In some countries, owning a home is a rite of passage: a symbol of a stable life and a sound investment.

However young adults in the United Kingdom, United States, and Europe have experienced declining home ownership rates.

Our chart of the week, drawn from research by Lisa Dettling and Joanne W. Hsu, senior economists at the US Federal Reserve, in the June issue of Finance & Development magazine , shows that millennial home ownership rates are nearly 10 percent lower than those of their baby boomer and Generation X counterparts of the same age.

For millennials who have purchased a home, net housing wealth—the value of the home, minus mortgage debt—is about the same as that of their baby boomer parents at the same age.It remains to be seen if millennials are delaying home purchases or forgoing home ownership all together. New research suggests barriers to financing a home, such as borrowing constraints, are at least partially to blame for falling home ownership rates and rising co-residence rates.

Whether these barriers will ease in the future is unknown. However, a recent study in the UK finds that groups experiencing low home ownership rates at age 30 tend to catch up later in life.

To read more research and find data on housing markets around the world, check out the IMF’s Global Housing Watch .

You can also read more blogs about global house prices and our recent chart of the week on the housing price boom in Norway .

Tag: IMF

China’s Growth Sustainable Says IMF

The results from the 2017 Article IV consultation with China have been published. The IMF acknowledged that China’s continued strong growth has provided critical support to global demand and they commended the authorities’ ongoing progress in re-balancing the Chinese economy toward services and consumption.

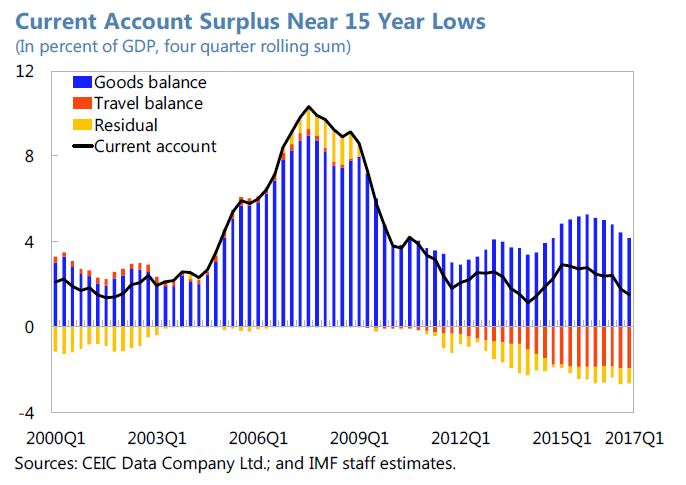

They noted that economic activity had recently firmed and saw this as an opportunity for the authorities to accelerate needed reforms and focus more on the quality and sustainability of growth. They supported the importance of reducing national savings to help prevent domestic and external imbalances and emphasized the need for greater social spending and making the tax system more progressive. Stronger domestic demand helped further reduce China’s external imbalance, though it remains moderately stronger compared to the level consistent with medium-term fundamentals

They noted that economic activity had recently firmed and saw this as an opportunity for the authorities to accelerate needed reforms and focus more on the quality and sustainability of growth. They supported the importance of reducing national savings to help prevent domestic and external imbalances and emphasized the need for greater social spending and making the tax system more progressive. Stronger domestic demand helped further reduce China’s external imbalance, though it remains moderately stronger compared to the level consistent with medium-term fundamentals

Amid strong growth, the authorities have pivoted toward tightening measures, reflecting a greater focus on containing financial sector risks.

Amid strong growth, the authorities have pivoted toward tightening measures, reflecting a greater focus on containing financial sector risks.

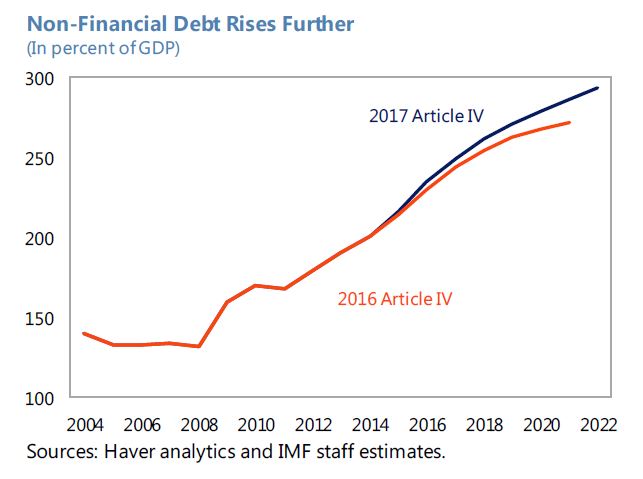

Debt is now expected to continue to grow as the IMF now assumes that the authorities will broadly maintain current levels of public investment over the medium term and not substantially consolidate the “augmented” deficit, reaching 92 percent of GDP in 2022 on a rising path. Private sector credit is projected to continue increasing over the medium term. Thus, total non-financial sector debt reached about 235 percent of GDP in 2016 and is projected to rise further to over 290 percent of GDP by 2022.

Debt is now expected to continue to grow as the IMF now assumes that the authorities will broadly maintain current levels of public investment over the medium term and not substantially consolidate the “augmented” deficit, reaching 92 percent of GDP in 2022 on a rising path. Private sector credit is projected to continue increasing over the medium term. Thus, total non-financial sector debt reached about 235 percent of GDP in 2016 and is projected to rise further to over 290 percent of GDP by 2022.

They say downside risks around the baseline have increased. A key consequence of the new baseline is that it envisions China using up valuable fiscal space to support a growth path with slower rebalancing and a higher probability of a sharp adjustment. Thus, if a sharp adjustment were to materialize, China would have lower buffers with which to respond. Such a potential adjustment could be triggered by several risks, including:

They say downside risks around the baseline have increased. A key consequence of the new baseline is that it envisions China using up valuable fiscal space to support a growth path with slower rebalancing and a higher probability of a sharp adjustment. Thus, if a sharp adjustment were to materialize, China would have lower buffers with which to respond. Such a potential adjustment could be triggered by several risks, including:

- Funding. A funding shock could come from at least two (related) pressure points. The first is the mostly short-term, “interbank” wholesale market (which includes banks’ claims on each other and on NBFIs). The second is a loss of confidence in short-term asset management products issued by NBFIs, or a run on the WMPs which fund them.

