Board announced that it will be providing relief to less-complex firms from stress testing requirements and CCAR by effectively moving the firms to an extended stress test cycle for this year. The relief applies to firms generally with total consolidated assets between $100 billion and $250 billion.

As a result, these less-complex firms will not be subject to a supervisory stress test during the 2019 cycle and their capital distributions for this year will be largely based on the results from the 2018 supervisory stress test. At a later date, the Board will propose for notice and comment a final capital distribution method for firms on an extended stress test cycle in future years.

Dodd-Frank Easing May Be Long-Term Negative for US Banks

Congressional passage of financial reform legislation easing the Dodd-Frank Act (DFA) for smaller and custodial banks is not likely to be a near-term ratings issue but could be negative for some banks’ credit profiles over the long term, if it results in significantly reduced capital levels, Fitch Ratings says.

The congressional legislation, which is widely expected to be signed into law by the president as early as this week, eases the capital and regulatory requirements for smaller institutions and custody banks. Fitch views robust regulation and capital as supportive of bank creditworthiness.

Key attributes of the legislation raise the systemic threshold to $250 billion from $50 billion for enhanced prudential standards (EPS), reduce stress testing requirements and modify applicability of proprietary trading rules (the Volcker Rule). The legislation reduces regulations for U.S. small to mid-size banks in particular, while only providing de-minimis regulatory relief to the largest U.S. banks. The change to the systemic threshold reduces the number of banks subject to heightened regulatory oversight to 12 from 38. Regulators will still have discretion to apply EPS to banks with $100 billion-$250 billion in assets. Banks above $250 billion in assets would not see much benefit from the legislation.

The biggest potential change to regulatory and capital requirements is for banks under $100 billion in assets, exempting them from DFA stress test requirements. From Fitch’s perspective, stress testing has provided discipline for banks and is an important risk governance practice that is considered in its rating analysis. The elimination or meaningful reduction of stress testing would likely have negative ratings implications.

Technically, the Fed’s CCAR process is not considered EPS and therefore the lower $50 billion proposed threshold isn’t applicable to CCAR, which applies to banks over $50 billion in assets. However, exempting banks with under $100 billion in assets from stress testing requirements makes it likely the Fed would align its CCAR testing requirements with Congress’ new thresholds. Banks with over $250 billion in assets would still be required to run CCAR; however, banks between $100 billion and $250 billion in assets would be subject to periodic rather than annual stress testing requirements.

Trust and custody banks would benefit from the potential carve out of central bank deposits to their supplementary leverage ratios, allowing for increased leverage. However, the joint banking regulators’ notice of proposed rulemaking (NPR) on the enhanced supplementary leverage ratio (eSLR) noted the proposed recalibration of the eSLR was contingent on the capital rules’ current definitions of tier 1 capital and total leverage exposure, which is being significantly altered by this legislation. The NPR specifically stated: “Significant changes to either of these components would likely necessitate reconsideration of the proposed recalibration as the proposal is not intended to materially change the aggregate amount of capital in the banking system.” The regulators’ response to this definition change only for the custody banks remains unclear. Ultimately, how much custody banks increase their leverage will also dictate ratings implications.

Banks with less than $10 billion in assets would be exempt from Volcker Rule restrictions on speculative trading, and banks originating less than 500 mortgages annually would be exempt from some of the record-keeping requirements of the Home Mortgage Disclosure Act. The Volcker Rule exemption would not aid large banks that must still demonstrate compliance with the rule. The legislation would also require U.S. regulators to consider certain investment-grade municipal securities as high-quality liquid assets for liquidity coverage calculations.

Higher asset threshold for US SIFI designation will ease some banks’ regulatory oversight, a credit negative

Last Wednesday, the US Senate passed the Economic Growth, Regulatory Relief, and Consumer Protection Act. A key component of this bill increases the asset threshold for a bank to be designated a systemically important financial institution (SIFI) to $250 billion of total consolidated assets from $50 billion, the threshold defined in the Dodd-Frank Act of 2010.

For US banks with assets of less than $250 billion, the higher asset threshold for SIFI designation is likely to lead to a relaxation of risk governance and encourage more aggressive capital management, a credit-negative outcome.

SIFI banks are subject to the enhanced prudential standards of the US Federal Reserve (Fed). The regulatory oversight of SIFIs is greater than for other banks, and SIFIs participate in the Fed’s annual Dodd-Frank Act stress test (DFAST) and the Comprehensive Capital Analysis and Review (CCAR), which evaluate banks’ capital adequacy under stress scenarios. Furthermore, transparency will decline with fewer participants in the public comparative assessment the stress tests provide.

