An important discussion about credit creation, why banks are talking interest rates down, and what economists are prepared to say and what they are not, courtesy of Joe Wilkes. Refers to the earlier post below:

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

An important discussion about credit creation, why banks are talking interest rates down, and what economists are prepared to say and what they are not, courtesy of Joe Wilkes. Refers to the earlier post below:

Joe Wilkes and I discuss the latest in retail as he visits a town with troubling issues – and a bellwether of what may be ahead.

Part 2 of my discussion with Property Expert Joe Wilkes. Seems like there will be a surge of new property listings as we move into spring so what are the implications?

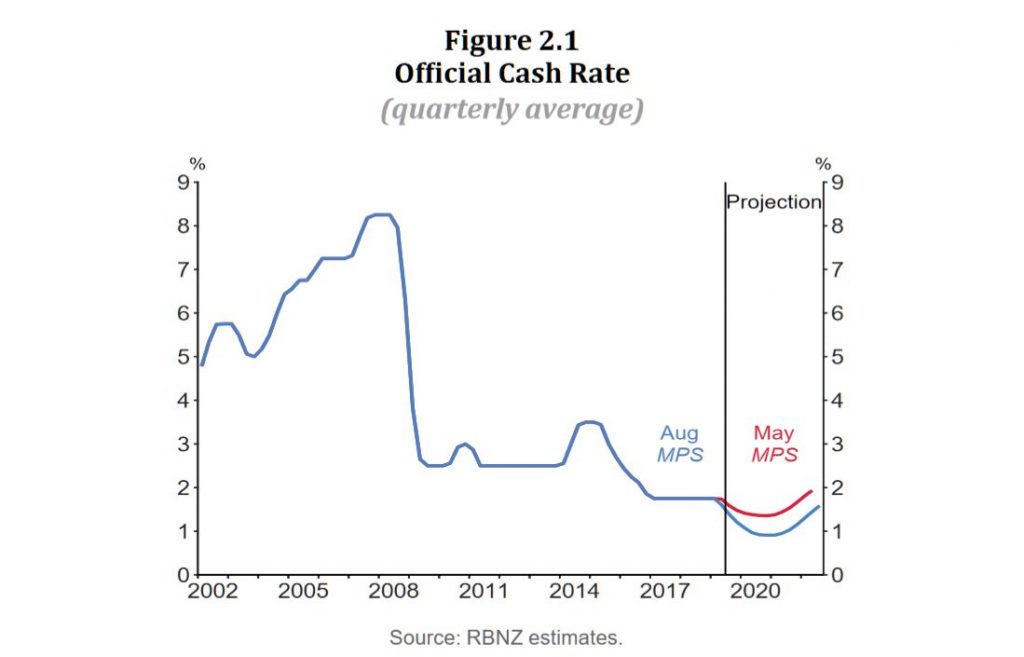

Property Expert Joe Wilkes and I discuss the recent moves by the Reserve Bank of New Zealand, and look at some of the latest data. How will lower rates play out?

Property Expert Joe Wilkes and I discuss the recent moves by the Reserve Bank of New Zealand, and look at some of the latest data. How will lower rates play out?

The New Zealand Council of Financial Regulators (CoFR) has announced a new vision for New Zealand’s economic wellbeing and has welcomed the addition of the Commerce Commission to the forum.

The new vision aims to contribute to maximising New Zealand’s sustainable economic wellbeing through responsive and coordinated financial system regulation, and allows for a longer term view that more effectively recognises the specific responsibilities of each agency.

CoFR works to identify and respond to issues of cross-agency relevance. CoFR’s members are the Reserve Bank, Financial Markets Authority, the Treasury, Ministry of Business, Innovation and Employment, and now the Commerce Commission. Responsibility for chairing CoFR alternates between the Reserve Bank Governor and the FMA Chief Executive.

The Reserve Bank’s Governor, Adrian Orr, said: “We recognise our responsibility for joint stewardship (te hunga tiaki) of a healthy and efficient financial system that benefits all New Zealanders.”

The Financial Markets Authority’s Chief Executive, Rob Everett, said: “The Council was instrumental in launching the recent conduct and culture review of New Zealand’s banks and life insurers. This illustrated the importance and benefits of regulators working together to tackle issues that span across the financial markets’ regulatory system. Ensuring a coordinated response to such issues will help to build confidence in the regulation of New Zealand’s financial markets.”

Mr Orr says, “Bringing the Commerce Commission on board with its consumer credit focus is a welcomed addition to this forum.”

CoFR meets quarterly to discuss financial markets regulatory issues, risks and priorities, and is attended by the heads of each agency. The existence of CoFR does not derogate from the existing statutory rights and responsibilities of the respective authorities. The most recent meeting occurred yesterday.

Its main objectives are to:

About the Council of

Financial Regulators

The Council of Financial Regulators (CoFR) has been operating since 2011 as a

forum for agencies with responsibility for financial sector regulation. CoFR is

comprised of the Reserve Bank, Financial Markets Authority, the Treasury,

Ministry of Business, Innovation and Employment, and recently the Commerce

Commission as a forum to share information, identify issues and develop

coordinated responses to issues that may require cross-agency involvement.

CoFR agreed to a financial markets regulatory charter in 2016, which sets out

how we operate our shared ownership of regulatory functions in this area. MBIE

developed the charter as a management tool to set expectations and provide an

overview of the regulatory system. The new vision seeks to build on this

charter.

CoFR formally meets quarterly to discuss financial markets regulatory issues,

risks and priorities. It comprises senior leaders from each agency and from

time to time, CoFR may invite representation from other regulatory agencies and

public authorities, as required.

More information:

The New Zealand Reserve Banks says the Official Cash Rate (OCR) is reduced to 1.0 percent. The Monetary Policy Committee agreed that a lower OCR is necessary to continue to meet its employment and inflation objectives.

Employment is around its maximum sustainable level, while inflation remains within our target range but below the 2 percent mid-point. Recent data recording improved employment and wage growth is welcome.

GDP growth has slowed over the past year and growth headwinds are rising. In the absence of additional monetary stimulus, employment and inflation would likely ease relative to our targets.

Global economic activity continues to weaken, easing demand for New Zealand’s goods and services. Heightened uncertainty and declining international trade have contributed to lower trading-partner growth. Central banks are easing monetary policy to support their economies. Global long-term interest rates have declined to historically low levels, consistent with low expected inflation and growth rates into the future.

In New Zealand, low interest rates and increased government spending will support a pick-up in demand over the coming year. Business investment is expected to rise given low interest rates and some ongoing capacity constraints. Increased construction activity also contributes to the pick-up in demand.

Our actions today demonstrate our ongoing commitment to ensure inflation increases to the mid-point of the target range, and employment remains around its maximum sustainable level.

Property expert Joe Wilkes and I look at falling sales as foreign property buyer exit. The liquidity fallout will be huge, and its happening in many countries. One reason to be cautious on property.

We look at the latest discussions on home prices and household debt. Some say we are armour-plated – but is that true? A discussion with Joe Wilkes.

Property expert Joe Wilkes and I discuss who is saving, and why.