- Retreat from Cross-Border Integration. Should higher trade barriers be imposed by trading partners, the impact would depend on their coverage and magnitude, how exchange rates respond, and whether China retaliates. For example, an illustrative simulation in the IMF’s Global Integrated Monetary and Fiscal Model suggests that if the U.S. puts a 10-percent tariff on Chinese exports and China allowed its real exchange rate to adjust, real GDP in China would fall by about 1 percentage point in the first year. If China retaliated with similar tariffs on U.S. imports, its GDP would contract further. However, given the complexity of global trade relationships and uncertainty regarding how exchange rates would adjust, the effect could be larger and more disruptive.

- Capital Outflows. Pressure on the exchange rate could resume because of a faster-than-expected normalization of U.S. interest rates, much weaker growth in China, or some other shock to confidence. In an extreme scenario, the pressure could lead to renewed large reserve loss and eventually a potential disruptive exchange rate depreciation. However, this risk is likely small in the short run due to the stronger enforcement of CFMs, the prominence of state-owned banks in the foreign exchange market, and ample foreign exchange reserves.

While agreeing on the growth outlook, the authorities disagreed about the associated risks. The authorities agreed that 2017 growth was likely to exceed marginally the 6.5 percent full year target. This implied some deceleration during the course of the year and would result in inflationary pressure remaining contained and a broadly unchanged current account. For the medium term, though the authorities shared the view that their 2020 target of doubling 2010 real GDP would likely be reached, they viewed the debt build-up thus far as manageable and likely to slow further as their reforms take effect. They also explained that their “projected growth targets” were anticipatory and not binding. They underscored that reaching the desired quality of growth was a greater priority than the quantity of growth. The authorities viewed domestic concerns, such as high financial sector leverage, as manageable considering ongoing reforms and Chinese-specific strengths, such as high domestic savings. They saw the external environment as facing many uncertainties, such as an unexpected fall in global demand or a retreat from globalization.

The IMF conclude that:

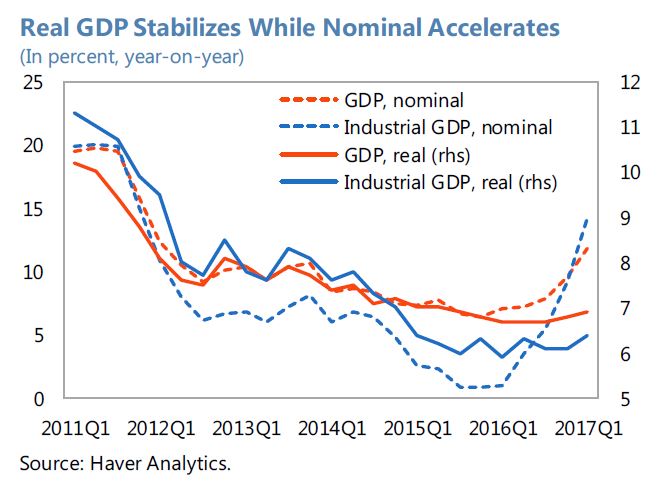

China continues to transition to a more sustainable growth path and reforms have advanced across a wide domain. Growth slowed to 6.7 percent in 2016 and is projected to remain robust at 6.7 percent this year owing to the momentum from last year’s policy support, strengthening external demand, and progress in domestic reforms. Inflation rose to 2 percent in 2016 and is expected to remain stable at 2 percent in 2017. Important supervisory and regulatory action is being taken against financial sector risks, and corporate debt is growing more slowly, reflecting restructuring initiatives and overcapacity reduction.

Fiscal policy remained expansionary and credit growth remained strong in 2016. Growth momentum will likely decline over the course of the year reflecting recent regulatory measures which have tightened financial conditions and contributed to a declining credit impulse.

The current account surplus fell to 1.7 percent of GDP in 2016, driven by a sharp recovery in goods imports and continued strength in tourism outflows. It is projected to further narrow to 1.4 percent of GDP this year, due primarily to robust domestic demand and a deterioration in terms of trade. Capital outflows have moderated amid tighter enforcement of capital flow management measures and more stable exchange rate expectations. After depreciating 5 percent in real effective terms in 2016, the renminbi has depreciated some 2¾ percent since then and remains broadly in line with fundamentals.

A Dip into Subzero Policy Rates

Zero was gradually adopted in the ancient world—both east and west—as the ultimate point of reference, a point above and below which things change. For the ancient Egyptians, zero represented the base of pyramids. In science it became the freezing point of water, in geography the altitude of the sea, in history the starting point of calendars.

In the realm of monetary policy, zero was typically seen as the lower bound for interest rates. That has changed in recent years in the context of a slow recovery from the 2008 crisis. Several central banks hit zero and began experimenting with negative interest rate policies. Most did so to counter very low inflation, but some also were concerned about currencies that were too strong.

Financial stability

Questions arose. Should we worry about the effectiveness of negative rates and their potential side effects? Would such policies support demand? Would they undermine financial stability? Would rate cuts below zero have different effects than above zero? We offered some answers in a recent paper drawing on the initial experience of the euro area, Denmark, Japan, Sweden, and Switzerland.

Our paper confirms and builds on initial discussions in IMFBlog by José Viñals, a former director of the IMF’s Monetary and Capital Markets Department, and some of his colleagues. Among our conclusions: the mechanics of monetary policy’s effect on the economy is similar above and below zero, and so far the overall impact on bank profits and lending has been small. But there are limits to the policy.