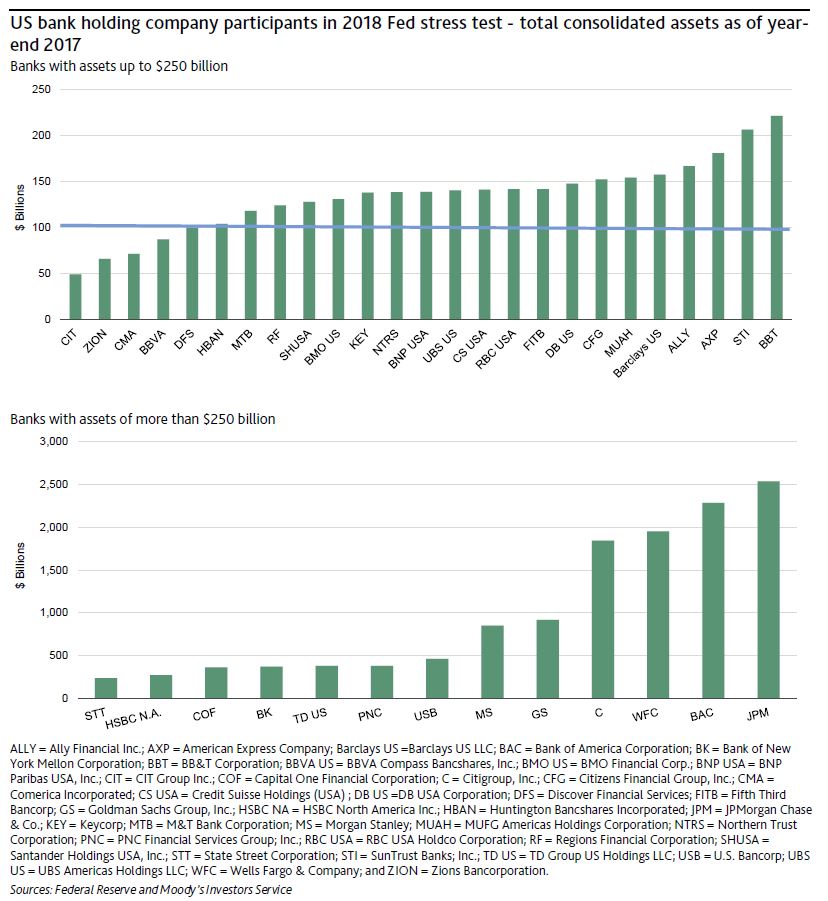

In 2018, the 38 bank holding companies shown in the exhibit below are subject to the Fed’s annual capital stress test. Passage of the bill into law would immediately exempt four banks with less than $100 billion of assets from the Fed’s enhanced prudential standards, which includes the stress test and living will requirements. These banks will have the most leeway in relaxing risk governance practices and managing their capital.

The 21 banks at the right of the top exhibit that have assets of $100-$250 billion1 could become exempt from enhanced prudential standards 18 months after passage of the bill into law. However, the Fed will have the authority to apply enhanced oversight to any bank holding company of this asset size and will still conduct periodic stress tests. In the 18 months after passage into law, it will be up to the Fed to develop a more tailored enhanced oversight regime for the $100-$250 billion asset group. The Fed also could continue to apply the same enhanced prudential standards. Therefore, it is difficult to assess the potential for their easier risk governance practices until more about the regulatory oversight is known.

If many of these banks are no longer required to participate in the public stress tests, it would reduce transparency. The quantitative results of DFAST and CCAR provide a relative rank ordering of stress capital resilience under a common set of assumptions. The loss of such transparency is credit negative.

For the largest banks, those with more than $250 billion in assets that remain SIFIs, there are no changes in the Fed’s supervision. The bill also specifies that foreign banking organizations with consolidated assets of $100 billion or more are still subject to enhanced prudential standards and intermediate holding company requirements.

In order to become law, the bill must also be passed by the US House of Representatives and signed by the president. This year’s annual Fed stress test will proceed as usual with submissions by the banks due 5 April, with results announced in June.

US Financial Stability In The Spotlight

The US Financial Stability Oversight Council has published their 2017 Annual Report. Their mandate under the Dodd-Frank Act is to identify risks to the financial stability of the US, promote market discipline and respond to emerging threats. At more than 150 pages, its is a long read, but well worth the effort. Also compare and contrast with the high household debt levels here!

