New Zealand based Property Expert Joe Wilkes and I discuss the latest on mortgage repayment holidays, which sets up our live stream event next Tuesday 25 August where Joe will join me to take the discussion further. Mark your diary and tell your Kiwi friends!

Tag: New Zealand

Helicopters To The Rescue, And Closing The Stable Door Too Late – With Joe Wilkes

The latest from our New Zealand Property Expert Joe Wilkes. New numbers of sales and rental listings reveals an interesting story!

https://www.linkedin.com/in/joe-wilkes-33803818/

https://youtu.be/G6RfJcJHotE = Baby Boomers Time Bomb

How Low Will The NZ GDP Go? – With Joe Wilkes

The latest from NZ with our resident property insider.

Joe Wilkes Is Back In Town…

Joe Wilkes, joins us, after a long absence, to discuss all the latest from his patch. Where will home prices go, and will this save the economy?

This should please those many fans who kept asking where Joe was….

RBNZ: Mortgage Holiday and Business Finance Support To Cushion COVID Impacts

The New Zealand Government, retail banks and the Reserve Bank are today announcing a major financial support package for home owners and businesses affected by the economic impacts of COVID-19.

The package will include a six month principal and interest payment holiday for mortgage holders and SME customers whose incomes have been affected by the economic disruption from COVID-19.

The Government and the banks will implement a $6.25 billion Business Finance Guarantee Scheme for small and medium-sized businesses, to protect jobs and support the economy through this unprecedented time.

“We are acting quickly to get these schemes in place to cushion the impact on New Zealanders and businesses from this global pandemic,” Finance Minister Grant Robertson said.

“These actions between the Government, banks and the Reserve Bank show how we are all uniting against COVID-19. We will get through this if we all continue to work together.

“A six-month mortgage holiday for people whose incomes have been affected by COVID-19 will mean people won’t lose their homes as a result of the economic disruption caused by this virus,” Grant Robertson said.

The specific details of this initiative are being finalised and agreed urgently and banks will make these public in the coming days.

The Reserve Bank has agreed to help banks put this in place with appropriate capital rules. In addition, it has decided to reduce banks ‘core funding ratios’ from 75 percent to 50 percent, further helping banks to make credit available.

We are announcing this now to give people and businesses the certainty that we are doing what we can to cushion the blow of COVID-19.

The Business Finance Guarantee Scheme will provide short-term credit to cushion the financial distress on solvent small and medium-sized firms affected by the COVID-19 crisis.

This scheme leverages the Crown’s financial strength, allowing banks to lend to ease the financial stress on solvent firms affected by the COVID-19 pandemic.

The scheme will include a limit of $500,000 per loan and will apply to firms with a turnover of between $250,000 and $80 million per annum. The loans will be for a maximum of three years and expected to be provided by the banks at competitive, transparent rates.

The Government will carry 80% of the credit risk, with the other 20% to be carried by the banks.

Reserve Bank Governor Adrian Orr, said: “Banks remain well capitalised and liquid. They also remain highly connected to New Zealand’s business sector and almost every household in New Zealand. Their ability to extend credit to firms to bridge the difficult times created by COVID-19 is critical and made more possible with today’s announcements. We will monitor banks’ behaviour over coming months to assess the effectiveness of the risk-sharing scheme.”

The Government, Reserve Bank and the Treasury continue to work on further tailor-made support for larger, more complex businesses, Grant Robertson said.

New Zealand Shutters

The New Zealand Prime Minister has announced severe restrictions will be imposed the next 48 hours to try to slow the virus spread there, where 102 cases have been counted.

They were at pains to underscore essential services and banking services will continue to be available, but other businesses will need to close, along with schools.

