NAB released their full year results today, which were below expectation, thanks to specific provisions to cover UK issues, lower net margin, and exchange rate movements. This despite a reduction in bad debt provisions by 14 basis points. The final dividend is 99 cents per share (cps) fully franked, unchanged from the 2015 interim and 2014 final dividends. This is a return on capital employed of 13.8%, which is 5% lower than CBA, the most profitable Australian bank.

However, once NAB gets rid of their UK problems, and focusses on the local market, it has the potential to leverage its franchise and up the ante. By tackling the capital issues aggressively, it has laid strong foundations.

Cash earnings were $5.84 billion, an increase of $0.78 billion or 15.5%. Analysts were expecting more than $6.2bn. In 2013 they reported a record $5.94bn. There are a large number of moving parts in the Group.

Excluding specified items, the increase was 2.4% over the year and 2.8% compared to the March 2015 half year. On a statutory basis, net profit attributable to the owners of the Company was $6.34 billion, an increase of $1.04 billion or 19.7%. Excluding discontinued operations, statutory net profit increased 22.7% to $6.36 billion. The main difference between statutory and cash earnings over the year relates to the effects of fair value and hedge ineffectiveness.

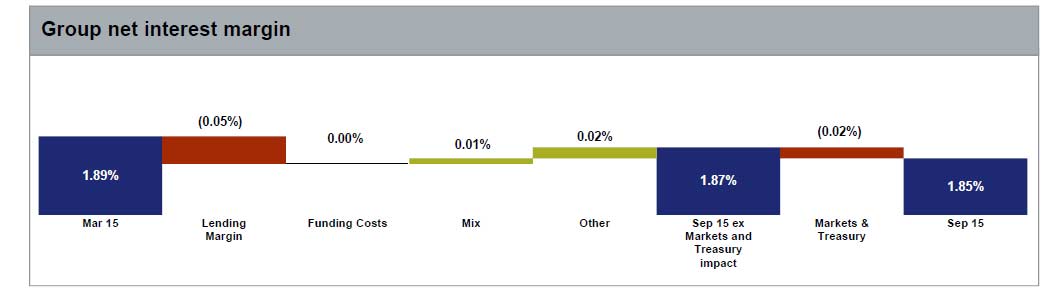

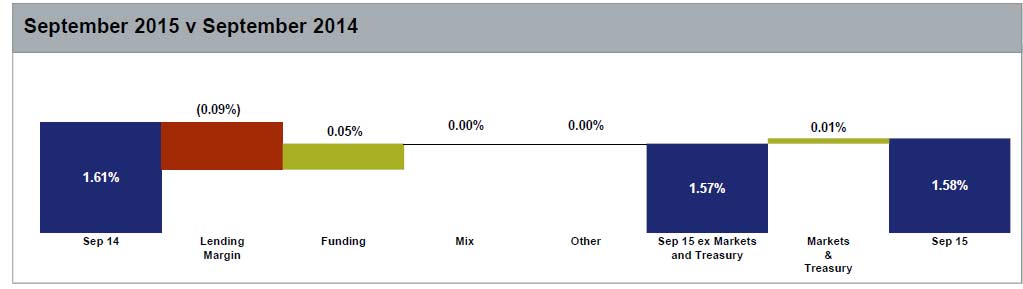

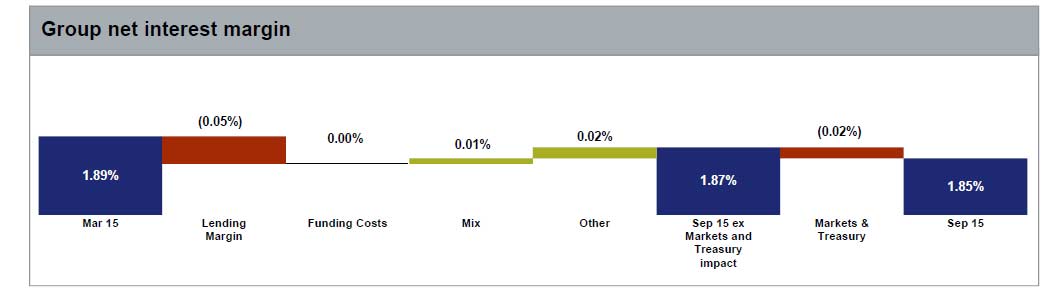

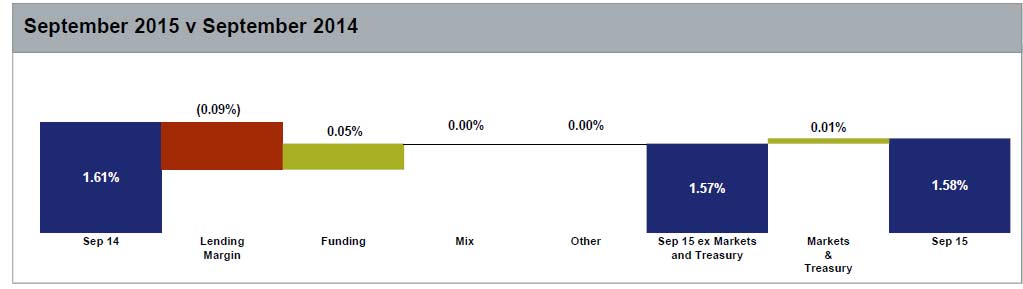

Revenue increased approximately 4%. Excluding gains from a legal settlement and the UK Commercial Real Estate loan portfolio sale and SGA asset sales, revenue rose approximately 3%, benefitting from higher lending balances, stronger Markets and Treasury income, increased NAB Wealth net income, and the impact of foreign exchange rates. Group net interest margin (NIM) declined 4 basis points, mainly due to competition for business lending.

Expenses fell approximately 1%, but excluding specified items and foreign exchange rate impacts rose approximately 4%. Key drivers include investment in the Group’s priority customer segments, increased technology costs, higher UK spend associated with preparing for separation, combined with wage increases.

Expenses fell approximately 1%, but excluding specified items and foreign exchange rate impacts rose approximately 4%. Key drivers include investment in the Group’s priority customer segments, increased technology costs, higher UK spend associated with preparing for separation, combined with wage increases.

