I discussed financialisation, the latest developments emerging from the Royal Commission, plus the Glass Steagall bill with Robert Barwick from the CEC.

You might also like:

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

I discussed financialisation, the latest developments emerging from the Royal Commission, plus the Glass Steagall bill with Robert Barwick from the CEC.

You might also like:

We discuss Glass-Steagall banking reform in the context of the derivatives industry

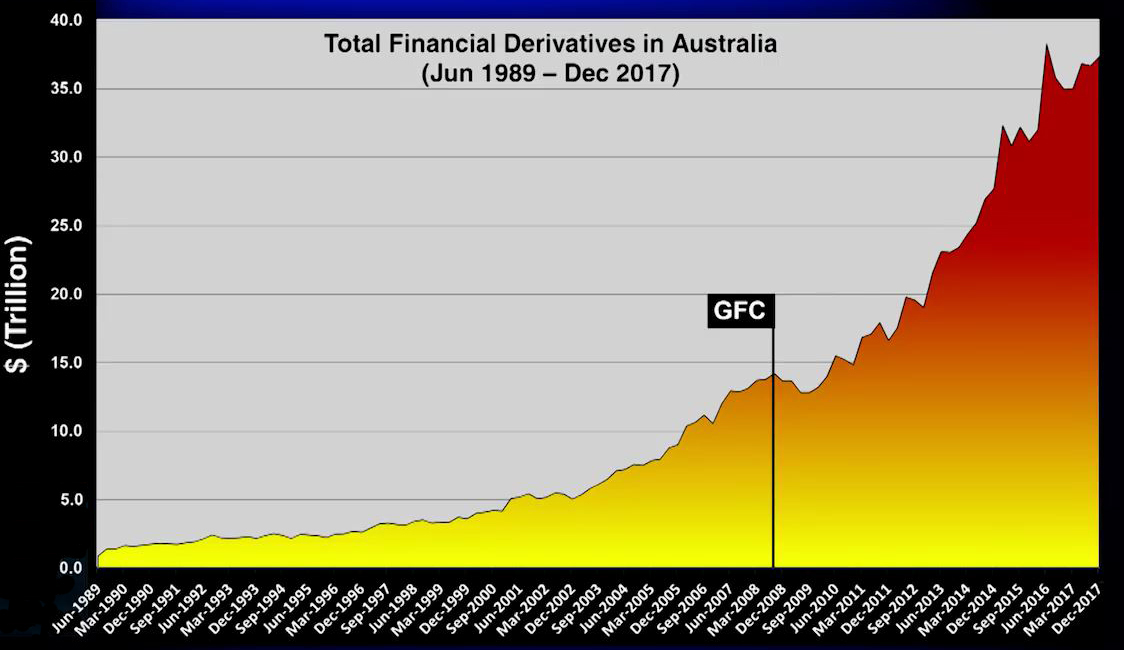

There is a chart doing the rounds courtesy for the CEC (an Australian Political Party, who is advocating the introduction of a Glass Steagall banking separation bill, and which is likely to tabled late June) which shows that the total value of financial derivatives in Australia is around $37 trillion dollars.

I have had a number of people ask about this data, which is not attributed. What does it show, and is it right?

I have had a number of people ask about this data, which is not attributed. What does it show, and is it right?

