I discuss the New Zealand South Island property market with a local, Paul Johnston. New Zealand is not Auckland. Is there a two-tier market?

Tag: New Zealand

Debt, Divorce and Death!

In a falling property market, who still has to sell? Property expert Joe Wilkes and I discuss. We also note how the banks are targetting some of these cohorts.

A Property Market Update – What’s Happening At The Top End?

NZ based property expert Joe Wilkes discussed the latest data, and we consider the wider implications of rising stocks of unsold properties.

Note: please check these files for viruses etc (we take no responsibility for any issues – though the files were thoroughly checked before upload).

Next New Zealand Cash Rate Move Is Likely Down

The Reserve Bank NZ said today the Official Cash Rate (OCR) remains at 1.75 percent. Given the weaker global economic outlook and reduced momentum in domestic spending, the more likely direction of our next OCR move is down.

Employment is near its maximum sustainable level. However, core consumer price inflation remains below our 2 percent target mid-point, necessitating continued supportive monetary policy.

The global economic outlook has continued to weaken, in particular amongst some of our key trading partners including Australia, Europe, and China. This weaker outlook has prompted central banks to ease their expected monetary policy stances, placing upward pressure on the New Zealand dollar.

Domestic growth slowed in 2018, with softness in the housing market and weak business investment contributing.

We expect ongoing low interest rates, and increased government spending and investment, to support economic growth over 2019. Low interest rates, and continued employment growth, should support household spending and business investment. Government spending on infrastructure, housing, and transfer payments also supports domestic demand.

As capacity pressures build, consumer price inflation is expected to rise to around the mid-point of our target range at 2 percent.

The balance of risks to this outlook has shifted to the downside. The risk of a more pronounced global downturn has increased and low business sentiment continues to weigh on domestic spending. On the upside, inflation could rise faster if firms pass on cost increases to prices to a greater extent.

We will keep the OCR at an expansionary level for a considerable period to contribute to maximising sustainable employment, and maintaining low and stable inflation.

Why a proposed capital gains tax could mean tax cuts for most New Zealanders

As part of a major review of New Zealand’s tax system, the government’s Tax Working Group recommended a comprehensive capital gains tax. New Zealand is one of few countries without a capital gains tax, and the proposal has generated outrage, via The Conversation.

Commentators have described the proposed tax as a “mangy dog”, “an envy tax”, an “attack on the kiwi way of life” and “offensive to New Zealand values”.

Digging deeper beyond the headline-grabbing rhetoric, some commentators have expressed concern the proposed tax will have a detrimental impact on the economy by distorting investment decisions and creating an excessive administrative burden on taxpayers and the Inland Revenue Department (IRD). There are also claims about the lack of fairness in taxing “hard earned gains” that have been built up for retirement.

Missing from the debate is the fact that a capital gains tax should reduce income taxes for most New Zealanders.

A fair tax system

The debate strikes at the heart of two essential elements used to assess the quality of a tax: equity and efficiency.

In order to be equitable, a tax should treat people with similar economic situations in a similar way. This is called horizontal equity. Equally, taxation should fall more heavily on those who have the ability to pay. This is referred to as vertical equity.

These are the principles set out by the great Scottish economist Adam Smith in his 18th-century magnum opus The Wealth of Nations. In order to evaluate the tax proposals, New Zealand’s Tax Working Group used Smith’s principles of fairness alongside two distinctly New Zealand frameworks: Te Ao Māori (Māori worldview) and the Living Standards Framework. These two frameworks have been developed to guide policy makers toward the objective of inter-generational well-being, including the effect of policy on growing inequality and non-economic factors such as social and environmental capital.

Not taxing capital gains results in a failure to achieve both horizontal and vertical equity.

Taxing passive gains

Currently, in New Zealand, some income is taxed and some is not. The income that is taxed is typically derived from personal services (“hard work”) and from investments of capital (interest, rent and dividends). The income that is not taxed is typically derived from market movement, such as capital gains on assets.

On the whole, we have a counterintuitive approach to taxation in New Zealand where we tax “hard work” and fail to tax gains that accrue passively. Two people in similar situations are taxed differently. A person who invests in a small business that produces goods and services pays tax on all their profits, while another who invests in property that accumulates passive gains, does not.

In a world where the accumulation of capital through passive gain is increasingly being held by a smaller group, the need to tax those gains is becoming more urgent.

Statistics provided by the Tax Working Group indicate the taxation burden is flat across all income groups. This means our tax system does not operate according to Smith’s ability-to-pay principle. We have progressive tax rates but those in the highest income deciles enjoy much of their income in the form of tax-free capital gains. New Zealand’s failure to tax capital gains is inequitable.

Tax efficiency

The claims that a capital gains tax is inefficient centre around administrative issues and investment distortions. The first claim has some merit – new taxes usually result in additional administration, especially early on. The second has no merit whatsoever.

