I caught up with Paul Feeney, the Founder of Otivo a financial advice platform “Financial freedom for all”.

At its heart is an easy-to-use app that takes the mystery out of money.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

I caught up with Paul Feeney, the Founder of Otivo a financial advice platform “Financial freedom for all”.

At its heart is an easy-to-use app that takes the mystery out of money.

Go to the Walk The World Universe at https://walktheworld.com.au/

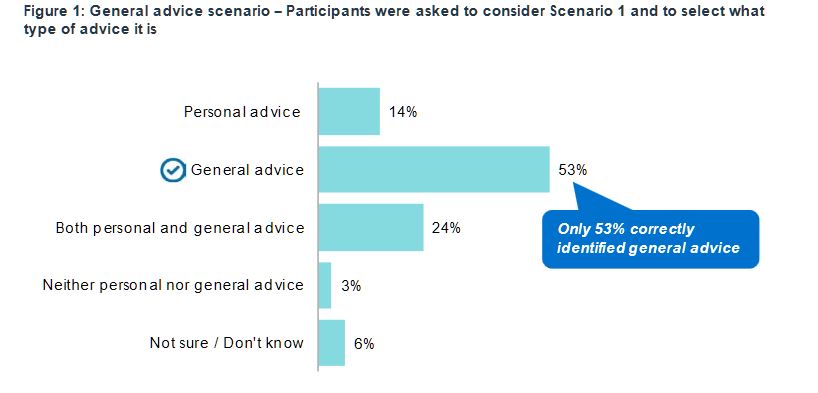

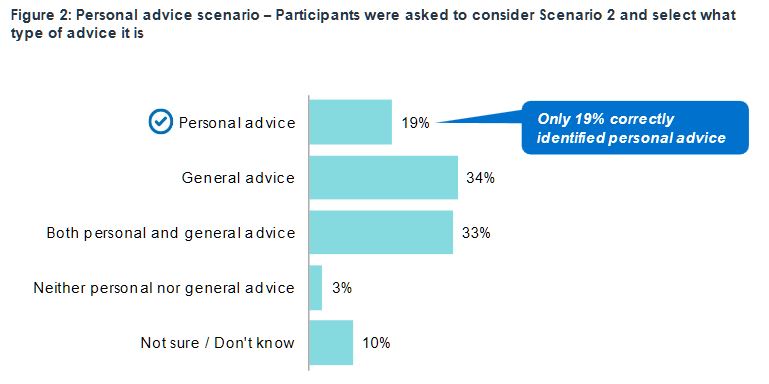

ASIC has released new research revealing many consumers confuse ‘general’ and ‘personal’ advice exposing them to greater risk of poor financial decisions.

The ASIC report, Financial advice: Mind the gap (REP 614), presents new independent research on consumer awareness and understanding of general and personal financial advice, identifying substantial gaps in consumer comprehension.

“This disturbing gap in understanding whether the advice they are getting is personal or not means many consumers are under the false premise their interests are being prioritised, when no such protection exists,” said ASIC Deputy Chair, Karen Chester.

Millions of Australians will likely seek financial advice at some stage in their lives. When they do, it is critical they understand whether that advice is personal, whether it is tailored to their circumstances and does the adviser have a legal obligation to act in their interest.

“The survey not only revealed consumers are not familiar with the concepts of general and personal advice, but only 53 per cent of those surveyed correctly identified ‘general’ advice. And even when provided the general advice warning, nearly 40 per cent of those surveyed wrongly believed the adviser had an obligation to take their personal circumstances into account,” Ms Chester said.

The report highlights the importance of consumer awareness and understanding of the distinction between personal and general advice with the Future of Financial Advice (FOFA) protections only applying when personal advice is provided. These include obligations for advisers to act in their client’s best interests, to provide advice that is appropriate to their client’s personal circumstances and to prioritise their client’s interests. These obligations do not apply when general advice is provided.

“The survey also revealed that the responsibilities of financial advisers, when providing general advice, is not well understood. Nearly 40 per cent of those surveyed were unaware that advisers were not required by law to act in their clients’ best interests,” Ms Chester said.

