New research from HashChing and Digital Finance Analytics shows a

massive discrepancy in home loan interest rates across NSW, with vast differences in rates even within the same suburbs.

Data shows that in some cases, neighbours are paying up to $87,027 more for new owner occupied loans (105 basis point disparity), and $201,704 more for refinanced owner occupied loans (235 basis point disparity). The calculation is based on an average home loan of $500,000 over 25 years.

Those borrowers paying higher rates are essentially adding an extra three years of mortgage repayments (34 months) compared to those on a lower rate.

According to Mandeep Sodhi, CEO of online mortgage marketplace HashChing, borrowers are more empowered to take control of their finances than ever, but need to be more proactive when it comes to their home loan.

“The data shows that the highest and lowest rates are not confined to single suburbs, suggesting location is not the be all and end all when it comes to interest rates. In fact, at the time that the data was recorded, the lowest rate, 3.49 per cent, was available all over Sydney, including the Eastern Suburbs, Sydney CBD, North Shore, Inner-West, Northern

Beaches and South Sydney.

Multiple suburbs were also found to have both the lowest and highest interest rates on the same type of loans for their region. For example, homeowners in Artarmon had the lowest and the highest rates on the North Shore for refinanced investment loans, and new owner occupied

loans.

The lowest new owner-occupied rate in Artarmon was 3.94 per cent, on a loan amount of $950,000. While the highest was a rate of 4.45 per cent, for a lower loan amount of $600,000. And, although the loan size for both the highest and lowest rates for refinanced investment loans was the same ($420,000), the lowest rate was 3.85 per cent and the highest was 5.79 per cent, that is a leap of 1.94 per cent.

According to Martin North, Principal of Digital Finance Analytics, the amount that households pay is determined by a range of factors: whether it is a new loan or a refinanced loan, where the property is located, the type of loan, the loan to value ratio, and how the loan is negotiated.

“Borrowers shouldn’t necessarily take the first rate they are offered. It is not in a lender’s interest to automatically offer the golden egg. Rather, a negotiation has to take place, and borrowers have to have an appetite for it.

“The lender is providing a service for you, so be prepared to negotiate, or use a broker to help get the best deal,” said Mr North.

Those who have already settled on a home loan were also called to be more proactive in reviewing their rate and situation frequently.

“Too often borrowers have a ‘set and forget’ mentality when it comes to their mortgage. What they don’t realise is you can actually renegotiate a better rate with your current lender, or switch providers entirely which can save thousands, often completely outweighing any switching costs that may be involved,” said Mr North.

The data indicated that new owner-occupied loans across Sydney CBD, Northern Beaches and Western Suburbs all had average interest rates above 4 per cent, while South Sydney (3.95), Eastern Suburbs (3.94), Inner West (3.89) and North Shore (3.86) sat just below.

The average refinanced owner-occupied rate in the Inner West was a high 4.12 per cent, followed by the Eastern Suburbs (3.99) and North Shore (3.95).