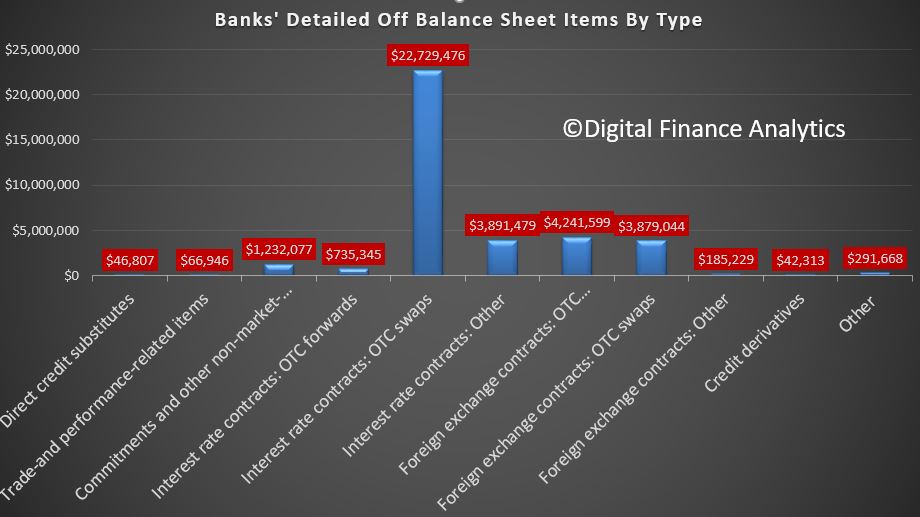

Well the short answer is easy. Derivatives are used quite extensively by many sectors of the Australian economy. The data comes from the RBA series B2 BANKS – OFF-BALANCE SHEET BUSINESS. This lists out Banks’ off-balance balances by category. The major component relates to interest rate derivatives, mainly over the counter (OTC) – meaning they are not exchange based transactions, but are bespoke hedges, either for their customers or trading on their own behalf with other banks, or both. Thus they may be speculative in nature, as traders are taking positions in the market. Over the years the treasury operations of banks have become a profit centre in their own right!

The RBA data shows the range of products, but the largest by far relate to interest rate swaps, which converts a fixed interest rate into a floating interest rate or vice versa. This offers protection against rate fluctuations, and the opportunity for speculative position taking. A large part of the turnover in both foreign exchange and interest rate derivatives markets is inter-bank activity, with these institutions hedging positions built up through market-making activity, or for proprietary purposes. According to data from the Bank for International Settlements (BIS), around 70 per cent of total turnover reported by Australian-located counterparties is undertaken with another bank, either domestically or offshore.

The RBA data shows the range of products, but the largest by far relate to interest rate swaps, which converts a fixed interest rate into a floating interest rate or vice versa. This offers protection against rate fluctuations, and the opportunity for speculative position taking. A large part of the turnover in both foreign exchange and interest rate derivatives markets is inter-bank activity, with these institutions hedging positions built up through market-making activity, or for proprietary purposes. According to data from the Bank for International Settlements (BIS), around 70 per cent of total turnover reported by Australian-located counterparties is undertaken with another bank, either domestically or offshore.

Looking in more detail, across the various instruments, there are more than $22.7 trillion of swaps are out there, plus other interest rate vehicles, as well as a smaller volume of foreign exchange contracts. These are the principal amounts of the instrument. By the way, the options contracts can be more risky depending whether you hold a put or a call option – but that’s another story.

Looking in more detail, across the various instruments, there are more than $22.7 trillion of swaps are out there, plus other interest rate vehicles, as well as a smaller volume of foreign exchange contracts. These are the principal amounts of the instrument. By the way, the options contracts can be more risky depending whether you hold a put or a call option – but that’s another story.

