Here is a show I recorded with Nucleus Wealth on the housing market. The discussion on net rental yields is especially relevant.

Tag: Nucleus Wealth

DFA Live Q&A HD Replay – Damien Klassen: Nucleus Wealth

This a replay edition of our most recent live Q&A in which I discussed the latest in the financial markets with Damien Klassen, Head of Investments at Nucleus Wealth.

https://walktheworld.com.au/

CONTENTS

0:00 Introduction

1:44 The Inflation Question

8:30 Booming Company Profits

19:20 Local or International Focus?

36:40 Political Tensions

43:50 Bonds, Currency And Metals

50:00 Gold

51:30 Manufacturing, Lithium and Innovation

1:00:00 Infrastructure Exposure

1:05:00 Volatility Trading

1:10:00 Sector Exposure

1:18:00 Investment Objectives – Diversification

1:19:15 Free Markets?

1:25:00 Property and Close

Original version with live chat replay is at https://youtu.be/fi8SMjqxvbg

Final Reminder: DFA Live 8pm Sydney – Invest Local, or Abroad? With Damien Klassen

Join us for a live Q&A as I discuss the latest in the financial markets with Damien Klassen, Head of Investments At Nucleus Wealth.

You can ask a question live.

https://walktheworld.com.au/

Successful Retirement Planning – With Tim Fuller

Head of Advice At Nucleus Wealth, Tim Fuller discusses the “4L’s” of Retirement Planning. When to start, how to start?

The thought of retirement can leave most people with a remarkable range of emotions. For many, it proposes a terrific milestone of life that frees up time to pursue opportunities for leisure, travel and more time with family. For others, it poses an ominous end of reliable income and stability, leaving anxiety about the unknown both personally and financially. Regardless of how it makes you feel, adding in robust retirement planning is a simple solution to ensure a more successful outcome.

Go to the Walk The World Universe at https://walktheworld.com.au/

DFA Live Q&A – HD Replay: Damien Klassen Market Update [Podcast]

Join us for a live Q&A as I discuss the latest financial market trends with Damien Klassen From Nucleus Wealth.

https://nucleuswealth.com/author/damien-klassen/

CONTENTS

0:00 Start

0:40 Introduction

1:40 Damien Joins

2:05 Is The Market Buying What The FED Is Selling?

17:00 YCC and Gold

20:00 Inflation Calculations

31:15 Bank Bond Information

33:45 Day Trading

40:30 Market Valuations

51:30 US and Australian Central Banks

53:00 Aussie Bank Bonds

1:05:40 Active Mutuals V EFTs

1:13:10 AUD Outlook

1:18:00 NZ Home Prices and Controls

1:22:00 Responsible Lending

1:29:00 Stock Market Volatility

1:33:00 Stealing From The Future?

Go to the Walk The World Universe at https://walktheworld.com.au/

DFA Live Q&A – HD Replay: Damien Klassen Market Update

Join us for a replay of our live Q&A as I discuss the latest financial market trends with Damien Klassen From Nucleus Wealth.

https://nucleuswealth.com/author/damien-klassen/

CONTENTS

0:00 Start

0:40 Introduction

1:40 Damien Joins

2:05 Is The Market Buying What The FED Is Selling?

17:00 YCC and Gold

20:00 Inflation Calculations

31:15 Bank Bond Information

33:45 Day Trading

40:30 Market Valuations

51:30 US and Australian Central Banks

53:00 Aussie Bank Bonds

1:05:40 Active Mutuals V EFTs

1:13:10 AUD Outlook

1:18:00 NZ Home Prices and Controls

1:22:00 Responsible Lending

1:29:00 Stock Market Volatility

1:33:00 Stealing From The Future?

Go to the Walk The World Universe at https://walktheworld.com.au/

FINAL REMINDER: DFA Live 8pm Sydney Tonight – Are Markets Buying What The FED Is Selling?

Join us tonight for a live discussion on the current market dynamics with Damien Klassen, Head of Investments at Nucleus Wealth. You can ask a question live via the YouTube chat.