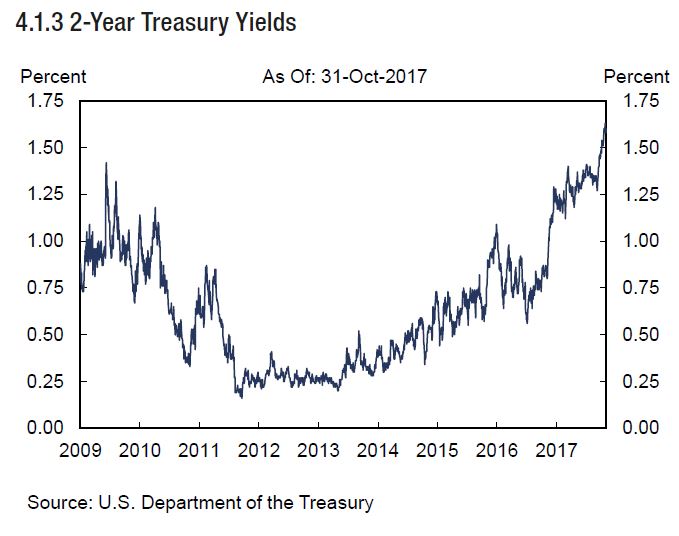

A couple of things caught my attention. First, the rise in the 2-Year Treasury Bonds, as rate are normalized. Rates are in their way up.

Yields on 2-year Treasury notes fell in the first half of 2016, reaching a low of 0.56 percent in July before reversing course (Chart 4.1.3). The 2-year Treasury yield has since risen 104 basis points to 1.60 percent, as of October 2017. The Federal Open Market Committee (FOMC) raised its target range for the federal funds rate 25 basis points four times since December 2016. Also, in October 2017, the Federal Reserve began normalizing its balance sheet.

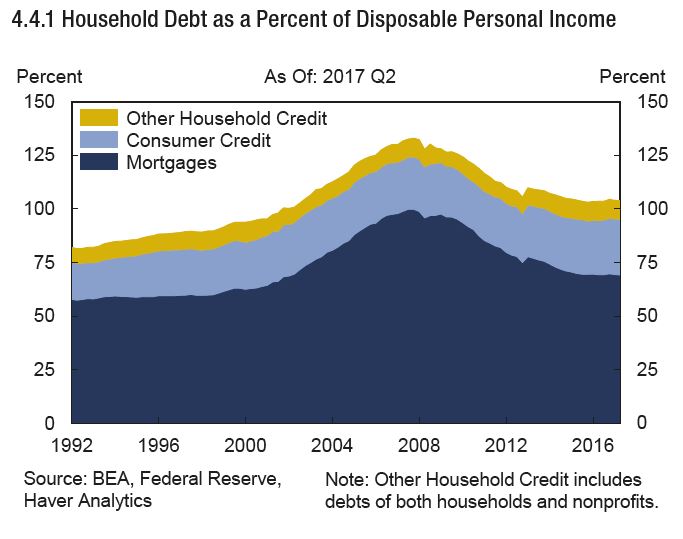

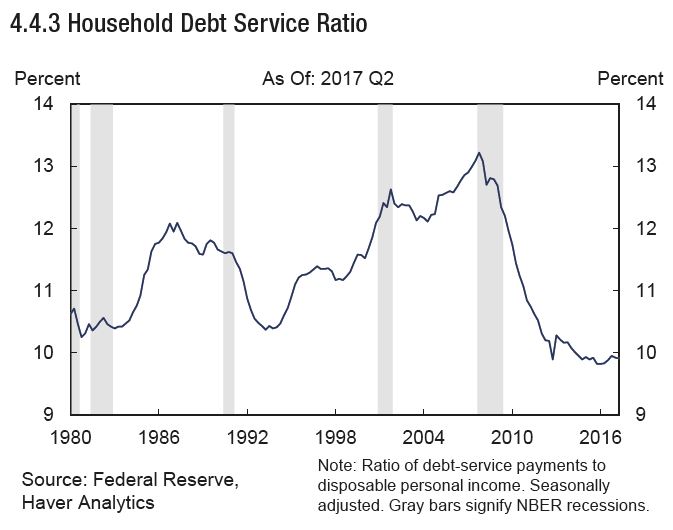

Next, household debt to disposable income is around 100%, significantly lower than Australian households, and on a very different trajectory.

There has been significant growth in auto loans and student loans, compared with mortgage debt. But the household debt service ratio is lower than here, a low interest rates helped keep the debt service ratio—the ratio of debt service payments to disposable personal income—unchanged in 2016 and the first half of 2017, near a 30-year low (Chart 4.4.3). Although the ratio of debtservice payments to disposable personal income for consumer credit has edged steadily upward since 2012, this trend has been fully offset by a decrease in the service ratio of mortgage debt.