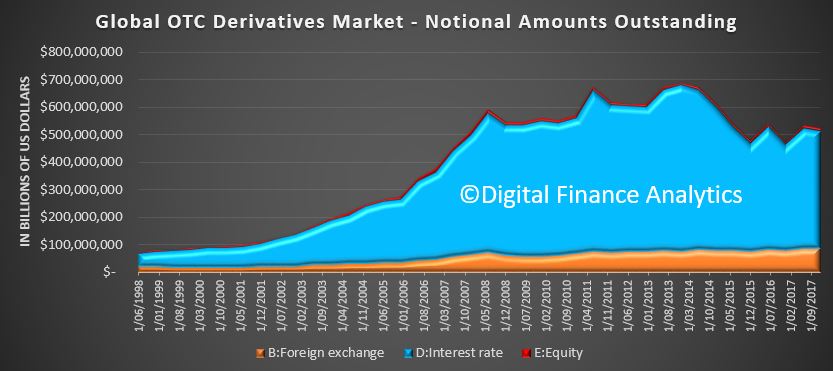

The bulk of the transactions are interest rate related. But it is worth noting as the RBA did in 2011, that “because redundant OTC derivatives positions are not generally closed out (unlike exchange-traded derivatives), turnover volumes result in a significant build-up of gross outstanding positions for dealers. This notional amount is a much larger figure than the estimated market value of these positions. The bulk of this build-up is due to interest rate derivatives, reflecting both the longer maturity of many interest rate derivatives contracts, and the heavy utilisation of these as hedging instruments by banks and their counterparties. Foreign Exchange derivatives comprise a smaller, though still significant, share. The relatively slower build-up in these positions over time largely reflects the much shorter duration of many FX instruments (in general, these may last only a few days or weeks, compared with many months and years for interest rate derivatives). The interdependencies of counterparties and operational complexities resulting from the build-up of these positions are prime reasons why some central clearing of these positions is desirable”.

The main dealers in Australia include, ANZ, Bank of America–Merrill Lynch, Bank of Tokyo-Mitsubishi, Barclays Capital, BNP Paribas, Citi, CBA, Deutsche Bank, Goldman Sachs, HSBC, J.P. Morgan, Macquarie Group, National Australia Bank, Royal Bank of Canada, UBS, and Westpac.

Just to confuse the picture a bit more, data from DTCC Data Repository (Singapore) Pte. Ltd. (DDRS), says OTC derivatives notional outstanding in Australia totaled $42.3 trillion as of June 30, 2017. Interest Rate Derivatives totaled $34.7 trillion and accounted for 82% of notional outstanding. Foreign Exchange derivatives comprised $7.3 trillion (17% of notional outstanding) and credit derivatives totaled only $264.1 billion. This is because OTC derivatives are used by parties other than banks of course, so the number is larger than the RBA bank series.

Australian Financial Markets Association (AFMA) is another data source. It was formed in 1986 and is “the leading industry association promoting efficiency, integrity and professionalism in Australia’s financial markets” according to their web site. They have more than 110 members, from Australian and international banks, leading brokers, securities companies and state government treasury corporations to fund managers, energy traders and industry service providers. The latest data from AFMA, which was included in their 2017 report says that OTC notional outstanding in Australia was $47.2 trillion, again with interest rates instruments the main element.

But, which ever way you look at it, the numbers are large.

But, which ever way you look at it, the numbers are large.

