We are seeing new content formats, streamed video and advertising seamlessly integrated in a social context, providing an immersive and frictionless media experience. This manifests in many ways including the broadcast of live sports on Twitter, integrated news feeds through Facebook instant articles, music streaming embedded into Twitter or the use of bots to deliver a ‘conversational’ two-way news experience. Social media is increasingly powerful in shaping our media consumption experiences. This year, we are seeing the popularity of more immersive forms of content and media. Going to the movies saw an increase of 20% since last year, and although nascent, the arrival of virtual reality (VR) is upon us with the majority of respondents (58%) believing it will enhance their viewing experience. Video advertising or live streaming integrated into social platforms is the new norm.

At the same time, we seem to be becoming more engaged with the content that we consume – this year sees multi-tasking while watching TV remain at almost ubiquitous levels, but we are doing fewer additional activities at the same time. More of us are paying for the video content that we want – 22% of respondents pay for a subscription video on demand (SVOD) service and we pay more attention to content that we have paid for (70% of respondents agree they tend to pay closer attention to content that they have paid to watch). We would rather pay for TV shows than be distracted by ads (43% of respondents agree) and in news, where we are willing to pay for news online, it is because we value the in-depth analysis.

This year we have focused on the Millennial effect – the extent to which Millennials are shaping the future of media consumption.

There are many behaviours which are subsequently adopted by Xers, Boomers and even Matures. But there are key differences within the ‘Millennials’ demographic. Trailing Millennials (14-26 year-olds) are the true digital natives, observable in distinct behaviours such as higher adoption of streaming as a means for accessing TV content (used more than live programming), increased willingness to pay for all forms of digital content and more pronounced digital habits such as bingeing and multi-tasking.

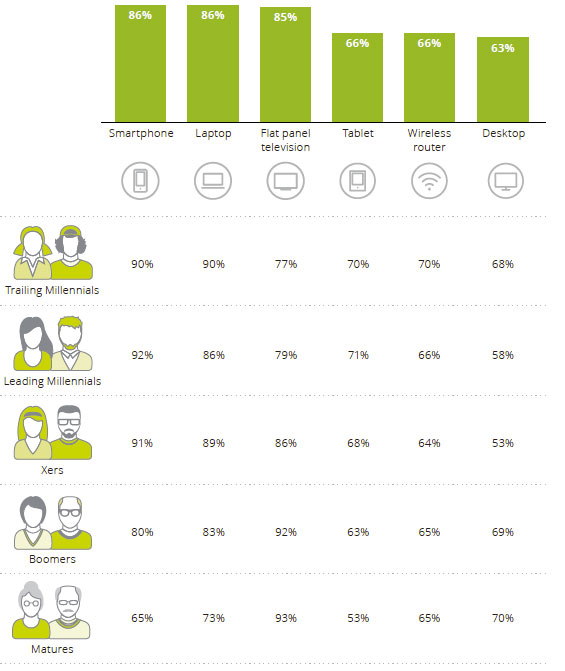

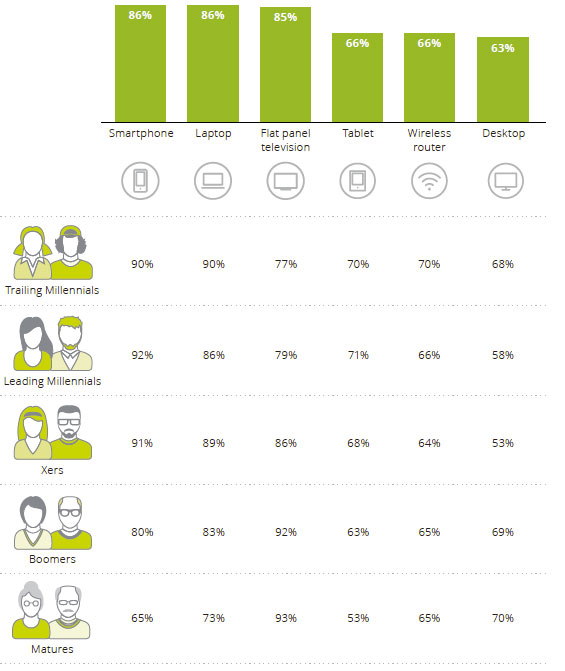

Highlights include, the number of connected devices we maintain continues to increase – 56% of survey respondents are digital omnivores (owning a smartphone, laptop and tablet), up from 50% last year. Device selection is all about convenience with 69% of respondents agreeing that being able to watch content when they want is more important than the device on which they watch it. Managing all these devices can be difficult, with 39% of respondents believing that managing all the connected technology in their house is so complex that they require help to operate it.

Sixty-one percent of Australian survey respondents engage with social media on a daily basis – up slightly since last year (59%) and representing 31% growth (CAGR) since 2013. This increase is observed across all age groups, although the fastest rates of growth over the past four years have been among Boomers (38% CAGR) and Matures (40% CAGR).

Sixty-one percent of Australian survey respondents engage with social media on a daily basis – up slightly since last year (59%) and representing 31% growth (CAGR) since 2013. This increase is observed across all age groups, although the fastest rates of growth over the past four years have been among Boomers (38% CAGR) and Matures (40% CAGR).

Uptake is greatest within Millennials with only 4% of Leading Millennials not actively using social media. Of those who do use social media, 77% of Trailing and 84% of Leading Millennials engage with these networks on a daily basis. Among Matures, there are two camps – as many Mature respondents are checking their social networks daily (36%) as there are not using social media at all (37%). For Boomers, nearly half are daily users (47%), whilst only a quarter (25%) aren’t on any form of social network.