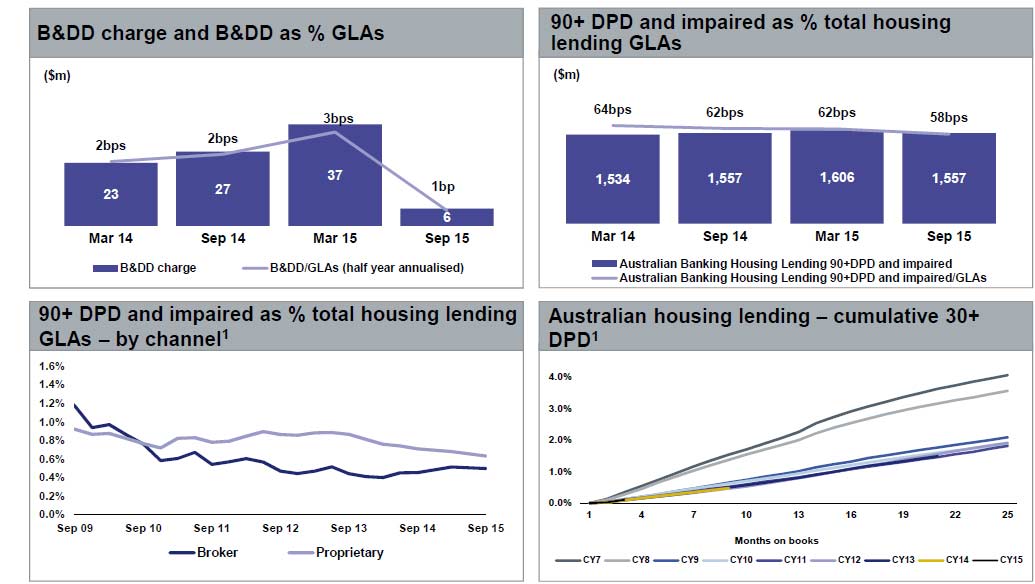

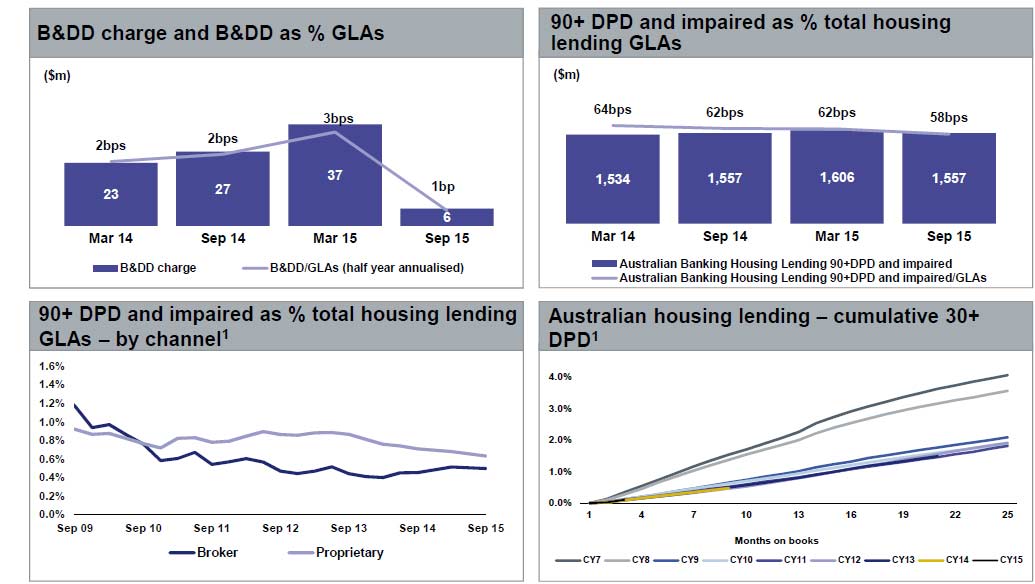

Improved asset quality resulted in a total charge for Bad and Doubtful Debts (B&DDs) of $823 million, down approximately 5% due to lower charges in Australian Banking and UK Banking. The charge includes a collective provision overlay of $102 million for Australian agriculture and resource sectors, and an increase in New Zealand collective provision charges of NZ$78 million predominantly relating to the dairy sector.

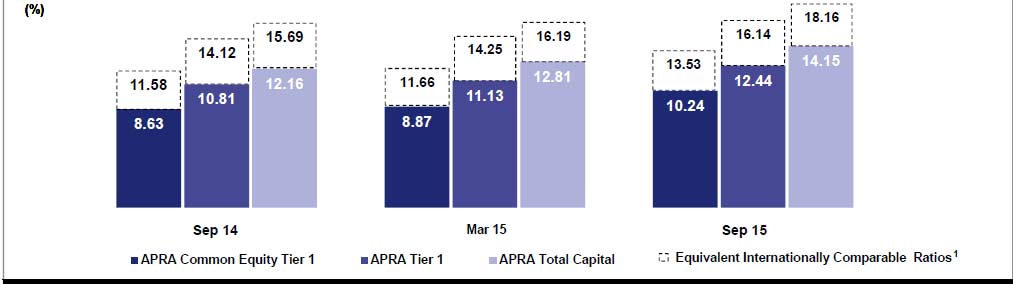

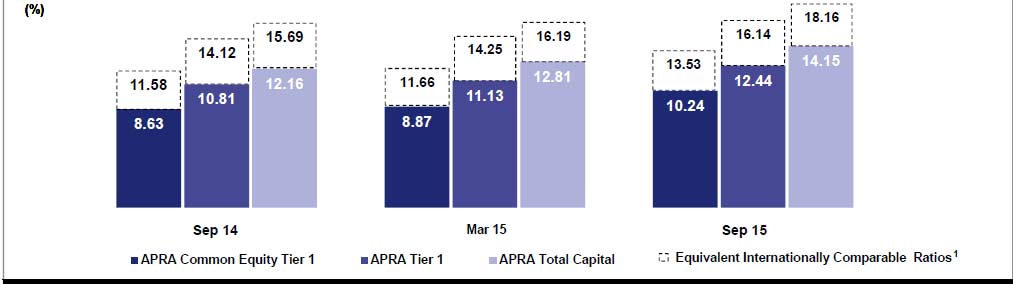

The Group’s Common Equity Tier 1 (CET1) ratio was 10.2% as at 30 September 2015, an increase of 137 basis points from March 2015 mainly reflecting the rights issue proceeds. The Group’s CET1 target ratio remains between 8.75% – 9.25%, based on current regulatory requirements. The CET1 ratio at 30 September 2015 is above the target range reflecting regulatory increases in mortgage risk weights from 2016 and the intended UK demerger.

The impact of recent capital raisings on the capital ratios are clear. The bank is now well positioned, and one of the strongest positioned in the world.

The Group maintains a well diversified funding profile and has raised approximately $26.5 billion of term wholesale funding in the 2015 financial year. The weighted average term to maturity of the funds raised by the Group over the 2015 financial year was 4.7 years. The stable funding index was 92.3% at 30 September 2015, 1.9 percentage points higher than at 30 September 2014. The Group’s quarterly average liquidity coverage ratio as at 30 September 2015 was 115%.

The Group maintains a well diversified funding profile and has raised approximately $26.5 billion of term wholesale funding in the 2015 financial year. The weighted average term to maturity of the funds raised by the Group over the 2015 financial year was 4.7 years. The stable funding index was 92.3% at 30 September 2015, 1.9 percentage points higher than at 30 September 2014. The Group’s quarterly average liquidity coverage ratio as at 30 September 2015 was 115%.