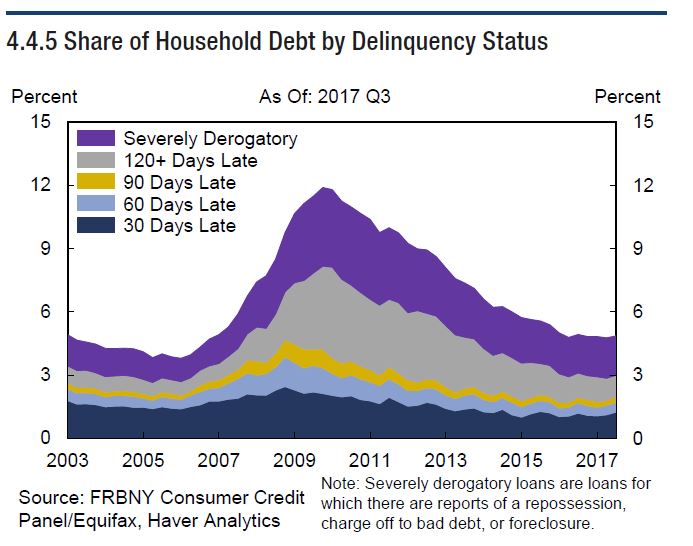

Finally loan delinquency is lower now than back in 2009.

Finally loan delinquency is lower now than back in 2009.

Continued decreases in delinquency rates on home equity lines of credit (HELOCs) and mortgage debt pushed household debt delinquencies to less than 5 percent, the lowest year-end level since 2006 (Chart 4.4.5). Decreased overall delinquency among subprime borrowers, continued write-downs of mortgage debt accumulated during the pre-crisis housing bubble, and a shift from subprime to prime mortgage balances drove the decline. The delinquency rate on student loans remained unchanged at 11 percent over the past few years after nearly doubling between 2003 and 2013. Despite elevated delinquency rates on student loans, default risk is generally limited for private lenders, since the federal government owns or guarantees most student loan debt outstanding. Signs of stress have emerged in auto lending in recent years, driven by increased subprime borrower delinquency. In the second quarter of 2017, auto loan balances that were delinquent for at least 90 days reached 3.9 percent of total auto loan balances, up from 3.3 percent three years prior. In recent quarters, credit card delinquency rates have increased slightly, and the percent of credit card loans that were delinquent for at least 90 days increased to 4.4 percent, compared to 3.7 percent three years prior. Despite this trend, the balance of credit card debt that was delinquent for at least 90 days has remained relatively stable at 7.4 percent in the second quarter of 2017, compared to 7.8 percent three years prior.

They discussed some highly relevant issues:

Managing Vulnerabilities in an Environment of Low, but Rising, Interest Rates – In previous annual reports, the Council identified vulnerabilities that arise from a prolonged period of low interest rates. In particular, as investors search for higher yields, some may add assets with higher credit or market risks to their portfolios. They may also use more leverage or rely on shorter-term funding. These actions tend to raise the overall level of financial risk in the economy and may put upward pressure on prices in certain markets. If prices in those markets were to fall sharply, owners could face unexpectedly large declines in their overall portfolio value, potentially creating conditions of financial instability. Although both short-term and long-term interest rates have risen since the last annual report, the consequences of past risk-taking may persist for some time. While the rise in short-term rates has benefitted net interest margins (NIMs) and net interest income at depository institutions and broker-dealers, a flatter yield curve and expectations for higher funding costs going forward may increasingly lower the earnings benefits from higher interest rates. In addition, the transition to higher rates may expose vulnerabilities among some market participants through a reduction in the value of their assets or an uncertain rise in costs of funding for depository institutions. These vulnerabilities can be mitigated by supervisors, regulators, and financial

institutions closely monitoring increased risk-taking incentives and risks that might arise from rising rates.

Housing Finance Reform – The government-sponsored enterprises (GSEs) are now into their tenth year of conservatorship. While regulators and supervisors have taken great strides to work within the constraints of conservatorship to promote greater investment of private capital and improve operational efficiency with lower costs, federal and state regulators are approaching the limits of their ability to enact wholesale reforms that are likely to foster a vibrant, resilient housing finance system. Housing finance reform legislation is needed to create a more sustainable system that enhances financial stability.

They called out a number of areas for focus where technology intersects finance:

Cybersecurity – As the financial system relies more heavily on technology, the risk that significant cybersecurity incidents targeting this technology can prevent the financial sector from delivering services and impact U.S. financial stability increases. Through collaboration and partnership, substantial gains have been made by both government and industry in response to cybersecurity risks, in part by refining their shared understanding of potential vulnerabilities within the financial sector. It is important that this work continue and include greater emphasis on understanding and mitigating the risk that significant cybersecurity incidents have business and systemic implications.

Financial Innovation – New financial market participants and new financial products can offer substantial benefits to consumers and businesses by meeting emerging needs or reducing costs. But these new participants and products may also create unanticipated risks and vulnerabilities. Financial regulators should continue to monitor and analyze the effects of new financial products and services on consumers, regulated entities, and financial markets, and evaluate their potential effects on financial stability.