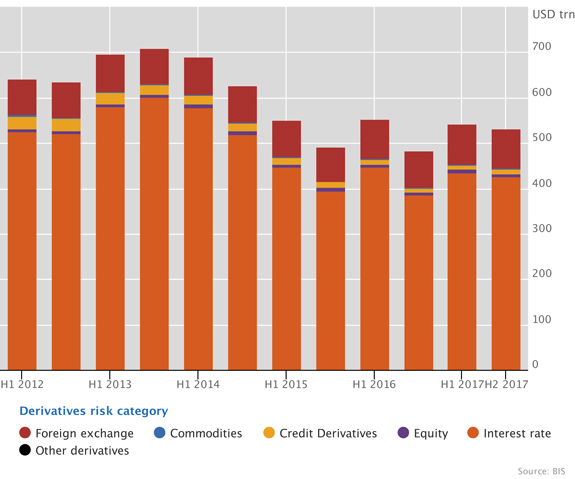

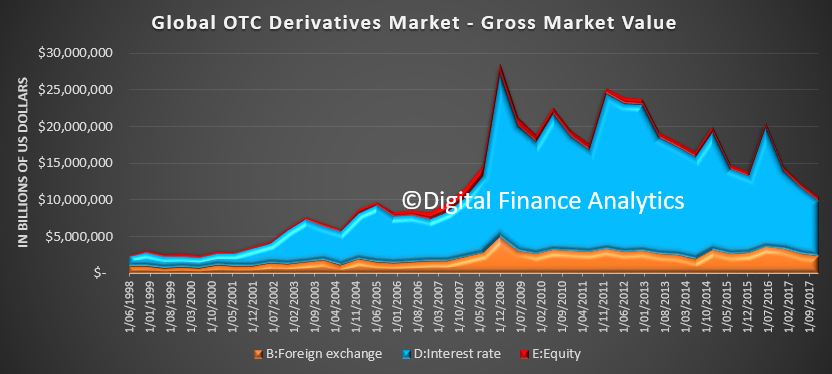

But, we cannot stop there. To try to get to grips with the bigger picture, lets look at the latest data from the BIS – The Bank For International Settlements, the Bankers Banker. They produce massive volumes of statistics including a series on derivatives. Their latest data is to December 2017 and they show that globally the nominal value of Over The Counter (OTC) derivatives has since 2015 has fluctuated in a range between about $480 trillion and $550 trillion. Notional amounts remained in this range in the second half of 2017, ending the year at $532 trillion. On a comparable basis, Australia would comprise about about $31.5 trillion of this, or about 6% of the total, although the RBA notes that data sourced from AFMA and BIS are not strictly comparable, in part due to differences in the data collection basis, and different categorisations of the Australian operations of foreign banks.

Globally, this is down from the $US710 trillion at the end of 2013, which was a 12 per cent increase on the year before. The longer term trend however shows the significant growth over the medium term. Relativity, Australian exposures are growing. But just how much is an interesting question.

Globally, this is down from the $US710 trillion at the end of 2013, which was a 12 per cent increase on the year before. The longer term trend however shows the significant growth over the medium term. Relativity, Australian exposures are growing. But just how much is an interesting question.

Then we need to ask whether the notional amounts outstanding are a meaningful number, because these turnover figures measure the notional principal of contracts. Because of the derivative nature of these transactions, the full principal is generally not exchanged at the time the transaction is initiated, nor might it ever be exchanged over the lifetime of the contract. This is unlike transactions in securities such as equities or bonds, where the full amount of consideration is exchanged at the time the transaction is settled.

Then we need to ask whether the notional amounts outstanding are a meaningful number, because these turnover figures measure the notional principal of contracts. Because of the derivative nature of these transactions, the full principal is generally not exchanged at the time the transaction is initiated, nor might it ever be exchanged over the lifetime of the contract. This is unlike transactions in securities such as equities or bonds, where the full amount of consideration is exchanged at the time the transaction is settled.

There is another way to look at the exposure. That is through the lens of bought and sold positions. The BIS says the sum of the absolute values of all outstanding derivatives contracts with either positive or negative replacement values evaluated at market prices prevailing on the reporting date gives us the gross market value. Globally, the gross market value of outstanding OTC derivatives contracts fell to $11 trillion at end-2017, its lowest level since 2007. The share of centrally cleared credit default swaps (CDS) rose to 55% at end-2017, as central clearing made further inroads.

So you might net off the exposures, positive and negative, to get a baseline netted position. In a balanced position the exposures may be quite small, but changes in relative rates may create much larger exposures without much notice. Thus in a volatile market these exposures could be larger than anticipated, which creates the risks in the system.

So you might net off the exposures, positive and negative, to get a baseline netted position. In a balanced position the exposures may be quite small, but changes in relative rates may create much larger exposures without much notice. Thus in a volatile market these exposures could be larger than anticipated, which creates the risks in the system.

The RBA said in 2010, the estimated market value of cross-sectoral bought (or sold) positions across all derivatives classes (both exchange traded and OTC) was around $350 billion, as opposed to the $15 trillion dollars notional exposure. The largest component of this was positions bought and sold between domestic financial institutions and offshore counterparties (largely financial institutions). However, the public sector and the non-financial corporate sector are also significant users, each with around $30 billion of bought and sold positions outstanding as at December 2010.

So the exposures can range from trillions of dollars to a few billions. It all depends what you mean by “exposures” in the first place.

And this is where it gets tricky. Banks have an obligation to assess their off-balance sheet exposures and use APRA approved formulations to discount the total exposures back to those which may appear in the balance sheet. Does APRA get inside these figures or validate them. We suspect not, leaving it to the accountants who work with the banks. An APRA spokesman after the GFC said, said: “We are not in the business of running banks, we are in the business of supervising them”, adding that the role of APRA was to set standards that the banks agreed to abide by.