Why consider the effects of negative rates now, when talk is shifting to interest rate normalization? For two reasons. First, we have accumulated enough experience—two years in most cases, more in others—to gauge the effects with greater certainty. Second, with rates expected to be generally lower in the new normal, the odds of hitting zero if monetary policy needs to be eased again are likely to be higher.

Why worry?

The fear is that negative rates could squeeze bank profits. Banks make money by charging borrowers more than they pay depositors. This margin could be compressed if deposit rates don’t fall as fast as lending rates or ultimately bottom out at zero. This scenario could put financial stability at risk because lower profits would make banks less resilient to shocks. It could also undermine the impact of monetary policy on lending, growth, and price stability.

Banks will hesitate to impose negative rates on depositors who have the option to withdraw their money and stash it in a safe. While storing, moving, and insuring cash is costly, it could be cheaper than paying the bank to hold money if rates are pushed very far below zero. Where is the tipping point? No one knows for sure. Depositors with larger cash balances and higher liquidity needs—such as companies—will tolerate more negative rates before switching to cash. Banks can thus afford to pass on negative rates to some of their depositors, and they have.

Banks can also cushion their margins by lowering lending rates by less than the policy rate cut. This will happen automatically if their portfolios consist primarily of long-term and fixed-rate loans and other assets. (At the same time, this more limited pass-through will reduce the impact of the policy rate cut.) Banks that rely more on large deposits and wholesale funding may gain ground against those relying primarily on retail deposits.

Further, even if margins compress somewhat, profits will not necessarily drop. Banks can support profits by charging fees and commissions, lowering provisioning charges as borrowers become safer, switching to cheaper wholesale funding, cutting costs, and booking capital gains from policy rate cuts. In addition, lower rates will spur economic growth and thus demand for bank services, which will ease the pressure on margins.

Early days

A review of early country experiences with relatively small cuts below zero supports this more benign view.

Overall, the policy seems to have worked well: money market rates and bond yields fell in every country we looked at. Currencies also weakened somewhat, at least temporarily. Deposit rates mostly remained positive, except those of large companies. Lending rates declined somewhat, though less than policy rates. Banks benefited from lower wholesale funding costs, and some raised fees. Bank profits have generally been resilient. Lending has held up.

But some banks suffered. As predicted, negative rates weighed on profits of banks with a greater share of deposit funding, small retail clients, short-term loans, and loans indexed to the policy rate (for example, in some southern members of the euro area). Banks facing tougher competition from lower-cost lenders and capital markets were also hurt.

Not the whole answer

So far, so good. Negative-rate policies appear to have helped domestic monetary conditions somewhat, with no major side effects on bank profits, payment systems, or market functioning.

However, if policy rates remain negative for a long time, or if a deeper dive below zero is contemplated, the effectiveness of the policy and the stability of the financial system could be at risk. Further, the ability of depositors to switch to cash limits how much rates can be cut. Other monetary support, combined with fiscal policy and structural reforms, remain critical to support recoveries.

All Hands on Deck: Confronting the Challenges of Capital Flows

The global financial crisis and its aftermath saw boom-bust cycles in capital flows of unprecedented magnitude. Traditionally, emerging market economies were counselled not to impede capital flows. In recent years, however, there has been growing recognition that emerging market economies may benefit from more proactive management to avoid crisis when flows eventually recede. But do they adopt such a proactive approach in practice?

In recent research, we analyze the policy response of emerging markets to capital inflows using quarterly data over 2005–13. Our analysis shows that emerging markets do react to capital flows—most commonly through foreign exchange intervention and monetary policy, but also using macroprudential measures and capital controls. Ironically, the most commonly prescribed instrument for coping with capital flows—tighter fiscal policy—is the least deployed in practice.

Menu of policies

Policymakers in emerging market economies have potentially five tools to manage capital flows: monetary policy; fiscal policy; exchange rate policy; macro-prudential measures; and capital controls. In deploying these, there is a natural correspondence (or mapping) between risks and instruments.

Monetary and fiscal policies can help address the inflation and economic overheating concerns raised by capital inflows. When the currency is not undervalued, foreign exchange intervention can be used to limit currency appreciation that threatens competitiveness; and macroprudential measures (such as reserve requirements, capital adequacy ratios, dynamic loan loss provisioning, etc.) can be applied to curb excessive credit growth and related financial stability risks.

Capital inflow controls can buttress these policies by limiting the volume of capital inflows or by tilting the composition of flows toward less risky types of liabilities. Countries with controls on capital outflows can also relax these restrictions to lower the volume of net flows, reducing overheating and currency appreciation pressures.

Proactive central bank response

Capital flows to emerging markets have been particularly volatile over the last decade. But emerging markets’ central banks have not been indifferent to this volatility.

Foreign exchange intervention, for example, follows the ebbs and flows of capital, with a strong correspondence between reserve accumulation and net inflows. On average, emerging markets’ central banks purchase some 30–40 percent of the inflow, but some central banks, especially those in Asia (such as India, Indonesia, Malaysia) and Latin America (Brazil, Peru) tend to intervene more heavily, while others (such as Mexico and South Africa) tend to intervene less.

In terms of monetary policy, capital inflows elicit higher policy rates in emerging markets on average, though the impact depends on the behavior of inflation, the output gap (a measure of economic slack), and the real exchange rate. Policy rates are thus raised in response to higher inflation or a larger output gap—implying a counter-cyclical monetary policy stance—but lowered in response to real exchange rate appreciation.

Procyclical fiscal policy

When it comes to fiscal policy, however, the stance is strongly procyclical in the face of capital inflows. Thus, government consumption expenditure rises as capital inflows surge, and falls as capital inflows decrease—presumably because of political economy constraints, and/or because emerging markets face difficulty in accessing international credit markets in bad times.

Less orthodox policies

Turning to macroprudential measures and capital controls on inflows, our analysis shows that these measures are generally tightened as inflows surge and relaxed when flows recede. There is, however, considerable cross-country variation in response. Some countries, such as Brazil, Korea, Turkey, tend to use these measures more often than others.