And finally, a range of other material structural issues:

Central Counterparties – Central counterparties (CCPs) have the potential to provide considerable benefits to financial stability by enhancing market functioning, reducing counterparty risk, and increasing transparency. These benefits require that CCPs be highly robust and resilient. Regulators should continue to coordinate in the supervision of all CCPs that are designated as systemically important financial market utilities (FMUs). Member agencies should continue to evaluate whether existing rules and standards for CCPs and their clearing members are sufficiently robust to mitigate potential threats to financial stability. Agencies should also continue working with international standard-setting bodies to identify and address areas of common concern as additional derivatives clearing requirements are implemented in other jurisdictions. Evaluation of the performance of CCPs under stress scenarios can be a very useful tool for assessing the robustness and resilience of such institutions and identifying potential operational areas for improvement. Supervisory agencies should continue to conduct these exercises. Regulators should also continue to monitor and assess interconnections among CCPs, their clearing members, and other financial institutions; consider additional improvements in

public disclosure; and develop resolution plans for systemically important CCPs.

Short-Term Wholesale Funding – While some progress has been made in the reduction of counterparty risk exposures in repurchase agreement (repo) markets in recent years, the potential for fire sales of collateral by creditors of a defaulted broker-dealer remains a vulnerability. The SEC should monitor and assess the effectiveness of the MMF rules implemented last year. Regulators should also monitor the potential migration of activity to other cash management vehicles and the impact of money market developments on other financial markets and institutions.

Reliance on Reference Rates – Over the past few years, regulators, benchmark administrators, and market participants have worked toward improving the resilience of the London Interbank Offered Rate (LIBOR) by subjecting the rate and its administrator to more direct oversight, eliminating little-used currency and tenor pairings, and embargoing the submissions of individual banks to the panel for a three-month period. However, decreases in the volume of unsecured wholesale lending has made it more difficult to firmly ground LIBOR submissions in a sufficient number of observable transactions, creating the risk that publishing the benchmark may not be sustainable. Regulators and market participants have been collaborating to develop alternatives to LIBOR. They are encouraged to complete such work and to take appropriate steps to mitigate disruptions associated with the transition to a new reference rate.

Data Quality, Collection, and Sharing – The financial crisis revealed gaps in the data needed for effective oversight of the financial system and internal firm risk management and reporting capabilities. Although progress has been made in filling these gaps, much work remains. In addition, some market participants continue to use legacy processes that rely on data that are not aligned to definitions from relevant consensus-based standards and do not allow for adequate conformance and validation to structures needed for data sharing. Regulators and market participants should continue to work together to improve the coverage, quality, and accessibility of financial data, as well as data sharing between and among relevant agencies.

Changes in Financial Market Structure and Implications for Financial Stability – Changes in market structure, such as the increased use of automated trading systems, the ability to quote and execute transactions at higher speeds, the increased diversity in the types of liquidity providers in such markets, and the expansion in trading venues all have the potential to increase the efficiency and improve the functioning of financial markets. But such changes and complexities also have the potential to create unanticipated risks that may disrupt financial stability. It is therefore important that market participants and regulators continue to try to identify gaps in our understanding of market structure and fill those gaps through the collection of data and subsequent analysis. In addition, evaluation of the appropriate use or expansion of coordinated tools such as trading halts across interdependent markets, particularly in periods of market stress, will further the goal of enhancing financial stability, as will collaborative work by member agencies to analyze developments in market liquidity.

US Banks Pass Federal Reserve’s Stress Test

Last Thursday, the US Federal Reserve published the results of the 2017 Dodd-Frank Act stress test (DFAST) for 34 of the largest US bank holding companies (BHCs), all of which exceeded the 4.5% minimum required common equity Tier 1 (CET1) capital ratio under the Fed’s severely adverse stress scenario, a credit positive.

This is the third consecutive year that all tested BHCs exceeded the Fed’s minimum requirement, and the median margin above the minimum also increased. However, for the first time, this year’s test incorporated the supplementary leverage ratio (SLR) for advanced-approach banks, which was more constraining for some of the banks.

DFAST considers how well banks withstand a severely adverse economic scenario, which is characterized as a severe global recession. The 2017 test scenario used modestly more favorable interest rates than in 2016 with a greater increase in rates and no negative short-term rates. The test incorporated a 6.5% peak-to-trough decline in US real gross domestic product, an increase in the unemployment rate to 10%, a 50% decline in equity prices through year-end 2017, and a 25% drop in home prices and a 35% decline in commercial real estate prices by 2019.

All 34 BHCs were subjected to this scenario, including new participant CIT Group Inc. In addition, the stress tests for eight of the 34 BHCs with substantial trading or processing operations were required to incorporate the sudden default of their largest loss-generating counterparty. The eight BHCs subject to the counterparty default component were Bank of America Corporation, The Bank of New York Mellon Corporation, Citigroup Inc., The Goldman Sachs Group, JPMorgan Chase & Co. Morgan Stanley, State Street Corporation, and Wells Fargo & Company. Finally, six of these eight BHCs with significant trading operations were also required to include a global market shock (Bank of New York Mellon Corporation and State Street Corporation were excluded from this global market shock scenario.)

