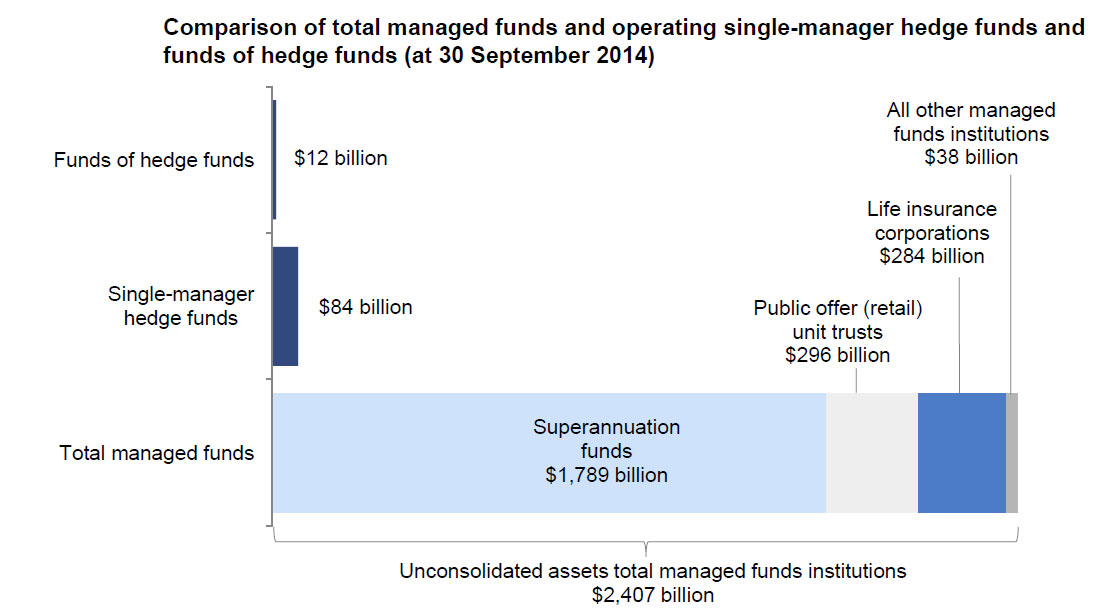

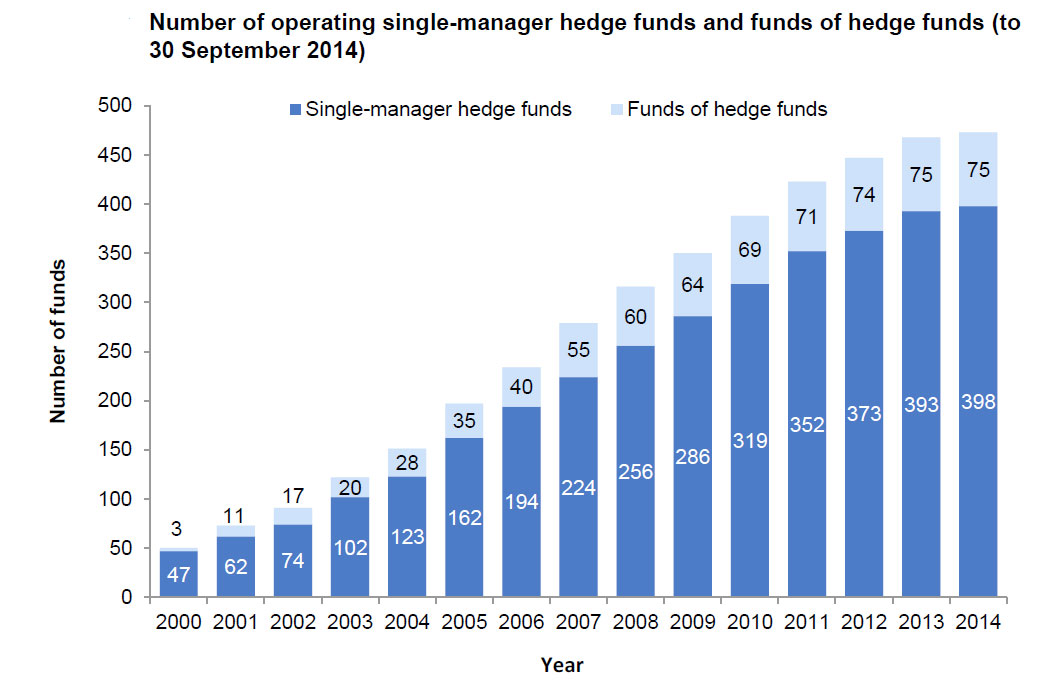

ASIC today published their report into the Australian Hedge Funds Industry. It draws from aggregated industry data and a survey to September 2014. Hedge funds comprise about 4% of managed funds in Australia, $95bn compared with $2,407bn. Superannuation funds accounted for approximately three-quarters of this total with nearly $1,789 billion in assets. The average Hedge Fund return last year was 4.2% (though with significant variations). There were 473 funds in operation and there are a large number of small funds.