For capital outflow controls, the reverse is true. Measures are relaxed when inflows surge—though it is only countries without fully open capital accounts, for example, India and South Africa, that tend to do so.

Natural mapping

Not only do emerging markets respond to inflows through various tools, their choice of the policy instrument also corresponds to the nature of the risk posed by capital flows.

Thus, foreign exchange intervention is generally used when the real effective exchange rate is appreciating, while what matters more for monetary policy tightening is the output gap. Macroprudential measures are typically deployed in the face of rapid domestic credit growth, while inflow controls are tightened when both credit growth and currency appreciation combine as a concern.

Bottom line

Following the repeated boom-bust cycles in capital flows, many emerging markets have internalized the lessons that they must manage capital flows if they are to reap the benefits of financial globalization, while minimizing the risks. They typically deploy a combination of instruments, with some correspondence between the nature of the risk and the tool deployed.

Nevertheless, there are important differences in policy response across countries, even in similar macroeconomic circumstances. This suggests that structural characteristics and political economy considerations may be at play in shaping a country’s specific policy response. An equally relevant question is whether the active policy management pursued by emerging economies has contributed to fewer financial crises in recent years. We hope that future research can shed light on these issues.

Global Growth IS Recovering – IMF

Latest estimates from the IMF suggest global growth is gaining momentum. But US growth estimates are down because of the slower growth agenda being prosecuted there thanks to the current political dynamics.

Overall, there is a more consistent pattern of upswing.

The recovery in global growth that we projected in April is on a firmer footing; there is now no question mark over the world economy’s gain in momentum.

As in our April forecast, the World Economic Outlook Update projects 3.5 percent growth in global output for this year and 3.6 percent for next.

The distribution of this growth around the world has changed, however: compared with last April’s projection, some economies are up but others are down, offsetting those improvements.

Notable compared with the not-too-distant past is the performance of the euro area, where we have raised our forecast. But we are also raising our projections for Japan, for China, and for emerging and developing Asia more generally. We also see notable improvements in emerging and developing Europe and Mexico.

Where are the offsets to this positive news on growth? From a global growth perspective, the most important downgrade is the United States. Over the next two years, U.S. growth should remain above its longer-run potential growth rate. But we have reduced our forecasts for both 2017 and 2018 to 2.1 percent because near-term U.S. fiscal policy looks less likely to be expansionary than we believed in April. This pace is still well above the lacklustre 2016 U.S. outcome of 1.6 percent growth. Our projection for the United Kingdom this year is also lowered, based on the economy’s tepid performance so far. The ultimate impact of Brexit on the United Kingdom remains unclear.

Overall, though, recent data point to the broadest synchronized upswing the world economy has experienced in the last decade. World trade growth has also picked up, with volumes projected to grow faster than global output in the next two years.

There do remain areas of weakness, however, among middle- and low-income countries, notably commodity exporters who continue to adjust to reduced terms of trade. Latin America still struggles with sub-par growth, and we have lowered projections for the region over the next two years. Growth this year in sub-Saharan Africa is projected to be higher than last year, but remains barely above the population growth rate, implying stagnating per capita incomes.

Risks

There are risks that the outcome could be better or worse than we now project. Near term, there is the possibility of even stronger growth in continental Europe, as political risks have diminished.

On the downside, however, many emerging and developing economies have been receiving capital inflows at favorable borrowing rates, possibly leading to risks of balance of payments reversals later. Strains could emerge if advanced economy central banks show an increasing preference for monetary tightening, as some have in recent months. Core inflation pressures remain low in advanced economies and measures of longer-term inflation expectations show no indications of upward drift beyond targets, so central banks should proceed cautiously based on incoming economic data, reducing the risk of a premature tightening in financial conditions.

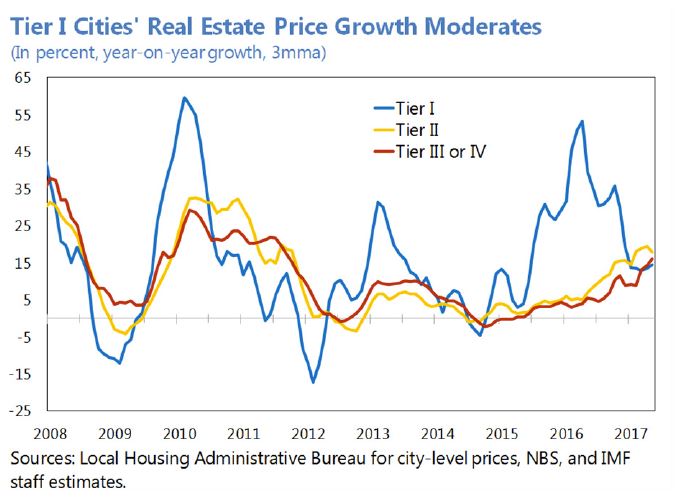

Supportive policy has promoted China’s recent high growth rates, and we have upgraded our 2017 and 2018 forecasts for China, by 0.1 and 0.2 percentage point, respectively, to 6.7 and 6.4 percent. But higher growth is coming at the cost of continuing rapid credit expansion and the resulting financial stability risks. China’s recent moves to address nonperforming loans and to coordinate financial oversight therefore are welcome.

Finally, the threat of protectionist actions and responses remains salient in the near and medium terms, as do geopolitical risks.

The longer horizon

Despite the current improved outlook, longer-term growth forecasts remain subdued compared with historical levels, and tepid longer-term growth also carries risks.

In advanced economies, median real incomes have stagnated and inequality has risen over several decades. Even as unemployment is falling, wage growth still remains weak. Thus, continuing slow growth not only holds back the improvement of living standards, but also carries risks of exacerbating social tensions that have already pushed some electorates in the direction of more inward-looking economic policies. In emerging economies in contrast, despite generally higher inequality than in advanced economies, substantial income gains have accrued even to those low in the income distribution.