On 28 June, the Fed will release the results of the Comprehensive Capital Analysis and Review (CCAR), which evaluates the BHCs’ capital plans, including dividends and stock repurchases, incorporating their DFAST results. The capital-planning processes of the large complex banks will also be publicly evaluated. Prior to the CCAR release, BHCs can reduce their planned capital distributions, commonly known as taking a “mulligan.” Our analysis of pre-provision net revenue declines and loan losses under the severely adverse scenario highlights still significant tail risks for DFAST participants. Nonetheless, we expect banks’ capital distribution requests to be more aggressive than in prior years, which will limit or negate improvement in their capital ratios.

ALL BANKS EXCEED MINIMUM REQUIRED CAPITAL IN THE SEVERELY ADVERSE SCENARIO

Exhibit 1 compares the minimum CET1 ratios of 34 participating BHCs under the Fed’s severely adverse scenario with their actual CET1 ratios reported at year-end 2016. The exhibit segments the BHCs into two groups: the 26 BHCs subject only to the severely adverse economic scenario (on the right), and the eight BHCs also subject to the additional global market shock and counterparty default components noted above (on the left). The minimum CET1 ratios of the eight large BHCs are all comfortably above the Fed’s 4.5% requirement despite being subjected to the additional stress components. The other 26 BHCs are also above the 4.5% requirement, although for many the margin is smaller than for the largest BHCs. The lowest minimum ratios were for Ally Financial Inc. at 6.6%, up from 6.1% in the 2016 test; and KeyCorp at 6.8%, up from 6.4% in 2016.

Even though all of the BHCs passed the 4.5% minimum threshold, many would still take sizeable capital hits under the Fed’s severely adverse scenario (Exhibit 2). The estimated declines in the BHCs’ CET1 ratios range from a high of 840 basis points (bp) for Morgan Stanley to a low of 210 bp for Santander Holdings USA, Inc.. Positively, the median of the 34 banks was narrower at 280 bp compared with 350 bp last year, indicating greater overall resilience to an economic shock. In its report, the Fed partly attributed this to lower losses from changes in the banks’ portfolio composition and risk characteristics.

SUPPLEMENTARY LEVERAGE RATIO IS A GREATER CONSTRAINT FOR SOME BANKS

SUPPLEMENTARY LEVERAGE RATIO IS A GREATER CONSTRAINT FOR SOME BANKS

The BHCs’ generally good results for stressed CET1 ratios in DFAST suggests that increased capital distributions are likely for the vast majority of institutions. However, CET1 is not the most constraining ratio for all banks. In particular, this year’s test for the first time incorporated the supplementary leverage ratio (SLR) for the advanced approach banks (Exhibit 3). Because the denominator of the SLR comprises average assets and off-balance sheet exposures, it tends to be much larger than the risk-weighted asset denominator of CET1, with the result that the banks’ margin above the 3% minimum SLR is smaller. Morgan Stanley had the lowest minimum SLR of 3.8%, which is likely to constrain its efforts to return more capital to shareholders. State Street and Goldman Sachs also had comparatively low minimum SLRs.

Financial CHOICE Act Passage Would Be Credit Negative for US Banks

Last Wednesday, the US House of Representatives’ Financial Services Committee held a hearing on the Financial CHOICE Act of 2017, which was introduced on 19 April and aims to provide banks relief from various provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in 2010.

The proposed legislation envisions a broad reduction in regulatory and supervisory requirements that would be negative for banks’ creditworthiness, increasing the potential asset risk in the banking system and the likelihood of a disorderly unwinding of a failed systemically important bank.

Increased likelihood of a disorderly bank resolution.

Among the CHOICE Act’s most notable provisions is the repeal of Title II of Dodd-Frank, including the orderly liquidation authority (OLA) to resolve highly interconnected, systemically important banks. Although the bill calls for a new section of the bankruptcy code to accommodate the failure of large, complex financial institutions, we believe that dismantling the OLA increases the likelihood of a disorderly wind-down of a failed systemically important bank with greater losses to creditors. Additionally, although the aim of repealing Title II is to end “too big to fail,” without the enactment of a credible replacement bank resolution framework, the actual effect could be the opposite.

A credible operational resolution regime (ORR) to replace OLA would require provisions specifically intended to facilitate the orderly resolution of failed banks and would provide clarity around the effect of a bank failure on its depositors and other creditors, its branches and affiliates.

The intent of OLA is to resolve failed banks as going concerns, preserving bank franchise value so as to limit losses to bank creditors and counterparties. If, under the new legislation, failed banks are liquidated instead of being resolved as going concerns, loss rates suffered by creditors would increase.

A disorderly resolution would also have greater repercussions for the broader financial markets and the economy. This suggests that although the intent of eliminating OLA may be to reduce the likelihood of future bank bailouts, absent an ORR we believe that the likelihood of a US government bailout of a systemically important US bank could actually increase.