Go to the Walk The World Universe at https://walktheworld.com.au/

Decoding Financial Advisor Fees With Tim Fuller [Podcast]

Tim Fuller, Head of Advice at Nucleus Wealth and I discuss the question of fees relating to financial advice, touching on the various structures and the evolution of the market.

Go to the Walk The World Universe at https://walktheworld.com.au/

Decoding Financial Advisor Fees With Tim Fuller

Tim Fuller, Head of Advice at Nucleus Wealth and I discuss the question of fees relating to financial advice, touching on the various structures and the evolution of the market. Go to the Walk The World Universe at https://walktheworld.com.au/

The question of financial adviser fees and the method charged has long been deliberated over, both internally in the industry, and from a client perspective. Like many professional services, the immediate ‘return on investment’ from financial advice can be challenging to quantify and validate. But having a good understanding of how you are charged can undoubtedly help. In this article, I will run through the three main methods for charging for financial advice, along with some thoughts on the benefits and potential drawbacks of each technique.

Commissions

Commissions, as found in many other industries, are payments made to a referrer (or, adviser) for placing a client into a product or service. The issue with commissions in financial advice was the opaqueness, or complete absence of disclosure of them. Clients would think they were getting financial advice that was in their best interests, but were in-fact just being sold to. To understand the significance of this, compare it to when you’re purchasing a car. In this case you know the salesman is going to be getting a commission, and can factor this into your decision, and objectively assess the car for your purposes yourself. If you thought the car salesman was working for your best interests, not his, and didn’t know anything about cars, you might be more likely to blindly accept his advice. As was the case in financial advice.

Cheaply made or high-cost products often then had the ability to pay the highest commissions, further fueling the impact this part of the industry had on retail clients. Increasingly sales-driven practices by some product providers were one of the catalysts for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (The Hayne Commission). Indeed, some of the larger financial product and advice providers had introduced high-pressure sales systems into their practices. This sales-oriented culture was not unique to Australia.

Thankfully, conflicted remuneration (commissions), where the outcome of the advice typically leads to additional revenue paid to the financial advisers from the product provider, has been banned, and grandfathered commissions are being phased out by the first of January 2021. But the lesson stands to always check the relevant and associated relationships, which adviser are now required by law to disclose.

Assets under management (AUM)

(Also known as funds under management (FUM))

The assets under management model charges clients a percentage-based fee to the financial adviser based on their portfolio value.

Benefits can include that clients can pay their adviser fees from their managed assets. As the portfolio decreases, the fee for service decreases.

The client’s adviser may achieve a higher return as they are essentially incentivised to perform when their income is dependent on assets under management increasing/performance.

A potential conflict of interest may exist when recommending investments based on assets under management. If the percentage-based fee differs across asset classes, the financial adviser could earn higher revenue by recommending the client invest in the higher cost assets.

The adviser may place clients in riskier investments that are not suited to their risk tolerance to receive more revenue.

Systemic risk (like the COVID-19 pandemic) can reduce the adviser’s fees as overall assets under managed could fall. If the client draws-down lump sums of their balance, the adviser’s assets under managed will fall, leading to a fall in revenue.

If the adviser is not directly responsible for some part of the investment process (i.e. Stock selection or asset allocation) but instead just vetting the quality and reliability of the investments selected, then the assets under management model is more tenuous to accept. Your investment balance size does not have a significant bearing on the overall cost of the work required, and perhaps a fixed fee for service may be more appropriate.

Fee for Service

The fee for service model charges clients:

- based on what the standard fees for a client with a similar size portfolio are; or

- the client can be charged based on complexity – i.e. a set charge for each service is added to the ‘standard’ fee.

Benefits include that the client is charged a standard fee and knows what they are paying up-front, and can ensure fair payment based on the complexity of services required. Besides, revenue is more certain from an adviser’s perspective, which can help with business planning and client segmentation. This fee method also separates the adviser’s performance from market performance.

Drawbacks can include that this may allow charging based on a ‘standard price’ for funds managed, similar to the assets under management model, so it’s really just a horse by a different name. The adviser then has the discretion to charge the client what they ‘think’ they can pay. This may mean that there is no uniformity in the pricing and brings the risk of undercharging if the client’s needs become more complex than initially thought.

