We had significant interest in our recent posts on mortgage rate sensitivity in a rising market. One recurring request was for a cumulative view of rate sensitivity. So today we post these views on a segmented basis, using our master household segmentation.

A quick recap, we updated our analysis of how sensitive households with an owner occupied mortgage are to an interest rate rise, using data from our household surveys. This is important because we now expect mortgage rates to rise over the next few months, as higher funding costs and competitive dynamics come into pay, and as regulators bear down on lending standards.

To complete this analysis we examine how much headroom households have to rising rates, taking account of their income, size of mortgage, whether they have paid ahead, and other financial commitments. We then run scenarios across the data, until they trip the mortgage stress threshold.

At this level, they will be in difficulty. The chart shows the relative distribution of borrowing households, by number. So, around 20% would have difficulty with even a rise of less than 0.5%, whilst an additional 4% would be troubled by a rise between 0.5% and 1%, and so on. Around 35% could cope with even a full 7% rise.

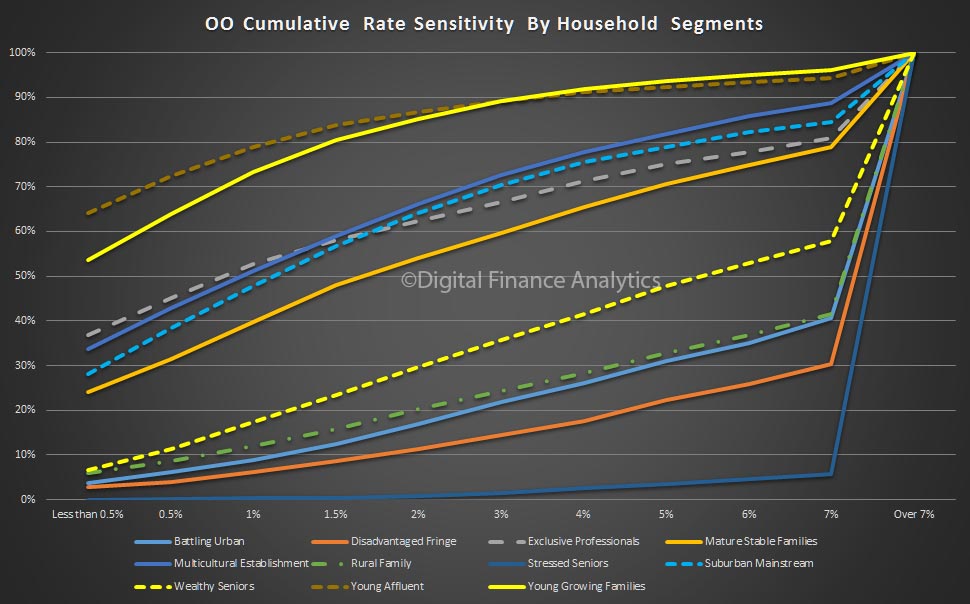

The chart below shows a segment view of this sensitivity. We add the score for each interest rate band. Young Affluent households are most sensitive to rate rises, thanks to large mortgages and static incomes. Young Growing Families are not far behind, but their household budgets are quite different. Other segments are more resilient, though a proportion of Exclusive Professionals are also highly leveraged. This first view takes account only of the owner occupied mortgages.

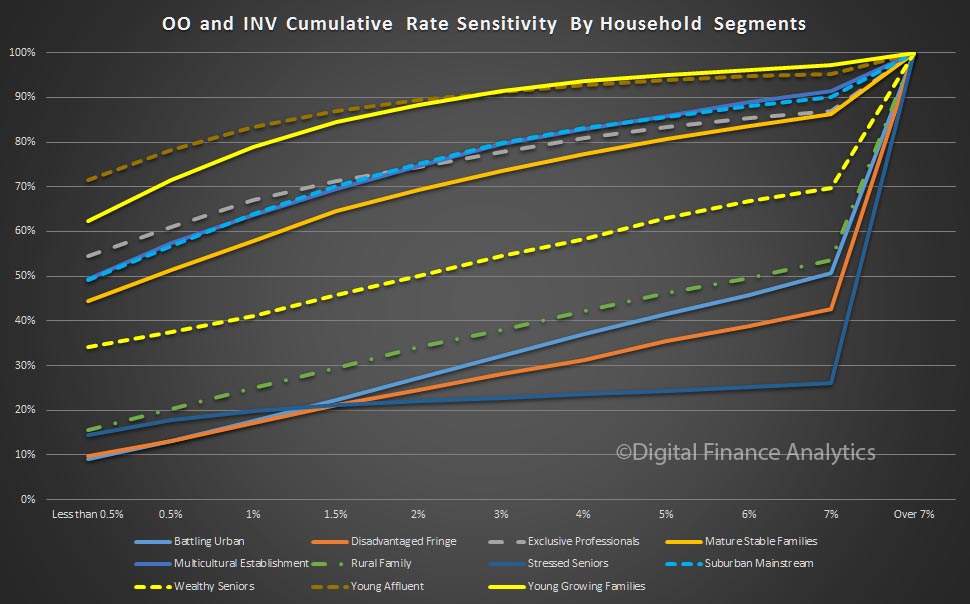

We can also overlay investment mortgages, and this changes the picture somewhat, when combined with owner occupied statistics. We see that the extra commitments have lifted the rate sensitivity, for example moving Exclusive Professionals from 36% to 54% exposed to a small rate increase.

We can also overlay investment mortgages, and this changes the picture somewhat, when combined with owner occupied statistics. We see that the extra commitments have lifted the rate sensitivity, for example moving Exclusive Professionals from 36% to 54% exposed to a small rate increase.

Overall we see that some households really have very little headroom to cope with rising rates, a symptom of high household indebtedness. Others are well protected and are also paying ahead.

Overall we see that some households really have very little headroom to cope with rising rates, a symptom of high household indebtedness. Others are well protected and are also paying ahead.