Sale of Life Insurance Business

NAB announced an agreement to sell 80% of NAB Wealth’s life insurance business to Japanese insurer Nippon Life Insurance Company (Nippon Life) for $2.4 billion. This transaction is separate and in addition to the life reinsurance transaction finalised in July 2015. As part of the partnership NAB will enter a 20 year distribution agreement to provide life insurance products through its owned and aligned distribution networks.

NAB will retain existing ownership of its investments business which includes superannuation, platforms, advice and asset management. The transaction will occur through the sale of 80% of MLC Limited after the extraction of NAB’s superannuation and investments business and certain other restructuring steps. NAB will retain the MLC brand, although it will be licensed for use by the life insurance business for 10 years, and will continue to be applied as is currently the case in our superannuation, investments and advice business. The transaction is expected to be completed by the second half of calendar 2016 subject to certain conditions including regulatory approvals, establishment of the life insurance business as a standalone entity, extraction of the superannuation business from MLC Limited and the finalisation of certain agreements. NAB will retain responsibility for managing the life insurance business until completion.

The transaction is expected to result in an indicative loss on sale of approximately $1.1 billion inclusive of transaction and separation costs, based on expected completion life insurance net assets of $3.6 billion including $1.6 billion of allocated goodwill. In addition, NAB’s pro forma FY15 CET1 ratio is expected to increase by approximately 50 basis points after allowing for transaction and separation costs, with this increased capital expected to be retained by NAB to meet potential increased regulatory capital requirements. One off post-tax costs of approximately $440 million are expected to be incurred by NAB relating to separation, and the extraction and simplification of the superannuation business.

UK Demerger

The Group has announced its intention to divest CYBG PLC (CYBG), through a demerger and Initial Public Offering (IPO), in early February 2016. Significant progress has been made on the proposed transaction, including advanced engagement with key regulators and listing authorities in both jurisdictions.

The Group’s intention is to pursue a demerger of approximately 75% of CYBG to NAB shareholders and a sale of the balance by way of IPO (up to approximately 25%) to institutional investors. It is proposed that CYBG will have a primary listing on the London Stock Exchange (LSE) and a CHESS Depositary Interest (CDI) listing on the Australian Securities Exchange (ASX).

The proposed demerger and IPO remains subject to a range of matters, including various court and regulatory approvals and NAB shareholder approval. Shareholder approval will be sought at a meeting expected to be in late January 2016.

As announced at the third quarter trading update on 10 August 2015, additional conduct provisions were expected to be required at the Full Year 2015 results in relation to both payment protection insurance (PPI) and interest rate hedging product (IRHP) costs.

These additional provisions have now been determined and comprise the following:

- Provisions of £390 million (£323 million or A$704 million after tax) in relation to PPI reflecting the impact of the past business review and the consequent need to undertake further proactive customer contact, as well as costs to run the remediation program

- Provisions of £75 million (£63 million or A$135 million after tax) in relation to interest rate hedging products and fixed rate tailored business loans based on additional expected claims

As announced at the March 2015 Half Year results, in order to achieve the proposed CYBG demerger and IPO the UK PRA requires capital support for CYBG of £1.7 billion in relation to potential future legacy conduct costs. The provisions of £465 million recognised in the September 2015 half year will form part of the £1.7 billion support package and, combined with £120 million for CYBG’s share of future conduct liabilities, will result in a capped indemnity from NAB of £1.115 billion upon separation. Assuming no further pre-demerger provisions are raised, future legacy conduct costs will be shared 90.3%/9.7% between NAB and CYBG respectively.

On completion of the demerger, the capped indemnity amount of £1.115 billion is expected to result in a deduction from NAB’s CET1. To the extent that claims against NAB under the capped indemnity are ultimately less than £1.115 billion, this is expected to result in a commensurate CET1 benefit for NAB.

Group asset quality metrics continued to improve over the period. The ratio of Group 90+ days past due and gross impaired assets to gross loans and acceptances of 0.71% at 30 September 2015 was 14 basis points lower compared to 31 March 2015 and 48 basis points lower compared to 30 September 2014.

The ratio of collective provision to credit risk weighted assets was 1.01% unchanged from 31 March 2015. The ratio of specific provisions to impaired assets was 32.7% at 30 September 2015 compared to 36.0% at 31 March 2015.

