The BIS is worried by the current low interest rate environment, and in a new report by a committee chaired by Philip Lowe warn of the impact on financial stability across the financial services sector, with pressures on banks via net interest margins, and on insurers and super funds. They warn that especially in competitive markets, risks rise in this scenario. Low interest rates may trigger a search for yield by banks, partly in response

to declining profits, exacerbating financial vulnerabilities.

In addition, keeping rates low for longer may create the need to lift rates sharper later with the risks of rising debt costs and the broader economic shock which follows. A salutatory warning!

Interest rates have been low in the aftermath of the Global Financial Crisis, raising concerns about financial stability. In particular, the profitability and strength of financial firms may suffer in an environment of prolonged low interest rates. Additional vulnerabilities may arise if financial firms respond to “low-for-long” interest rates by increasing risk-taking.

Interest rates have been low in the aftermath of the Global Financial Crisis, raising concerns about financial stability. In particular, the profitability and strength of financial firms may suffer in an environment of prolonged low interest rates. Additional vulnerabilities may arise if financial firms respond to “low-for-long” interest rates by increasing risk-taking.

The decade following the Great Financial Crisis (GFC) has been marked by historically low interest rates. Yields have begun to recover in some economies, but they are expected to rise only slowly and to stabilise at lower levels than before, weighed down by a combination of cyclical factors (eg lower inflation) and structural factors (eg productivity, demographics). Moreover, observers put some weight on the risk that interest rates may remain at (or fall back to) very low levels, a so-called “low-forlong”

scenario. An environment characterised by “low-for-long” interest rates may dampen the profitability and strength of financial firms and thus become a source of vulnerability for the financial system. In addition, low rates could change firms’ incentives to take risks, which could engender additional financial sector vulnerabilities.

In light of these concerns, the Committee on the Global Financial System (CGFS) mandated a Working Group co-chaired by Ulrich Bindseil (European Central Bank) and Steven B Kamin (Federal Reserve Board of Governors) to identify and provide evidence for the channels through which a “low-for-long” scenario might affect financial stability, focusing on the impact of low rates on banks and on insurance companies and private pension funds (ICPFs).

Now a report by the Committee on the Global Financial System finds that low market interest rates for a long time could have implications for financial stability as well as for the health of individual financial institutions. Philip Lowe, Chair, Committee on the Global Financial System and Governor, Reserve Bank of Australia said:

“The adjustment of financial firms to a low interest rate environment warrants further investigation, especially when low rates are associated with a generalised overvaluation of risky assets. I hope that this reports provides both a sound rationale for ongoing monitoring efforts and a useful starting point for future analysis”.

Financial stability implications of a prolonged period of low interest rates identifies channels through which a “low-for-long” interest rate scenario might affect the health of banks, insurance companies and private pension funds.