The current cyclical upswing offers policymakers an ideal opportunity to tackle some of the longer-term forces behind slower underlying growth. Suitable structural reforms can raise potential output in all countries, especially if supported by growth-friendly fiscal policies including productive infrastructure investment, provided there is room in the government budget. In addition, investment in people is critical—whether in basic education, job training, or reskilling programs. Such initiatives will both increase labor markets’ resilience to economic transformation and raise potential output. The same policy measures that can help economies adjust to globalization—as described in the recent report we co-authored with the World Bank and World Trade Organization—are more broadly necessary to meet the challenges of technology and automation.

Strengthening multilateral cooperation is another key to prosperity, in a range of areas including trade, financial stability policy, corporate taxation, climate, health, and famine relief. Where domestic developments have a strong international impact, policies based narrowly on national advantage are at best inefficient and at worst highly damaging to all.

Peer Pressure: Tax Competition and Developing Economies

Economists tend to agree on the importance of competition for a sound market economy. So, what’s the problem when it comes to governments competing to attract investors through the tax treatment they provide? The trouble is that by competing with one another and eroding each other’s revenues, countries end up having to rely on other—typically more distortive—sources of financing or reduce much-needed public spending, or both.

All this has serious implications for developing countries because they are especially reliant on the corporate income tax for revenues. The risk that tax competition will pressure them into tax policies that endanger this key revenue source is therefore particularly worrisome.

Keep up with the others

Many have argued that tax competition between governments can trim wasteful spending and lead to better governance; the ‘starve the beast’ argument. But the mobility of tax bases across national borders makes this benefit less clear, whether the base relates to labor income, commodity transactions, or most commonly, capital income.

More technically, countries tend, with good reason, to tax things that are not highly responsive to taxation. But international mobility means that activities are much more responsive to taxation from a national perspective than from a collective perspective. This is especially true of the activities and incomes of multinationals. Multinationals can manipulate transfer prices and use other avoidance devices to shift their profits from high tax countries to low, and they can choose in which country to invest. But they can’t shift their profits, or their real investments, to another planet. When countries compete for corporate tax base and/or real investments they do so at the expense of others—who are doing the same. By failing to exploit the lesser responsiveness of tax base and investment at the collective level than at the national level, countries thus risk mutual harm by eroding a source of revenue that may well have been more efficient than the alternatives available to them.

Headline corporate income tax rates have plummeted since 1980, by an average of almost 20 percent. This doubtless reflects a variety of effects at work—changing views on the growth impact of corporate taxation, for instance—but it is a telling sign of international tax competition at work, which closer empirical work tends to confirm.

And even though revenues have remained steady so far in developing countries and increased in advanced economies—perhaps because, for unrelated reasons, the share of capital in national income has increased—there is nothing to guarantee that this will continue. And some developments could make tax competition more intense: if the OECD-G20 ‘BEPS’ project reduces tax avoidance, for instance, competition through other means could increase.Fiercely competitive; fiercely contentious

To better understand these issues and how they might be addressed, the IMF and World Bank recently gathered together a hundred or so tax experts and officials. Embert St. Juste, of the Ministry of Finance in St. Lucia, for instance, noted that the members of the Organisation of Eastern Caribbean States have been competing with increasing fervour over foreign direct investment and tourism. And the Finance Minister of the Republic of Serbia, Dušan Vujović, said that with greater globalization, all countries have been dragged, willingly or not, into the fray.

Kimberly Clausing, an economics professor at Reed College, presented new work suggesting that paper profits may be much more sensitive to tax rates than previously thought. She cited a recent paper that finds that for every percentage point drop in the average tax rate in a low-tax jurisdiction, profits reported there by foreign corporations of U.S. multinationals increase by between 3.5 and 7 percentage points. This remains contentious. Paul Ryan from the Irish Department of Finance suggested that the impact, particularly from more advanced economies to less, has been exaggerated. But tax competition is generally seen as a real threat to revenue, most notably for developing countries.

There is an answer: use international coordination to stop, or at least limit, the race. That, however, is much more easily said than done.

Passive-aggressive

Partial solutions can help but are inherently limited. As Michael Devereux of the University of Oxford stressed, if only some countries coordinate, they can make themselves more vulnerable to competition from those outside the group. And even if all coordinate, they can remain vulnerable if they do not do so over all relevant aspects of the tax system. Nonetheless, partial approaches can help.

Some recent proposals would fundamentally change corporate tax systems. Gaetan Nicodeme from the European Commission explained its proposal for a Common Consolidated Corporate Tax Base. Under the first stage of this, businesses operating in more than one European Union country would consolidate their taxable profits across borders, so the profits in one country could be offset against losses in another. In a second stage, their profits within the EU would be allocated for tax purposes across member states by a formula reflecting the proportions of their assets, employment or other indicators of their activities in each. This, however would not eliminate tax competition, since governments would still have an incentive to use low tax rates to attract investment, workers or whatever else appears in the allocation formula.

An alternative system that has attracted considerable attention recently in the United States is the destination-based cash-flow tax under which taxes are levied based on where goods end up (destination), rather than where they were produced. If adopted universally, and well designed, this would ease pressures of tax competition. But if adopted unilaterally by one or a few countries, it would amplify profit shifting problems for others. This is because, intuitively, profits from sales elsewhere could then be taken tax-free in those countries, which would likely lead those without a destination-based cash-flow tax to compete more aggressively, or adopt one themselves.

Issues of international tax competition are not going away anytime soon, and that there is a lot at stake for developing countries. In the face of possible tectonic shifts in tax systems, such as a move to a destination-based corporate taxation, it has become even more important to understand the cross-border impact of national tax policies and how governments react to them. This remains an issue of debate and study, and both the IMF and the World Bank plan to continue this analysis, including at this week’s high-level event co-organized with the Ministry of Finance of Indonesia. As part of the Voyage to Indonesia leading up to the World Bank-IMF Annual Meetings in 2018, the discussions will focus on the challenges that tax competition poses for the members of the Association of Southeast Asian Nations.

