APRA has issued new guidance for residential mortgage lending and tabled proposed changes to the bank mortgage reporting framework. Actually this does not seem to move the risk dial very far, but makes earlier guidance more specific and tidies up what were previously ad hoc reporting requests.

APRA has issued new draft guidelines for Residential Mortgage Lending, and is inviting responses by 19th December. These include revisions to Prudential Practice Guide APG 223 Residential mortgage lending to incorporate measures either announced by APRA in December 2014 or communicated to authorised deposit-taking institutions (ADIs) since that time. APRA expects to finalise the revised guidance in the first quarter of 2017.

APRA has issued new draft guidelines for Residential Mortgage Lending, and is inviting responses by 19th December. These include revisions to Prudential Practice Guide APG 223 Residential mortgage lending to incorporate measures either announced by APRA in December 2014 or communicated to authorised deposit-taking institutions (ADIs) since that time. APRA expects to finalise the revised guidance in the first quarter of 2017.

They include more specific guidance on risk culture, compliance, affordability buffers, interest only loans and loans to SMSF.

Here are the main changes proposed.

“Failure to meet responsible lending conduct obligations, such as the requirement to make reasonable inquiries about the borrower’s requirements and objectives, or failure to document these enquiries, can expose an ADI to potentially significant risks. A prudent ADI would conduct a periodic assessment of compliance with responsible lending conduct obligations to ensure it does not expose itself to significant financial loss”.

“An ADI’s serviceability tests are used to determine whether the borrower can afford the ongoing servicing and repayment costs of the loan for which they have applied”.

“APRA expects that any material changes to an ADI’s serviceability policy would be analysed and the potential impact on the risk profile of new loans written would be reported to appropriate risk governance forums. Reference to competitors’ policies as the primary justification for policy changes would be seen by APRA as indicative of weak risk governance”.

“ADIs generally use some form of net income surplus (NIS) model to make an assessment as to whether the borrower can service a particular loan, based on the nature of the borrower’s income and expenses”

“Good practice would ensure that the borrower retains a reasonable income buffer above expenses to account for unexpected changes in income or expenses as well as for savings purposes. It would be prudent for ADIs to monitor the level of, and trends for, lending to borrowers with minimal income buffers. High or increasing levels of marginal borrowers may indicate elevated serviceability risk”.

“A prudent ADI would include various buffers and adjustments in its serviceability assessment model to reflect potential increases in mortgage interest rates, increases in a borrower’s living expenses and decreases in the borrower’s income, particularly for less stable income sources”

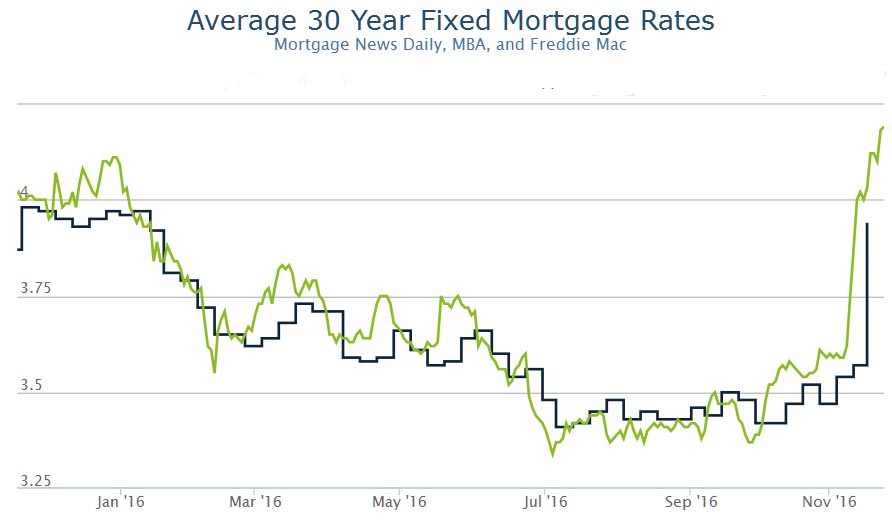

“Good practice would apply a buffer over the loan’s interest rate to assess the serviceability of the borrower (interest rate buffer). This approach would seek to ensure that potential increases in interest rates do not adversely impact on a borrower’s capacity to repay a loan. The buffer would reflect the potential for interest rates to change over several years. APRA expects that ADI serviceability policies should incorporate an interest rate buffer of at least two percentage points. A prudent ADI would use a buffer comfortably above this”.