A return to greater risk-taking, only partly offset by improved profitability prospects. The CHOICE Act would also ease restrictions on risk-taking by eliminating the Volcker Rule and rolling back the supervisory function of the US Consumer Financial Protection Bureau (CFPB), limiting it instead to the enforcement of specific consumer protection laws. Eliminating the Volcker Rule restrictions on proprietary trading could reverse the decline in banks’ trading inventories and private equity and hedge fund investments since the financial crisis. That decline in trading inventories has contributed to a decline in risk measures such as value at risk. How far inventories rebound and proprietary trading pick up will take time to become evident, but increased risk seems likely. Changes to the CFPB could also add risk by lifting the regulatory scrutiny that has caused banks to scale back or eliminate some riskier consumer lending products (such as payday advances).

The CHOICE Act also imposes a variety of restrictions and requirements on US banking regulators that could erode the robustness of US banking regulation. More generally, weakened supervision and oversight create the potential for increased asset risk in the banking system. From a credit risk standpoint, the resulting uptick in credit costs and tail risks from increased risk-taking would outweigh the potential boost to bank profitability from reduced compliance expenses and new revenue opportunities.

Less robust capital supervision and stress-testing.

The CHOICE Act calls for a reduction in the frequency of regulatory stress testing, and an exemption from enhanced US Federal Reserve supervision, including stress-testing, for banks with a Basel III supplementary leverage ratio of at least 10%. These measures would undermine the post-crisis Dodd-Frank Act Stress Test (DFAST) and Comprehensive Capital Analysis and Review (CCAR) regimes, which have driven both an increase in capital ratios and a more conservative approach to capital management.

We believe that DFAST and CCAR have been successful tools in reducing the risk of bank failures, not only improving capital and placing beneficial restrictions on shareholder distributions but, more importantly, stimulating vast improvements in banks’ internal risk management and capital planning processes. The DFAST and CCAR results are a useful, independent and public tool to analyze banks’ stress capital resilience over time. The public disclosures from these exercises are an important data point for creditors, the market and our own stress-testing analysis, and provide a strong incentive for bank management teams to closely manage and fully resource their stress-testing and capital-planning processes.

The Impact of the Dodd-Frank Act

One of the outcomes of the 2008 financial crisis was recognizing the cascading effects that the severe financial stress or failure of a large institution can have on financial markets and the economy at large. A primary goal, therefore, of post-crisis financial reform was heightened supervision and regulation of those institutions whose sheer size or risk-taking posed the greatest threat to financial stability.

These reforms were primarily codified in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Under the Dodd-Frank Act, US financial institutions with $50 billion or more in assets are subject to enhanced prudential regulatory standards. These standards are designed to accomplish two primary objectives:

- Improve an institution’s resiliency to both decrease its probability of failure and increase its ability to carry out the core functions of banking

- Reduce the effects of a bank’s failure or material weakness on the financial system and the economy at large

To meet these objectives, the Federal Reserve employs a number of tools to monitor institutions and reduce the risks they pose to the U.S. financial system.

Capital Stress Testing

The Fed annually assesses all bank holding companies with more than $50 billion in assets to ensure they have sufficient capital to weather economic and financial stress. This exercise, called the Comprehensive Capital Analysis and Review (CCAR), also allows the Fed to look at the impact of various financial scenarios across firms.

If the Fed determines that an institution cannot maintain minimum regulatory capital ratios under two sets of adverse economic scenarios, the institution may not make any capital distributions such as dividend payments and stock repurchases without permission.

A complementary exercise to CCAR is Dodd-Frank Act stress testing (DFAST). The DFAST exercise is conducted by the financial firm and reviewed by the Fed. It aids the Fed in assessing whether institutions have sufficient capital to absorb losses and support operations during adverse economic scenarios. This forecasting exercise applies to banks and bank holding companies with more than $10 billion in consolidated assets.

Liquidity Stress Testing

The financial crisis made it clear that a firm’s liquidity, or ability to convert assets to cash, is important during periods of financial stress. In response, the Fed launched the Comprehensive Liquidity Assessment and Review (CLAR) in 2012 for the country’s largest financial firms.

CLAR allows the Fed to assess the adequacy of the liquidity positions of the firms relative to their unique risks and to test the reliability of these firms’ approaches to managing liquidity risk.

Resolution and Recovery Plans

Banking organizations with total consolidated assets of $50 billion or more are also required to submit resolution plans to the Fed and the Federal Deposit Insurance Corp. Each plan must describe the organization’s strategy for rapid and orderly resolution in the event of material financial distress or failure.

Have these tools made a difference? The answer is clearly “yes,” as shown in the figure below.