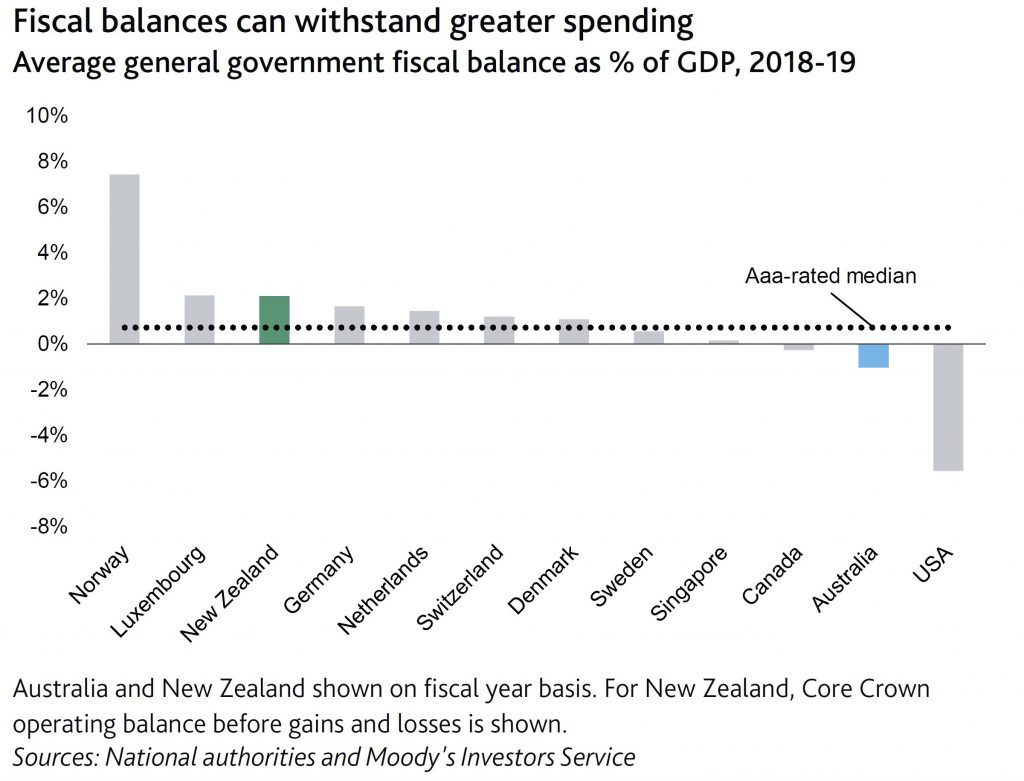

Australia’s and New Zealand Has Fiscal Space To Support Demand

Moody’s says that on 22 March, Australia (Aaa stable) announced economic relief measures, totalling AUD66 billion ($38.2 billion, or around 3% of

GDP) in support to households, businesses and guarantees to small and medium-sized enterprises (SMEs), in addition to a package announced previously and a set of measures aimed at supporting credit.

On 17 March, New Zealand (Aaa stable) announced a NZD12.1 billion ($7.3 billion), or 4% of GDP, stimulus package to provide immediate support to the economy and alleviate the disruption caused by the coronavirus outbreak.

Both governments have indicated that they will adopt further measures amid the rapidly deteriorating global economic outlook.