“In addition, a prudent ADI would use the interest rate buffer in conjunction with an interest rate floor, to ensure that the interest rate buffer used is adequate when the ADI is operating in a low interest rate environment. Prudent serviceability policies should incorporate a minimum floor assessment interest rate of at least seven per cent. Again, a prudent ADI would implement a minimum floor rate comfortably above this”.

“APRA expects ADIs to fully apply interest rate buffers and floor rates to both a borrower’s new and existing debt commitments. APRA expects ADIs to make sufficient enquiries on existing debt commitments, including consideration of the current interest rate, remaining term, and outstanding balance and amount available for redraw of the existing loan facility, as well as any evidence of delinquency. ADIs using a proxy to estimate the application of interest rate buffers and floor rates to the servicing cost of existing debt commitments would, to be prudent, ensure that such a proxy is sufficiently conservative in a range of situations, updating the methodology to reflect prevailing interest rates”.

“APRA also expects ADIs to use a suitably prudent period for assessing the repayment of outstanding credit card or other revolving personal debt when calculating a borrower’s expenses”.

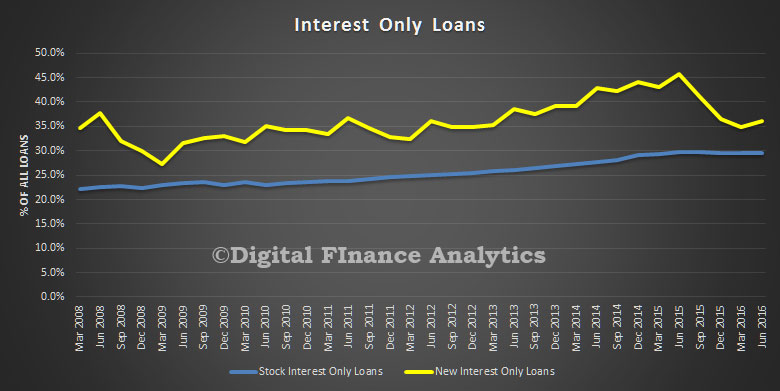

“For interest-only loans, APRA expects ADIs to assess the ability of the borrower to meet future repayments on a principal and interest basis for the specific term over which the principal and interest repayments apply, excluding the interest-only period”.

“When assessing a borrower’s income, a prudent ADI would discount or disregard temporarily high or uncertain income. Similarly, it would apply appropriate adjustments when assessing seasonal or variable income sources. For example, significant discounts are generally applied to reported bonuses, overtime, rental income on investment properties, other types of investment income and variable commissions; in some cases, they may be applied to child support or other social security payments, pensions and superannuation income. Prudent practice is to apply discounts of at least 20 per cent on most types of non-salary income; in some cases, a higher discount would be appropriate. In some circumstances, an ADI may choose to use the lowest documented value of such income over the last several years, or apply a 20 per cent discount to the average amount received over a similar period”.

“In the case of investment property, industry practice is to include expected rent on a residential property as part of a borrower’s income when making a loan origination decision. However, it would be prudent to make allowances to reflect periods of non-occupancy and other costs. ADIs would normally place less reliance on third party estimates of future rental income than on actual rental receipts from a property. In APRA’s view, prudent serviceability policies incorporate a minimum haircut of 20 per cent on expected rental income, with larger haircuts appropriate for properties where there is a higher risk of non-occupancy or where fees and expenses are higher (e.g. some strata requirements). Good practice would be for an ADI to place no reliance on a borrower’s potential ability to access future tax benefits from operating a rental property at a loss. Where an ADI chooses to include such a tax benefit, it would be prudent to assess it at the current interest rate rather than one with a buffer applied”.