Hourly rates

Many other professionals and tradespeople, including accountants, specialist doctors, engineers, mechanics, and plumbers, charge an hourly rate for services rendered.

Benefits include a set maximum rate per hour, charged based on complexity/as required. The financial adviser is charging a fee for their expertise but reserves the right to increase above the quoted amount as needed.

Drawbacks can be that the adviser could ‘make-up’ hours but complete the work for a client in less time, often called ‘padding’ work. Clients may not precisely understand the basis for the charges they are paying.

Suppose the adviser forgets to record the hours whilst working with the client and, days later, tries to record the information. In that case, there is the potential to under or overcharge for services.

Conclusion

It is unlikely that each of these models could be considered more ‘ethical’ than one another. In a perfect world, clients should choose their preferred method of compensation of their advisers, and that a combination of how financial adviser’s fees are paid may be more appropriate and ‘fair’ to the client. Keep in mind that perhaps a combination of the above may be the best fit, where an initial, and often more involved, piece of work is priced in one way, usually fee for service, then moved to a more reflective model, such as assets under management for ongoing service.

Tim Fuller is Head of Advice at Nucleus Wealth.

The Central Bank V’s Bond Market Tussle

I catch up with Damien Klassen from Nucleus Wealth to discuss the latest on the bond rates, inflation and Central Bank intervention.

Go to the Walk The World Universe at https://walktheworld.com.au/ for more on Nucleus Wealth.

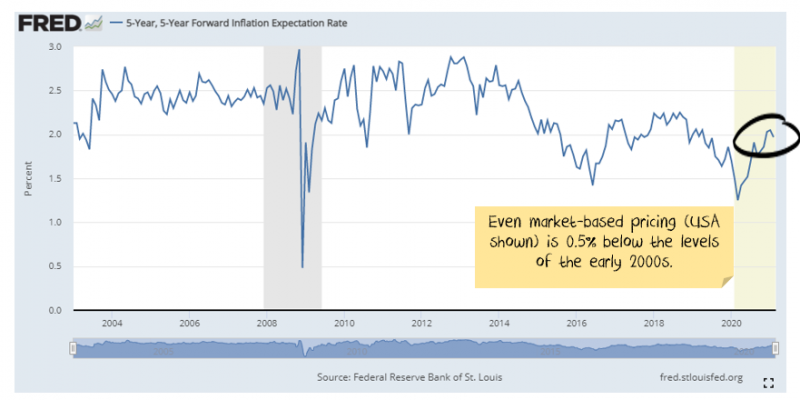

The 2021 inflation mirage

Posted on by Damien Klassen

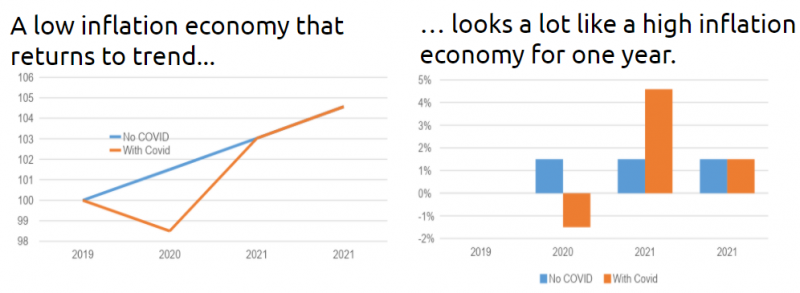

While rising inflation expectations were a minor feature in January, in February markets reflected higher inflation expectations and we expect this to continue in 2021.

The 2021 Inflation spurt will likely be temporary

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game will be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

In short, policymakers have decided on zombification: limit bankruptcies; increase debt and never raise interest rates again. It doesn’t make for a healthy economy. But it limits short-term pain which appears to be the current goal of most politicians.

This zombification is inflationary in the recovery phase but deflationary soon afterwards as oversupply swamps demand.

We are, therefore, suspicious that beyond 2021/22 we are entering a new inflationary cycle, as some have posited.