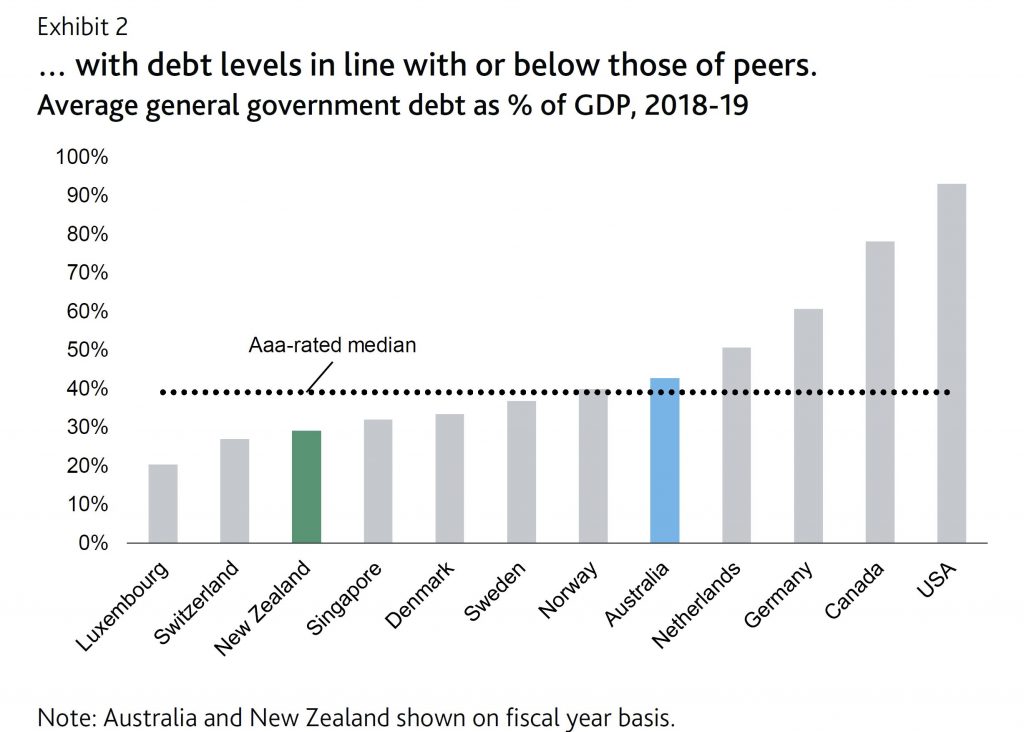

The measures highlight the strong institutional capacity of both Australia and New Zealand to develop emergency fiscal responses during an unprecedented global shock. The measures also demonstrate a high degree of fiscal flexibility that allows for larger near-term budgetary expenditure without threatening longer-term fiscal strength.

In addition to the previously announced AUD17.6 billion support to the economy, the Australian government plans to spend about AUD25 billion in support to businesses in this and the next fiscal year (the fiscal year ends in June), AUD21 billion in support to households and to offer AUD20 billion of guarantees to SMEs. Measures include a boost to SMEs’ cash flow, with upfront payments, temporary relief on creditors’ claims for financially distressed companies, a direct lump-sum payment to individuals and, specifically, to vulnerable households among other measures.

The New Zealand government will spend NZD6 billion by June 2020, as around NZD5.1 billion of the entire package is allocated as wage subsidies for affected businesses in all regions and sectors. The measure aims to stave off a significant deterioration in the labor market. The government has also announced various business tax changes to alleviate businesses’ cash flow pressures and NZD500 million in additional spending on public healthcare, much of which will go on measures that prevent transmission of the coronavirus in the country.

These stimulus packages come in addition to ongoing monetary policy stimulus in both economies. The Reserve Bank of Australia (RBA) has cut its policy rate by 50 basis points so far in March and offered an at least AUD90 billion (0.5% of GDP) special funding facility to commercial banks, which includes an incentive to increase lending to small and medium sized businesses.

The Reserve Bank of New Zealand (RBNZ) delivered an emergency policy rate cut of 75 basis points on 16 March, in addition to announcing a 12-

month delay to the increase in bank capital requirements, which it estimates will allow banks additional lending capacity of around

NZD47 billion (16% of GDP).

The RBA has also announced a quantitative easing program, aimed at ensuring the yield on three-year government bonds remains around 0.25%, while the RBNZ has left the door open for unconventional monetary policy including largescale asset purchases. {Subsequently Announced].

After accounting for these stimulus packages, Moody’s expects a moderate weakening in both governments’ fiscal positions, with Australia’s

surplus turning to a deficit in fiscal 2020. New Zealand plans to fund its stimulus package with increased debt issuance and a drawdown in cash reserves, pushing net debt above the target range of 15%-25% of GDP.

