QBE Insurance reported their full year 2017 results today and reported a statutory 2017 net loss after tax of $1,249 million, which compares with a net profit after tax of $844 million in the prior year.

This is a diverse and complex group, which is now seeking a path to rationalisation. They declared their Asia Pacific result “unacceptable” and said the strategy was to “narrow the focus and simplify back to core” with a focus on the reduction in poor performing segments.

This begs the question. What is the status of their Lenders Mortgage Insurance (LMI) business? They reported a higher combined operating ratio consistent with a cyclical slowdown in the Australian mortgage insurance industry, higher claims and a lower cure rate. Very little detail was included in the results, but this aligns with similar experience at Genworth who reported a 26% drop in profit, the listed monoline and provides greater insight into the mortgage sector.

This begs the question. What is the status of their Lenders Mortgage Insurance (LMI) business? They reported a higher combined operating ratio consistent with a cyclical slowdown in the Australian mortgage insurance industry, higher claims and a lower cure rate. Very little detail was included in the results, but this aligns with similar experience at Genworth who reported a 26% drop in profit, the listed monoline and provides greater insight into the mortgage sector.

Both LMI’s are experiencing similar stresses, with lower premium income, and higher claims. And this before the property market really slows, or interest rates rise! Begs the question, how secure are the external LMI’s?

QBE LMI reported a combined operating ratio of 50.7%, up from 34.9% in the prior year, largely reflecting an increase in the net claims ratio to 33.0% from 21.2% previously. The net claims ratio deteriorated due to a moderate increase in arrears rates, primarily related to properties located in mining towns in Western Australia and Queensland, coupled with an increase in the propensity for claims in arrears to generate claims (a reduced “cure” rate) and an increase in average claims severity. The commission ratio increased to 4.5% from 1.8% in the prior year, reflecting a lower exchange commission following the non-renewal of our external quota share reinsurance treaty. Note that QBE LMI (is required to) has their own reinsurance protection.

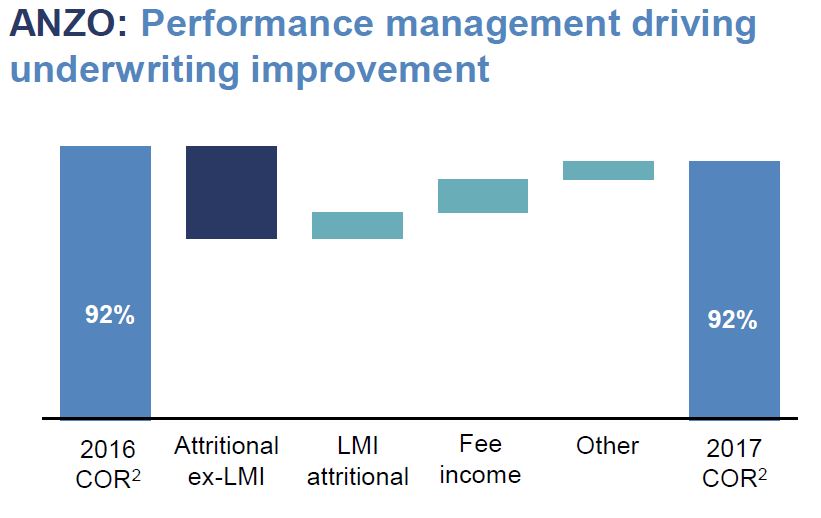

Notwithstanding reduced LMI earnings, Australian & New Zealand Operations’ combined operating ratio improved to 92.0% from 92.4% in the prior period, underpinned by a 1.8% improvement in the attritional claims ratio or 2.5% excluding LMI.

The overall results for the group includes the significant non-cash impairment of goodwill ($700 million) and write down of the deferred tax asset following the reduction in the US corporate tax rate ($230 million) in our North American Operations.

Overall, the results reflect the record cost of catastrophes in the second half of 2017 together with deterioration emerging markets businesses and two significant non-cash items. Notwithstanding comprehensive reinsurance protections, the net cost of catastrophes for QBE (after reinsurance) was $1,227 million in 2017 compared with $439 million in 2016.