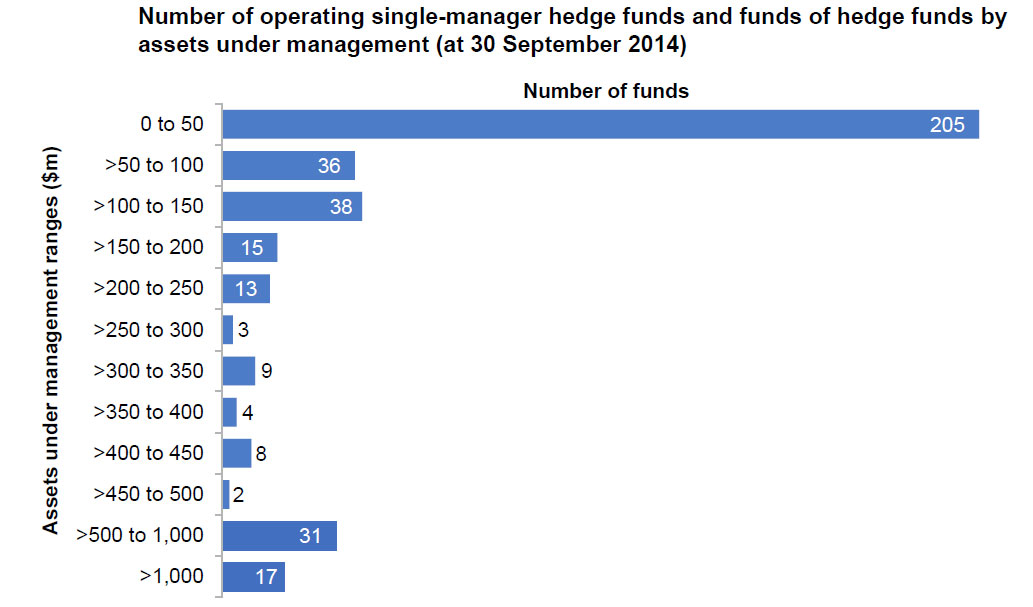

There were 473 funds in operation and there are a large number of small funds.

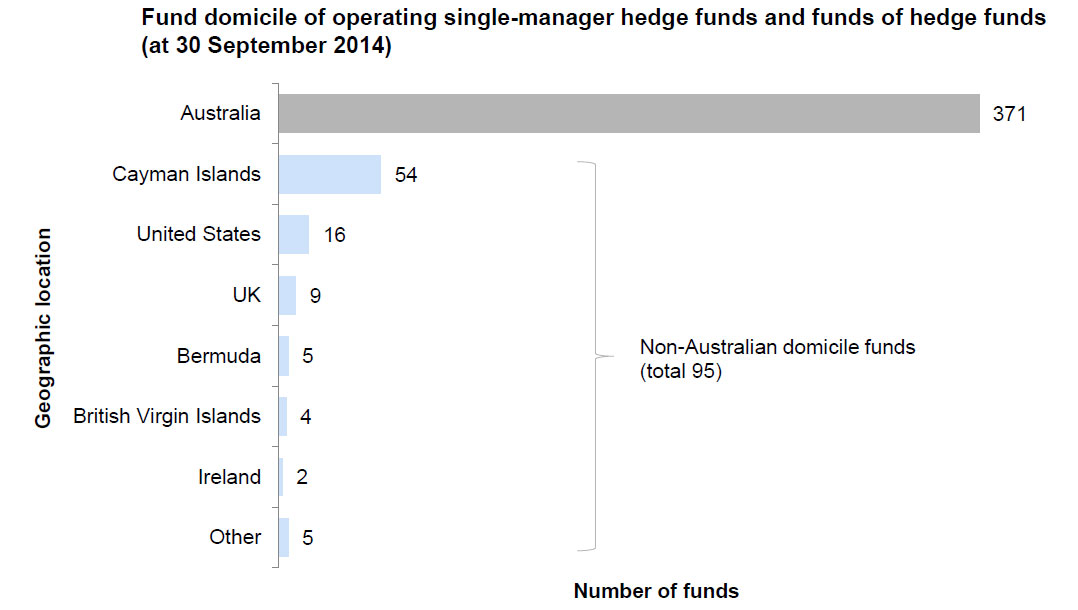

Nearly 80% of the operating single-manager hedge funds and funds of hedge funds were domiciled in Australia. In terms of assets under management, just over 81% of single-manager hedge funds and 99% of funds of hedge funds were domiciled in Australia.