Beyond these measures, weaker revenue growth because of slower economic activity and the triggering of automatic stabilizers will weaken fiscal balances. Moody’s does not view this near-term budgetary expansion by both sovereigns as significantly threatening their fiscal strength. Indeed, it highlights the flexibility and capacity that both governments possess to utilize fiscal policy to support their credit profiles amid an increasingly difficult global economic environment. Particularly for New Zealand, fiscal surpluses and debt levels below Aaa-rated peers provide ample fiscal flexibility

RBNZ to Implement $30bn Asset Purchase of NZ Govt Bonds

The New Zealand Monetary Policy Committee (MPC) has decided to implement a Large Scale Asset Purchase programme (LSAP) of New Zealand government bonds.

The negative economic implications of the coronavirus outbreak have continued to intensify. The Committee agreed that further monetary stimulus is needed to meet its inflation and employment objectives.

Globally, the number of people infected with the virus has increased rapidly and measures to contain the outbreak have become more restrictive. Global trade and travel, and business and consumer spending have been curtailed significantly.

The severity of the impacts on the New Zealand economy has increased. Weaker global activity is affecting the economy through a range of channels, not just reduced trade. Domestic measures to contain the outbreak of the virus are also reducing economic activity. Employment and inflation are expected to fall relative to their targets in the near term.

In addition, financial conditions have tightened unnecessarily over the past week, reducing the impact of the low OCR on achieving the MPC’s mandate. Heightened risk aversion has caused a rise in interest rates on long-term New Zealand government bonds and the cost of bank funding.

The Committee has decided to implement a LSAP programme of New Zealand government bonds. The programme will purchase up to $30 billion of New Zealand government bonds, across a range of maturities, in the secondary market over the next 12 months. The programme aims to provide further support to the economy, build confidence, and keep interest rates on government bonds low.

The Committee will monitor the effectiveness of the programme and make adjustments and additions if needed. The low OCR, lower long-term interest rates, and the fiscal stimulus recently announced together provide considerable support to the economy through this challenging period.

Record of meeting: Monetary Policy Committee (MPC)

20-22 March 2020

On Friday 20 March the Chair of the MPC spoke with the external members of the MPC by phone to update them on the Bank’s financial stability activities and the interaction with monetary policy. These activities were public. The external MPC members were made aware of what the other members of the Committee were involved in with regard to the Bank’s ongoing support to financial market functioning and stability.

The Chair and the external members also discussed the fact that any further monetary stimulus provided by the Bank would likely be through the purchase of government bonds in a Large Scale Asset Programme (LSAP). All MPC members were also made aware that monetary policy recommendations were being sent to them for a decision soon, and that there would likely be an ongoing series of Bank monetary and financial stability actions as the economic impacts of COVID-19 unfolded.

MPC members received papers on Friday evening containing staff advice about the ongoing deterioration in the economic situation relating to COVID-19.

The initial view of staff was that an MPC decision on their recommendations would be preferable by Sunday 22 March 2020. On Saturday 21 March, following advice from the Reserve Bank’s financial markets team as to their operational and legal readiness to implement a LSAP, the MPC Chair called for an MPC decision to be made by email. An in-person meeting was seen as unnecessarily risky given current official guidance about social distancing.

There was agreement amongst members to proceed in this manner and by Sunday morning there was a consensus MPC agreement to:

- Provide further monetary policy stimulus through a Large Scale Asset Purchase (LSAP) programme of New Zealand government bonds in the secondary market.

- The initial scale of the LSAP programme is up to $30 billion of government bonds, across a range of maturities, to be purchased over the next 12 months.

- Communicate the decision on the morning of 23 March.

This decision was made in response to staffs’ briefing material to the committee indicating the increasing severity of the economic situation and deterioration in financial market conditions.

It was noted that the Government’s fiscal package announced on March 17 has delivered significant spending stimulus in addition to the monetary stimulus announced on March 16. However, the health and safety measures announced by governments over prior days – related to the reduction in travel and large gatherings globally – would add to inflation and employment falling below target in the near term.