ASIC anticipates the need for financial advice to grow, reflecting an ageing population and many financial products, especially retirement products, becoming more complex. ASIC reports that much of the advice is likely to be general advice, and while appropriate in some circumstances, it is inevitably of limited use.

“ASIC is seeing increased sales of complex financial products under general advice models – so not tailored to personal circumstances – leaving many consumers, especially retirees, exposed to the potential risk of financial loss. And whilst the Financial Services Royal Commission, and the Government’s response, dealt with the most egregious risks of hawking of complex financial products, consumer confusion about what is personal and general advice needs to be addressed,” Ms Chester said.

The report’s findings reinforce those of the Murray Financial System Inquiry and the Productivity Commission reports on the financial and superannuation systems. Those reports made recommendations about the use of the term ‘general advice’, which is likely to lead to false consumer expectations as to the value of and protections afforded advice received.

Ms Chester said, “This consumer research is timely. It comes as the Government is considering policy recommendations on financial advice from the Productivity Commission’s twin reports on Australia’s financial and superannuation systems. And at a time when the financial system itself undergoes much change, following the intense scrutiny of the Financial Services Royal Commission, including considering new financial advice and distribution business models”.

The report includes quantitative and qualitative research commissioned by ASIC and undertaken by independent market research agency, Whereto Research. The research used hypothetical advice scenarios to test consumer recognition of when general and personal advice was being provided, and awareness of adviser responsibilities when being given each type of advice.

Report 614 Financial advice: Mind the gap is the first stage in ASIC’s broader research project into consumer experiences with and perceptions of the financial advice sector. Additional research by ASIC will get underway in 2019 to identify a more appropriate label for general advice and consumer-test the effectiveness of different versions of the general advice warning.

ASIC today released an update on the fees for no service (FFNS) further review programs undertaken by six of Australia’s major banking and financial services institutions.

ASIC’s ongoing supervision of the review programs undertaken by AMP, ANZ, CBA, Macquarie, NAB and Westpac (the institutions) has shown that most of the institutions are yet to complete further reviews – i.e. reviews to identify systemic FFNS failures beyond those already identified and reported to ASIC since 2013.

ASIC Commissioner Danielle Press said the institutions had taken too long to conduct these reviews, and welcomed the Government’s commitment to give ASIC new directions powers that could speed up remediation programs in the future.

‘These reviews have been unreasonably delayed. ASIC acknowledges that they are large scale reviews – they relate to systemic failures over long periods with reviews going back six to 10 years and cover 36 licensees from the six institutions that currently authorise more than 7,000 advisers]. However, we believe the institutions have failed to sufficiently prioritise and resource their reviews, particularly as ASIC advised them to commence the reviews in mid-2015 or early 2016.

‘We are pleased the Government has agreed to adopt recommendations from the 2017 ASIC Enforcement Review Taskforce Report, which includes a directions power. This would allow ASIC to direct AFS licensees to establish suitable customer review and compensation programs,’ she said.

The main reasons for delays by the institutions are:

ASIC’s large-scale FFNS supervisory work includes overseeing:

Under the compensation programs, AMP, ANZ, CBA, NAB and Westpac have collectively paid or offered approximately $350 million in compensation to customers who were charged financial advice fees for no service at the end of January 2019. Additionally, the institutions have provisioned more than $800 million towards potential compensation for further systemic FFNS failures. However, these reviews are incomplete.

Along with supervision of the compensation programs and further reviews undertaken by the institutions, ASIC is also conducting a number of FFNS investigations and plans to take enforcement action against licensees that have engaged in misconduct.

Report card on further reviews undertaken by the institutions

ASIC has today released guidance on its proposed approach to approving and overseeing compliance schemes for financial advisers (RG 269).

The financial advice professional standards reforms include obligations for financial advisers to, from 1 January 2020, comply with a code of ethics and be covered by an ASIC-approved compliance scheme under which their compliance with the code of ethics will be monitored and enforced.

RG 269 explains our process and criteria for determining whether to grant approval to a compliance scheme. It also sets out:

- our expectations for the governance and administration, monitoring and enforcement processes, and ongoing operation of compliance schemes

- how we will exercise our powers to revoke the approval of a compliance scheme and to impose or vary conditions on the approval, and

- the notifications that monitoring bodies must make to ASIC.