Nearly 80% of the operating single-manager hedge funds and funds of hedge funds were domiciled in Australia. In terms of assets under management, just over 81% of single-manager hedge funds and 99% of funds of hedge funds were domiciled in Australia.

Since 2012, assets under management for funds of hedge funds have remained relatively flat at around $12 billion. This does not mirror the global sector where assets under management for funds of hedge funds have fallen by approximately 17% to US$457 billion over the same period

Since 2012, assets under management for funds of hedge funds have remained relatively flat at around $12 billion. This does not mirror the global sector where assets under management for funds of hedge funds have fallen by approximately 17% to US$457 billion over the same period

The majority of the Australian hedge funds sector comprises small-sized funds, with just over half (54%) of the sector holding assets under management of less than $50 million

The majority of the Australian hedge funds sector comprises small-sized funds, with just over half (54%) of the sector holding assets under management of less than $50 million

The most common strategy employed by managers for operating single-manager hedge funds and funds of hedge funds was equity long/short (53.8%), with multi-strategy in second place (10.6%) and fixed income in third place (9.5%).

The most common strategy employed by managers for operating single-manager hedge funds and funds of hedge funds was equity long/short (53.8%), with multi-strategy in second place (10.6%) and fixed income in third place (9.5%).

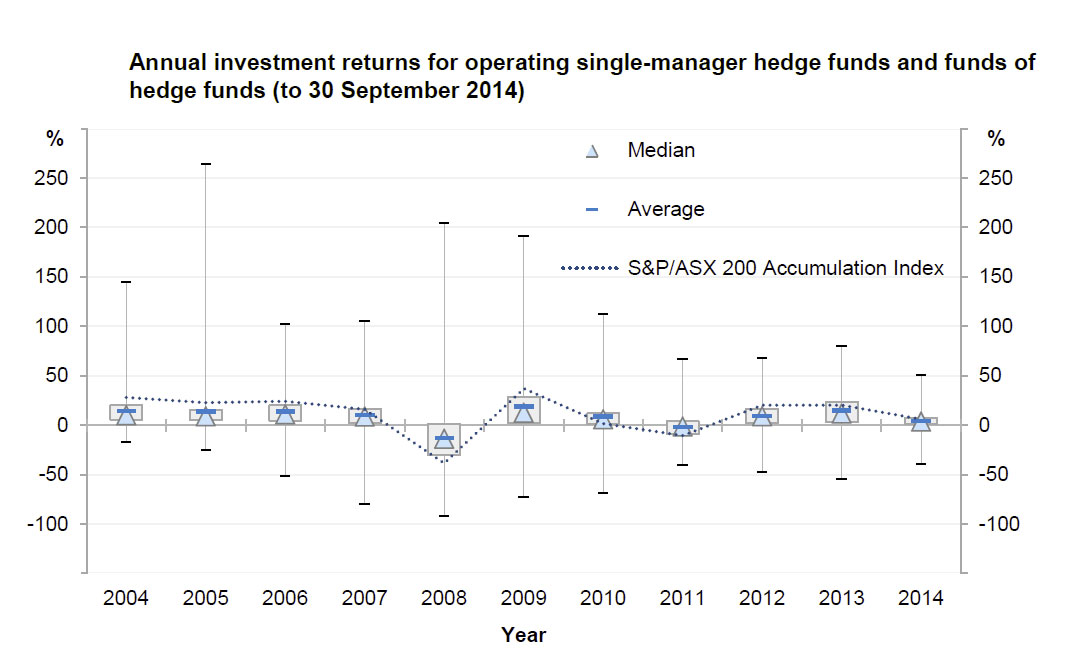

In the 12 months to 30 September 2014, the average annual net return for single-manager hedge funds and funds of hedge funds was 4.2%. This was down from the previous year when funds on average achieved a return of 14.4%. The third quarter of 2014 was the worst performing quarter for the year for the global hedge funds sector, posting returns of –0.4% for the year. Concerns over Greece leaving the Eurozone during this period caused equity markets to fall, which may have affected hedge fund investments. The year to 30 September 2014 saw returns for hedge funds globally fall to 3.3%, which highlighted the weakness in the sector in 2014 in comparison to the previous year when an average of 7.8% was posted for the same period.

In the 12 months to 30 September 2014, the average annual net return for single-manager hedge funds and funds of hedge funds was 4.2%. This was down from the previous year when funds on average achieved a return of 14.4%. The third quarter of 2014 was the worst performing quarter for the year for the global hedge funds sector, posting returns of –0.4% for the year. Concerns over Greece leaving the Eurozone during this period caused equity markets to fall, which may have affected hedge fund investments. The year to 30 September 2014 saw returns for hedge funds globally fall to 3.3%, which highlighted the weakness in the sector in 2014 in comparison to the previous year when an average of 7.8% was posted for the same period.

