Other lenders have moved to fill the gap, including developers themselves, but lending hurdles are higher across the board. Foreign nationals looking to obtain finance in Australia are often left disappointed in the current environment.

While the big four are not writing new loans for non-residents, some do still consider loans for temporary visa holders.

Lending criteria for foreign nationals varies across the big four.

Westpac is not writing new loans for non-residents.

The Commonwealth Bank doesn’t provide loans to non-residents. CBA has a maximum LVR of 70 per cent for selected temporary visa holders earning Australian income.

ANZ no longer lends to foreign nationals. Applicants must be permanent residents of Australia, NZ citizens, or 457 visa holders. Applicants are allowed to have a maximum of 30 per cent foreign income, with specific documentation required to verify it.

For National Australia Bank, a maximum LVR of 60 per cent applies for temporary visa holders living in Australia, and 70 per cent for Australia and New Zealand citizens and permanent residents living overseas. All foreign income is ‘shaded’ by 40 per cent when assessing serviceability.

HSBC and Citigroup are said to be filling the gap when finance isn’t available from the big four, according to some reports, but both banks did not reply to requests for information.

John Kolenda, Managing Director of 1300HomeLoan, told SCHWARTZWILLIAMS it is more challenging for foreigners to obtain housing finance in Australia than in the past, but it’s not impossible.

He said, “Some, mainly second-tier lenders, are still lending to foreign nationals. However, these applicants must meet strict credit criteria and maximum LVRs have been significantly reduced over the last 18 months, making obtaining a non-resident loan quite challenging.”

Kolenda said demand from foreign nationals for Aussie loans is as “strong as ever”, but doesn’t always get the borrower over the line.

“The problem is some applicants are simply unable to meet the lender’s credit criteria leaving many foreign nationals without the ability to obtain funds in Australia to purchase a property,” he said.

Though tighter lending restrictions at the big four banks has, to a certain degree, simply shifted demand to other lenders, Kolenda says those “other lenders” are also constrained in their lending.

“These lenders in many cases have increased interest rates, tightened credit criteria and reduced maximum LVRs on non-resident loans,” he said, adding, “many non-resident borrowers may find difficulty obtaining a loan from all lenders at the moment.”

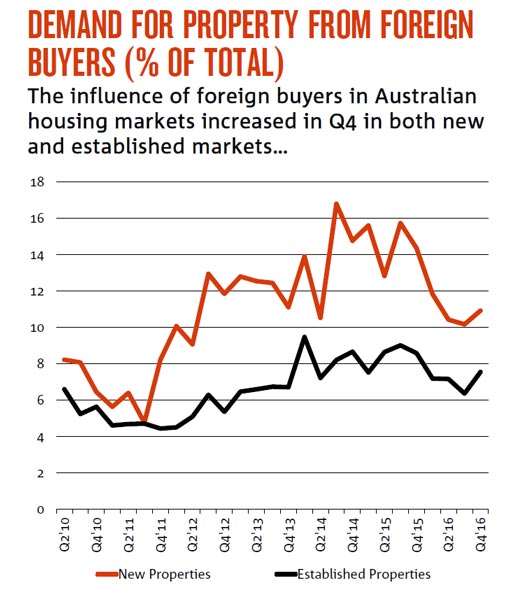

According to NAB’s Residential Property Survey, foreign buyers increased their share of both new and established property markets in the final quarter of 2016, the first increase since late 2015.

The share of new property sales made by foreign nationals increased to 10.9 per cent during the December 2016 quarter. The rise follows four quarters of declining rates – no doubt an impact of the tighter lending rules. The recovery at the end of the year could indicate foreign nationals are finding finance elsewhere as alternatives to the major banks spring up.

In new property markets, foreign buyers were noticeably more prevalent in Victoria, where their market share of sales rose to 19.3 per cent, up from 15.0 per cent in the previous quarter.

The same trend was observed in the share of foreign buyers purchasing existing dwellings, which rose to 7.6 per cent in the fourth quarter of 2016, up from 6.4 per cent the previous quarter, and the highest result since the final quarter of 2015.