ASIC Deputy Chair Peter Kell said that ASIC is committed to ensuring robust, transparent, fair and consistent compliance schemes that effectively monitor and enforce compliance with the code of ethics.

‘Effective compliance schemes are a key component of the reforms that will require higher standards of ethical behaviour and professionalism among financial advisers.’

‘Our guidance requires high standards for compliance schemes, reflecting the significant responsibility that monitoring bodies operating compliance schemes will have. This includes the responsibility to effectively monitor and sanction adviser members if required,’ he said.

The code of ethics is being developed by the Financial Adviser Standards and Ethics Authority (FASEA). Consultation on an exposure draft of the code of ethics released by FASEA closed on 1 June 2018. At this time, FASEA has not released the final code. If there are significant changes from the draft code, we may need to revise our guidance when the final code is released.

Download

- Regulatory Guide 269 Approval and oversight of compliance schemes for financial advisers (RG 269)

- Report 595 Response to submissions on CP 300 Approval and oversight of compliance schemes for financial advisers (REP 595)

- Consultation Paper 300 Approval and oversight of compliance schemes for financial advisers (CP 300) and submissions

Background

Given all the interest in the lending practices across the sector, we have launched a series of DFA video shows on the critical issues surrounding Responsible Lending.

In the series we will look at why responsible lending is so important (for households, industry players and the broader economy), what lessons we did – or should have learnt following the GFC, how changes are likely to play out ahead, and how advice for lending services compares with wealth advice.

Principal at DFA Professor Gill North will lead the shows. The first is an overview of the series and the key themes we will address.

Gill has written widely in this area, and you can access her work via SSRN or though Deakin University

ASIC should consider replicating the UK’s ‘restricted’ regulatory model in order to make financial advice affordable for more Australians, argues NMG Consulting via InvestorDaily.

In his latest Trialogue note, NMG Consulting partner Oliver Hesketh made the case for financial advice that is exclusively tied to in-house product.

The ‘tied’ advice regulatory model, which operates in the UK as ‘restricted’ advice, involves a “very clear understanding between the customer and the adviser that only in-house product will be offered”, Mr Hesketh said.

At present, holistic advice is prohibitively expensive for the vast majority of Australians unless it subsidised by a vertically integrated business model, he said.

“If vertically integrated advice models can no longer be tolerated, or the cost of regulation renders it unfeasible, that means around 900 thousand Australians would be left without any financial advice at all,” Mr Hesketh said.

Intra-fund advice, on the other hand, is of limited value to super fund members, he said (it doesn’t even allow the adviser to consider the superannuation balance of their spouse).

The solution could be to adopt a similar ‘tied’ regulatory model as the UK, which would “allow industry funds to offer a valuable, lower-cost proposition to more members than they can realistically target today”, Mr Hesketh said.

“It’s difficult to believe the regulator might entertain a tied advice regime right now, but in our view at least, consumers would be well-served by a third regulatory framework for financial advice that recognises the cost of maintaining true independence in advice may be more than the average Australian is prepared to pay,” he said.

Mr Hesketh will be speaking at the 18th Annual Wraps, Platforms and Masterfunds Conference on 1-3 August in Crowne Plaza Hunter Valley.

ASIC has commenced proceedings in the Federal Court of Australia against Westpac Banking Corporation in relation to alleged poor financial advice provided by one of its former financial planners, Mr Sudhir Sinha.

In Court documents filed yesterday, ASIC alleges that, in four sample client files selected by ASIC, Mr Sinha breached the ‘best interests’ duty under the Corporations Act (‘the Act’), provided inappropriate financial advice, and failed to prioritise the interests of his clients.

Mr Sinha provided financial advice in the Perth area as an employee of Westpac from 2001 to November 2014. In June 2017, Mr Sinha was banned by ASIC from providing financial services for a period of five years as a result of his failure to meet his ongoing advice service obligations (refer 17-178MR).

ASIC contends, as Mr Sinha’s responsible licensee during that period, Westpac is liable for the alleged breaches of the ‘best interests’ obligations by Mr Sinha under section 961K of the Act. ASIC also alleges that Westpac contravened sections 912A(1)(a) and (c) of the Act, which requires Westpac to do all things necessary to ensure that the financial services covered by its licence are provided efficiently, honestly and fairly, and to comply with financial services laws.