The Need For Granularity

An interesting working paper from the IMF “Financial Stability Analysis: What are the Data Needs?” looks in detail at the information which is required to enable regulators to understand the dynamics and early warning signs of risks to financial stability. They argue we need to get granular, and think more about “micro-prudential”. Macro-prudential is not enough. In essence, they say that whilst aggregate data may paint an acceptable picture, it can mask significant pockets of risk which are only revealed by going granular. They also call out a wide range of data gaps, from shadow banking to capital flows.

The growing incidences of financial crises and their damage to the economy has led policy makers to sharpen the focus on financial stability analysis (FSA), crisis prevention and management over the past 10–15 years. The statistical world has reacted with a number of initiatives, but does more need to be done? Taking a holistic view, based on a review of experiences of policy makers and analysts, this paper identifies common international threads in the data needed for FSA and suggests ways to address these.

While there has been an encouragingly constructive response by statisticians, not least through the G-20 Data Gaps Initiative, more work is needed, including with regard to shadow banking, capital flows, corporate borrowing, and granular data. Further, to support FSA, the paper identifies potential enhancements to the conceptual advice in statistical manuals including with regard to foreign currency and remaining maturity.

Specifically, they highlight the need to understand, at a granular level the debt profile of households and companies. We agree especially as we have significant data gaps in the Australian context, with regulators relying on relatively high-level, myopic and out of data information. Worse still many banks themselves do not have the granularity they need, so even if regulators asked for more precision, it would not be forthcoming. And confidentiality is an often used shibboleth.

Time to get granular!

To meet the need for increased availability of granular data not only could the collection of more granular data be considered but more use could be made of existing micro data (data that are collected for supervisory or micro-prudential purposes).

Other initiatives to strengthen financial institutions’ risk reporting practices include data reporting requirements arising from the implementation of Basel III and the Solvency II rules; the development of recovery and resolution plans by national banking groups; and the efforts to enhance international financial reporting standards. In addition to contributing to financial institutions’ own risk managements, the improvements in regulatory reporting can contribute to the quality of the more aggregate macro-prudential data for the assessment of system-wide financial stability risks at the national, regional, and international levels.

However, the use of micro data for macro financial assessment has its challenges, the most important being the strict confidentiality requirements associated with the use of micro data. Such requirements typically limit data sharing among statistical and supervisory agencies, and with users. But also granular information brings data quality and consistency issues that need to be dealt with to be able to draw appropriate conclusions for macro-prudential analysis. Tissot points out the importance of being able to aggregate micro information so it can be analyzed, and communicated to policy makers while on the other hand the “macro” picture on its own can be misleading, as it may mask micro fragilities that have system-wide implications.

Macro-stress testing is a key tool to assess the resilience of financial institutions and sectors to shocks and would benefit from more detailed information particularly for the top-down stress tests.

Another area where better data are needed to assess financial stability risks is related to the monitoring of the household sector. Such data include comprehensive information on the composition of assets and liabilities, and household income and debt service payments. Further, the growing interest of policy makers in the inequality gap (i.e., of consumption, saving, income and wealth) has led to a demand for distributional information.

Note: IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Norway’s House Price Boom

Does this sound familiar? From The IMF Blog.

Think Londoners and New Yorkers have it bad when it comes to sky-high house prices? Residents of Oslo have reason to gripe, too.

House prices in the Norwegian capital are among the world’s highest, as measured by the average cost of a home relative to household median income. Prices in Oslo are perhaps the most visible symptom of a real estate boom across the oil-rich, Nordic nation of 5.2 million people.

Nationwide, the cost of a home relative to income has almost doubled since the mid-1990s. Strong demand for housing in Norway has been driven by growing incomes, the rising number of households relative to housing supply, low interest rates, and generous tax incentives for home ownership.

Our Chart of the Week shows the evolution of Norway’s house price-to-income ratio compared with that in the 35 countries of the Organization for Economic Cooperation and Development, the Paris-based group of advanced economies, and euro area countries. As house prices have risen, so has household debt, which—as measured in percent of disposable income―has reached historic levels and is among the highest in the OECD.

All of this raises the risk that a large correction in house prices—driven for example by slower real income growth, a reverse in sentiment, or interest rate hikes―could weaken household finances and depress private demand, which could in turn hurt corporate and bank earnings. That’s among the messages of Norway: Selected Issues, a paper published by the IMF on July 5 in conjunction with the annual checkup, known as an Article IV Consultation.

The Norwegian authorities have already taken important steps to protect the economy from the impact of a potential housing bust, such as requiring banks to hold more capital and introducing tighter mortgage regulations. In particular, some early signs of softening in housing market conditions emerged recently following the introduction at the beginning of this year of a debt-to-income limit on new mortgages—in line with IMF’s past advice. But more may be needed if vulnerabilities in the housing sector intensify. Options could include tighter limits on loan-to-value ratios, higher mortgage risk weights, and reducing the scope for banks to deviate from mortgage regulations.

In the longer term, the ability of the financial sector and the economy more broadly to withstand housing market shocks should be strengthened through reforms like reducing tax preferences for housing, relaxing constraints on new property construction, and developing the rental market to provide more alternatives to home ownership.