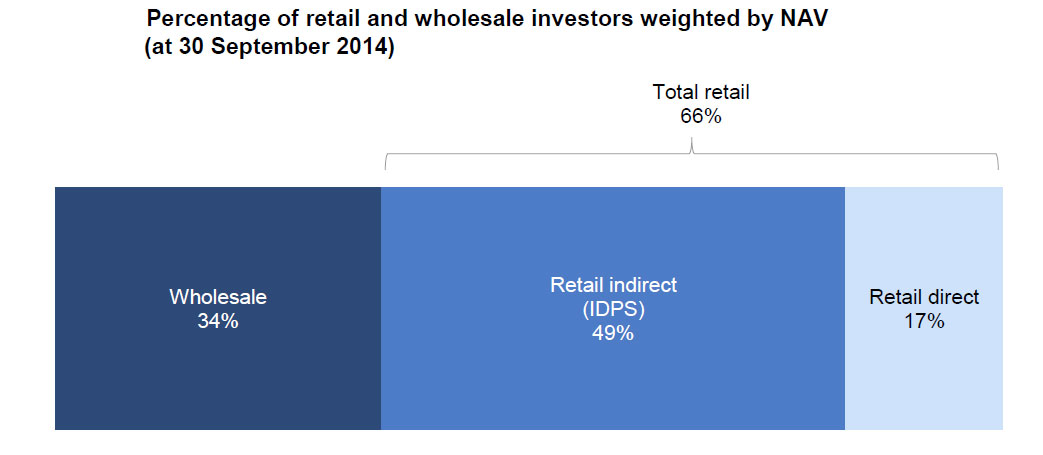

Turning to the survey, Retail direct investors accounted for 17% of the investors by net asset value in the surveyed hedge funds. This is a 7.3% increase from the 9.7% reported in ASIC’s 2012 hedge funds survey.

Turning to the survey, Retail direct investors accounted for 17% of the investors by net asset value in the surveyed hedge funds. This is a 7.3% increase from the 9.7% reported in ASIC’s 2012 hedge funds survey.

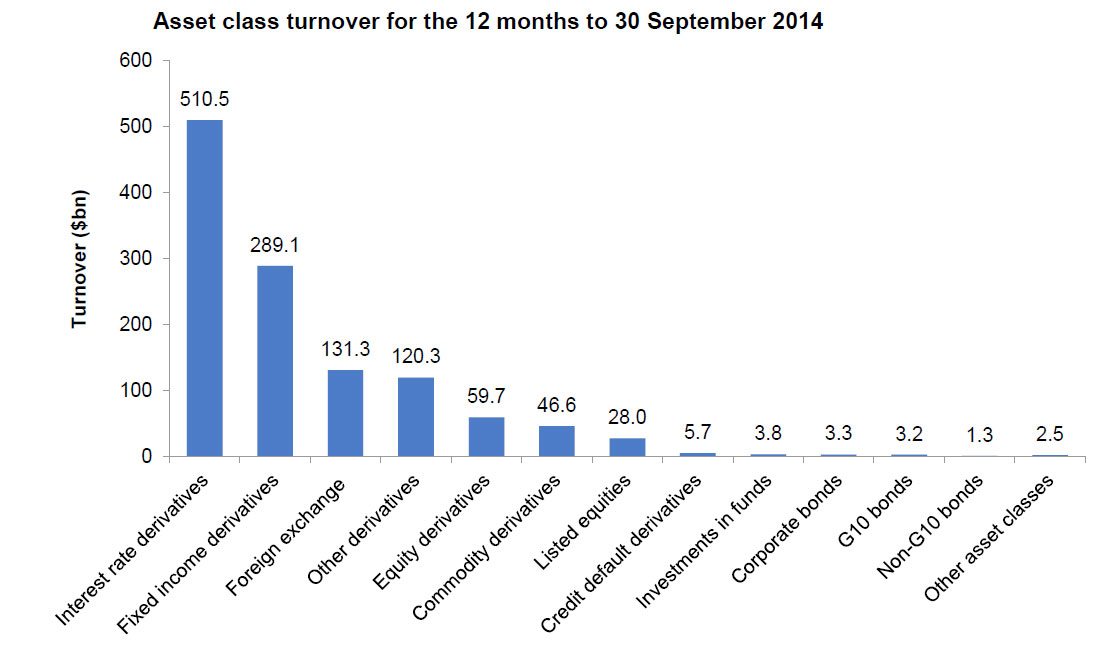

The vast majority of funds’ reported turnover was in interest rate derivatives and fixed income derivatives. Interest rate derivatives were the most highly traded individual asset class at $510.5 billion, reflecting their importance in managing interest rate exposure.

The vast majority of funds’ reported turnover was in interest rate derivatives and fixed income derivatives. Interest rate derivatives were the most highly traded individual asset class at $510.5 billion, reflecting their importance in managing interest rate exposure.