“A borrower’s living expenses are a key component of a serviceability assessment. Such expenses materially affect the ability of a residential mortgage borrower to meet payments due on a loan. ADIs typically use the Household Expenditure Measure (HEM) or the Henderson Poverty Index (HPI) in loan calculators to estimate a borrower’s living expenses. Although these indices are extensively used, they might not always be an appropriate proxy of a borrower’s actual living expenses. Reliance solely on these indices generally would therefore not meet APRA’s requirements for sound risk management. APRA therefore expects ADIs to use the greater of a borrower’s declared living expenses or an appropriately scaled version of the HEM or HPI indices. That is, if the HEM or HPI is used, a prudent ADI would apply a margin linked to the borrower’s income to the relevant index. In addition, an ADI would update these indices in loan calculators on a frequent basis, or at least in line with published updates of these indices (typically quarterly). Prudent practice is to include a reasonable estimate of housing costs even if a borrower who intends to rely on rental property income to service the loan does not currently report any personal housing expenses (for example, due to living arrangements with friends or relatives)”.

“An override occurs when a residential mortgage loan is approved outside an ADI’s loan serviceability criteria or other lending policy parameters or guidelines. Overrides are occasionally needed to deal with exceptional or complex loan applications. However, a prudent ADI’s risk limits would appropriately reflect the maximum level of allowable overrides and be supported by a robust monitoring framework that tracks overrides against risk tolerances. It is also good practice to implement limits or triggers to manage specific types of overrides, such as loan serviceability overrides. APRA expects that where overrides breach the risk limits, appropriate action would be taken by senior management to investigate and address such excesses”.

“There are varying industry practices with respect to defining, approving, reporting and monitoring overrides. APRA expects an ADI to have a framework that clearly defines overrides. In doing so, it is important that any loan approved outside an ADI’s serviceability criteria parameters should be captured and reported as an override. This includes loans where the borrower is assessed to have a net income surplus of less than $0 (even if temporary) or where exceptions to minimum serviceability requirements have been granted, such as waivers on income verification. ADIs may have their own definitions that include other types of loans (such as those outside LVR limits) as overrides for internal risk monitoring purposes”.