Segmentals

Australian Banking cash earnings were $5,111 million, an increase of 3% reflecting higher revenue and lower B&DD charges. Revenue rose 4% benefitting from stronger Markets and Treasury performance combined with higher volumes of housing and business lending while NIM declined 3 basis points as a result of lending competition. Expenses rose 6% or 5% excluding the impact of changes in foreign exchange rates, with investment in front line banker roles in priority customer segments combined with higher project costs, partly offset by productivity savings. Asset quality metrics continued to improve and B&DD charges of $665 million fell 10% over the year and 18% over the March 2015 half year. This largely reflects lower new impaired loans, and is despite higher collective provision charges including a $102 million overlay for the agriculture and resource sectors.

Looking at housing in particular, net margin is unchanged, and the impact of recent loan classifications are visible.

Looking at housing in particular, net margin is unchanged, and the impact of recent loan classifications are visible.

Loss rates are down in September 2015.

Loss rates are down in September 2015.

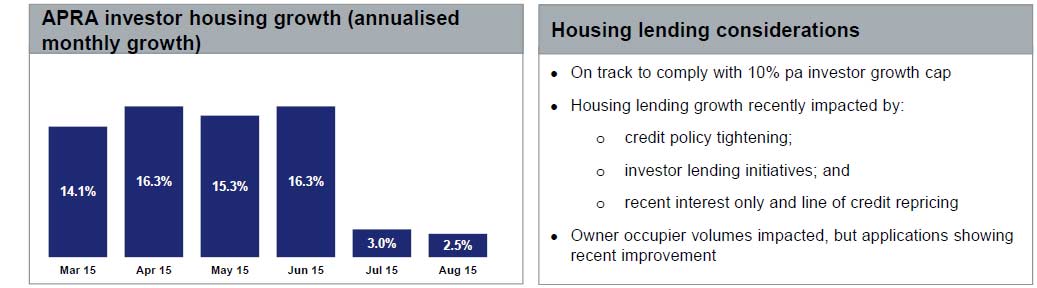

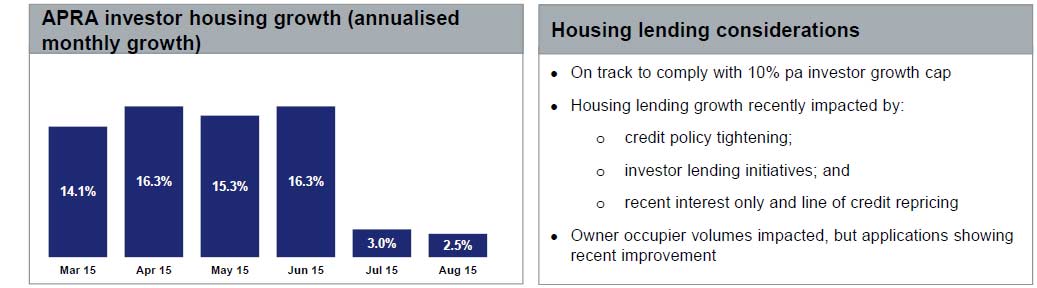

NAB says they will be within the 10% APRA speed limit for investment home loans.

NAB says they will be within the 10% APRA speed limit for investment home loans.

NAB Wealth cash earnings increased 27% to $464 million benefitting from stronger insurance income and stable costs. Net income rose 10% reflecting higher premium pricing, improved insurance lapses and claims, and non-recurrence of insurance reserve strengthening in the prior year. While funds under management rose 8% with strong investment markets and the acquisition of Orchard Street Investment Management in the March 2015 half year, this was offset by lower IoRE and lower investment margins mainly due to MySuper plan transitions and business mix changes.

NAB Wealth cash earnings increased 27% to $464 million benefitting from stronger insurance income and stable costs. Net income rose 10% reflecting higher premium pricing, improved insurance lapses and claims, and non-recurrence of insurance reserve strengthening in the prior year. While funds under management rose 8% with strong investment markets and the acquisition of Orchard Street Investment Management in the March 2015 half year, this was offset by lower IoRE and lower investment margins mainly due to MySuper plan transitions and business mix changes.

NZ Banking local currency cash earnings of $823 million rose 2% over the year. Good underlying profit growth was partly offset by higher collective provision charges in the September 2015 half year predominantly relating to the dairy sector. Revenue rose 4% with improved lending volumes and higher margins. Cost growth was contained to 2%, while still investing in staff and technology to support the Auckland focused growth strategy.

UK Banking local currency cash earnings of £156 million were broadly flat. Mortgage volume growth and a halving of B&DD charges to £38 million reflecting asset quality improvements, were more than offset by higher costs particularly in the September 2015 half year, and lower margins. Costs rose 7% reflecting investment in the franchise and the impact of pre separation activities, which were partly offset by a one-off pension scheme gain.