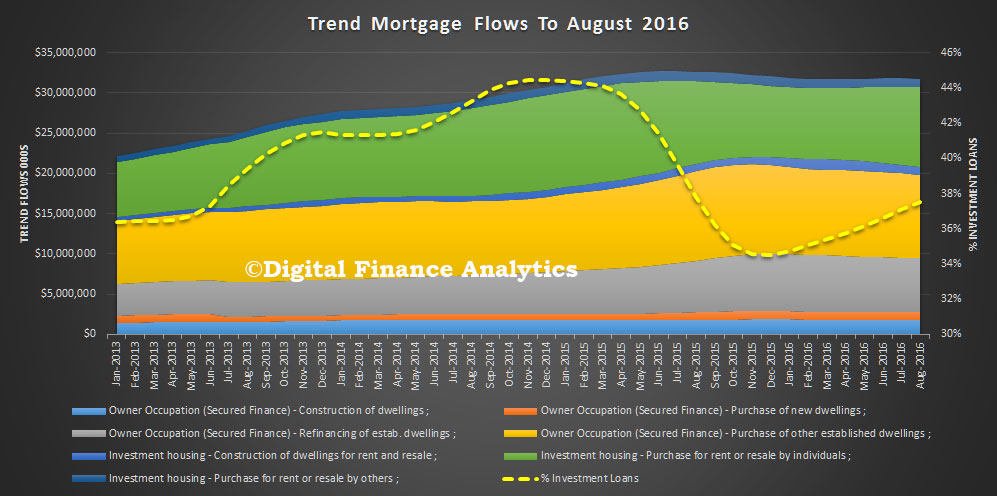

The latest edition (volume 23) of the mortgage industry report was released Oct 19. In this edition we look at mortgage discounting and refinance behaviour. This report takes input from the DFA household surveys, but is not directly available due to compliance requirements. However, the underlying DFA data is available via The Property Imperative, on request.

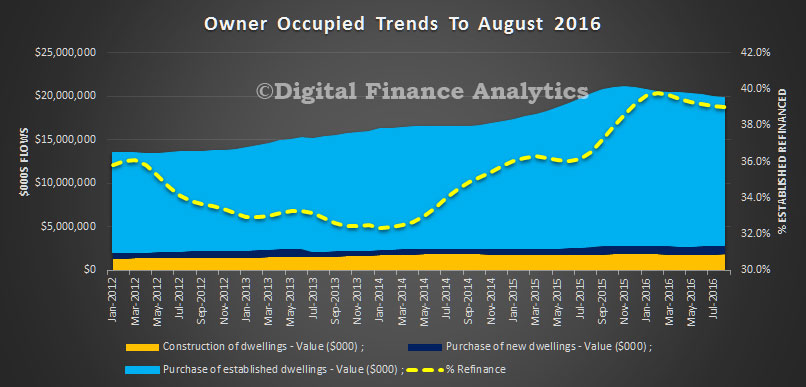

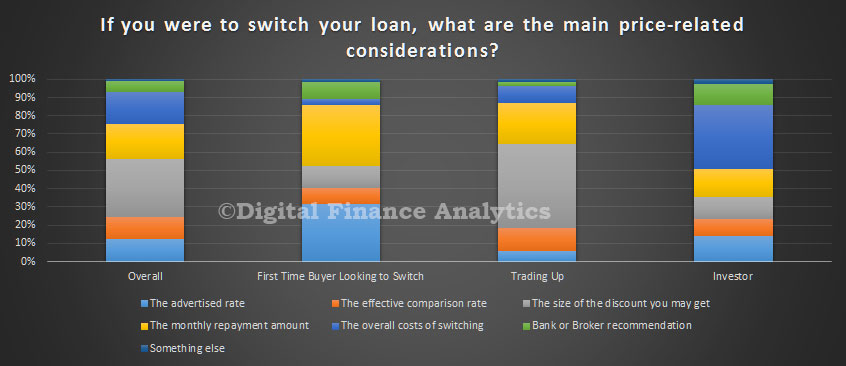

We looked further at refinancing behaviour. About a quarter of loans are churning each year. We asked specifically about the price drivers, and we found that more households are now aware of mortgage discounts, although first time buyer switchers were more concerned with the monthly mortgage repayment costs, whilst investors were more concerned with the overall costs of switching.