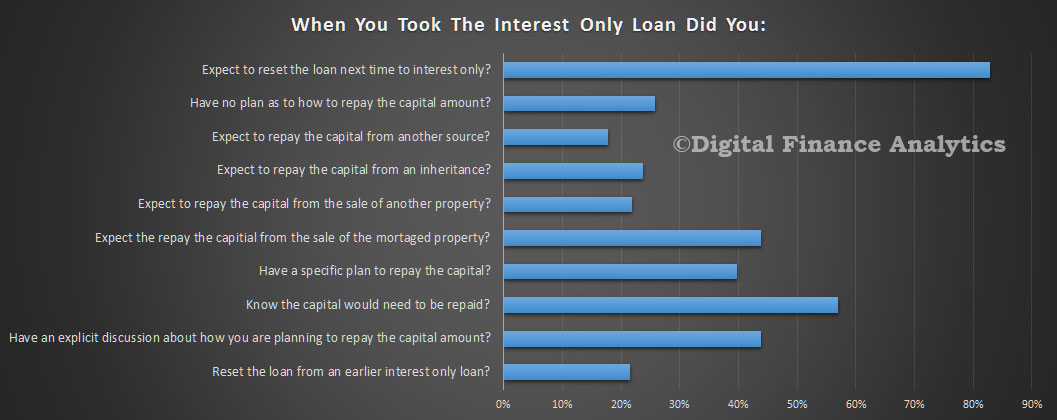

“Borrowers may have legitimate reasons to prefer interest-only loans in some circumstances, such as for repayment flexibility or tax reasons. However, interest-only loans may carry higher credit risk in some cases, and may not be appropriate for all borrowers. This should need to be reflected in the ADI’s risk management framework, including its risk appetite statement, and also in the ADI’s responsible lending compliance program. APRA expects that an ADI would only approve interest-only loans for owner-occupiers where there is a sound and documented economic basis for such an arrangement and not based on inability of a borrower to service a loan on a principal and interest basis. APRA expects interest-only periods offered on residential mortgage loans to be of limited duration, particularly for owner-occupiers. As noted above, a prudent serviceability assessment would incorporate the borrower’s ability to repay principal and interest over the actual repayment period”.

“Some ADIs provide loans to property held in SMSFs. The nature of loans to SMSFs gives rise to unique operational, legal and reputational risks that differ from those of a traditional mortgage loan. Legal recourse in the event of default may differ from a standard mortgage, even with guarantees in place from other parties. Customer objectives and suitability may be more difficult to determine. In performing a serviceability assessment, ADIs would need to consider what regular income, subject to haircuts as discussed above, is available to service the loan and what expenses should be reflected in addition to the loan servicing. APRA expects that a prudent ADI would identify the additional risks relevant to this type of lending and implement loan application assessment processes and criteria that adequately reflect these risks. APRA also expects that a decision to undertake lending to SMSFs would be approved by the ADI at an appropriate governance forum and explicitly incorporated into the ADI’s policy framework”.

APRA has also released for consultation with ADIs proposed new reporting requirements for residential mortgage lending data. APRA expects to finalise these revised reporting requirements in the first half of 2017 with reporting to commence from the December 2017 quarter.

To better enable APRA’s supervisory monitoring and oversight of residential mortgage lending, and reduce the reliance on ad hoc information requests, APRA proposes to introduce a new reporting standard under the FSCOD Act, Reporting Standard ARS 223.0 Residential Mortgage Lending (ARS 223), and a new form, Reporting Form ARF 223.0 Residential Mortgage Lending (ARF 223.0).

These changes will enable APRA to maintain its supervisory intensity of residential mortgage lending and address emerging risks, while removing some unnecessary reporting burden on ADIs.

All locally incorporated ADIs will be subject to ARS 223.0 and required to submit ARF 223.0, 28 calendar days after the end of each calendar quarter. While smaller ADIs are currently not required to submit ARF 320.8, residential mortgage portfolios typically make up the majority of their balance sheet. Comprehensive supervisory monitoring of the credit risk of these ADIs is therefore dependent on obtaining information about their residential mortgage lending. APRA expects that much of this information will already be available by ADIs for their own internal monitoring purposes.

ARF 223.0 will collect information on both the portfolio stock and the new lending activity each quarter. ADIs with a Level 2 group will need to complete ARF 223.0 on a Level 2 basis, and other ADIs on a Level 1 basis.

Depending on their level of residential mortgage lending activity in Australia, branches of foreign banks may also be required to submit ARF 223.0 each quarter, as directed by APRA.

The proposed reporting standard, form and reporting instructions are available on the APRA website.

2.1 Details of outstanding residential mortgage loans

In order to accurately assess the risk profile of the residential mortgage loan portfolio of an ADI or the industry as a whole, APRA needs to have relatively detailed information on residential mortgage loan portfolios.

ADIs currently report outstanding loan balances to households and some loan characteristics on ARF 320.8, split by purpose of the loan. ADIs currently report the balance on impaired or past-due loans in ARF 220.0, split between owner-occupied and investor loans with no further detail.

The proposed ARF 223.0 will capture loans to households as well as borrowers which have similar risk profiles to households, such as loans to family trusts and SMSFs and to non-residents. ADIs will be required to report new information including: facility limits; a more detailed breakdown by LVRs; loan vintage; loans subject to lenders mortgage insurance; loans secured by property overseas; and loans secured by a unit or apartment.