Section 961K of the Act is a civil penalty provision, and attracts a maximum penalty of $1 million per contravention.

Separately, Westpac has a significant remediation programme underway in respect of Mr Sinha’s conduct. Westpac has reported to ASIC that, as at 14 June 2018, it has paid approximately $12 million in compensation to clients impacted by Mr Sinha’s poor advice and ongoing advice service failures.

Last week, ASIC issued a report confirming in-house product bias within institutionally-aligned licensees between 2015 and 2017, finding that 68 per cent of all client funds across these businesses had been invested in products owned and operated by related entities.

A review of sample files where advice to switch products to an in-house product was provided also found that as many as 75 per cent did not meet the FOFA fiduciary duty in ASIC’s opinion.

Responding to questions from InvestorDaily, a spokesperson for ANZ said its internal review of in-house versus external product distribution had yielded different results to those of the regulator, but noted the bank was unaware how ASIC gauged the numbers.

“Our assessment of the split between ANZ Financial Planning customers’ investments in ANZ products and those in external products is closer to 47/53 respectively, but we do not know what methodology ASIC have used,” the spokesperson said.

The bank said it also permits advisers to apply to recommend products not included on their APLs, and last year received 1,200 of these requests – an “overwhelming majority” of which the spokesperson said were approved.

The spokesperson added that the bank “will continue to work with ASIC and all the other regulators to help them with the important work they do to keep our industry secure and accountable”.

ANZ’s comments follow the release of an internal letter written by the bank’s chief executive, Shayne Elliott, addressing the royal commission into banking, superannuation and financial services.

In the letter, Mr Elliott said seeing all the bank’s instances of misconduct over the last decade laid out in a single document was “confronting”.

“It’s completely unacceptable that we have caused some of our customers financial harm and emotional stress. I’m ultimately accountable for this and once again apologise,” Mr Elliott said.

“Of course, it would be easy to lay the blame on a few bad apples or to say that these are largely historical technical glitches resulting from large complex IT systems. That would be wrong.”

Spokespeople for AMP and Westpac both referred InvestorDaily to the FSC, which has also challenged the investigative approach used by the regulator.

An Australian Securities and Investments Commission (ASIC) review of financial advice provided by the five biggest vertically integrated financial institutions has identified areas where improvements are needed to the management of conflicts of interest. 68% of clients’ funds were invested in in-house products.

This highlights the problems in vertically integrated firms, something which the Productivity Commission is also looking at.

The review looked at the products that ANZ, CBA, NAB, Westpac and AMP financial advice licensees were recommending and at the quality of the advice provided on in-house products.

The review was part of a broader set of regulatory reviews of the wealth management and financial advice businesses of the largest banking and financial services institutions as part of ASIC’s Wealth Management Project.

The review found that, overall, 79% of the financial products on the firms’ approved products lists (APL) were external products and 21% were internal or ‘in-house’ products. However, 68% of clients’ funds were invested in in-house products.

The split between internal and external product sales varied across different licensees and across different types of financial products. For example, it was more pronounced for platforms compared to direct investments. However, in most cases there was a clear weighting in the products recommended by advisers towards in-house products.

ASIC noted that vertical integration can provide economies of scale and other benefits to both the customer and the financial institution. Consumers might choose advice from large vertically integrated firms because they seek that firm’s products due to factors such as convenience and access, and recommendations of ‘in-house’ products may be appropriate. Nonetheless, conflicts of interest are inherent in vertically integrated firms, and these firms still need to properly manage conflicts of interest in their advisory arms and ensure good quality advice.

ASIC will consult with the financial advice industry (and other relevant groups) on a proposal to introduce more transparent public reporting on approved product lists, including where client funds are invested, for advice licensees that are part of a vertically integrated business. ASIC noted that any such requirement is likely to cover vertically integrated firms beyond those included in this review. The introduction of reporting requirements would improve transparency around management of the conflicts of interests that are inherent in these businesses.