But there will be an inflation spurt in 2021

For almost the past 15 years many economists have been forecasting a dramatic return to inflation driven by central bank largesse. The most fearful of these suggest that inflation is an inevitable consequence of quantitative easy and that Weimar Germany / Zimbabwe hyperinflation is not far off. So far they have been wrong.

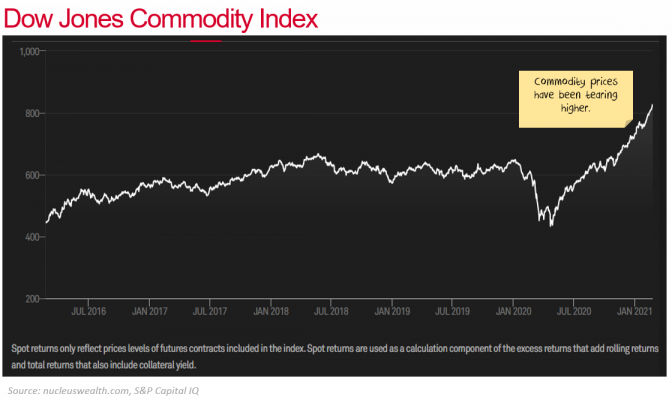

They are about to have their day in the sun. Or at least something that looks like the start of their day in the sun. Inflation will bounce hard over the next six months, especially in the US on the back of a number of factors:

- Shortages from supply chain disruptions and lockdowns

- Structural changes in consumption following COVID

- Structural changes in supply chains following COVID

- Inventory cycle rebuild

- Government stimulus giving money to people who aren’t working

- The increased minimum wage in the US

- Lower US dollar

The Value stock rotation lives and dies on this narrative.

It can continue with inflation and rising market interest rates or end without it, culminating in a return to Growth stocks. We are positioning for a run to Value that lasts for 6-12 months. For it to continue, we will need to see more policy innovation, especially the putative integration of fiscal and monetary policy worldwide.

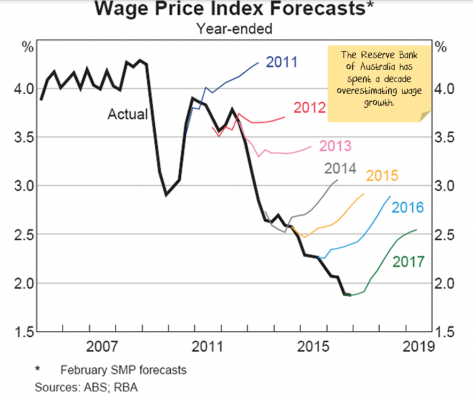

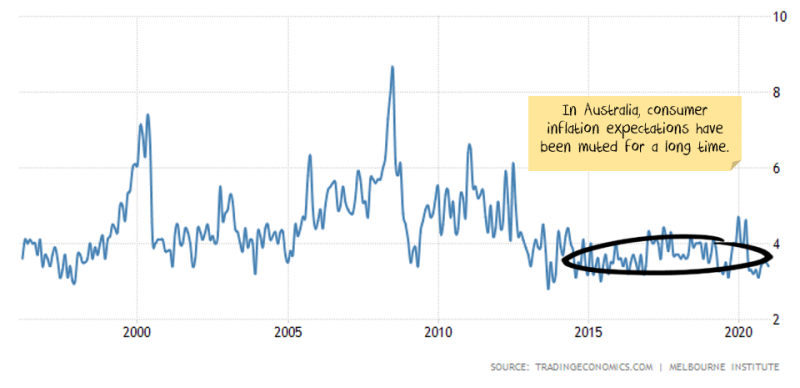

Until lowflation returns

For the past dozen years inflation has disappointed, continually falling below central bank expectations. This is for a number of reasons, the key ones include:

- High unemployment / low wage growth

- Low expectations

- Technology advances

- Globalisation leading to a flatter supply curve

- High levels of debt

- Inequality

- Falling lending growth in China

The 2021/22 inflation mirage

With this in mind, the important investment factor for 2021 will be managing the inflation scare, followed by its likely disappointment.

There are a number of factors that could extend the duration of the elevated inflation, the chief being government stimulus. We are expecting it to be six months or more before it is time to switch back into the stocks that are resistant to deflationary pressures.