Property expert Joe Wilkes and I discuss relativities….

Tag: New Zealand Property

Is It Up ORR Is It Down?

Property expert Joe Wilkes and I discuss central banks’ drive to cut the cash rate, in an attempt to reinflate the property bubble. And New Zealand is a case in point.

Capital Gains? – Ready, Steady, Stop! (Podcast)

I discuss the latest from New Zealand with property expert Joe Wilkes, and we look at changes to capital gains, negative gearing and other factors which may impact the market.

Some interesting comparisons with the UK and Australian markets too!

Auckland Housing Crisis – An Extended Show

This is a additional show containing more footage from Joe Wilkes on Auckland property development. Contains new footage not contained in our released highlights package.

Even more relevant, given the recent falls in sales and prices in the region!

More Data On New Zealand’s Slowing Property Market

Harcourts Market Watch to 13th February 2019 contains some interesting insights into the New Zealand market.

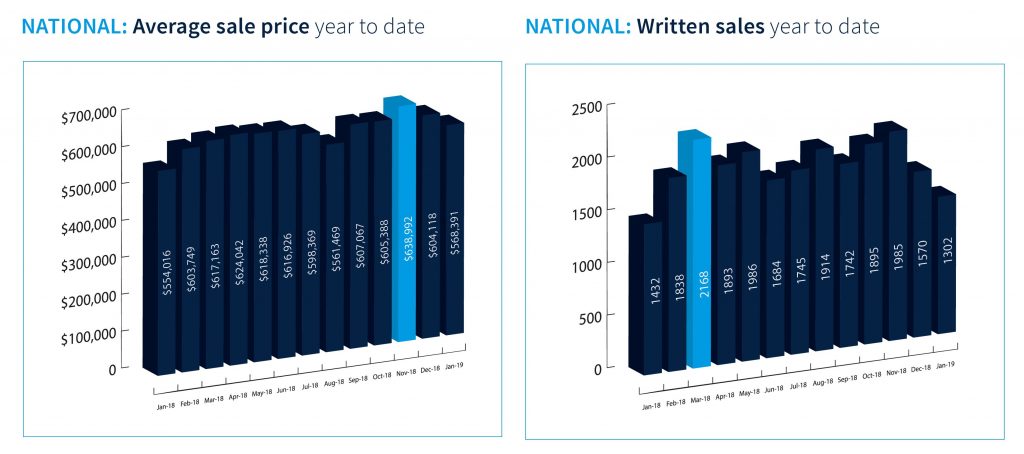

The New Zealand average national house price in January 2019 increased by 2.59% from $554,016 in January 2018 to now sit at $568,391.

But the average has fallen since a November peak of $638,992, a fall of 12%! In addition written sales decreased from a high of 2,168 in March 2018, and is lower this January than last.

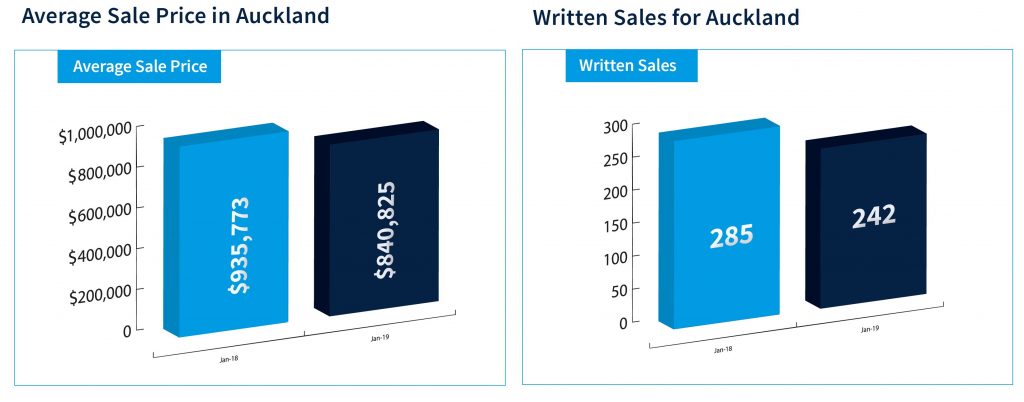

In Auckland, the average house price in January was back 10.15%

on the same recorded period for 2018 with the average for the month

sitting at $840,825.

Total listings, new auctions and written sales remained down on the

previous year in the country’s biggest city. The market is changing,

and this has been well reported across all media outlets.

In Wellington which includes the Taranaki and Hawke’s Bay regions,

the average sale price is up 11.64% on the same period in 2018 from

$468,546 to now sit at $523,099. Total new listings were

only slightly back on January 2018 with 303 versus 300 listings, a small

change of 0.99%.

In Christchurch, the average house price has increased from $520,458

in January 2018 to $564,876 in January 2019 which is an uplift of 8.53%;

starting 2019 the right way.

Written sales are back 3.5% from 314 to 303 alongside property

currently listed with Harcourts back 7.38% from 1518 to 1406 when

we measure January 2019 against January 2018.

For the Central Region, taking in Bay of Plenty and Waikato,

the average sale price has risen by 13.99% to now sit at $547,742

for January 2019. New auctions, written sales and total listings have

all increased over the same recorded period signalling prosperity in

this region.

In the provincial South Island, the average sale price has seen a 2.59%

increase on January 2018 rising from $410,911 to now sit at $421,563

in January 2019. All other measures were back on the same recorded

period; however, this region still remains one of the most affordable

to buy in throughout New Zealand.

In De-Nile – Are Auckland Sellers Sailing Down A River In Egypt?

In the latest from our New Zealand property expert Joe Wilkes, we look at the latest data with a focus on recent home price movements. Things are getting interesting!

All About The Latest From New Zealand – A Joe Wilkes Special!

Joe and I discuss the latest data from New Zealand, and compare things with the Australian property story. Parallels abound!

Why Planning Matters

In the light of the Opal Tower, and other problem buildings, property expert Joe Wilkes and I discussed the underlying drivers of these issues, in the light of his recent trip to Auckland and the New Zealand economy.

It seems when short term “value creation” (= Greed?) is king, standards, amenity value and community all go out of the window.

And the main stream “housing shortage” story does not help!

Time for a new path.

Please consider supporting our work via Patreon

Or make a one off contribution to help cover our costs via PayPal

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

The 12 Days Of Christmas – DFA Style

A short “seasonal” segment using some of Joe Wilkes’ recent footage from his trip to Auckland (thanks Joe).

Seasonal greetings to all our viewers, followers and supporters!

Auckland’s “Mad” Property Market

We have released episode 2 of our series on New Zealand property, as Joe Wilkes, Property Expert continues his tour of Auckland’s new suburbs. Is there really a “property shortage”, or is something else afoot?

And this is not just an Auckland “thing!”