Uptake is greatest within Millennials with only 4% of Leading Millennials not actively using social media. Of those who do use social media, 77% of Trailing and 84% of Leading Millennials engage with these networks on a daily basis. Among Matures, there are two camps – as many Mature respondents are checking their social networks daily (36%) as there are not using social media at all (37%). For Boomers, nearly half are daily users (47%), whilst only a quarter (25%) aren’t on any form of social network.

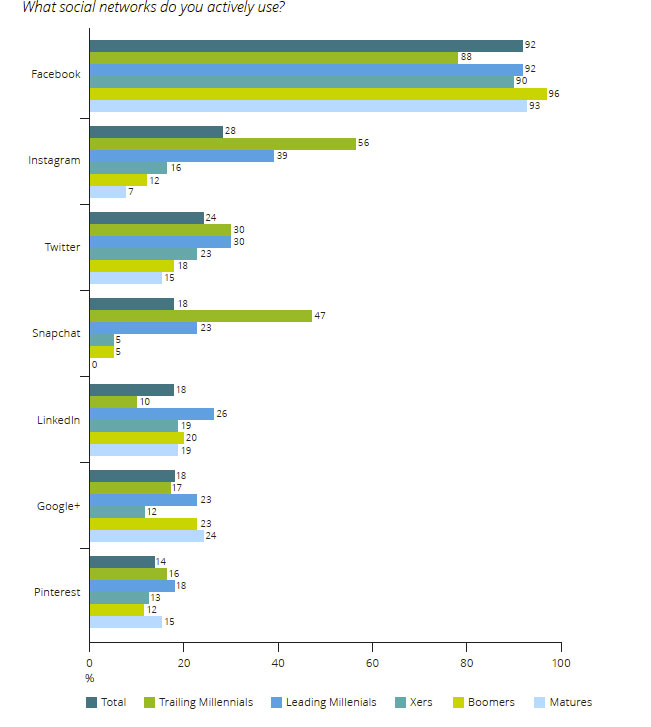

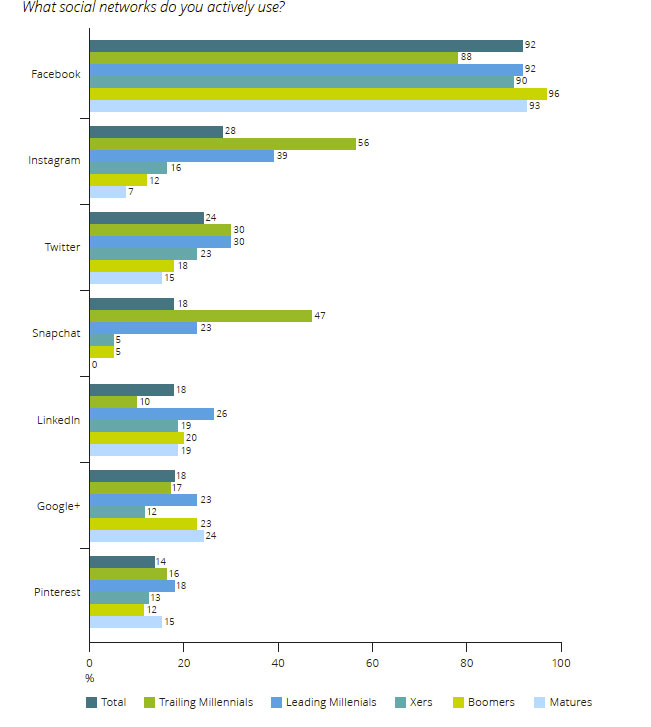

Twenty-seven percent of social media users check or update their status four or more times a day (up from 23% in 2015). These heavy users are predominately Millennials, although this year they are also joined by some more socially active Boomers and Matures. And as the mix of generations actively engaging with social media changes, it helps to know who is using what and why. Friends, followers, or connections? Facebook is the big winner among social networks. It is by far the most commonly used – 92% of survey respondents who use social media are actively using Facebook and this is reflected across generations. Facebook has become the centre of our social (media) lives, used to ‘keep up’ (in all senses) with our near and dear, whether they are near or far.

Seventy-eight percent of users rank ‘keeping up with friends and family’ in their top three reasons for using Facebook. Being connected with others is more important to them than other reasons for use, such as entertainment (43%) or simply distraction (42%). But what this connection really means is more nuanced. Facebook has shifted our definition of what it means to be a ‘friend’ or to be ‘connected’. It is a platform focused on growing user interactions and now boasts a plethora of services to achieve this outcome (e.g. posts, photos, videos, live video, messenger, games and news sharing). Using Facebook can perhaps now best be seen as something of a habit, less about real connections and more about keeping up with the facade that people curate (intentionally or not) on their profile pages.

As a consequence, for some it might be starting to lose its appeal. Younger generations are not the most represented on Facebook, it’s their parents and grandparents. Ninety-six percent of Boomers who are using social media are actively using Facebook, surpassing the 92% of Leading Millennials who are. And of all generational groups, Trailing Millennial social networkers are using Facebook the least, with 88% identifying as active users.

The youngest generation – the most prolific users of social media – are looking further for their social media needs and newer (post-2010) social networks are catching on. The second and third most actively used social networks are Instagram (owned by Facebook) and Twitter – though they significantly lag the scale of Facebook (28% and 24% of survey respondents who use social media are on these two platforms). Instagram’s appeal is in the visual moment captured; 66% of survey respondents rank ‘sharing photos and videos’ in their top three reasons for use. In contrast, survey respondents value Twitter for both entertainment (56%) and keeping up to date on breaking news (52%).