For New Zealand’s economy to thrive, greater investment in the production of goods and services is required. However, these investments are often risky. And they are taxed when profitable. Hence it is a far more attractive investment proposition to invest in low-risk assets that attract little or no tax, such as land.

Contrary to popular belief, land investment, in itself, is not a productive activity. The land is there regardless of who owns it. Someone may conduct productive activity on the land, such as farming or building houses, but the ownership itself does not produce goods or services. A capital gains tax would reduce distortion in investment choices, not increase it.

If tax applies to gains on investment in assets as it does to business profits, it will encourage investment decisions based on where the greatest return can be made, not where tax-free gains are derived. The lack of capital gains tax has been distorting investment decisions for decades.

Impact on economy

In the longer term, it would be a positive outcome to attract some investment out of property and into production of goods and services, regardless of any possible adjustments that might occur in the short term.

And the tax cuts? Missing from this debate entirely has been recognition of the Tax Working Group’s recommendation that the additional tax collected from a capital gains tax should be used to reduce income taxes. This is not a “tax grab” but a reallocation of the tax burden.

If the government were to implement the recommendations of the Tax Working Group report, most New Zealanders would find themselves with an increase in their after tax income. Greater equality would seem to be more consistent with kiwi values than the status quo.

Author: Alison Pavlovich, Assistant Lecturer in Taxation, Massey University

Capital Gains? – Ready, Steady, Stop!

I discuss the latest from New Zealand with property expert Joe Wilkes, and we look at changes to capital gains, negative gearing and other factors which may impact the market.

Some interesting comparisons with the UK and Australian markets too!

In De-Nile – Are Auckland Sellers Sailing Down A River In Egypt?

In the latest from our New Zealand property expert Joe Wilkes, we look at the latest data with a focus on recent home price movements. Things are getting interesting!

https://episodes.castos.com/dfa/FInal.mp3

Please consider supporting our work via Patreon

Or make a one off contribution to help cover our costs via PayPal.

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

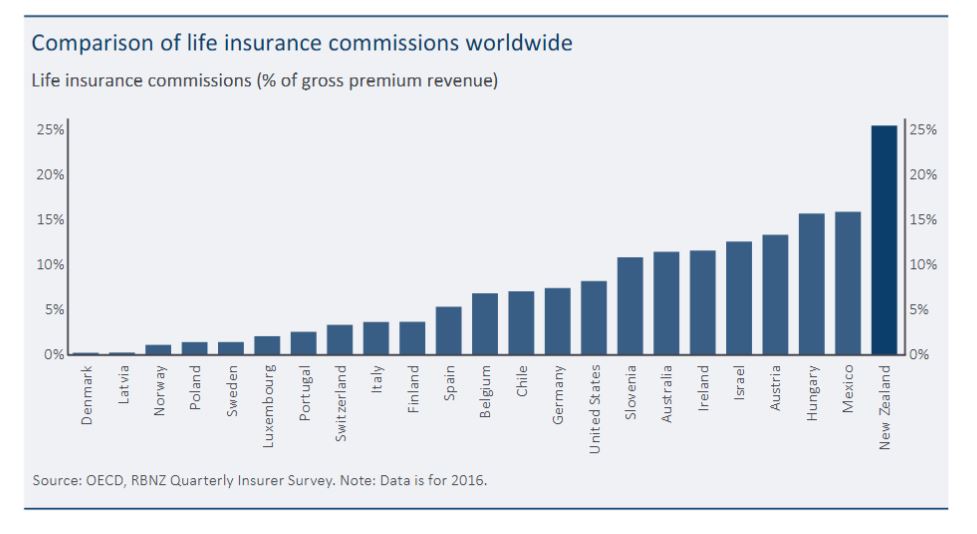

NZ Life Insurance Sector Found Wanting

The Financial Markets Authority (FMA) and Reserve Bank of New Zealand (RBNZ) have completed their joint review of 16 New Zealand life insurers. This review follows the regulators’ bank review published in November 2018.

The findings appear to mirror the Australian Royal Commission, with a focus on shareholders rather than customers – sounds familiar? In addition commissions are extremely high in New Zealand.

Rob Everett, FMA Chief Executive said: “Overall the report shows the life insurance sector in a poor light. Life insurers have been complacent about considering conduct risk, too slow to make changes following previous FMA reviews and not sufficiently focused on developing a culture that balances the interests of shareholders with those of customers.”

The regulators found extensive weaknesses in life insurers’ systems and controls, with weak governance and management of conduct risks across the sector and a lack of focus on good customer outcomes.