The capital ratios of the country’s largest firms (those with more than $250 billion in assets) have shown solid positive progress. In fact, one important measure of capital strength for this group of institutions, the average Tier 1 risk-based capital ratio, has increased 48.1 percent since 2007.

Some in the industry and in Washington, D.C., are calling for a re-evaluation of the Dodd-Frank Act provisions. While modifications for smaller, non-systemic firms would be welcomed by many, the damage from the financial crisis makes it sensible to continue strong expectations for the largest firms.

Repealing Dodd-Frank: What’s the Likely Fallout?

In a move that generated widespread concern last week, President Donald Trump signed an executive order that aims to repeal the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. Even Dodd-Frank’s strongest supporters acknowledge that parts of the law could be tweaked to remove excessive financial regulation and made simpler. But they worry that in the process of such reforms, much of what is good in Dodd-Frank will be undone.

The Trump administration’s vehicle to repeal Dodd-Frank is the Financial Choice Act, a failed 2016 bill being reintroduced by Republican Congressman Jeb Hensarling, who is chairman of the House Financial Services Committee. The bill gets its new traction from Trump’s presidential order, signed on February 3, which lists seven so-called “Core Principles” to regulate the U.S. financial system. The order directs the treasury secretary to consult with the heads of the member agencies of the Financial Stability Oversight Council and report within 120 days if existing laws and regulations support those principles.

According to Michael Barr, University of Michigan Law School professor and a key architect of the Dodd-Frank Act, the Choice Act would imperil the interests of the middle class, retirees and investors. “It just seems like a recipe for a huge disaster,” he said. “[Dodd-Frank] put in place real guardrails against re-creating the kind of financial crisis we saw in 2008. It is inexcusable that the administration has targeted the most vulnerable people in our society to be the ones that bear the brunt of their ideological push.”

Wharton professor of legal studies and business ethics Peter Conti-Brown does not expect an easy passage for the Choice Act. He said he is intrigued by the game plan of the administration in its pushback against Dodd-Frank. Describing the Republicans in Congress as “a coalition that includes rightwing Rust Belt populism that is hostile to international trade, for example,” he noted that they “should similarly be profoundly skeptical” of most provisions of the Choice Act. “It would be very hard to sell to those who voted for radical change … and call for an end to protections for average workers, consumers and investors.”

Barr and Conti-Brown discussed the likely legislative path and consequences of unwinding Dodd-Frank on the Knowledge@Wharton show on Wharton Business Radio on SiriusXM channel 111.

Deregulation on Horizon for US Financial Institutions

Deregulation is likely to be a significant theme for US financial institutions (FIs), with the Trump administration and Republican leaders in Congress indicating broad support to limit and simplify the regulatory regime, says Fitch Ratings. Fitch does not believe that the Dodd-Frank Act will be repealed in full; however, select provisions are potentially subject to substantial revision.

Determining the aggregate ratings or credit impact of a major deregulation initiative without specific policy proposals would be premature. It remains unclear which, if any, deregulation policies will be the focus of the administration and ultimately be passed.

However, Fitch believes that the Financial Choice Act (FCA), proposed by House Financial Service Committee Chairman Representative Jeb Hensarling, R-TX, in 2016, may serve as a blueprint for some of the changes ahead. The FCA is broad in scope and includes proposals to change FI activities, modify and potentially reduce financial regulators’ authority, limit regulatory burdens for certain FIs, add greater congressional oversight of regulators and propose reform to market infrastructure.

In determining the potential impact of such regulatory changes, both the direct impact of the change and the responses from individual banks will be key in determining the ultimate issuer credit effect. The extent to which the reforms could lead to a reduction or changes to the quality of capital and/or liquidity, or weaken governance, will be particularly important for ratings over time.

Several parts of the FCA target regulatory relief for strongly capitalized and well-managed banks, such as a proposal to exempt banks from many regulations should they exceed a 10% or higher financial leverage ratio. Smaller banks meeting the requirements would most likely benefit. For large global systemically important banks, Fitch estimates that the $400 billion in incremental Tier I capital necessary to achieve the minimum leverage ratio – the calculation would likely be similar to the Basel III supplementary leverage ratio – would outweigh any potential cost benefits of regulatory relief.

Limiting regulatory authority is another key plank of the FCA. The most significant change for the markets would be the proposed restructuring of the Federal Reserve, including how it sets interest rates, as well as its authority as a central bank. The proposed rule also calls for restructuring the Consumer Financial Protection Bureau (CFPB), adding congressional review of financial agency rulemaking and subjecting agencies’ rulemaking to judicial review, among others.

Overall, Fitch believes that such reviews could hamper agencies’ effectiveness and significantly impede their ability to issue new rules, which could have an overall negative effect on the system. Fitch believes that restructuring the CFPB with a Consumer Financial Opportunity Commission, as stipulated in the FCA, would lower compliance costs and reduce potential fines for consumer finance, but lead to weakening control frameworks.