With the publication of ASIC’s remuneration review imminent, broking faces a tough summer, and as temperatures rise, so do tensions within the industry. So when global investment bank UBS published a report claiming that mortgage fraud was “systemic”, and driven by brokers, the reaction from the industry was swift and predictably outraged.

In an environment of suspicion, UBS’ report is the last thing the industry needs right now. Surveying 1,228 Australians, the report found that 32% of customers who secured a mortgage through a broker misrepresented at least part of their application; and of that 32% more than half said their broker told them to do it – furthermore this figure was higher in 2016 than in 2015.

Broker clients were significantly more likely to overstate income and understate other debts, according to the report. UBS’ conclusion was damning: “We believe banks need to tighten underwriting standards via the broker channel, even at the expense of near-term market share.”

Covered by the ABC and The Australian, UBS’ findings quickly spread beyond finance into mainstream news, and have been noticed by the regulators. On being asked about fraud by the Senate Economics Legislation Committee, APRA chairman Wayne Byres noted that “we have told the larger institutions that we’ll be asking them to have their external auditors do a review of what are essentially fraud control mechanisms to ensure that there are mechanisms in place and … are working,” according to The Australian. UBS’ report clearly cannot be ignored so, MPA asks, should the industry be seriously concerned?

The problems with UBS’ survey

FBAA CEO Peter White has made his views quite clear: “This really should not be taken seriously … I believe that not only are these figures wrong, but that they are based on claims that can never be verified.”

He’s not been the only one to question UBS’ methodology. Lawyer Matthew Bransgrove, author of Avoiding Mortgage Fraud in Australia, told MPA that he is “dismissive” of the report: “It is a self-assessed survey. Obtaining money by deception is a criminal offence in all jurisdictions in Australia, so it would be surprising if those who were fraudulent were candid.”

The MFAA also criticised the report.

UBS’ approach of asking borrowers to admit they lied on applications – even under the condition of anonymity – hardly seems likely to get honest responses from people. Yet to UBS this uncertainty is a reason for more concern, for the report states that “if anything we believe it is more likely these figures may understate the level of misrepresentation in mortgage applications, as some respondents may not want to state they were less than completely accurate despite anonymity.”

It’s possible that borrowers may simply be mistaken. Talking to MPA about fraud prevention, Mortgage Choice CEO John Flavell questioned whether borrowers really understood their application: “Can every single respondent who said their lender and/ or broker misrepresented their financials in their loan application pinpoint exactly what is was that was fraudulent?”

UBS’ report states that “respondents were required to be personally and deeply involved in the discussion and completion of the mortgage paperwork” but, again, we don’t know how or if they verified that.

As for the blame game, proving that 41% of 2016’s “not completely accurate” applications were because of brokers rather than the borrower is, again, extremely difficult to verify. UBS’ survey was done online, and although it involved 63 questions, whether it goes into enough detail to prove a broker encouraged misrepresentation is again doubtful.

Don’t get too comfortable

Picking holes in UBS’ report doesn’t prove broking doesn’t have a problem, however. Fraud and misrepresentation in mortgage applications are real problems, according to Veda’s 2015 Cybercrime and Fraud Report. Fraudulent mortgage applications made up 17% of all attempted fraud – second only to credit cards – and broker fraud had risen by a quarter, to represent 21% of fraud overall. Meanwhile, fraud through bank branches has fallen by a quarter to 11% of fraud overall.