But as we have described the exposures are highly leveraged, and in a time of crisis, these smaller deeply discounted exposure values may be insufficient to handle the demands from the derivatives they hold. If so, and in a crisis, a bank may find their exposures escalate and it might swamp their balance sheet, meaning that the other operations, including loans and deposits may get caught up.

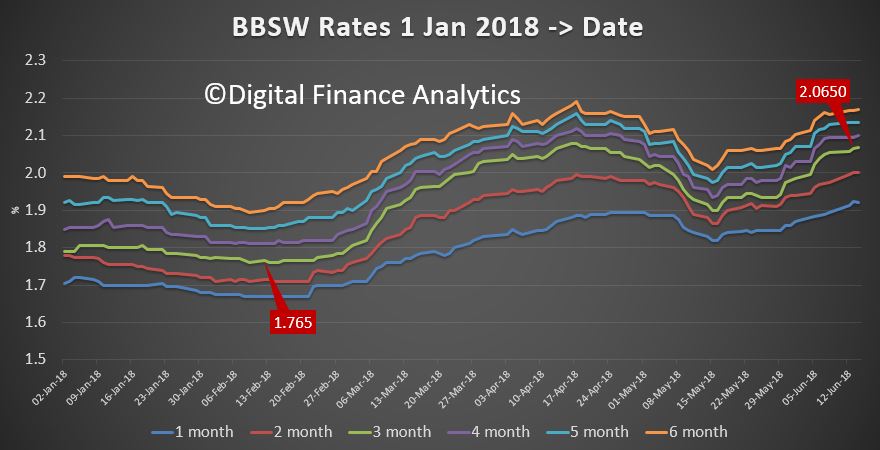

This is especially relevant, because in the current environment, with interest rates shifting between the USA and Australia, as shown by the BBSW chart, (rates have move up around 30 basis points since February) things could get interesting.

And this is the point, banks who play in the derivatives area actually have additional risks in their business, which are not knowable, but potentially large. In a crisis, it risks the rest of the business. There is no ring fence.

And this is the point, banks who play in the derivatives area actually have additional risks in their business, which are not knowable, but potentially large. In a crisis, it risks the rest of the business. There is no ring fence.

And this is where Glass-Steagall comes in, because this legislation would separate the trading operations from core banking operations, and protect depositors as a result. The current “all mixed up” universal banks are totally exposed.

But such a change would also have an immediate impact on both the profitability and capability of banks, which is why they will resist any such move, despite it now being proposed in Italy, and already in existence in some form in China.

The bottom line is the $37 trillion is a good representation of the current gross exposures in our banking system, and this dwarfs the banks’ current balance sheets, and the countries total economy. The risks are literally enormous, and in a system-wide banking crash, when multiple parties are exposed, a bail-out if required would likely have profound economic effects. It might be enough to swamp the entire economy. That’s how big the potential risks are. That’s why Glass-Steagall is worth pursuing.

Perhaps originally a banks was a safe place for people with money to store it, and people who needed funds to obtain them. Simple. But when I worked for the big banks there was an increasing focus on boosting shareholder returns by financial engineering and acquisition, and this included expanding into areas such as wealth management, insurance and advisory businesses. The big institutional investors loved the returns from non-organic growth partly thanks to tax breaks available on restructuring costs on the way through. Focus in customers, and on enabling them to achieve their financial goals was a poor second. The industry had become an end in itself! One reason why I left the industry.

But that expansion is now in full reverse, and this is likely to hit returns to investors and change the shape of the industry in the years ahead. Perhaps bigger is not necessarily better. Perhaps it’s time to get back to the roots of banking.

But that expansion is now in full reverse, and this is likely to hit returns to investors and change the shape of the industry in the years ahead. Perhaps bigger is not necessarily better. Perhaps it’s time to get back to the roots of banking.

The Royal Commission into Financial Services Miscount continues to highlight the structural issues which lay under the surface in financial services. For example, how can mortgage brokers or financial advisers, employed by a bank, recommend a product from that same bank, when they receive commissions when so doing. There are inherent conflicts which are not to the benefit of the customer This is vertical integration, when advice, product sales and product manufacturing all live under the same roof.