The Need to Reinvigorate Trade to Boost Global Economic Growth – IMF

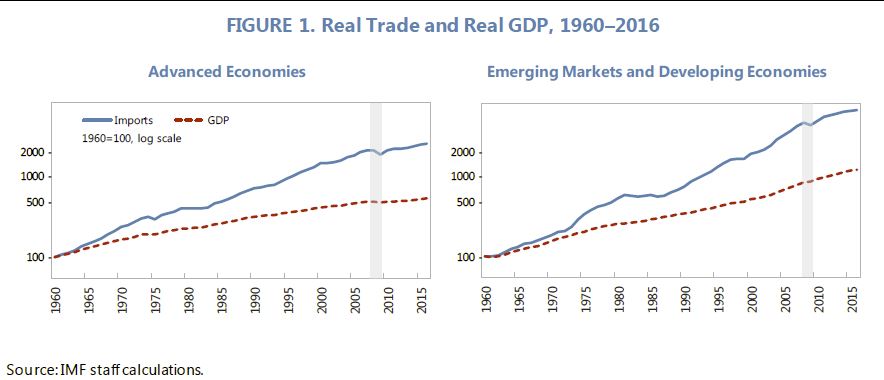

The IMF says “the sharp slowdown in global trade in recent years is both a symptom of and a contributor to low growth. After a sharp drop during the GFC and a brief rebound in its immediate aftermath, trade and output growth again slowed, with trade being unusually weak relative to past performance.

Recent analyses attribute the trade slowdown, in varying degrees, to such factors as changes in the composition of economic activity away from import-intensive investment, a slowing pace of global value chain growth and trade liberalization, and an uptick in trade protectionism. While rates of investment and of economic growth have weighed on trade, recent trade growth has been some 1 to 2 percentage points a year less than would have been expected based on the historical relationship between trade and these macroeconomic factors”.

Ms. Christine Lagarde, Managing Director of the International Monetary Fund (IMF), Mr. Jim Yong Kim, President of the World Bank, and Mr. Roberto Azevedo, Director-General of the World Trade Organization (WTO) made the following statement [today] on the occasion of the G20 Leaders’ Summit in Hamburg, Germany:

“The economic wellbeing of billions of people depends on trade. Deeper trade integration twinned with supportive domestic policies can help boost incomes and accelerate global growth. This calls for decisive actions by world leaders gathering for the G-20 Summit this week.

“The good news is that when it comes to trade, we do not need to choose between inclusiveness and economic growth.

“Evidence shows that opening of economies to trade, especially in the late 20th century, boosted incomes and living standards across advanced and developing countries. Since the early 2000’s, however, the pace of opening has largely stalled, with too many existing trade barriers and other policies that favor chosen domestic industries over the broader economy remaining in place, and new barriers being created. Such policies can cause a chain reaction, as other countries adopt similar measures with the effect of lowering overall growth, reducing output, and harming workers.

“Reinvigorating trade, packaged with domestic policies to share gains from trade widely, needs to be a key priority. One part of this is to remove trade barriers and reduce subsidies and other measures that distort trade. Stepping up trade reform is essential to reinvigorate productivity and income growth, both in advanced and in developing countries.

“But these reforms also require thinking in advance and during implementation about those workers and communities that are being negatively affected by structural economic changes. Even though job losses in certain sectors or regions have resulted to a larger extent from technology than from trade, thinking in advance about the policy package that shares trade gains widely is critical for the success of trade reforms. Without the right supporting polices, adjustment to structural changes can bring a human and economic downside that is often concentrated, sometimes harsh, and has too often become prolonged.

“This is why governments must find better ways of supporting workers. Each country needs to find its own mix of policies that is right for their circumstances. Approaches such as a greater emphasis on job search assistance, retraining, and vocational training can help those negatively affected by technology or trade to change jobs and industries. Unemployment insurance and other social safety nets give workers the chance to retool.

“Education systems may also be important to prepare workers for the changing demands of modern labor markets; that requires a commitment to life-long learning, from early childhood education, to workplace training, to online courses for seniors, just to name a few. In addition, housing, credit, and infrastructure policies could be designed so as to ease worker mobility.

“Recent analysis by the IMF, World Bank, and WTO shows that, when it comes to trade, we do not need to choose between inclusiveness and economic growth. Now is the time to press ahead with trade reforms that can deliver greater prosperity for all.”

That report showed that the number of agreements notified to the WTO has risen from about 50 in 1990 to around 280 in 2015, while their scope has also expanded. A new World Bank database documents the increasing “depth” of agreements, examining 52 policy areas and their legal enforceability. More recent preferential trade agreement (PTAs) cover substantially more policy areas than earlier PTAs, which focused primarily on tariff liberalization. Evidence points to a strong link between trade agreements and exports, particularly with respect to “deep” agreements that have broad policy coverage.

