While the state enjoys the nation’s lowest unemployment rate at 4.8 per cent, 3.5 per cent local economic growth and negligible net debt, new Treasurer Dominic Perrottet reported a 2016-17 surplus of $4.5 billion from total revenues of $78 billion.

“We are the envy of the Western world,” Mr Perrottet told the budget lock-up media briefing.

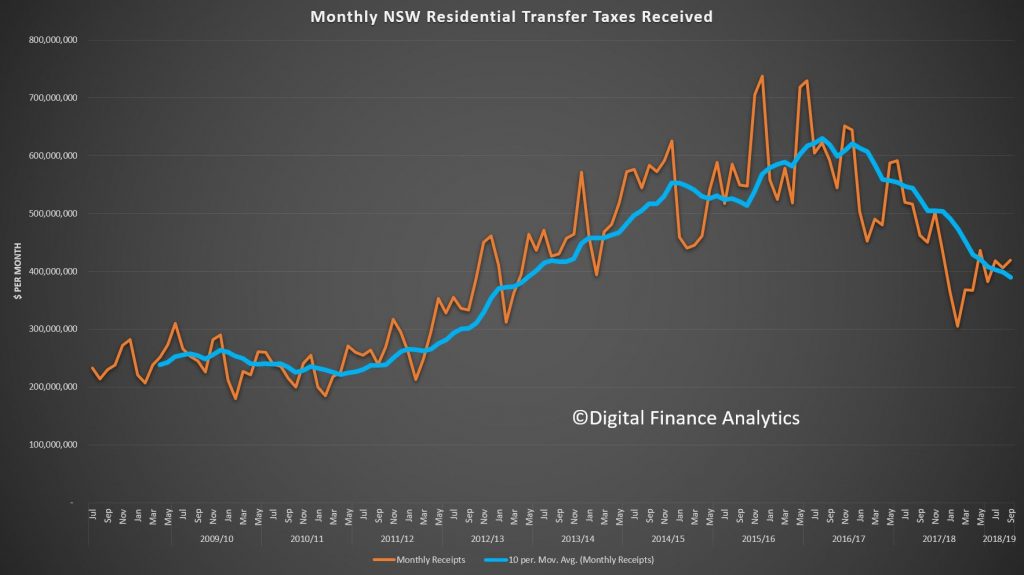

The results were boosted by stamp duty receipts of half a billion dollars from the recent sale of the state’s electricity poles and wires and the demand-driven astronomical prices of Sydney property now at $7.2 billion in 2017-18.

While former federal treasury head Dr Ken Henry once described state property transfer taxes as a distorting influence on the efficient use of land, NSW and other mainland states have become addicted to it.

Stamp duty on a $2 million house in NSW currently costs the buyer $95,763, a big windfall for the state.

Also addictive is the state’s dependence on payroll tax, currently at $8.6 billion rising to just on $10 billion a year by 2021.

Payroll tax, easy to collect, nevertheless has been described by economists as a tax on jobs.

NSW also mainlines on gambling for its big revenues, collecting $800 million from club poker machines, $766 million from pub pokies, $111 million from racing, $363 million from lotteries and $278 million from Star Casino.

Grand total from gambling: $2.3 billion.

Mr Perrottet, a proclaimed Christian and father of four, says he supports a national approach to the anti-social impacts of gambling.

The Turnbull government and federal Treasurer Scott Morrison are unlikely to have any sympathy for Mr Perrottet’s complaint that NSW is being short-changed on GST distribution by $15 billion over the next four years.

“Right now GST from NSW taxpayers is subsidising inefficient Labor states, some of whom seem more interested in increasing the size of their bureaucracies, rather than undertaking reform,” Mr Perrottet said in his ‘bearpit’ budget speech.

Housing in NSW ‘still unaffordable’

While Premier Berejiklian promised a game changer on housing affordability, her government’s budget does not deliver systemic change.

Instead, it offers a planning red tape-cutting blitz to boost supply and “a fair go for first home buyers” in the form of stamp duty exemptions from July 1 for new and existing properties up to $650,000, with discounts up to $800,000.

Following the recent federal budget lead, foreign investors have been constrained with an investor transfer duty surcharge increase.

While welcoming the state budget’s bias to local first home buyers, property affordability analysts say low interest rates and relentless demand pressure from population growth will continue to drive Sydney’s sky high property prices.

Infrastructure ‘equivalent to 124 Harbour Bridges’

With the NSW population projected to increase to 11 million by 2056, the state’s already congested city road systems are now a big political problem.

Through its asset recycling program, property sales and privatisations, the state’s ‘Restart NSW’ fund is bankrolling $73 billion in capital works over four years, including the contentious Westconnex toll road now cutting through suburban houses in western Sydney and the stand-alone privately operated Sydney Metro fully automated commuter train with the track now under construction from Sydney’s north west, under Sydney harbour and through the CBD to the south west.

Mr Perrottet made this declaration about the infrastructure spend: “That’s equivalent to building 124 Harbour Bridges – a once-in-a-generation investment that will transform our state forever.”

The capital works include already announced new schools and hospital upgrades, but announced on Tuesday was a $720 million upgrade for the Prince of Wales Randwick hospital in Sydney’s eastern suburbs.

While wage growth in Australia has been flatlining in recent years with a depressive impact on economic growth, the NSW government is insisting on maintaining its 2.5 per cent cap on public sector wages.

With the Reserve Bank governor Dr Philip Lowe this week saying employee demands for higher wages were now justified, Mr Perrottet would not be moved, also insisting that departmental efficiency dividends would continue to be imposed.

In a blatant move for political popularity the state will now fund a non-means tested $100 per child payment for sporting activity, said to be justified by the obesity epidemic.

Significantly for a state budget, this one is presented with an “outcomes” template for the first time, similar to Oklahoma in the US.

NSW Treasury secretary Rob Whitfield, a former banker, says benchmarking performance alongside the budget numbers will help to change the state’s political culture to accountability for its primary function – service delivery.