Or consider horizontal integration, where a bank owns ever more of what’s called a share of wallet, by expanding into insurance and wealth management. They can cross sell in theory, and accumulate vast amounts of customer intelligence across the board. In practice it’s much harder, thanks to cultural differences across divisions, management complexity, and consumers often want diversity not uniformity. In fact, though already we have seen a bevy of break-ups and sell-offs in a quest for capital efficiency. NAB, for example will be selling off their MLC wealth management business, marking the end of their mass-market wealth experiment. They will retain their upper end JBWere business as part of their Private Bank, for the most affluent customers. Other players are also divesting wealth businesses, partly because they never really generated the value expected, (and frittered away shareholder funds in the process) and because of the higher risks thanks to the FOFA “Best Interests” requirement.

The Productive Commission Draft report on superannuation released today, makes the point that a quarter of households are being poorly served by the current superannuation system, and the retail funds – those owned by many of the major banks, are charging more and returning less. They recommend a significant number of changes, which if implemented could enhance the benefits to savers, and remove many of the snouts from the trough. The big operators, including the big banks, though, will hate it.

But there are other conflicts too – for example the sector analysts within the banks on one hand claim to operate behind Chinese walls within their institutions, but we wonder whether their observations on the economy and housing market are truly independent. If an analyst employed by one of the big banks really thought the housing market would crash, would they spell this out (and risk a significant re-rating of their own entity)? We suspect this is why many of the analysis have only become recently mildly negative, despite the evidence building towards a more substantial correction. There are a few thought leaders who are ahead of the curve, but also a swag of followers, wanting to stay in the pack.

And then there are risks within banking from organisations who mix the more speculative aspects of trading and funding from the core banking operations – the meat and potato services like holding deposits and making loans, in fact at the moment, as we have discussed before, banks can create loans on demand, thanks to their ability to use a range of financial instruments – it has little to do with deposits. This by the way is counter to what most economists would claim. The derivatives market is, in a word, gigantic – with a “notional amount” of $500 trillion which is 25 times the GDP of the US and about 7 times global GDP, though other have estimated it at $1.2 quadrillion on the high-end. Other market analysts estimate the derivatives market at more than 10 times the size of the total world gross domestic product. Whichever way you look at it, it’s big.

Given the significant exposures to derivatives in the system globally and held by the large financial institutions, the risks are significant and growing. Remember in 2007 it was derivatives which led the way to the broader collapse in the financial system, and we have more exposure today.

Finally, the old argument that scale is required for efficiencies sake is mainly humbug, with smaller organisations often nimbler, less encumbered by legacy systems and more efficient – bigger is not necessarily better.

It is likely the Royal Commission, in their interim report will be discussing disaggregation options within the banks. On the other hand, it is also as likely that the Banks are already lobbying Canberra to deflect any potential breakups, claiming scale and stability and autonomy should be king. But as the Productivity Commission recently argued, the interests of customers are left far behind. Structural changes are needed.

So what are the break-up options worth considering?

One option to fix the Banking System would be to bring in a Glass-Steagall type regime. Glass-Steagall emerged in the USA in 1933, after a banking crisis, where banks lent loans for a long period, but funded them from short term, money market instruments. Things went pear shaped when short and long term rates got out of kilter. So The Glass-Steagall Act was brought in to separate the “speculative” aspects of banking from the core business of taking deposits and making loans. Down the track in 1999, the Act was revoked, and many say this was one of the elements which created the last crisis in the USA in 2007.

Now the Citizens Electoral Council of Australia CEC (an Australian Political Party) has drafted an Australian version of the Glass-Steagall act, and Bob Katter has announced that he will try to bring the legislation as a Private Member’s Bill called The Banking System Reform (Separation of Banks) Bill 2018. And Bob Katter has form here, in taking the lead in Parliament on Glass-Steagall, as he did on the need for a Royal Commission into the banks in 2017.