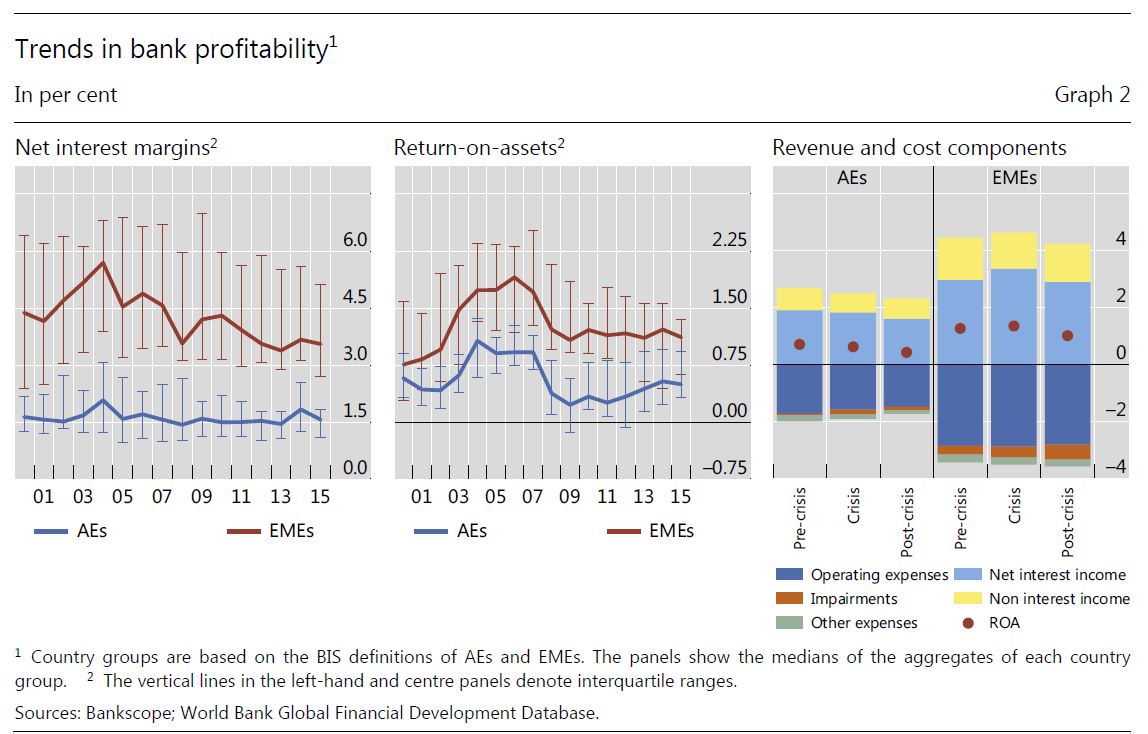

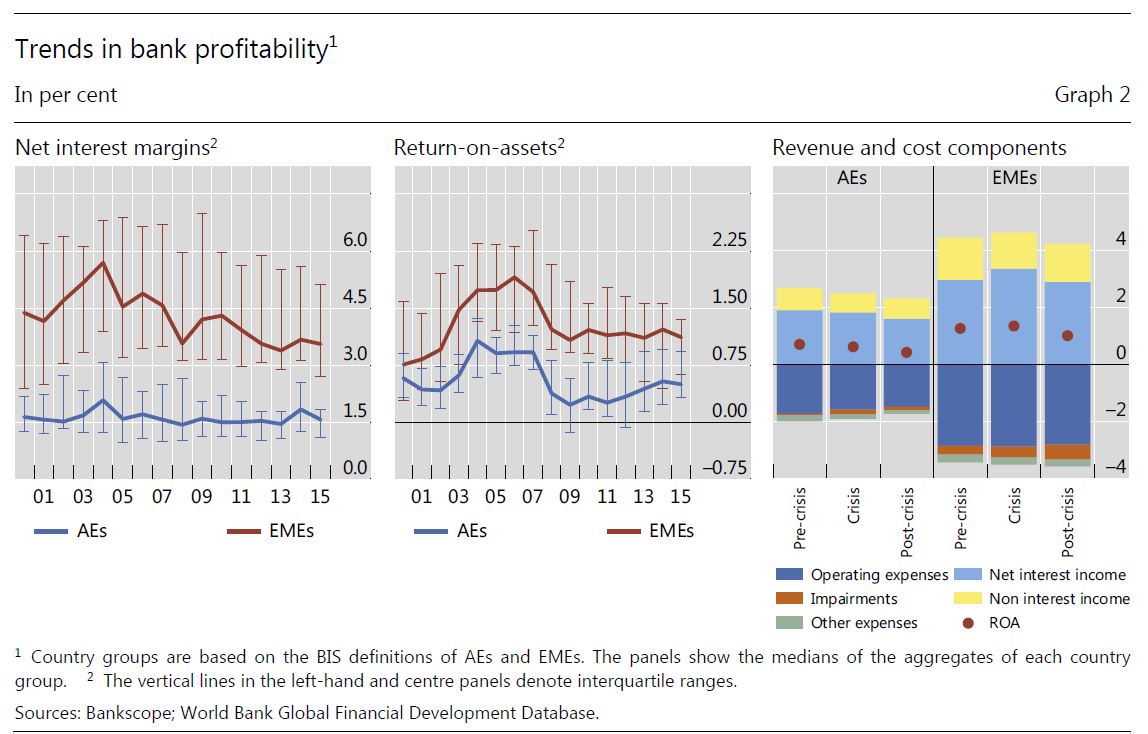

For banks, based on econometric evidence, simulation models, and reviews of past stress tests, the Working Group found considerable evidence that low interest rates and shallower yield curves depress net interest margins (NIMs). This effect was more pronounced for banks facing constraints on their ability to reduce deposit rates, for example, because of very low interest rates or strong competitive pressures. low rates might reduce resilience by lowering profitability, and thus the ability of banks to replenish capital after a negative shock, and by encouraging risk-taking. These effects can be expected to be particularly relevant for banks operating in jurisdictions where nominal deposit rates are constrained by the effective lower bound, leading to compressed net interest margins. For banks in emerging market economies (EMEs), such adverse effects might materialise not only as a result of low domestic interest rates but also as a consequence of “spillovers” from low interest rates in advanced economies (AEs), which can encourage capital inflows into EMEs, excessive local credit expansion, and heightened competitive pressures for EME banks.

Lower for longer would be harder on insurers and pension funds than on banks. Even though the CGFS analysis did not show that measures of firms’ financial soundness dropped significantly, prolonged low rates could still involve material risks to financial stability. In particular, a “snapback”, involving an unexpected sudden increase in market rates from currently low levels, could affect banks’ solvency and create liquidity issues for insurers and pension funds.

“A key takeaway is that, while a low-for-long scenario presents considerable solvency risk for insurance companies and pension funds and limited risk for banks, a snapback would alter the balance of vulnerabilities,”

Chair Philip Lowe, said.

“The first line of defence against these risks should be to continue to build resilience in the financial system by encouraging adequate capital, liquidity and risk management. But the report also underscores the need to monitor institutions’ exposures in a comprehensive way, including through stress tests.”

The CGFS is a central bank forum for the monitoring and analysis of broad financial system issues. It supports central banks in the fulfilment of their responsibilities for monetary and financial stability by contributing appropriate policy recommendations.