Fintech: Capturing the Benefits, Avoiding the Risks

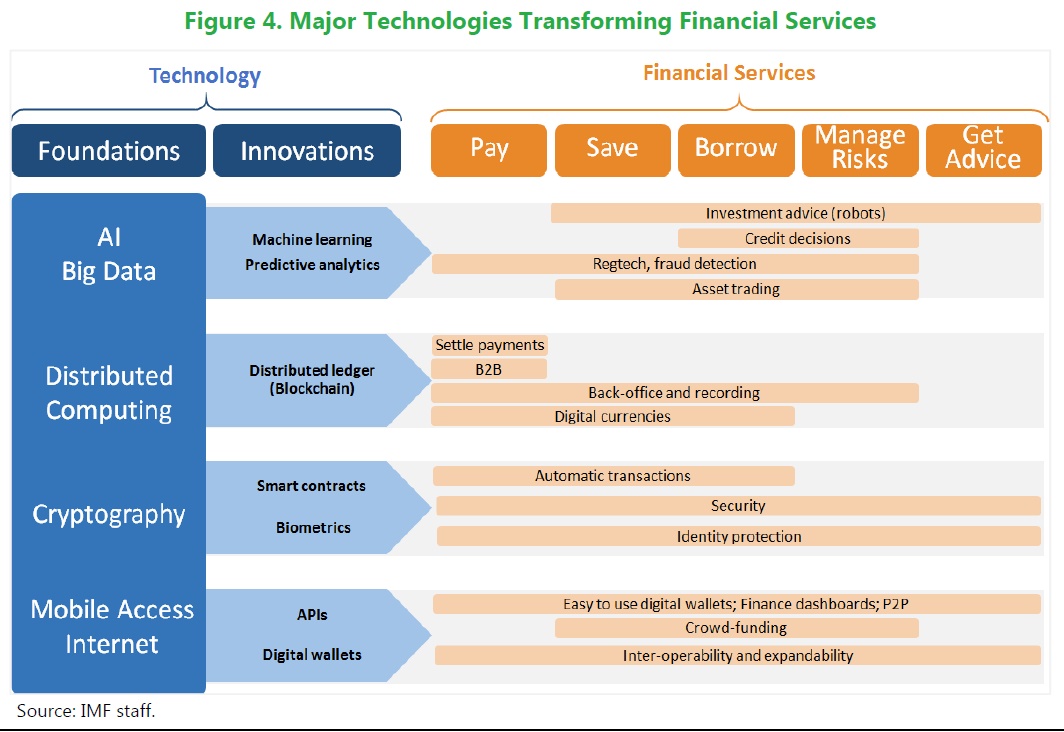

The IMF have published a paper on Fintech. From artificial intelligence to cryptography, rapid advances in digital technology are transforming the financial services landscape, creating opportunities and challenges for consumers, service providers, and regulators alike. This paper reviews developments in this new wave of technological innovations, often called “fintech,” and assesses their impact on an array of financial services. Given the IMF’s mandate to promote the stability of the international monetary system, it focuses on rapidly changing cross-border payments.

Using an economic framework, the paper discusses how fintech might provide solutions that respond to consumer needs for trust, security, privacy, better services, and change the competitive landscape. The key findings include the following:

Using an economic framework, the paper discusses how fintech might provide solutions that respond to consumer needs for trust, security, privacy, better services, and change the competitive landscape. The key findings include the following:

- Boundaries are blurring among intermediaries, markets, and new service providers.

- Barriers to entry are changing, being lowered in some cases but increased in others, especially if the emergence of large closed networks reduces opportunities for competition.

- Trust remains essential, even as there is less reliance on traditional financial intermediaries, and more on networks and new types of service providers.

- Technologies may improve cross-border payments, including by offering better and cheaper services, and lowering the cost of compliance with anti-money laundering and combating the financing of terrorism (AML/CFT) regulation.

Overall, the financial services sector is poised for change. But it is hard to judge whether this will be more evolutionary or revolutionary. Policymaking will need to be nimble, experimental, and cooperative.

When you send an email, it takes one click of the mouse to deliver a message next door or across the planet. Gone are the days of special airmail stationery and colorful stamps to send letters abroad.

International payments are different. Destination still matters. You might use cash to pay for a cup of tea at a local shop, but not to order tea leaves from distant Sri Lanka. Depending on the carrier, the tea leaves might arrive before the seller can access the payment.

All of this may soon change. In a few years, cross-border payments and transactions could become as simple as sending an email.

Financial technology, or Fintech, is already touching consumers and businesses everywhere, from a local merchant seeking a loan, to the family planning for retirement, to the foreign worker sending remittances home.

But can we harness the potential while preparing for the changes? That is the purpose of the paper published today by IMF staff, Fintech and Financial Services: Initial Considerations.

The possibilities of Fintech

What is Fintech precisely? Put simply, it is the collection of new technologies whose applications may affect financial services, including artificial intelligence, big data, biometrics, and distributed ledger technologies such as blockchains.

While we encourage innovation, we also need to ensure new technologies do not become tools for fraud, money laundering and terrorist financing, and that they do not risk unsettling financial stability.

Although technological revolutions are unpredictable, there are steps we can take today to prepare.

The new IMF research looks at the potential impact of innovative technologies on the types of services that financial firms offer, on the structure and interaction among these firms, and on how regulators might respond.

As our paper shows, Fintech offers the promise of faster, cheaper, more transparent and more user-friendly financial services for millions around the world.

The possibilities are exciting.

- Artificial intelligence combined with big data could automate credit scoring, so that consumers and businesses pay more competitive interest rates on loans.

- “Smart contracts” could allow investors to sell certain assets when pre-defined market conditions are satisfied, enhancing market efficiency.

- Armed with mobile phones and distributed ledger technology, individuals around the world could pay each other for goods and services, bypassing banks. Ordering tea leaves from abroad might become as easy as paying for a cup of tea next door.

These opportunities are likely to reshape the financial landscape to some degree but will also bring risks.

Intermediaries, so common to financial services—such as banks, firms specialized in messaging services, and correspondent banks clearing and settling transactions across borders—will face significant competition.

New technologies such as identity and account verification could lower transaction costs and make more information available on counterparties, making middlemen less relevant. Existing intermediaries may be pushed to specialize and outsource well-defined tasks to technology companies, possibly including customer due-diligence.

But we cannot ignore the potential advances in technology that might compromise consumer identities, or create new sources of instability in financial markets as services become increasingly automated.

Rules that will work effectively in this new environment might not look like today’s rules. So, our challenge is clear—how can we effectively build new regulations for a new system?

Regulating without stifling innovation

First, oversight needs to be reimagined. Regulators now focus largely on well-defined entities, such as banks, insurance companies and brokerage firms. They may have to complement this focus with more attention on specific services, regardless of which market participants offers them. Rules would be needed to ensure sufficient consumer safeguards, including privacy protection, and to guard against money laundering and terrorist financing.

Second, international cooperation will be critical, because advances in technology know no borders, and it will be important to keep networks from moving to less regulated jurisdictions. New rules will need to clarify the legal status and ownership of digital tokens and assets.

Finally, regulation should continue to function as an essential safeguard to build trust in the stability and security of the networks and algorithms.

The launch or our paper today is one of the steps in the process of preparing for this new digital revolution. As an organization with a fully global membership, the IMF is uniquely positioned to serve as a platform for discussions among the private and public sectors on the rapidly evolving topic of Fintech.

As our research shows, adapting is not only possible, but it is the only way to ensure that the promise of Fintech is enjoyed by everybody