The 21st Century Glass-Steagall Act has been updated to prohibit commercial banks from speculating in the specific financial products that caused the 2008 global financial crisis, which didn’t exist in 1933, such as financial derivatives. These updates are reflected in the Australian bill. Aside from specific practices, the overriding lesson of the 2008 crash is that commercial banks should not mix with other financial activities such as speculative investment banking, hedge funds and private equity funds, insurance, stock broking, financial advice and funds management. The banks have gone far beyond traditional banking, into other financial services and speculating in derivatives and mortgage-backed securities. Consequently, they have built up a housing bubble, which is heading towards a crash and an Australian financial crisis.

The bill also addresses the question of the role and function of APRA, the financial regulator, which we believe has a myopic fixation on financial stability at all costs, never might the impact on customers, as the recent Productivity Commission review called out.

A few points worth making. First there is merit in the Glass-Steagall reforms, and I recommend getting behind the initiative, despite the fact that it will not fix the current problem of the massive debt households have. There is an online petition you can sign, and draft letters you can send to your MPs.

Remember that Banks were able to create loans thanks to funding being available from the capital markets, and so bid prices up. Turn that off, and their ability to lend will be curtailed ahead, which is a good thing, but the existing debts will remain. Now some are concerned about the CEC, and its motives. The CEC, is an Australian federally registered political party which was established in 1988. From 1992 onward the CEC joined with Lyndon H. LaRouche. But my point is, if you need a horse, and a horse appears, ride the horse and worry less about which stable it came from. I applaud the CEC for driving the Glass Stegall agenda.

But to deal with the debt burden we have, there are some other things to consider. For example, at the moment the standard mortgage contract gives banks full recourse — if you default the bank can not only sell the property, but also get a court judgment to go after your other assets and even send you bankrupt. In the USA some states have non-recourse loans, and recent research showed that borrowers in these non-recourse states are 32 per cent more likely to default than borrowers in recourse states. This is because if the outcome of missing your mortgage payments is losing pretty much everything you own and being declared bankrupt, you will do just about anything possible to keep paying your home loan. And banks will be more likely to make riskier loans when they have full recourse. So I wonder if we should consider changes to the recourse settings in Australia, which appear to me to favour the banks over customers, and encourage more sporty lending.

Then, there is the idea of changing the fundamental basis of bank funding, using the Chicago Plan. You can watch our video “Popping The Housing Affordability Myth” where we discuss this in more detail and “It’s Time for An Alternative Finance Narrative” where we go into more details. Essentially, the idea is to limit bank lending to deposits they hold, and it offers a workout strategy to deal with the high debt in the system and remove the boom and bust cycles. This is not a mainstream idea at the moment, but I think the ideas are worthy of further exploration. This is something I plan to do in a later post and look at how a transition would work. I believe that down the track we have to find a way to unwind all the unaffordable debt which is out there, the alternative is a generation or two of debt slaves, great for the Banks, not great for society. The excesses of the past 20 years have to be fixed. The Chicago Plan offers one mitigation path, there are others, including a so-called loan Jubilee.

But we need to go further and ask whether the Central Banks around the world are truly looking after our best interests or the banks, in the name of financial stability. For example, it is the Basel Capital rules, established by the Bankers Banker, the Bank for International Settlement, which makes lending for mortgages so much more capitally efficient compared with lending for productive business purposes, in the name of credit risk and stability. But to my mind these rules are part of the problem, and the tweaks they make to adjust the risk sensitivity (in consultation with the big banks) does not really address the underlying issues.

Indeed, some will point to the strong links between big business, big banks and the central bankers (and something of a revolving door between big banks and politics. All of which may work against the best interests of the community.

So it seems to me we need some fresh thinking to break out of our current dysfunctional banking models. Today, they may support GDP results as they inflate home prices more, but we are at the point where households a “full of debt”. So we see higher risks in the system – even the RBA recently called out risks relating to the amount of debt in the household sector, and the prospect of higher funding costs, a credit crunch, and lower consumption should home prices fall. And the latest data shows that prices are falling in the major centres now, and auction results continue lower. I believe that the RBA’s business as usual approach will lead us further up the debt blind alley. Which is why we need more radical reform in the banking system and the regulators if we are to chart a path ahead.