ASIC also examined a sample of files to test whether advice to switch to in-house products satisfied the ‘best interests’ requirements. ASIC found that in 75% of the advice files reviewed the advisers did not demonstrate compliance with the duty to act in the best interests of their clients. Further, 10% of the advice reviewed was likely to leave the customer in a significantly worse financial position. ASIC will ensure that appropriate customer remediation takes place.

Acting ASIC Chair Peter Kell said that ASIC is already working with the major financial institutions to address the issues that have been identified in the report on quality of advice and management of conflicts of interest.

‘There is ongoing work focusing on remediation where advice-related failures have led to poor customer outcomes, and the results of this review will feed into that work,’ said Mr Kell.

ASIC is already working with the institutions to improve compliance and advice quality through action such as:

- improvements to monitoring and supervision processes for financial advisers; and

- improvements to adviser recruitment processes and checks.

ASIC will continue to ban advisers with serious compliance failings.

ASIC highlighted that the findings from this review should be carefully examined by other vertically integrated firms. ‘While this review focused on five major financial services firms, the lessons should be considered by all vertically integrated firms in the financial services sector.’

Sell-side” research is general financial advice prepared and distributed by an AFS licensee to investors to help them make decisions about financial products. ASIC says such firms must manage the conflicting interests of their issuing and investing clients when preparing investor education research. They have given the industry six months (to 1 July 2018) to make sure their compliance measures conform to the ASIC’s expectations as expressed in the released regulatory guidance.

ASIC has released regulatory guidance on managing conflicts of interest and handling inside information by Australian financial services (AFS) licensees that provide sell-side research.

Research helps investors to make investment decisions. The quality of research can affect the advice received and investment decisions. A licensee who provides research must comply with a number of regulatory obligations. They must:

- control and manage inside information

- manage conflicts during the capital raising process, including avoiding,

- controlling and disclosing these conflictsmanage research teams, including budgeting, research analyst remuneration and coverage decisions

Regulatory Guide 264 Sell-side research (RG 264) looks at the key stages of a capital raising transaction and provides specific guidelines on how an AFS licensee should appropriately manage conflicts of interest during each of these stages , including the preparation and production of investor education reports. RG 264 also provides general guidance for AFS licensees on the identification and handling of inside information by research analysts, and about the structure and funding of sell-side research teams.

The guidance addresses uneven market practice that has developed since the publication of Regulatory Guide 79 Research report providers: Improving the quality of investment research (RG 79) in 2004. It also responds to industry requests for more detailed guidance on sell-side research and supplements guidance in RG 79.

RG 264 takes into account feedback from stakeholders following public consultation earlier this year, see Report 560 Response to Submissions on CP 290 Sell-side research (REP 560).

Commissioner Cathie Armour said, ‘The timely flow of information and objective research analysis is vital to fair and efficient markets. Investors consider sell-side research when making investment decisions. It is critical that sell-side research represents the genuine, professional opinion of analysts.

‘Wholesale investors want early information and analyst insights on companies undertaking capital raising. Firms that manage this process must manage the conflicting interests of their issuing and investing clients when preparing investor education research. It is important thatthis deal-related research does not undermine the prospectus disclosure or continuous disclosure requirements. RG 264 will help industry strike the right balance between these competing considerations’.

While RG 264 does not extend the regulatory framework in RG 79, ASIC will give industry six months to 1 July 2018 to make sure their compliance measures conform to the expectations set out in the this guide.

Download

- Regulatory Guide 264 Sell-side research

- Report 560 Response to Submissions on CP 290 Sell-side research

- Consultation Paper 290 Sell-side research and non-confidential submissions

Background

In June 2017, ASIC released Consultation Paper 290 Sell-side research (CP 290) which proposed to provide further guidance on managing conflicts of interest and inside information involving sell-side research.

The consultation followed the release of Report 486 Sell-side research and corporate advisory: Confidential information and conflicts (REP 486) in August 2016. REP 486 set out observations from our review of how material non-public information and conflicts of interest are handled in the context of sell-side research and corporate advisory activities.

ASIC’s review showed that AFS licensees involved in providing research would benefit from detailed guidance on managing material, non-public information and conflicts of interest.

Sell-side research is general financial advice prepared and distributed by an AFS licensee to investors to help them make decisions about financial products.