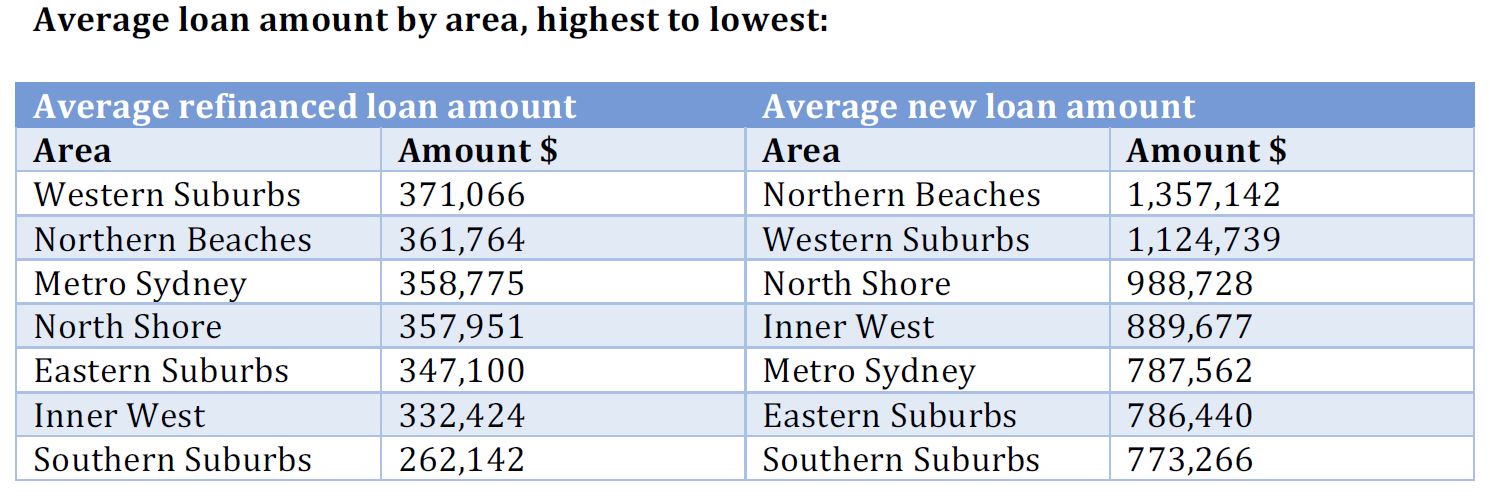

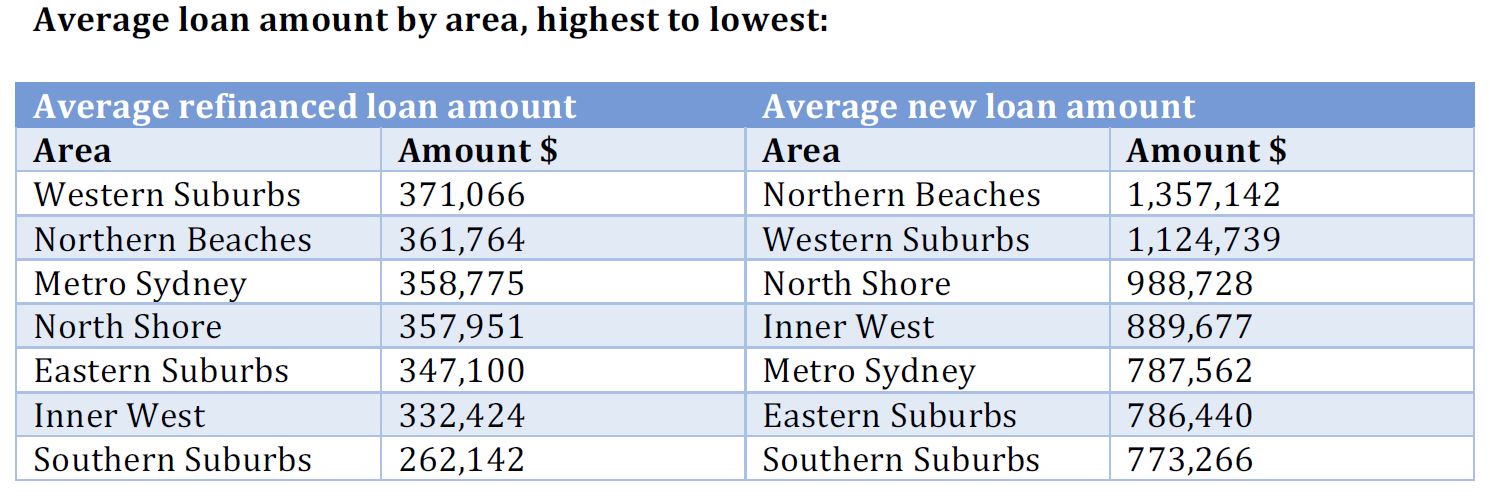

The average loan size for those refinancing was $341,603 and the average loan size for a new home was $958,222 – with Northern Beaches and Western Suburbs residents borrowing the most.

* Note, high rates due to poor credit history or unique circumstances were removed from the data before analysis.

* Note, high rates due to poor credit history or unique circumstances were removed from the data before analysis.