Returning inflation and employment to target over the medium term will require support from monetary policy. How much stimulus will depend on how the COVID-19 pandemic progresses and the actions to abate the virus.

The committee considered a range of scenarios, and it was apparent that in light of the evolving situation more stimulus was needed.

Committee members’ attention was drawn to the tightening in financial conditions over the past week. Interest rates on long-term New Zealand government bonds had risen significantly, affecting the cost of wholesale funding for any banks accessing the market at this time. Such increases mean that the reduction in the OCR announced on March 16 was not effectively passing through into interest rates faced by borrowers. The depreciation in the exchange rate had helped ease conditions at the margin but not sufficiently.

The staff briefing material also included updates on global economic developments and other countries’ economic policy responses to the pandemic.

Committee members were advised that the recommendation of a $30 billion LSAP program reflected a current assessment of the maximum effective stimulus achievable while maintaining a well-functioning government bond market. Staff noted the importance for liquidity to remain in the bond market and for multiple market makers.

Staff recommended that purchases up to $30 billion should be spread over at least 12 months and across a range of maturities, in order to leave enough liquidity for the New Zealand government bond market to function effectively. And that the Bank’s communications should emphasise that the LSAP programme would provide confidence and support for the government bond market, and monetary stimulus through keeping longer-term interest rates low.

Members noted that the exact amount of stimulus needed is difficult to quantify, and that the range of economic scenarios they had seen were consistent with a need to deliver significant stimulus.

Briefing material also included information about the implications of an LSAP program to the Reserve Bank’s balance sheet, and about the governance arrangements in place between the Reserve Bank and the Minister of Finance. It was noted that MPC agreement would be sought if further stimulus was needed to be provided, either by increasing the size of the LSAP programme, or through the use of other instruments.

The Committee reached a consensus to:

- Approve a programme of Large Scale Asset Purchases to a total volume of $30 billion of NZ Government bonds over 12 months

- Delegate to staff the implementation decisions of the LSAP programme

- Communicate the program in terms of the total volume to be purchased

RBNZ Provides Further Financial System Support

A further announcement from the Reserve Bank NZ today. They have established a Term Auction Facility to support the markets/banks, FX swap funding, and a $30bn US Swap line from the Fed. They also removed the credit tiers for ESAS account holders. All signs of Central Bank support for the financial plumbing.

New Zealand’s financial system remains sound, with strong capital and liquidity buffers.

Assistant Governor Christian Hawkesby said the Reserve Bank is actively involved in financial markets to ensure smooth market functioning despite the global uncertainty from COVID-19. Regular market operations continue to ensure there is ample liquidity in the financial system.

“The measures we are implementing today provide additional support to domestic financial markets. We will ensure our operations make financial markets operate smoothly,” Mr Hawkesby said.

“We are working in tandem with the banks, the wider financial market community, and the Government.”

The provision of term funding

The Term Auction Facility (TAF) is a program that will alleviate pressures in funding markets. The TAF gives banks the ability to access term funding, with collateralised loans available out to a term of 12 months.

Banks currently have robust liquidity and funding positions and can manage short-term disruptions to offshore funding markets. The opening of the TAF will provide confidence that the Reserve Bank stands ready to support the market if needed. Further operation details on the TAF are available in a Domestic Markets media release.

Providing funding in FX swap markets

The Reserve Bank is providing liquidity in the FX swap market, to ensure this form of funding can be accessed at rates near the Official Cash Rate (OCR). This activity will increase in the weeks ahead to support funding markets.

Re-establishment of a USD swap line

The Reserve Bank has re-established a temporary USD swap line with the US Federal Reserve. This will support the provision of USD liquidity to the New Zealand market, in an amount up to USD 30 billion. This is a facility that is being offered to many other central banks globally.

Supporting liquidity in the New Zealand government bond market

The Reserve Bank has been providing liquidity to the New Zealand government bond market to support market functioning.