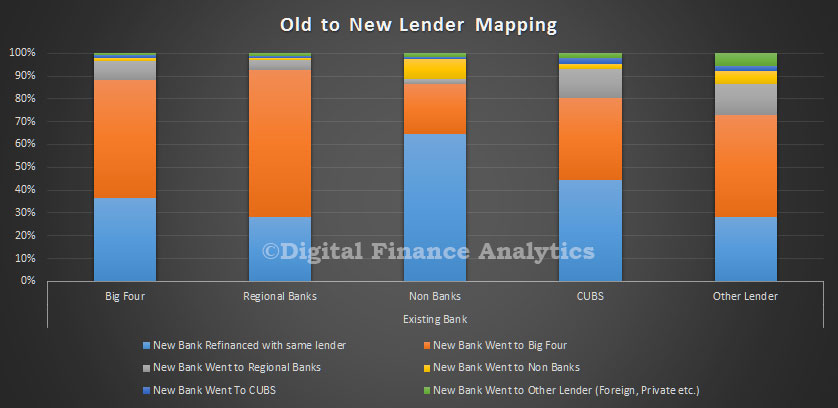

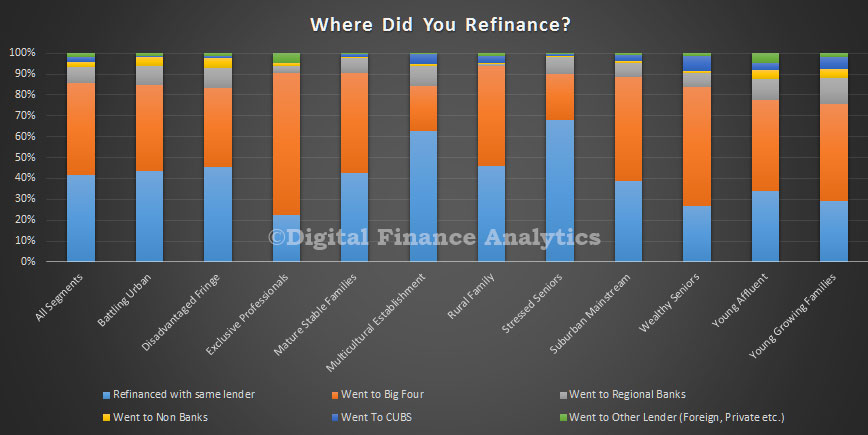

We found that most borrowers churned between the big four, though there were some variations.

We found that most borrowers churned between the big four, though there were some variations.

Across our household segments, we see some variations in refinance preferences, but the regionals, credit unions are other lenders are not picking up share. Indeed with more rational pricing behaviour now in edivence in the majors, and selective discounting, it looks like they will maintain their grasp on the market.

Across our household segments, we see some variations in refinance preferences, but the regionals, credit unions are other lenders are not picking up share. Indeed with more rational pricing behaviour now in edivence in the majors, and selective discounting, it looks like they will maintain their grasp on the market.

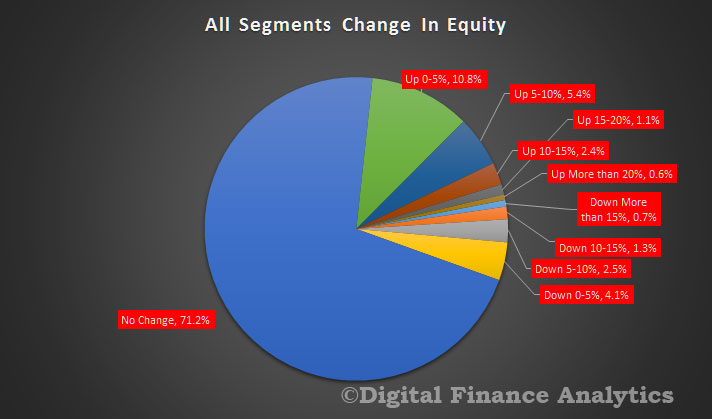

We also found that around 20% of those seeking to refinance are looking to extract equity from their existing property – to take advantage of rising home prices, compared with 8% to repaid capital.

We also found that around 20% of those seeking to refinance are looking to extract equity from their existing property – to take advantage of rising home prices, compared with 8% to repaid capital.