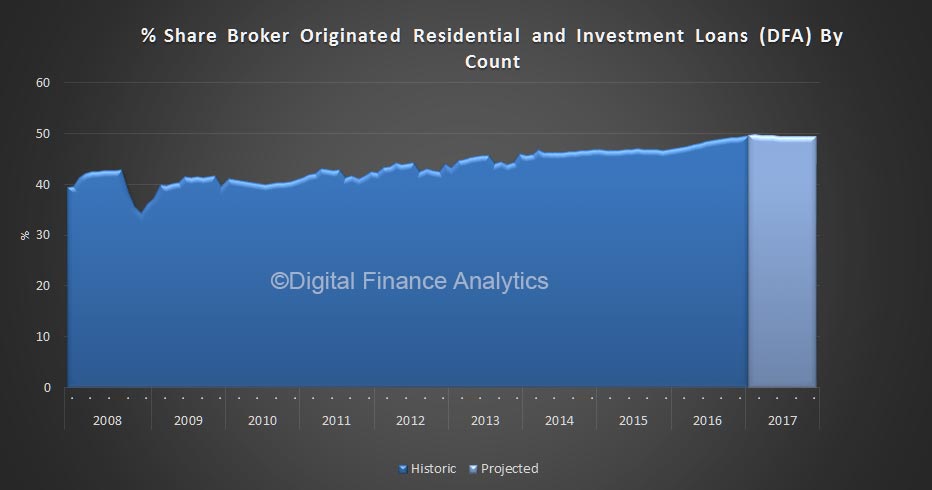

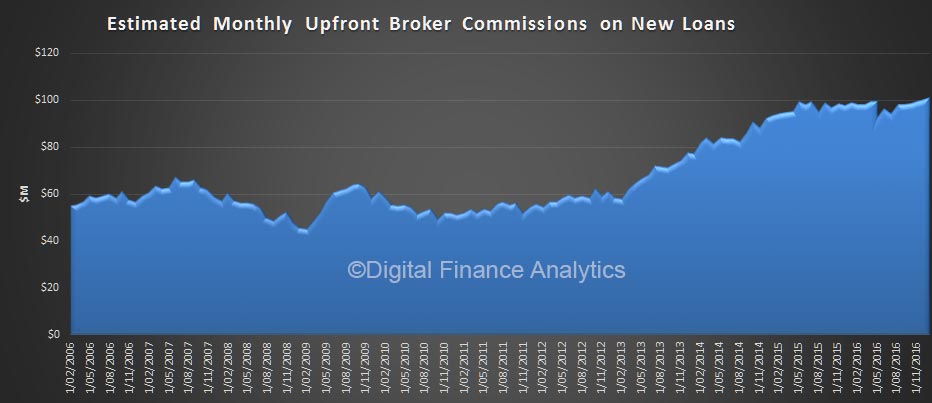

Worsening housing affordability could drive systemic fraud. Asked about fraud, Martin North, principal of Digital Finance Analytics, noted that consumers “know they have to do a double somersault backwards to get into the market”.

Nevertheless, North cautioned, broker advice was “not the same as telling porkies, but I guess it’s a gradation. I don’t see structural issues coming through. We know brokeroriginated loans are slightly more risky, but that’s only two to three points more risk, and it’s partly to do with the business mix in that channel.”

ASIC regularly bans brokers for fraud, most recently Bernard Meehan in October; Jennifer Farias in September and Madhvan Nair in July. Since July 2010, ASIC has banned 74 individuals or companies from providing credit services, including 32 permanent bans, and prosecuted 12 in court.

Individual cases, however, don’t back up suggestions that fraud is “systemic”. The closest to that the industry has seen was earlier this year, when Westpac and ANZ admitted they were hit by hundreds of loan frauds involving fraudulent Chinese documents. The Australian Financial Review, which reported the story, claimed that mortgage brokers had been involved. ANZ spokesman Paul Edwards told the AFR that “the issue is relatively small” and that the value of loans inflicted was well under $1bn.

Several of the major and non-major banks later pulled back from the foreign buyer market, although this could also be attributed to changing capital requirements.

Fraud and turnaround times

UBS’ second claim is just as concerning for brokers, and relates to turnaround times: “While the banks continue to target greater automation and faster mortgage approval process to improve customer service and maintain market share, this may be coming at the expense of rigour in credit assessment.”

Turnaround times are critical for brokers, and consistently voted their No.1 concern (above interest rates) in MPA’s Brokers on Banks survey.

Many banks have highperformer segments, whose members get preferential turnaround times; others are investing huge amounts in automating as much of the lending progress as possible. One of these is ING DIRECT, whose LendFast system aims to cut turnaround times by a third and is the largest investment in broking infrastructure the bank has ever made.

While agreeing that fraud remains a risk, ING CEO Uday Sareen told MPA that “there is absolutely no compromise when cutting down turnaround times or any relaxation in our systems and policies to prevent fraud.” In fact, Sareen claims that by automating more of the workflow, LendFast actually has the opposite effect.

“The element of discretion and rules and parameters that get hardcoded actually reduce the potential and the incidence of fraud,” he said.

Asked by MPA, Suncorp Bank’s executive manager of lending, Barbara O’Conor Nash, also pointed to automatic fraud checking,noting that: “We continuously review our processes to ensure we’re addressing any known real or emerging risks. Application, property and income verification are critical parts of our lending practices and the bank also uses extensive automated fraud processes, which work in parallel.”

Automated fraud prevention has come a long way in recent years, driven by Veda’s Shared Fraud Database, which automatically flags individuals previously involved in fraud when they apply for credit.

Yet, evidently, software can only go so far: in May, CBA introduced individual checking of applications by a case officer, to help detect whether brokers are deliberately engaging in fraudulent behaviour. Mortgage Choice told MPA they also conduct regular in-depth checks of their brokers, including annual “mystery shopper” visits and annual compliance checks of multiple applications.

Fraud expert Bransgrove is confident fraud prevention tactics are getting better, not worse.

“The threat is reducing because of the Veda database, the vigilance of aggregators and brokers, and because of the good work ASIC is doing in removing the bad eggs from the industry,” he said.

UBS’ report, Bransgrove’s comments and Veda’s aforementioned figures make for confusing reading, because they point in such different directions. Veda’s figures show that mortgage fraud is down, but increasingly more likely to go through the broker channel than branches, suggesting that fraud prevention, while effective, is more effective in some areas than others. This would support UBS’ view that mortgage brokers “are a potential area of weakness” in the fight against fraud.

Clearly more research is needed to determine whether that potential weakness really translates into systemic problems in reality; Veda’s 2016 fraud report late in the year will therefore become essential reading.

Counter-intuitively, with such heightened regulator tension, simply dismissing fraud allegations may do more damage than publicly engaging with efforts to stamp out what is an age-old problem.