Ensuring a robust monetary policy implementation framework

To support the implementation of monetary policy, the Reserve Bank is removing the allocated credit tiers for Exchange Settlement Account System (ESAS) account holders. This change means that all ESAS credit balances will now be remunerated at the OCR. Under the previous framework, banks were charged a penalty rate on deposits of cash balances above their allocated credit tiers.

The removal of credit tiers for ESAS account holders will provide additional flexibility for the Reserve Bank in its market operations, by keeping short-term interest rates anchored near the OCR regardless of the level of settlement cash in the system. This framework for monetary policy implementation (i.e. a floor system) is common among other central banks overseas.

The Reserve Bank will continue to monitor the use of our liquidity facilities and ESAS settlement accounts. We anticipate that liquidity will continue to be distributed efficiently throughout the banking system. If not, we will review our framework for monetary policy implementation as needed.

A commitment to market functioning

The Reserve Bank has a number of tools to provide additional liquidity and the ability to increase the size of operations where needed. We are committed to using these to support smooth market functioning.

In addition to the tools listed above, the Bank has an established role to provide liquidity in the New Zealand dollar foreign exchange market in periods of illiquidity or dysfunction, and is operationally ready to undertake this role if required.

Mr Hawkesby reiterated that the Reserve Bank continues to monitor developments, and remains ready to act further to ensure markets and the financial system operate in a stable and efficient manner.

RBNZ Cuts Cash Rate to 0.25% (Down from 1%)

The Reserve Bank New Zealand announced today that following an emergency meeting yesterday, the Official Cash Rate (OCR) is 0.25 percent, reduced from 1.0 percent, and will remain at this level for at least the next 12 months. The also signalled the likelihood of QE to follow.

The negative economic implications of the COVID-19 virus continue to rise warranting further monetary stimulus.

Since the outbreak of the virus, global trade, travel, and business and consumer spending have been curtailed significantly. Increasingly, governments internationally have imposed a variety of restraints on people movement within and across national borders in order to mitigate the virus transmission.

Financial market pricing has responded to these events with declining global equity prices and increased interest rate spreads on traditionally riskier asset classes.

The negative impact on the New Zealand economy is, and will continue to be, significant. Demand for New Zealand’s goods and services will be constrained, as will domestic production. Spending and investment will be subdued for an extended period while the responses to the COVID-19 virus evolve.

Several factors will continue to assist and support economic activity in New Zealand.

New Zealand’s financial system remains sound and our major financial institutions are well capitalised and liquid. The Reserve Bank is also ensuring that the banking system continues to function normally.

The Government is operating an expansionary fiscal policy and has imminent intentions to increase its support with a fiscal package to provide both targeted and broad-based economic stimulus.

The New Zealand dollar exchange rate has also depreciated against our trading partners acting as a partial buffer for export earnings.

And, the Monetary Policy Committee agreed to provide further support with the OCR now at 0.25 percent. The Committee agreed unanimously to keep the OCR at this level for at least 12 months.

The Committee also agreed that should further stimulus be required, a Large Scale Asset Purchase programme of New Zealand government bonds would be preferable to further OCR reductions.

The members discussed the broad range of Official Cash Rate (OCR) settings that would be suitable. Staff briefed the Committee on the scale of policy stimulus required given deteriorating global conditions and the impact of travel restrictions. The Committee discussed the relative contributions of planned fiscal and financial stability measures in consideration of the monetary policy response. Staff also advised that an OCR of 0.25 percent was currently the lower limit, given the operational readiness of the financial system for very low or negative interest rates.

Subsequent Committee discussion focused on two scenarios:

- a 0.5 percentage point cut in the OCR to 0.5 percent, followed by an assessment of the rapidly developing COVID-19 situation, with the ability to follow up with more stimulus as needed at the scheduled March OCR review

- A 0.75 percentage point reduction in the OCR to 0.25 percent.

Members noted that lower interest rates would likely support the soundness of the financial system – in the context of the Committee’s Remit.

Given views on the required level of stimulus given the economic impact of COVID-19, the committee agreed a 0.75 percentage point reduction in the OCR would be a more suitable option.