Adrian Orr, Reserve Bank Governor said: “The industry must act urgently and undergo major change to address these weaknesses, as their services are vulnerable to misconduct and the escalation of issues that have been seen in other countries. Public trust in life insurers could be eroded unless boards and senior management transform their approach to conduct risk and achieve a customer-focused culture. Ultimately insurers need to take responsibility for whether customers are experiencing good outcomes from their products, regardless of how they are sold.”

Other key findings:

- Limited evidence of products being designed and sold with good customer outcomes in mind.

- Some insurers did little or nothing to assess a product’s ongoing suitability for customers.

- Sales incentives structures risk sales being prioritised over good customer outcomes.

- Where sales were through an intermediary, there was a serious lack of insurer oversight and responsibility for the sales and advice, and customer outcomes.

- Remediation of conduct issues is generally very poor, with insurers slow to respond to issues and in some cases not sufficiently remediating them.

The review did not find widespread cases of misconduct on the part of life insurance companies. However, there were several instances of poor conduct. There were also a small number of cases of potential misconduct (i.e.: breaches of the law) that are now subject to investigations by the appropriate regulator.

Some of the issues and themes are similar to those highlighted in the Australia Royal Commission, albeit on a smaller scale. The FMA and RBNZ are not confident that insurers themselves are aware of all the current issues. This creates a serious risk of further conduct issues arising.

Next steps

All 16 life insurers will receive individual feedback. By 30 June 2019, each insurer will need to report back to the regulators. They will need to provide an action plan that the regulators will review, including how they will address incentives based on sales volumes for internal staff and commissions for intermediaries. Regular reporting on progress and implementation will be required.

Concerns for consumers

Purchasing life insurance is one of the most important financial decisions people will make. Customers should be able to have confidence their insurance will do what the insurance company or their financial adviser has told them. Many customers do experience the benefits of their insurance policies every year.

A positive finding in the report showed that, in general, frontline claims teams were focused on good outcomes with a strong desire to do the right thing for their customers.

The purpose of the thematic review and the report’s recommendations are to ensure the industry responds with urgency to the issues identified.

Further information and guidance for consumers can be found on the FMA website, here fma.govt.nz/investors/life/

Regulatory issues

Insurer conduct is currently only regulated indirectly through the FMA’s regulation of financial advice, which is generally provided by intermediaries. No one regulator has oversight of insurers’ and intermediaries’ conduct over the entire insurance policy lifecycle.

The report sets out some areas where the regulators recommend that the Government consider addressing regulatory gaps, similar to those put forward in our review of banks. The regulators acknowledge further policy work will be required and that any additional regulation will need to drive better outcomes for customers.

RBNZ Bank Financial Strength Dashboard wins international award

Central Banking Publications has named the Bank Financial Strength Dashboard as ‘Initiative of the Year’ in its annual awards.

In announcing the award, Central Banking commented that very few central banks have opened up their financial system to public scrutiny to quite the same level as the Reserve Bank of New Zealand.

They said that by revealing key metrics on the banking sector in a visual format that can be taken in at a glance, the Reserve Bank has hit on a simple method of boosting discipline among banks.

Reserve Bank Governor Adrian Orr said the award was a great honour.

“We aspire to be a ‘Great Team, Best Central Bank’ and the award recognises a significant step towards that goal,” Mr Orr said.

“Awareness among consumers and investors is an important aspect of ensuring a sound financial system. The Dashboard is designed to make it easy to access and understand the financial position of New Zealand banks. By keeping the public informed about risks to the sector, banks themselves are held to greater market discipline.

“The Dashboard has proven very popular, with more than 10,000 visits per quarter since its launch and we believe this has significantly broadened the audience for prudential disclosures.

“It is the result of huge effort and dedication from many people in our organisation and the sector at large. I congratulate them all and encourage people to use the Dashboard when making banking decisions,” Mr Orr said.

Background

Central Banking Publications is a financial publisher owned by Incisive Media and specialising in public policy and financial markets, with emphasis on central banks, international financial institutions and financial market infrastructure and regulation.

Central Banking Publications was founded in 1990, and makes a number of annual awards to central banks and market participants over a range of categories. This is the sixth year of the awards.

The Reserve Bank previously won the ‘Initiative of the year’ award in 2016 for its enterprise risk management system. It has also won ‘Central Bank of the Year’ in 2015 and Reserve Bank senior adviser Leo Krippner won the award for ‘Economics in Central Banking’ in 2017.

Judging was by the Central Banking Awards Committee, which is made up of the Central Banking Editorial Team and Editorial Advisory Board, comprising former senior central bank governors from around the world. The awards will be presented at a gala dinner in London on 13 March.

Bailing In And Bailing Out: The Latest Update From New Zealand

I discuss the latest developments in the New Zealand property market with Joe Wilkes. We look at the latest from the Reserve Bank, Deposit Bail-In and Bank Scorecards. Also highly relevant to other markets.

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

Or make a one off contribution to help cover our costs via PayPal