The definitions used in ARF 223.0 have been streamlined to better align with ADIs’ own internal information management systems. For example, the definitions of an owner-occupied loan and an investor loan have been updated. These changes should make it easier to report and therefore reduce the ongoing reporting burden.

More detail about problem loans will be required than is currently reported on ARF 220.0. ADIs will be required to report past-due loans according to risk characteristics (such as loan type, origination channel and LVR), mortgage loans with hardship arrangements, mortgagee in possession loans, loans less than 90 days past due and new non-performing loans in the quarter.

2.2 Details of new loans

In addition to portfolio metrics, information on the risk profile of new loans is essential for analysis of ADIs’ credit risk.

ADIs currently report limited information on new loan approvals on ARF 320.8, including breakdowns on purpose, some loan features and LVRs. Revolving credit is not captured on ARF 320.8.

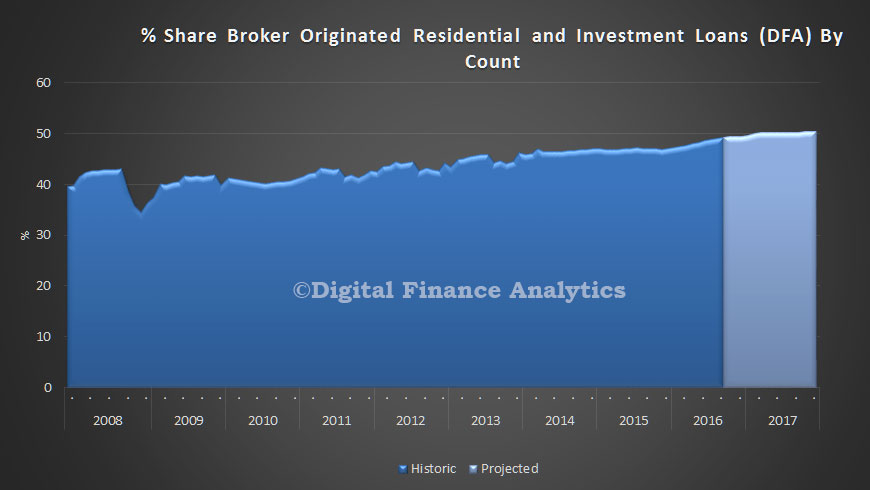

ARF 223.0 will require ADIs to report loans originated during the quarter, rather than loans approved, as this is a better and more reliable measure of loans affecting an ADI’s risk profile. Details on new loan originated to trusts operated by households, such as family trusts and SMSFs, will be included in reporting, as well as loans to non-residents. Originations of revolving credit facilities will also be reported.

ADIs will be required to report more detailed data on loans originated during the quarter than is required on ARF 320.8, including information on borrowers, loan-to-income ratios, collateral type and location and a more granular breakdown by LVR. Most of the existing detail on loan approvals reported on ARF 320.8 will continue to be reported for originations on ARF 223.0, such as loan purpose and loan features.

ADIs will also be required to report information on the average variable interest rate and average loan serviceability assessment rate of loans originated during the quarter. These data will be used to analyse changes in serviceability parameters.

2.3 Use of ARF 320.8

APRA’s needs for regular statistics on mortgage lending activity will be largely met by the proposed ARF 223.0.

However, the RBA relies on the information reported on ARF 320.8 to perform its role. The RBA will become the primary user of ARF 320.8 and has requested that APRA continue to collect the form on its behalf from ADIs with over $1 billion of residential mortgage term loans each quarter.

The RBA is currently reviewing ARF 320.8 and intends to consult ADIs on revised reporting requirements in late-2016. Both APRA and the RBA are working together to minimise reporting burden by limiting the overlap between collections, and by streamlining concepts and definitions.