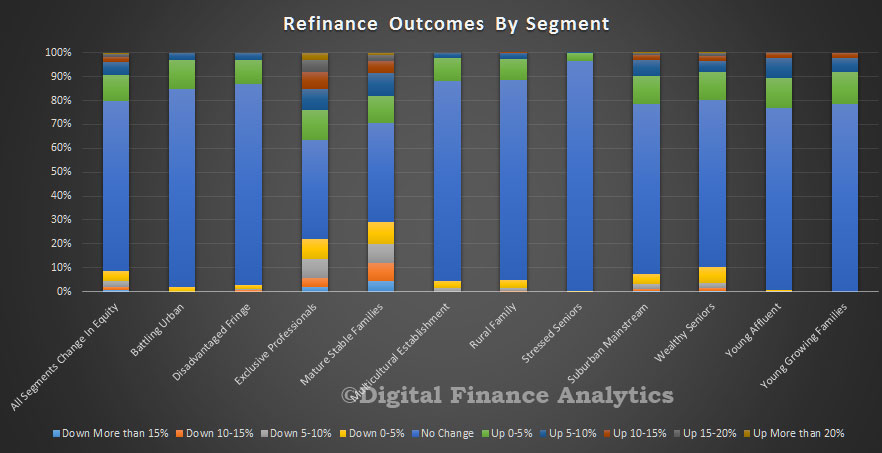

Again there are significant variations across the household segments.

Again there are significant variations across the household segments.

In summary the JP Morgan report says:

In summary the JP Morgan report says:

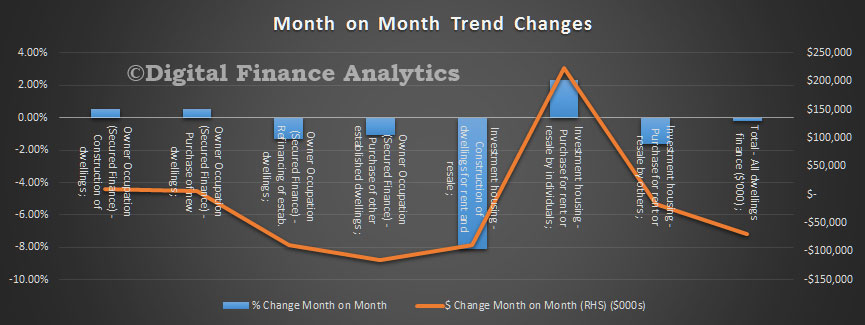

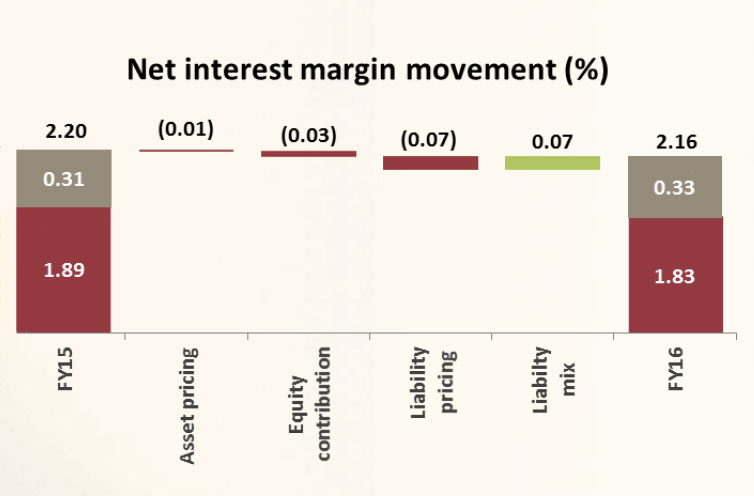

2016 has been characterized by unprecedented levels of discounting until recent weeks. Over the last 12 months, rather than preserving ROE (i.e. re-price to offset higher capital requirements), banks looked to preserve margin (but see the ROE dilute as a consequence of the higher capital allocation). Effectively, it is as though the industry saw the November 2015 re-pricing as a war-chest to go and buy market share through bigger front-book discounts, rather than remaining disciplined on price in order to preserve ROEs.

This volume of the Australian Mortgage Industry Report focuses on the recent evidence of more rational pricing, and the need for the major players in the mortgage industry to exhibit more pricing discipline. At the heart of the issue is the fact that incremental ROEs since the financial crisis (that is change in profit over change in capital) are around 12% – not much better than the cost of equity, and bordering on being insufficient to grow dividends.

Within this construct, we see mortgage ROEs having fallen from ~35%-40% down to ~25%, which leaves the remaining non-mortgage businesses delivering cost-of-equity style returns.

The implications for mortgage pricing are simple. Either margins need to be maintained, or dividends will come under pressure. With profitability across the non-mortgage portfolio not improving, mortgage ROEs can’t really ‘afford’ to go lower than they are today without having an impact on dividend sustainability. Effectively, we may have reached a ‘line in the sand’ on mortgage profitability.